Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Analysis And Implications

Table of Contents

Deciphering the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

The NAV represents the net value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV is calculated daily by taking the total market value of all the assets held in the ETF (including dividends receivable), subtracting liabilities, and dividing by the number of outstanding shares.

Several factors influence daily NAV fluctuations:

- Currency Exchange Rates: Because this ETF is USD hedged, fluctuations in the exchange rate between the underlying assets' currencies and the USD are mitigated, but not completely eliminated. Small changes can still affect the NAV.

- Underlying Asset Performance: The primary driver of NAV changes is the performance of the underlying assets—the hundreds of companies included in the MSCI World Index. A positive day for global markets generally translates to a higher NAV.

- Dividend Distributions: When the ETF distributes dividends, the NAV decreases by the dividend amount per share. This reflects the distribution of assets to shareholders.

Here's a breakdown:

- Definition of NAV: The net asset value of a single share.

- Calculation Methodology: Total asset value less liabilities, divided by outstanding shares.

- Impact of Currency Hedging: Reduces, but doesn't eliminate, the impact of currency fluctuations on NAV.

- Influence of Underlying Assets: The primary determinant of NAV performance.

For example, if the underlying assets increase in value by 1%, the NAV will generally increase by a similar percentage (accounting for expenses). Conversely, a decline in the value of underlying assets will lead to a decrease in NAV.

Analyzing Historical NAV Performance and Trends

[Insert a chart or graph here showing the historical NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist. The chart should clearly show long-term trends and periods of volatility.]

Analyzing this chart reveals both long-term growth and short-term volatility. Periods of strong global economic growth generally correlate with higher NAVs, while market downturns lead to decreases. By comparing this ETF's performance to benchmarks like other MSCI World ETFs (both hedged and unhedged), investors can assess its relative performance and risk profile.

- Long-term growth analysis: Shows consistent, albeit volatile, growth over time.

- Volatility assessment: Illustrates the fluctuations in NAV, highlighting risk levels.

- Benchmark comparison: Provides context by comparing the ETF's performance to similar investment options.

- Key performance drivers: Identifies market factors and economic conditions that influence NAV.

Implications of NAV Changes for Investment Strategies

NAV fluctuations significantly impact various investment strategies.

- Buy-and-hold strategy: For long-term investors using a buy-and-hold strategy, short-term NAV fluctuations are less critical, with focus on long-term growth potential.

- Dollar-cost averaging: Regularly investing a fixed amount regardless of the NAV mitigates the risk of investing a lump sum at a market peak.

- Entry/exit point considerations: While NAV is a crucial factor, it shouldn't be the sole determinant of buy/sell decisions. Other factors like expense ratios and market sentiment should be considered.

- Risk management techniques: Diversification within a portfolio and understanding the ETF's risk profile are essential risk management tools.

Careful consideration of these factors enables investors to make informed decisions about when to enter or exit a position.

Comparing Amundi MSCI World II UCITS ETF USD Hedged Dist to Alternatives

Several ETFs track the MSCI World Index. Comparing the Amundi MSCI World II UCITS ETF USD Hedged Dist to alternatives reveals key differences:

- Expense ratio comparison: A lower expense ratio results in higher returns for investors.

- Tracking error analysis: Measures how closely the ETF's performance tracks the underlying index.

- Performance comparison: Comparing historical returns provides insights into relative performance.

- Advantages and disadvantages: Weighing pros and cons helps investors choose the best option for their needs.

Consider whether the currency hedging offered by the Amundi ETF aligns with your investment goals and risk tolerance. Unhedged ETFs offer potential for higher returns but also expose investors to currency risk.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Analysis

Understanding the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for informed investment decisions. By analyzing historical NAV performance, understanding the factors influencing it, and comparing it to alternatives, investors can make more strategic choices. Remember that NAV is only one piece of the puzzle; consider the ETF's expense ratio, trading volume, and your overall investment strategy. Conduct thorough research and consult a financial advisor before investing. The Amundi MSCI World II UCITS ETF USD Hedged Dist, with its carefully considered currency hedging, offers a potentially valuable addition to a diversified portfolio for investors seeking global market exposure. Begin your deeper dive into Amundi MSCI World II UCITS ETF investment today!

Featured Posts

-

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025 -

Daily Nav Updates For The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Daily Nav Updates For The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Free Transfer Target Crystal Palace Interested In Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace Interested In Kyle Walker Peters

May 24, 2025 -

Porsche 956 Nin Tavan Asili Sergilenmesinin Nedenleri

May 24, 2025

Porsche 956 Nin Tavan Asili Sergilenmesinin Nedenleri

May 24, 2025 -

Avrupa Borsalarinda Karisik Sonuclar

May 24, 2025

Avrupa Borsalarinda Karisik Sonuclar

May 24, 2025

Latest Posts

-

Princess Road Collision Pedestrian Struck Latest News And Updates

May 24, 2025

Princess Road Collision Pedestrian Struck Latest News And Updates

May 24, 2025 -

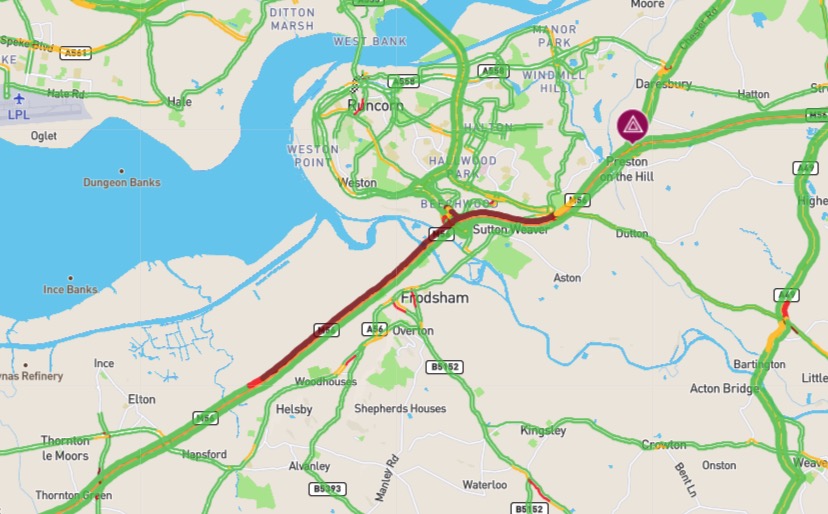

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Long Delays On M6 Motorway Due To Van Overturn

May 24, 2025

Long Delays On M6 Motorway Due To Van Overturn

May 24, 2025 -

M62 Westbound Roadworks Resurfacing From Manchester To Warrington Planned Closure

May 24, 2025

M62 Westbound Roadworks Resurfacing From Manchester To Warrington Planned Closure

May 24, 2025 -

Planned M62 Westbound Closure Resurfacing Works Between Manchester And Warrington

May 24, 2025

Planned M62 Westbound Closure Resurfacing Works Between Manchester And Warrington

May 24, 2025