Analysis: Berkshire Hathaway's Long-Term Strategy In The Japanese Trading Sector

Table of Contents

The Rationale Behind Berkshire Hathaway's Japanese Investments

Berkshire Hathaway's decision to invest heavily in Japan isn't arbitrary; it's a strategic maneuver driven by several compelling factors.

Diversification and Risk Mitigation

Investing in the Japanese market significantly diversifies Berkshire's portfolio, reducing its reliance on the US economy. This is a crucial risk mitigation strategy, as the US and Japanese markets exhibit relatively low correlation. A downturn in one market doesn't necessarily translate to a parallel decline in the other, thus offering a buffer against overall portfolio volatility.

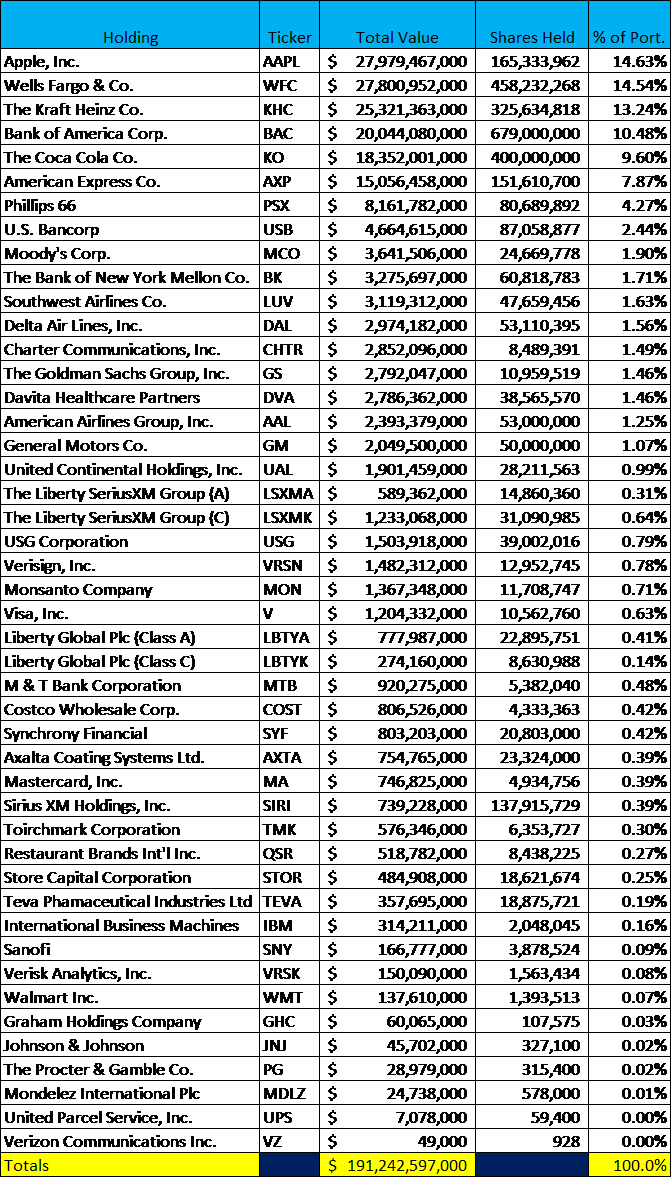

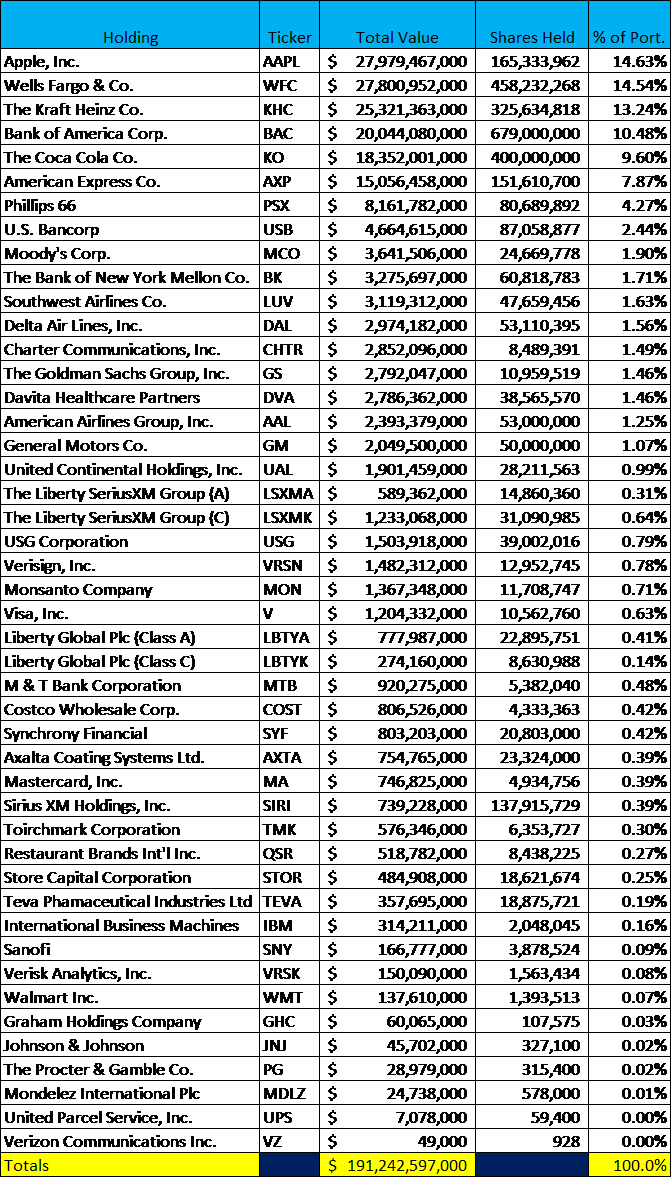

- Examples of Berkshire's Japanese investments: While specific portfolio holdings are not publicly detailed to the same extent as US investments, Berkshire has disclosed significant stakes in five major Japanese trading companies: Itochu, Mitsubishi, Mitsui & Co., Sumitomo, and Marubeni. These companies represent diverse sectors within the Japanese economy, including energy, materials, and consumer goods.

- Reduced Market Correlation: The historical performance of the US and Japanese stock markets demonstrates a relatively low correlation coefficient, meaning their price movements are not strongly linked. This decreased correlation contributes significantly to portfolio diversification and risk reduction.

Attractive Valuation and Growth Potential

Many Japanese companies, particularly within the trading sector, offer compelling valuations and substantial long-term growth potential. Years of relative stagnation have left some sectors undervalued, presenting attractive entry points for a value investor like Warren Buffett.

