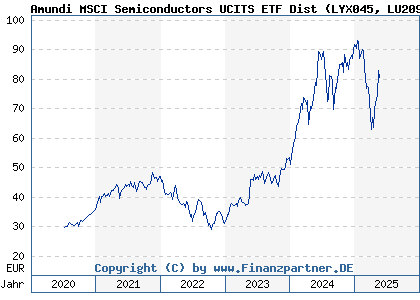

Amundi MSCI World II UCITS ETF Dist: Daily NAV And Its Importance

Table of Contents

What is the Amundi MSCI World II UCITS ETF Dist Daily NAV?

The Amundi MSCI World II UCITS ETF Dist daily NAV represents the value of a single share in the ETF at the close of the market each day. Understanding Net Asset Value (NAV) is fundamental to ETF investing. Simply put, the NAV is calculated by taking the total value of all the assets held by the ETF (stocks, bonds, etc.) and dividing it by the total number of outstanding shares.

The daily NAV calculation involves a complex process of valuing all the underlying assets at their market price at the end of the trading day. This is then adjusted for any expenses or liabilities associated with the ETF. While the precise calculation is complex, investors don't need to understand the intricacies; they only need to understand its significance and how to utilize it.

You can find the Amundi MSCI World II UCITS ETF Dist daily NAV from several reliable sources:

- Amundi's official website: Amundi, the fund manager, typically publishes the daily NAV on their investor relations section.

- Financial news websites: Major financial news sources often provide real-time or end-of-day NAV data for popular ETFs like the Amundi MSCI World II UCITS ETF Dist.

- Brokerage platforms: If you hold the ETF through a brokerage account, the daily NAV will be readily accessible on your account statement or trading platform.

Example: Let's say the Amundi MSCI World II UCITS ETF Dist daily NAV is €100 on Monday. If it closes at €101 on Tuesday, your investment has increased by 1%. Conversely, if it falls to €99, your investment has decreased by 1%. This simple example highlights the direct impact of daily NAV fluctuations on investment value.

The Importance of Monitoring Amundi MSCI World II UCITS ETF Dist Daily NAV

Monitoring the Amundi MSCI World II UCITS ETF Dist daily NAV is vital for several reasons:

Performance Tracking: The daily NAV changes provide a clear picture of the ETF's performance over time. By tracking these changes, investors can easily see how their investment is performing, whether it's outperforming or underperforming its benchmark.

Investment Decisions: Observing NAV trends helps inform buy and sell decisions. A consistent upward trend might suggest a strong performing asset, while a prolonged downward trend could signal a need to re-evaluate the investment strategy.

Risk Management: Monitoring the NAV allows investors to assess the risk associated with their investment. Significant and sudden drops in the NAV can indicate higher levels of risk and potential losses.

Benchmarking: Comparing the ETF's daily NAV to its benchmark index (the MSCI World Index in this case) is crucial to assess its relative performance. Does it consistently track the benchmark, or is it outperforming or underperforming?

- Identify trends in NAV fluctuations: Are there recurring patterns or seasonal variations?

- Assess the impact of market events on NAV: How does the NAV react to significant global events, such as interest rate changes or geopolitical instability?

- Compare NAV performance to benchmarks: How does the ETF's NAV performance compare to the MSCI World Index or other similar global equity ETFs?

Factors Affecting Amundi MSCI World II UCITS ETF Dist Daily NAV

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist:

Global Market Fluctuations: Global market trends significantly impact the NAV. A bull market generally leads to increased NAV, while a bear market usually results in a decrease.

Currency Exchange Rates: Because this is a globally diversified ETF, currency fluctuations between the Euro (or your local currency) and the currencies of the underlying assets play a significant role. Changes in exchange rates can positively or negatively impact the NAV.

Underlying Asset Performance: The performance of the companies included in the MSCI World Index directly affects the ETF's NAV. If the underlying companies perform well, the NAV typically increases.

Dividend Distributions: Dividend payments from the underlying companies are usually reinvested, which can positively impact the NAV in the long term. However, on the ex-dividend date, the NAV may temporarily decrease to reflect the distribution.

- Geopolitical events and their impact on NAV: Major geopolitical events can cause significant market volatility and affect the NAV.

- Sector-specific performance affecting the NAV: The performance of specific sectors within the MSCI World Index can influence the overall NAV.

- The effect of interest rate changes on the NAV: Changes in interest rates can affect the valuation of the underlying assets and therefore the NAV.

