Analysis: How Trump's Tariffs Could Cost California $16 Billion

Table of Contents

Industries Most Heavily Impacted by Trump's Tariffs in California

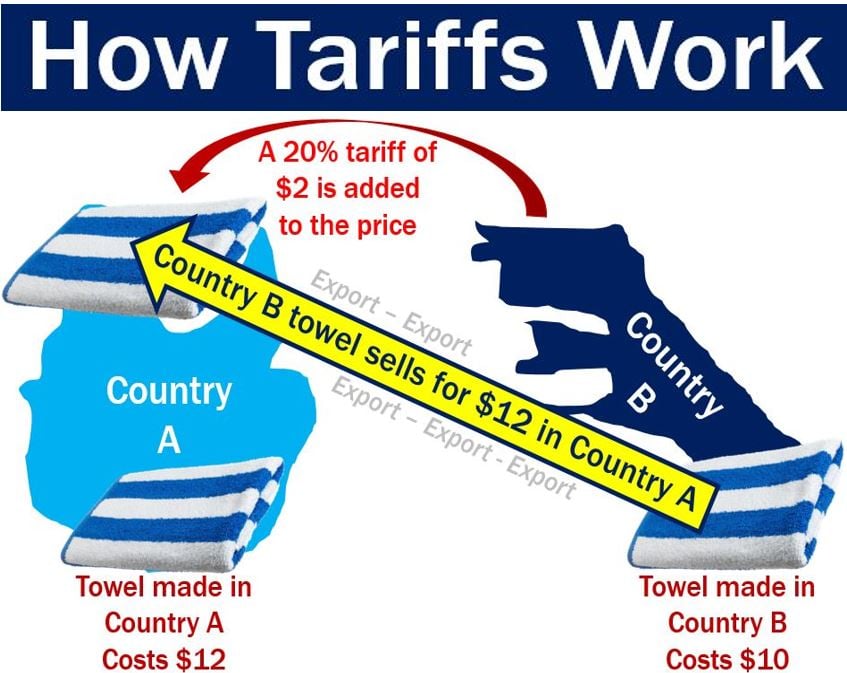

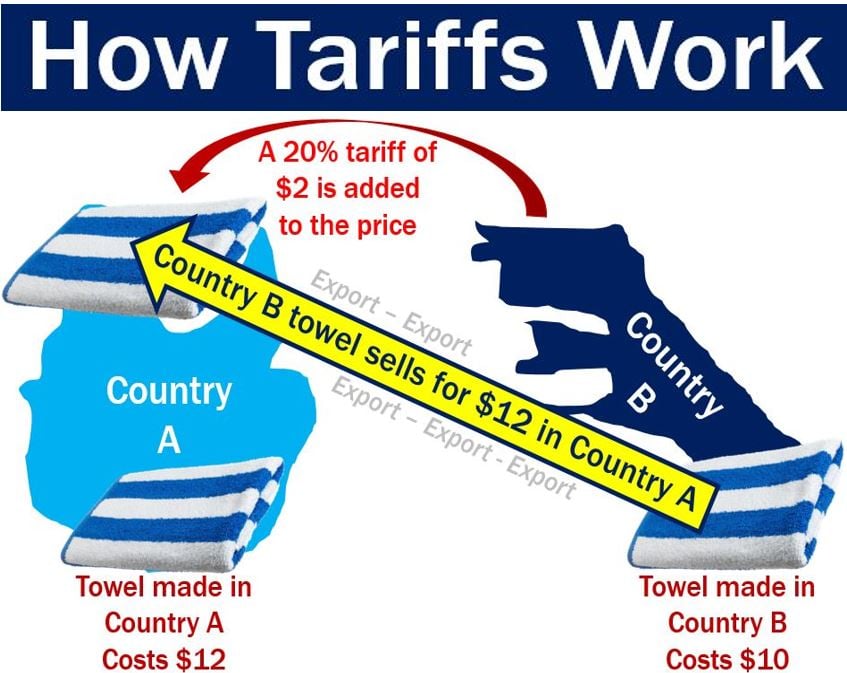

Trump's tariffs significantly impacted several key Californian industries, creating a ripple effect throughout the state's economy.

Agriculture: A Bitter Harvest for California Farmers

California's agricultural sector, a cornerstone of the state's economy, suffered greatly under Trump's tariffs. The impact of "tariff impact on agriculture" was particularly pronounced on exports to China, a major trading partner.

- Specific examples: Tariffs on almonds, walnuts, and wine significantly reduced export volumes to China and other countries. The resulting price increases for Californian farmers led to decreased profitability and, in some cases, farm closures. The "California agriculture" industry faced reduced demand and increased competition from other exporting nations.

- Statistics: A study by [insert credible source here] estimated a [insert percentage]% decrease in agricultural exports from California due to tariffs, resulting in a loss of [insert dollar amount] in revenue for farmers. This had a direct impact on farmworkers' jobs and livelihoods. The keywords "agricultural exports" and "tariff impact on agriculture" highlight the severity of the problem.

Manufacturing: A Blow to California's Industrial Base

California's manufacturing sector, encompassing electronics, textiles, and other goods, also felt the pinch of Trump's tariffs. Increased input costs due to tariffs on imported materials significantly hampered the competitiveness of Californian manufacturers in the global market.