- Drivers of Growth: Factors driving growth in these sectors include:

- Technological advancements, particularly in areas like renewable energy and automation.

- Government initiatives aimed at stimulating economic growth and infrastructure development.

- A recovering global economy driving increased demand for Japanese goods and services.

- Potential for Future Returns: Berkshire’s long-term outlook anticipates significant capital appreciation as these undervalued companies realize their growth potential.

Strategic Partnerships and Synergies

Berkshire Hathaway's investment in Japan opens doors to potential strategic partnerships and synergies with leading Japanese corporations. This could extend beyond simple financial investments to encompass collaborations in various sectors.

- Potential Synergy Areas:

- Insurance: Berkshire Hathaway's vast insurance operations could find synergies with Japanese insurance companies.

- Manufacturing: Collaborations in manufacturing and supply chain management could leverage Berkshire's expertise and Japanese companies' manufacturing prowess.

- Technology: Partnerships could be forged in sectors such as renewable energy and automation technology.

- Advantages of Strategic Partnerships: These partnerships could lead to increased market access, technological innovation, and enhanced operational efficiencies for both parties.

Berkshire Hathaway's Investment Approach in Japan

Berkshire's investment approach in Japan is consistent with its globally recognized long-term strategy.

Long-Term Buy-and-Hold Strategy

Berkshire's characteristic long-term, buy-and-hold strategy is central to its Japanese investments. This approach prioritizes building long-term value rather than engaging in short-term market speculation.