Interpreting NAV Changes in Context

It's crucial to consider the broader market context when interpreting daily NAV changes. A small daily drop might not be cause for concern if the entire market is experiencing a downturn. Conversely, a seemingly insignificant daily increase could be a positive sign if the overall market is relatively flat.

Differentiating between short-term volatility and long-term trends is essential. Daily NAV fluctuations are common, especially in volatile markets. Focus on the long-term trend rather than reacting to every small daily change. A long-term investment strategy is crucial for success with ETFs like the Amundi MSCI World II UCITS ETF Dist.

Conclusion

Tracking the Amundi MSCI World II UCITS ETF Dist daily NAV is essential for informed investment decisions. Understanding daily NAV fluctuations allows for effective performance tracking, robust risk management, and strategic investment planning. By monitoring the NAV, comparing it to benchmarks, and considering broader market conditions, investors can make more confident decisions regarding their investment in this globally diversified ETF.

Call to Action: Actively monitor the Amundi MSCI World II UCITS ETF Dist daily NAV using reliable sources like Amundi's website, financial news portals, and your brokerage platform. Regularly reviewing this key metric, along with a thorough understanding of the ETF's composition and historical performance, is vital for developing a sound long-term investment plan. Don't just look at the daily NAV; use it as a tool to understand the broader performance of your Amundi MSCI World II UCITS ETF NAV, enabling informed decisions regarding your Amundi MSCI World ETF NAV and your overall investment strategy. Continue researching and tracking your daily NAV tracking to maximize your investment potential.