- Examples: Increased tariffs on steel and aluminum raised the cost of production for many manufacturers, making their products less competitive internationally. The electronics industry, reliant on imported components, saw increased production costs and a decline in profitability. The term "California manufacturing" is crucial here.

- Job losses: The "tariff impact on manufacturing" resulted in job losses across various manufacturing sectors in California, contributing to increased unemployment in certain regions. [Insert source and statistics here regarding job losses in specific manufacturing sectors in California]. The keyword "job losses in California" highlights a critical social and economic consequence.

Retail and Consumer Goods: Higher Prices for California Consumers

The impact of Trump's tariffs wasn't limited to producers; California consumers also faced the brunt through increased prices for a range of goods. "Retail prices" soared as tariffs were passed onto consumers.

- Examples: Tariffs on imported goods, such as clothing, furniture, and electronics, led to noticeably higher prices in retail stores across California. The keywords "consumer goods" and "retail prices" accurately capture this aspect of the economic impact.

- Reduced Consumer Spending: Higher prices resulted in reduced consumer spending, creating a negative feedback loop that impacted other businesses reliant on consumer demand. This resulted in decreased overall economic activity, leading to concerns about "inflation in California."

The Economic Ripple Effect: Beyond Direct Costs

The effects of Trump's tariffs on California extended far beyond the direct impacts on specific industries.

Job Losses and Unemployment: A Widening Economic Gap

The combined impact of tariffs across different sectors led to significant job losses throughout California, impacting employment rates and creating economic hardship for many families.

- Statistics: [Insert credible source and statistics on projected job losses across different sectors]. Regional variations in job losses were observed, with some areas experiencing more significant impacts than others. The keywords "California unemployment" and "job losses due to tariffs" emphasize the social consequences.

- Long-term Consequences: The long-term economic consequences of these job losses include reduced household income, decreased consumer spending, and potential downward pressure on wages. The possibility of an "economic recession" was a genuine concern.

Reduced State Revenue: A Strain on Public Services

Decreased economic activity in key sectors directly impacted California's state budget, leading to reduced tax revenue and potential cuts in public services.

- Impact on the Budget: The decrease in tax revenue from affected industries created a significant strain on the "California state budget." The keywords "tax revenue" and "government spending" are crucial to understanding this impact.

- Potential Cuts: Potential cuts to vital public services, such as education, healthcare, and infrastructure, were a serious concern as the state grappled with reduced revenue.

Potential Mitigation Strategies and Policy Responses

Addressing the negative consequences of Trump's tariffs required a multi-pronged approach involving both government intervention and strategic business adaptation.

Government Intervention: A Necessary Response

Government intervention was crucial to mitigating the damage caused by the tariffs.

- Government Assistance: Government programs offering financial assistance to affected businesses, such as low-interest loans and grants, could have helped to soften the blow. The keyword "government assistance" highlights a crucial potential response.

- Trade Negotiations: Negotiating new trade agreements to diversify export markets and reduce reliance on countries imposing tariffs could have helped lessen the impact. The term "economic policy" highlights the importance of government action.

Business Adaptation: Resilience in the Face of Adversity

Businesses needed to adapt their strategies to navigate the challenges posed by the tariffs.

- Supply Chain Diversification: Businesses could diversify their supply chains to reduce reliance on countries imposing tariffs. This is captured by the keyword "supply chain management".

- Investment in Technology: Investing in technology to improve efficiency and reduce costs could have helped businesses remain competitive despite increased input costs. This links to the keyword "business resilience."

- Cost Reduction: Implementing cost-reduction measures and exploring alternative sourcing strategies could help mitigate the impact. "Economic diversification" represents a key long-term strategy for future resilience.

Conclusion: The Ongoing Impact of Trump's Tariffs on California

Trump's tariffs posed a significant threat to the California economy, with projections suggesting a potential $16 billion loss. The impact stretches across various sectors, from agriculture and manufacturing to retail, leading to job losses, reduced state revenue, and increased prices for consumers. While the situation was serious, proactive government intervention and strategic adaptation by businesses were crucial to mitigating the negative consequences. Understanding the full impact of Trump's tariffs on California is essential for developing effective strategies to protect the state's economic future. Continue to stay informed about the effects of Trump's tariffs on California and advocate for policies that support economic stability and growth.

Featured Posts

-

Presenza Di Microplastiche Nell Acqua Una Mappa Del Rischio

May 16, 2025

Presenza Di Microplastiche Nell Acqua Una Mappa Del Rischio

May 16, 2025 -

Albanese Vs Dutton A Critical Analysis Of Their Policy Pitches

May 16, 2025

Albanese Vs Dutton A Critical Analysis Of Their Policy Pitches

May 16, 2025 -

From Write Off To Title Contender Paddy Pimbletts Journey

May 16, 2025

From Write Off To Title Contender Paddy Pimbletts Journey

May 16, 2025 -

Sigue En Directo El Partido Roma Monza

May 16, 2025

Sigue En Directo El Partido Roma Monza

May 16, 2025 -

Ufc Veterans Take The Realistic Outlook On Pimblett Vs Chandler

May 16, 2025

Ufc Veterans Take The Realistic Outlook On Pimblett Vs Chandler

May 16, 2025