- Illustrative Examples: Berkshire's significant investments in the five major Japanese trading houses reflect this long-term commitment. These are not short-term plays, but rather strategic investments intended to yield returns over many years.

- Advantages of Long-Term Approach: This approach allows Berkshire to weather short-term market fluctuations and benefit from the sustained growth of its investments.

Focus on High-Quality Businesses

Berkshire consistently targets companies with strong fundamentals, reliable management, and sustainable business models. This focus is replicated in its Japanese investments.

- Examples of High-Quality Businesses: The five trading houses selected by Berkshire are examples of established companies with long track records, strong balance sheets, and diverse operations.

- Alignment with Investment Philosophy: This selection reflects Berkshire's unwavering commitment to investing in businesses with demonstrably strong long-term potential.

Passive Investment Style

Berkshire's Japanese investments are largely passive, focusing on long-term value creation rather than active management or attempting to influence company strategy.

- Comparison to Active Strategies: Unlike some investment firms that actively seek to reshape their portfolio companies, Berkshire's approach in Japan is hands-off, trusting in the management of the invested companies.

- Benefits of Passive Approach: This minimizes interference and allows management teams to focus on running their businesses effectively.

Potential Challenges and Risks

While the potential rewards of Berkshire Hathaway's Japanese investments are significant, several challenges and risks exist.

Geopolitical Risks

Geopolitical risks, including trade disputes and economic slowdowns in either Japan or globally, could negatively impact Berkshire's investments.

- Potential Negative Impacts: A global economic downturn or significant trade friction could reduce demand for Japanese goods and services, impacting the performance of Berkshire's holdings.

- Risk Mitigation Strategies: Berkshire's diversified portfolio and long-term horizon provide some insulation against these risks.

Currency Fluctuations

Fluctuations in the US dollar and Japanese yen exchange rate can significantly affect the profitability of Berkshire's investments.

- Potential Scenarios: A strengthening yen against the dollar would reduce the value of Berkshire's returns when converted to US dollars.

- Currency Risk Reduction: Hedging strategies could be employed to mitigate some of this risk, although complete elimination is usually not feasible.

Regulatory Environment

Navigating the Japanese regulatory environment presents potential complexities and challenges.

- Potential Regulatory Hurdles: Understanding and complying with Japanese regulations related to investments and corporate governance is crucial.

- Successful Navigation: Berkshire's experience and expertise in global markets should allow them to successfully navigate this regulatory landscape.

Assessing Berkshire Hathaway's Long-Term Vision in Japan

Berkshire Hathaway's investment in the Japanese trading sector represents a significant strategic move driven by diversification needs, attractive valuations, and potential for future growth. The company's characteristic long-term, buy-and-hold strategy, focus on high-quality businesses, and passive investment style are all applied in this new market. While geopolitical risks, currency fluctuations, and the regulatory environment present challenges, Berkshire's experience and financial strength position it well to navigate these hurdles. The long-term implications of this strategy are far-reaching, impacting not only Berkshire Hathaway’s future but also the Japanese economy and the broader global investment landscape. Further research into Berkshire Hathaway's Japanese strategy, its long-term investment approach in Japan, and detailed Japanese trading sector analysis will provide a more comprehensive understanding of this momentous shift.

Featured Posts

-

Psg Fiton Minimalisht Pas Pjeses Se Pare Analiza E Ndeshjes

May 08, 2025

Psg Fiton Minimalisht Pas Pjeses Se Pare Analiza E Ndeshjes

May 08, 2025 -

A Three Minute Role Nathan Fillions Impact On Saving Private Ryan

May 08, 2025

A Three Minute Role Nathan Fillions Impact On Saving Private Ryan

May 08, 2025 -

Stream Andor Season 1 Episodes On Hulu And You Tube Before Season Two

May 08, 2025

Stream Andor Season 1 Episodes On Hulu And You Tube Before Season Two

May 08, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

May 08, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

May 08, 2025 -

Growth Investors Bold Claim Bitcoin To Soar 1 500

May 08, 2025

Growth Investors Bold Claim Bitcoin To Soar 1 500

May 08, 2025