Analysis Of Ontario's $14.6 Billion Deficit: Causes And Consequences

Table of Contents

Underlying Causes of Ontario's $14.6 Billion Deficit

Several interconnected factors have contributed to the significant $14.6 billion deficit facing Ontario. Let's examine the key drivers:

Increased Healthcare Spending

Rising healthcare costs represent a major contributor to Ontario's fiscal woes. This is driven by several factors:

- Aging Population: Ontario's aging population necessitates increased demand for healthcare services, particularly long-term care and specialized treatments.

- Technological Advancements: While improving healthcare outcomes, advancements in medical technology often come with significant cost increases. New drugs, procedures, and equipment contribute substantially to the overall budget.

- Inefficiencies in Healthcare Delivery: Administrative inefficiencies and a lack of coordination across healthcare providers can lead to higher costs and duplicated services. Streamlining these processes is crucial for cost reduction.

- Specific Cost Increases: Examples of rising costs include a substantial increase in drug costs (especially for specialty medications), escalating hospital operating budgets (including staffing and supplies), and the growing demand for home healthcare.

Provincial Debt Servicing Costs

Ontario's existing debt burden adds significantly to the annual deficit.

- High Interest Payments: A significant portion of the provincial budget is allocated to paying interest on previous borrowing. Fluctuations in interest rates directly impact these costs.

- Fluctuating Interest Rates: Rising interest rates increase the cost of debt servicing, exacerbating the deficit. Conversely, lower rates can provide some relief.

- Growing Debt Burden: The accumulating debt necessitates larger and larger interest payments each year, creating a vicious cycle.

- Provincial Comparison: Comparing Ontario's debt servicing costs to other provinces with similar economies helps contextualize the situation and identify potential areas for improvement.

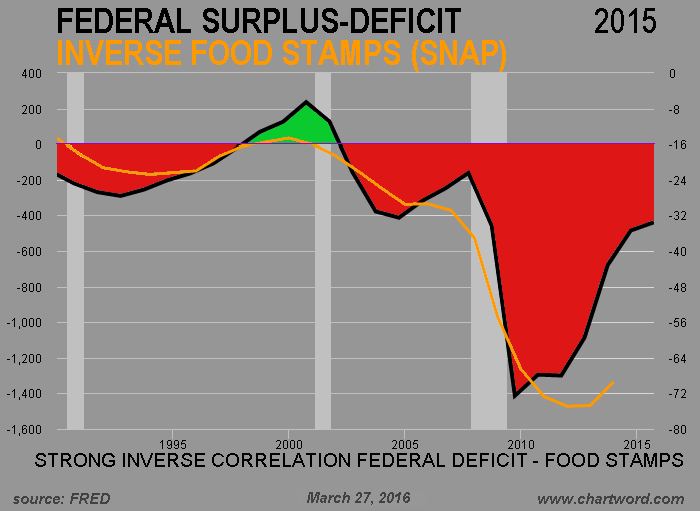

Decreased Revenue Due to Economic Slowdown

Economic downturns significantly impact provincial revenue streams.

- Impact of Recessions: Recessions or periods of economic slowdown directly reduce tax revenue due to decreased economic activity.

- Reduced Consumer Spending: Lower consumer spending translates to reduced sales tax revenue for the province.

- Impact of Job Losses: Job losses lead to a decrease in income tax revenue, further impacting the provincial budget.

- Revenue Stream Comparison: Analyzing revenue streams across different years helps illustrate the impact of economic fluctuations on Ontario's finances.

Government Spending on Social Programs

Expenditure on essential social programs also contributes to the deficit.

- Social Assistance, Education, and Other Programs: Significant funding is allocated to social assistance, education (including post-secondary institutions), and other vital social programs.

- Debate Surrounding Spending Levels: There is ongoing public debate regarding the appropriate level of government spending on social welfare programs, balancing the need for social support with fiscal responsibility.

- Trade-offs and Prioritization: Difficult decisions must be made regarding balancing social spending with deficit reduction efforts. This requires careful prioritization of programs and services.

- Provincial Comparison of Social Spending: Comparing social program spending in Ontario to other provinces can provide valuable insights and inform policy decisions.

Underestimation of Revenue Projections

Inaccurate revenue forecasting can contribute to budget shortfalls.

- Analysis of Past Revenue Forecasts: Evaluating the accuracy of past revenue projections reveals patterns and potential sources of error.

- Causes of Miscalculations: Various factors, including unexpected economic shifts and misjudgments regarding economic growth, can contribute to inaccurate revenue forecasts.

- Importance of Accurate Forecasting: Accurate revenue forecasting is crucial for sound fiscal planning and responsible budgeting.

Consequences of Ontario's $14.6 Billion Deficit

The $14.6 billion deficit has far-reaching consequences for Ontario's economy and its residents.

