Analysis Of ING Group's 2024 Annual Report On Form 20-F

Table of Contents

Financial Highlights of ING Group's 2024 Form 20-F

Revenue and Profitability

The ING Group 2024 Form 20-F details the company's revenue streams and profitability. Analyzing these figures provides crucial insights into the company's financial performance. Key metrics to consider include net income, operating income, and revenue growth. Year-over-year comparisons are essential to understand trends and identify potential areas of strength or weakness.

- Net Income: [Insert data from the 20-F here. Example: A year-over-year increase of X% in net income, indicating strong profitability.] Discuss the factors contributing to this change (e.g., increased lending activity, successful cost-cutting measures).

- Operating Income: [Insert data from the 20-F here. Example: A slight decrease in operating income despite increased revenue, highlighting potential cost pressures.] Analyze the reasons behind this change (e.g., increased operating expenses, competitive pressures).

- Revenue Growth: [Insert data from the 20-F here. Example: Strong revenue growth in specific sectors, such as retail banking, driven by increased customer acquisition and higher transaction volumes.] Identify the key drivers of revenue growth and their potential for future performance.

- Profit Margin: [Insert data from the 20-F here. Example: A stable profit margin despite economic headwinds, suggesting efficient cost management.] Analyze the factors influencing profit margin and their implications for future profitability.

Key Financial Ratios

Analyzing key financial ratios provides a deeper understanding of ING Group's financial health and performance relative to industry benchmarks and its own historical performance.

- ROE (Return on Equity): [Insert data from the 20-F here. Example: A ROE of X%, compared to Y% in the previous year and Z% industry average.] Discuss the implications of this ratio for shareholder returns.

- ROA (Return on Assets): [Insert data from the 20-F here. Example: An ROA of X%, reflecting the efficiency of asset utilization.] Compare this to previous years and industry averages.

- Debt-to-Equity Ratio: [Insert data from the 20-F here. Example: A debt-to-equity ratio of X, indicating [assess the level of risk – e.g., a healthy leverage position or potential concerns about high debt levels].] Discuss the company's capital structure and its implications for financial risk.

Capitalization and Liquidity

ING Group's Form 20-F provides essential information about its capital adequacy and liquidity position, which are critical indicators of its financial stability and resilience.

- Tier 1 Capital Ratio: [Insert data from the 20-F here. Example: A Tier 1 capital ratio exceeding regulatory requirements, signifying strong capital adequacy.] Discuss the implications for risk absorption capacity.

- Liquidity Coverage Ratio (LCR): [Insert data from the 20-F here. Example: A high LCR, demonstrating the ability to meet short-term liquidity needs.] Explain the significance of this ratio for managing short-term financial obligations.

- Capital Structure Changes: [Insert data from the 20-F here. Example: Any significant changes in capital structure, such as equity issuance or debt reduction, and their impact on the balance sheet.] Analyze the strategic implications of these changes.

Significant Events and Developments in 2024 (as per Form 20-F)

Strategic Initiatives and Acquisitions

The ING Group 2024 Form 20-F likely details significant strategic initiatives and acquisitions undertaken during the year.

- New Strategic Initiatives: [Insert details from the 20-F here. Examples: Launch of new digital banking services, expansion into new markets, or strategic partnerships.] Analyze their impact on revenue growth and market share.

- Acquisitions and Divestitures: [Insert details from the 20-F here. Examples: Acquisitions of fintech companies to enhance digital capabilities, or divestitures of non-core assets to streamline operations.] Discuss the rationale and financial implications of these transactions.

Regulatory Changes and Compliance

Regulatory changes significantly impact financial institutions. The 20-F will disclose any such changes and their impact.

- New Regulations: [Insert details from the 20-F here. Examples: New regulations related to data privacy, anti-money laundering, or capital requirements.] Explain how these changes affect ING Group's operations and compliance costs.

- Compliance Issues and Penalties: [Insert details from the 20-F here. Discuss any reported compliance issues, penalties, or legal proceedings.] Analyze their impact on reputation and profitability.

Market Conditions and Economic Impact

Macroeconomic factors and market conditions greatly influence ING Group's performance.

- Economic Downturn: [Insert details from the 20-F here. Example: Discuss how economic downturns affected lending activity, loan defaults, and investment returns.] Analyze the company's resilience to economic fluctuations.

- Geopolitical Risks: [Insert details from the 20-F here. Example: Discuss the impact of geopolitical events on market volatility and investment strategies.] Analyze how ING Group managed these risks.

Risk Factors and Future Outlook (based on Form 20-F)

Identified Risks

The ING Group 2024 Form 20-F will disclose key risk factors.

- Financial Risk: [Insert details from the 20-F here. Examples: Credit risk, market risk, liquidity risk, and interest rate risk.] Discuss the company's strategies to mitigate these risks.

- Operational Risk: [Insert details from the 20-F here. Examples: Cybersecurity threats, operational failures, and regulatory breaches.] Discuss the company's contingency plans.

Management’s Discussion and Analysis (MD&A)

The MD&A section provides management's perspective on the company's performance and future outlook.

- Financial Projections: [Insert details from the 20-F here. Example: Summarize management's projections for revenue growth, profitability, and key financial ratios.] Assess the reasonableness of these projections.

- Growth Prospects: [Insert details from the 20-F here. Example: Discuss management's assessment of growth opportunities and potential challenges.] Analyze the strategic initiatives that support these prospects.

