Amundi MSCI World Ex-US UCITS ETF Acc: NAV Calculation And Implications

Table of Contents

The Mechanics of Amundi MSCI World ex-US UCITS ETF Acc NAV Calculation

Understanding how the NAV of the Amundi MSCI World ex-US UCITS ETF Acc is calculated is paramount to successful investing. This involves several key components.

Understanding the Components of NAV

The Amundi MSCI World ex-US UCITS ETF Acc invests in a diversified portfolio of equities from developed markets worldwide, excluding the United States. Therefore, understanding its NAV requires analyzing several factors:

- Asset Composition: The ETF primarily holds stocks, representing a broad range of sectors and companies across various developed economies. The weighting of each holding is determined by the MSCI World ex-US index it tracks.

- Market Value Determination: The market value of each holding is determined by its closing price on the relevant exchange. This price fluctuates throughout the trading day, impacting the ETF's NAV.

- Currency Exchange Rates: As the ETF invests globally, currency exchange rates play a significant role. The value of foreign holdings is converted into the base currency (likely EUR for a UCITS ETF) using the prevailing exchange rate at the end of the trading day. Fluctuations in exchange rates directly affect the NAV.

Key Factors Influencing Daily NAV Calculation:

- Market prices of underlying assets

- Currency exchange rates

- Accrued income (dividends and interest)

- Management fees and expenses

The Role of Expenses and Fees

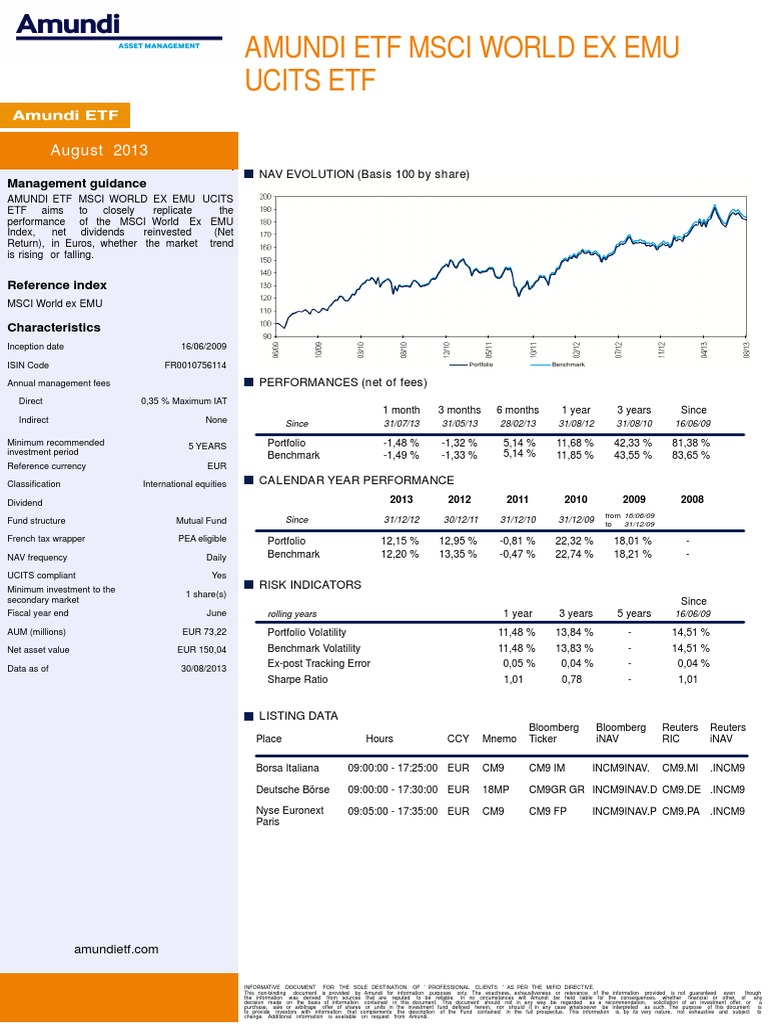

The Amundi MSCI World ex-US UCITS ETF Acc, like all ETFs, incurs various expenses. These expenses directly impact the NAV and, consequently, your returns.

- Management Fees: These are charged annually to cover the fund manager's services.

- Operating Expenses: These cover administrative costs, custodial fees, and other operational expenditures.