Impact on Provincial Services

The deficit necessitates difficult choices regarding the allocation of provincial resources.

- Reduced Funding for Essential Services: Reduced funding may impact education, infrastructure projects, healthcare, and other essential services.

- Service Cuts or Increased User Fees: To address the deficit, the government may need to consider service cuts or increase user fees for certain services.

- Long-Term Implications: Significant cuts to essential services can have long-term implications for the quality of life in Ontario and future economic growth.

Increased Tax Burden on Residents

Addressing the deficit might require increased taxation.

- Potential for Tax Increases: Tax increases, either direct or indirect, could be implemented to generate additional revenue.

- Impact on Household Budgets: Increased taxes can significantly impact household budgets, potentially reducing disposable income and consumer spending.

- Analysis of Tax Strategies: A comprehensive analysis of different tax strategies is needed to determine the most effective and equitable approach to revenue generation.

Impact on Credit Rating and Borrowing Costs

The deficit can affect Ontario's credit rating and borrowing costs.

- Potential Credit Rating Downgrade: A large deficit could lead to a downgrade in Ontario's credit rating, increasing borrowing costs.

- Increased Borrowing Costs: Higher borrowing costs make it more expensive for the province to fund infrastructure projects and other essential investments.

- Long-Term Economic Implications: Higher borrowing costs can have significant long-term economic implications, hindering economic growth and development.

Economic Growth and Investment

The deficit can negatively impact economic growth and investment.

- Effect on Investor Confidence: A large deficit can negatively impact investor confidence, discouraging both domestic and foreign investment.

- Reduced Private Sector Investment: Uncertainty about the province's fiscal health can reduce private sector investment, hindering job creation and economic growth.

- Implications for Job Creation: Reduced investment can lead to fewer job creation opportunities, impacting employment rates and overall economic prosperity.

Conclusion: Addressing the Challenges Posed by Ontario's $14.6 Billion Deficit

Ontario's $14.6 billion deficit is a complex issue stemming from a combination of increased spending, decreased revenue, and inaccurate revenue projections. The consequences are far-reaching, impacting essential services, the tax burden on residents, the province's credit rating, and ultimately, economic growth. Addressing this challenge requires a multi-pronged approach, potentially including strategic spending cuts, carefully considered tax increases, and proactive measures to stimulate economic growth. It's crucial for Ontario residents to stay informed about the provincial budget, engage in public discourse, and demand accountability from their elected officials to develop effective and sustainable solutions for managing Ontario's $14.6 billion deficit and preventing similar fiscal challenges in the future. For more information on the Ontario budget and fiscal plans, visit the official website of the Ontario Ministry of Finance: [Insert Link Here].

Featured Posts

-

New York Knicks Game 2 Loss Thibodeaus Referee Controversy

May 17, 2025

New York Knicks Game 2 Loss Thibodeaus Referee Controversy

May 17, 2025 -

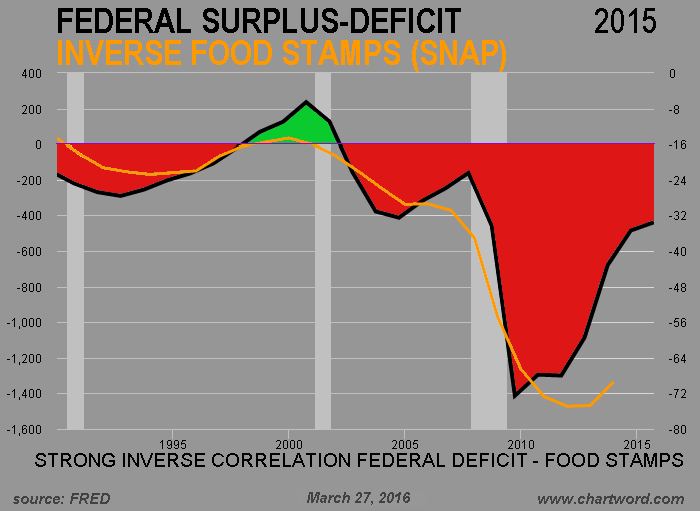

Escape The Noise Soundproof Apartments And Quiet Salons In Tokyo Real Estate

May 17, 2025

Escape The Noise Soundproof Apartments And Quiet Salons In Tokyo Real Estate

May 17, 2025 -

Andor Season 2 A Recap Before The New Episodes Arrive

May 17, 2025

Andor Season 2 A Recap Before The New Episodes Arrive

May 17, 2025 -

Creatine Your Questions Answered

May 17, 2025

Creatine Your Questions Answered

May 17, 2025 -

One Key Factor Separating Top Nba Teams From Championship Glory

May 17, 2025

One Key Factor Separating Top Nba Teams From Championship Glory

May 17, 2025