Conclusion: Key Takeaways from the ING Group 2024 Form 20-F Analysis

This analysis of ING Group's 2024 Form 20-F highlights [summarize key findings – e.g., strong profitability despite economic headwinds, robust capital position, and potential risks related to regulatory changes]. While ING Group demonstrates [mention positive aspects], potential challenges remain, including [mention potential weaknesses]. For a deeper understanding of ING Group's financial strategy and performance, we encourage you to download and review the full ING Group 2024 Annual Report (Form 20-F) and conduct your own comprehensive financial analysis. Further research into specific aspects, such as their risk management strategies or strategic initiatives, will provide a more nuanced understanding of their future prospects.

Featured Posts

-

A Real Pains Disney Arrival April Release Date Announced

May 23, 2025

A Real Pains Disney Arrival April Release Date Announced

May 23, 2025 -

Improving Your Briefs Tips For Clarity And Conciseness

May 23, 2025

Improving Your Briefs Tips For Clarity And Conciseness

May 23, 2025 -

The Importance Of Middle Managers Bridging The Gap Between Leadership And Teams

May 23, 2025

The Importance Of Middle Managers Bridging The Gap Between Leadership And Teams

May 23, 2025 -

Cat Deeleys Pre Show Wardrobe Malfunction A This Morning Dress Blunder

May 23, 2025

Cat Deeleys Pre Show Wardrobe Malfunction A This Morning Dress Blunder

May 23, 2025 -

A Preview Of The 2025 Rendez Vous With French Cinema Festivals And Awards

May 23, 2025

A Preview Of The 2025 Rendez Vous With French Cinema Festivals And Awards

May 23, 2025

Latest Posts

-

Cyril Ramaphosas White House Visit Evaluating His Response To The Unexpected

May 23, 2025

Cyril Ramaphosas White House Visit Evaluating His Response To The Unexpected

May 23, 2025 -

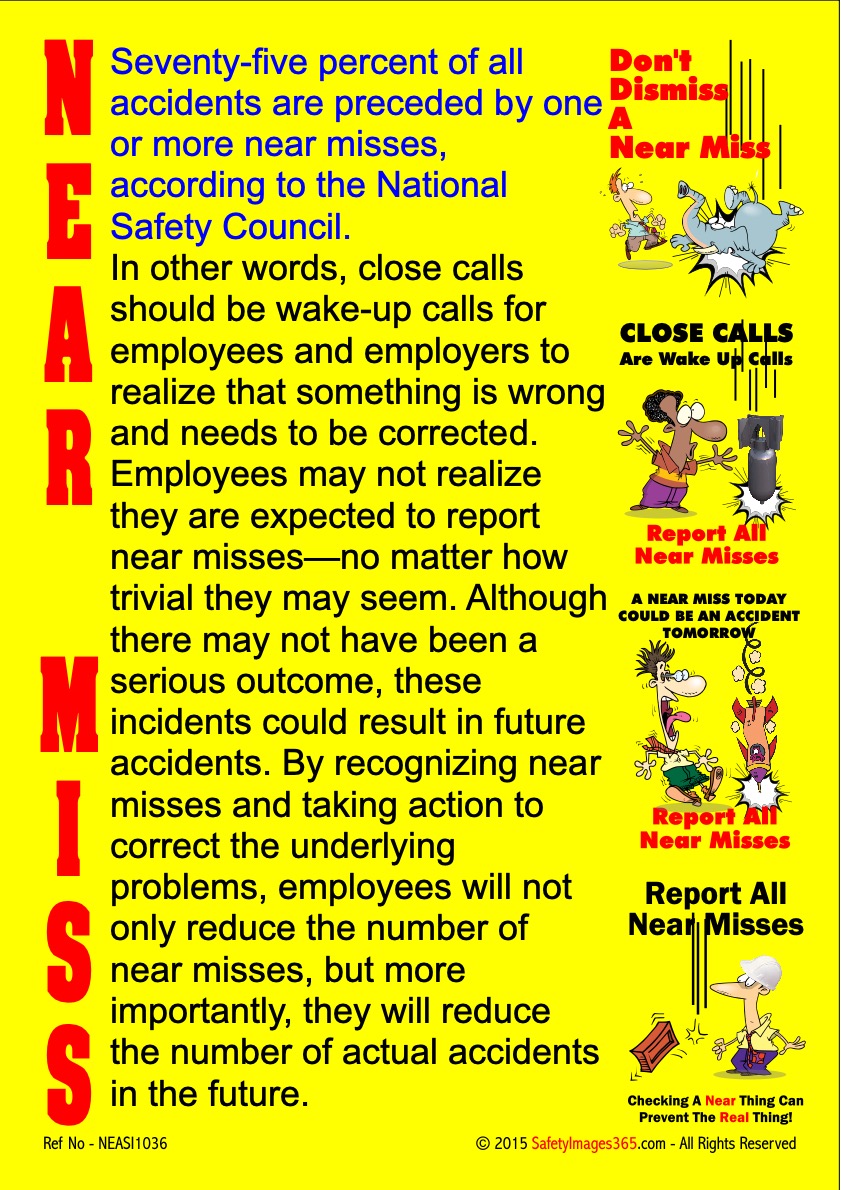

The Reality Of Airplane Accidents A Visual Analysis Of Near Misses And Crashes

May 23, 2025

The Reality Of Airplane Accidents A Visual Analysis Of Near Misses And Crashes

May 23, 2025 -

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 23, 2025

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 23, 2025 -

Analyzing Ramaphosas White House Encounter Could He Have Handled It Differently

May 23, 2025

Analyzing Ramaphosas White House Encounter Could He Have Handled It Differently

May 23, 2025 -

Trump Tax Bill Clears House After Late Night Negotiations

May 23, 2025

Trump Tax Bill Clears House After Late Night Negotiations

May 23, 2025