Featured Posts

-

Memorial Day 2025 Air Travel When To Fly And When Not To

May 24, 2025

Memorial Day 2025 Air Travel When To Fly And When Not To

May 24, 2025 -

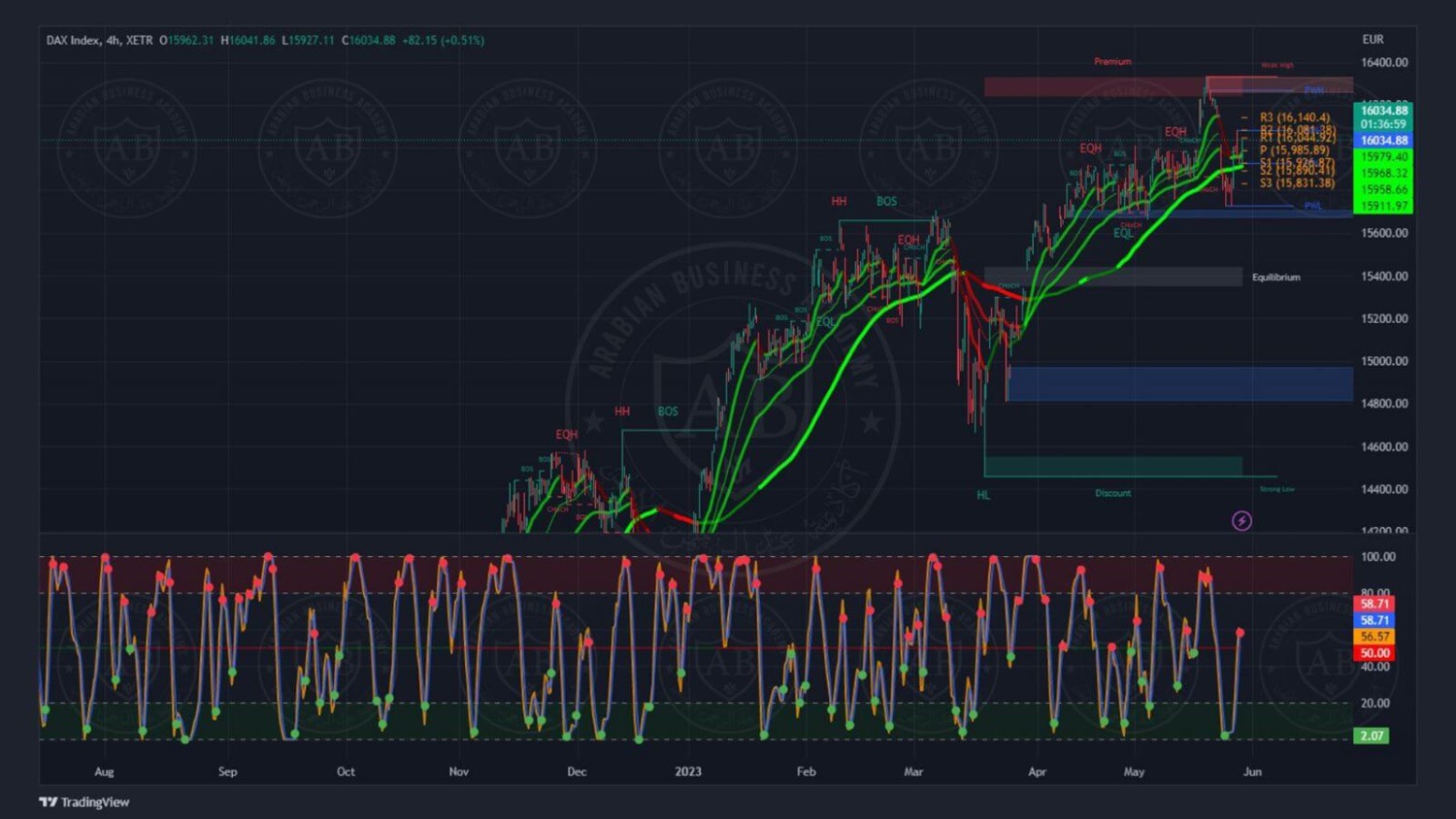

Mwshr Daks Alalmany Yqwd Alteafy Alawrwby Bed Tjawzh Ldhrwt Mars

May 24, 2025

Mwshr Daks Alalmany Yqwd Alteafy Alawrwby Bed Tjawzh Ldhrwt Mars

May 24, 2025 -

Glastonbury 2024 Unannounced Us Band Teases Festival Slot

May 24, 2025

Glastonbury 2024 Unannounced Us Band Teases Festival Slot

May 24, 2025 -

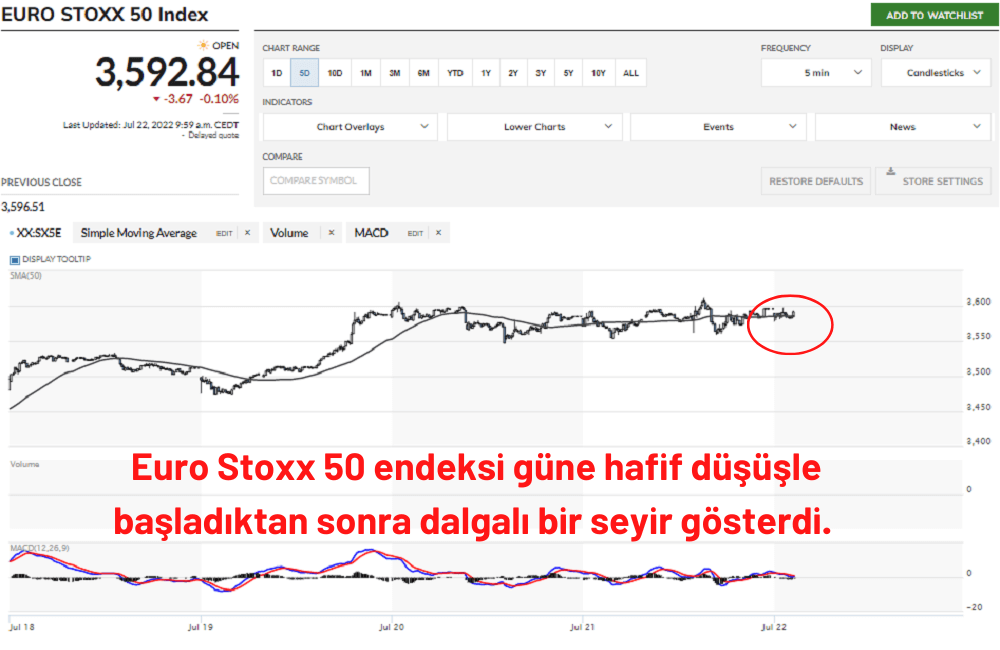

Avrupa Piyasalari Buguenkue Karisik Performans

May 24, 2025

Avrupa Piyasalari Buguenkue Karisik Performans

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025

Latest Posts

-

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025 -

M56 Closed Live Traffic Updates Following Serious Crash

May 24, 2025

M56 Closed Live Traffic Updates Following Serious Crash

May 24, 2025 -

M56 Road Closure Live Traffic And Travel Updates Due To Accident

May 24, 2025

M56 Road Closure Live Traffic And Travel Updates Due To Accident

May 24, 2025 -

Severe M56 Crash Causes Significant Traffic Disruption Live Updates

May 24, 2025

Severe M56 Crash Causes Significant Traffic Disruption Live Updates

May 24, 2025 -

M56 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025

M56 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025