- Other Charges: These might include brokerage commissions and other transaction costs associated with buying and selling assets.

These fees reduce the overall value of the ETF, impacting the investor's net return. Understanding the fee structure is vital when comparing investment options.

Different Types of Fees Associated with the ETF:

- Total Expense Ratio (TER)

- Transaction fees (if applicable)

- Custodian fees

Frequency of NAV Calculation

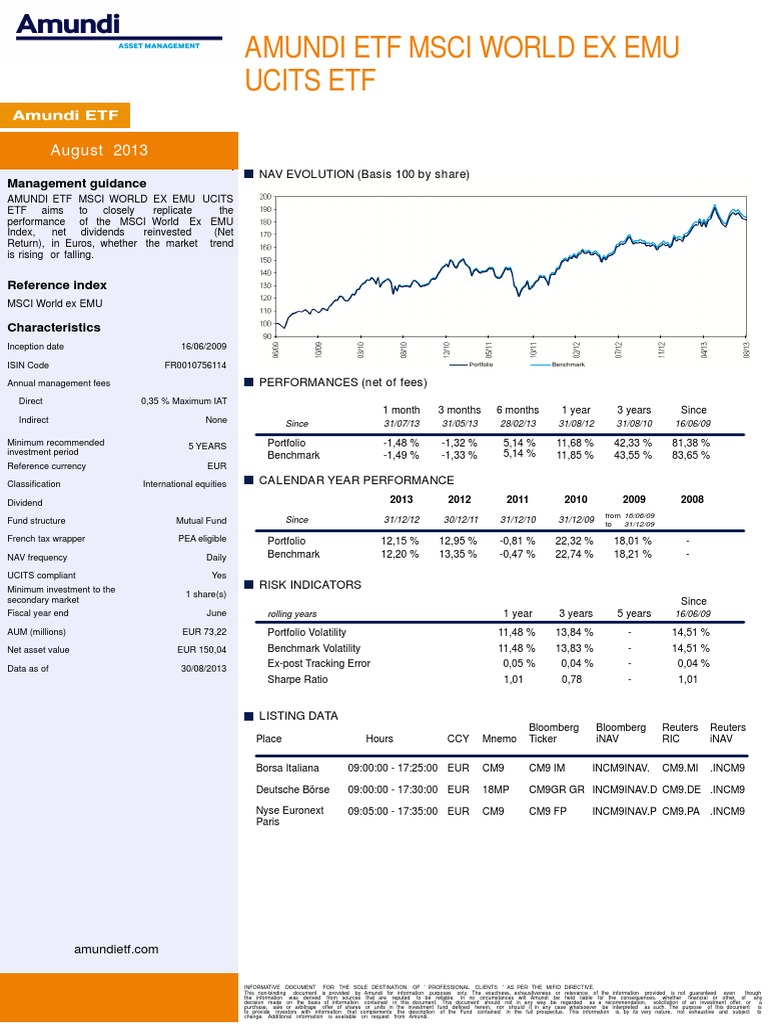

The NAV of the Amundi MSCI World ex-US UCITS ETF Acc is typically calculated daily, reflecting the closing market prices of its underlying assets.

- Calculation Process: The calculation involves aggregating the market value of all holdings, adjusting for currency exchange rates, and deducting all expenses.

- Dissemination to Investors: The calculated NAV is typically made available to investors at the end of each trading day through the ETF provider's website and various financial data providers.

Process and Timelines:

- NAV calculated daily at market close.

- Published on the Amundi website and financial data providers shortly after market close.

- Delay may occur due to data availability or processing times.

Implications of NAV Fluctuations for Investors

Understanding NAV fluctuations is crucial for making sound investment decisions.

NAV and Investment Returns

The NAV of the Amundi MSCI World ex-US UCITS ETF Acc directly reflects the performance of its underlying assets. An increase in NAV signifies an increase in the value of your investment, while a decrease reflects a loss. Market volatility significantly impacts these fluctuations.

Examples of How NAV Changes Affect Investment Gains/Losses:

- If the NAV increases from €100 to €110, you have a 10% return on your investment.

- Conversely, a decrease from €100 to €90 represents a 10% loss.

NAV and Investment Decisions

Investors use NAV data to make informed buy and sell decisions.

- Buy Signal: A consistently rising NAV trend can suggest a positive outlook for the ETF.

- Sell Signal: A sustained downward trend in the NAV could indicate a potential need for re-evaluation or adjustments to the investment strategy.

Practical Tips for Using NAV Data for Investment Strategies:

- Monitor NAV trends over time.

- Compare NAV to benchmark indices for relative performance.

- Consider diversification to mitigate risk associated with NAV fluctuations.

Understanding the Difference Between NAV and Market Price

While closely related, the NAV and the market price of the Amundi MSCI World ex-US UCITS ETF Acc might differ slightly.

- Discrepancy: The discrepancy arises from factors such as the bid-ask spread (the difference between the buying and selling price) and intraday trading activity.

- Bid-Ask Spread: This represents the difference between the price at which investors can buy and sell the ETF in the market.

Illustrative Examples:

- The NAV might be €100, but the market price might be €99.80 (bid) or €100.20 (ask), due to the bid-ask spread.

Accessing and Interpreting Amundi MSCI World ex-US UCITS ETF Acc NAV Data

Sources of NAV Information

Reliable NAV data for the Amundi MSCI World ex-US UCITS ETF Acc is available through various sources:

- Amundi Website: The official website of Amundi is the primary source for accurate and up-to-date NAV information.

- Financial News Sources: Major financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) often publish ETF NAV data.

Links to Relevant Websites (If available, include direct links):

Interpreting NAV Data Effectively

Understanding and interpreting NAV data requires careful analysis.

- Data Interpretation: Focus on long-term trends rather than short-term fluctuations.

- Benchmark Comparison: Compare the ETF's NAV performance against its benchmark index (MSCI World ex-US) to assess relative performance.

Practical Tips for Interpreting NAV Data:

- Use charts and graphs to visualize NAV trends.

- Consider using rolling averages to smooth out short-term volatility.

- Consult with a financial advisor for personalized guidance.

Conclusion: Making Informed Decisions with Amundi MSCI World ex-US UCITS ETF Acc NAV Data

Understanding the NAV calculation of the Amundi MSCI World ex-US UCITS ETF Acc is essential for making informed investment decisions. Fluctuations in NAV directly impact your investment returns. By regularly monitoring the NAV and understanding its relationship to market conditions and expenses, you can better manage your investment strategy. Remember to use multiple sources for data verification and consider seeking professional financial advice tailored to your individual needs and risk tolerance when investing in the Amundi MSCI World ex-US UCITS ETF Acc or any other exchange-traded funds.

Featured Posts

-

Affordable Country Homes Properties Under 1 Million In The Uk

May 25, 2025

Affordable Country Homes Properties Under 1 Million In The Uk

May 25, 2025 -

H Nonline Sk Hospodarsky Pokles V Nemecku Vedie K Masivnym Prepustaniam

May 25, 2025

H Nonline Sk Hospodarsky Pokles V Nemecku Vedie K Masivnym Prepustaniam

May 25, 2025 -

Planning Your Memorial Day 2025 Trip Smart Flight Booking

May 25, 2025

Planning Your Memorial Day 2025 Trip Smart Flight Booking

May 25, 2025 -

Nemecke Spolocnosti Rusia Pracovne Miesta Rozsiahle Prepustanie V Ekonomike

May 25, 2025

Nemecke Spolocnosti Rusia Pracovne Miesta Rozsiahle Prepustanie V Ekonomike

May 25, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzio

May 25, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzio

May 25, 2025

Latest Posts

-

Kyle Walker And Serbian Models Details Emerge After Wifes Departure

May 25, 2025

Kyle Walker And Serbian Models Details Emerge After Wifes Departure

May 25, 2025 -

Recent Photos Annie Kilners Sparkling New Ring And Its Significance

May 25, 2025

Recent Photos Annie Kilners Sparkling New Ring And Its Significance

May 25, 2025 -

Footballer Kyle Walkers Milan Party Amidst Family Matters

May 25, 2025

Footballer Kyle Walkers Milan Party Amidst Family Matters

May 25, 2025 -

Following Walker Sighting Annie Kilner Debuts Impressive Diamond Ring

May 25, 2025

Following Walker Sighting Annie Kilner Debuts Impressive Diamond Ring

May 25, 2025 -

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025