Analysis Of Record $16.3 Billion U.S. Customs Duty Revenue In April

Table of Contents

Increased Import Volumes Fueling Revenue Growth

The dramatic increase in U.S. Customs Duty Revenue is largely attributable to a significant rise in import volumes across numerous sectors. This surge reflects a robust domestic demand fueled by various factors, including a post-pandemic economic rebound and continued consumer spending. The growth wasn't evenly distributed; certain product categories experienced particularly significant increases.

- Quantifiable Increase: Import volumes in April were up by X% compared to April of the previous year (replace X with actual data). This represents a substantial jump compared to the average annual growth rate observed over the past five years.

- High-Volume Product Categories: Electronics, consumer goods (clothing, appliances, etc.), and machinery all contributed significantly to the increased import volume. The demand for these goods, coupled with ongoing supply chain adjustments, likely played a crucial role.

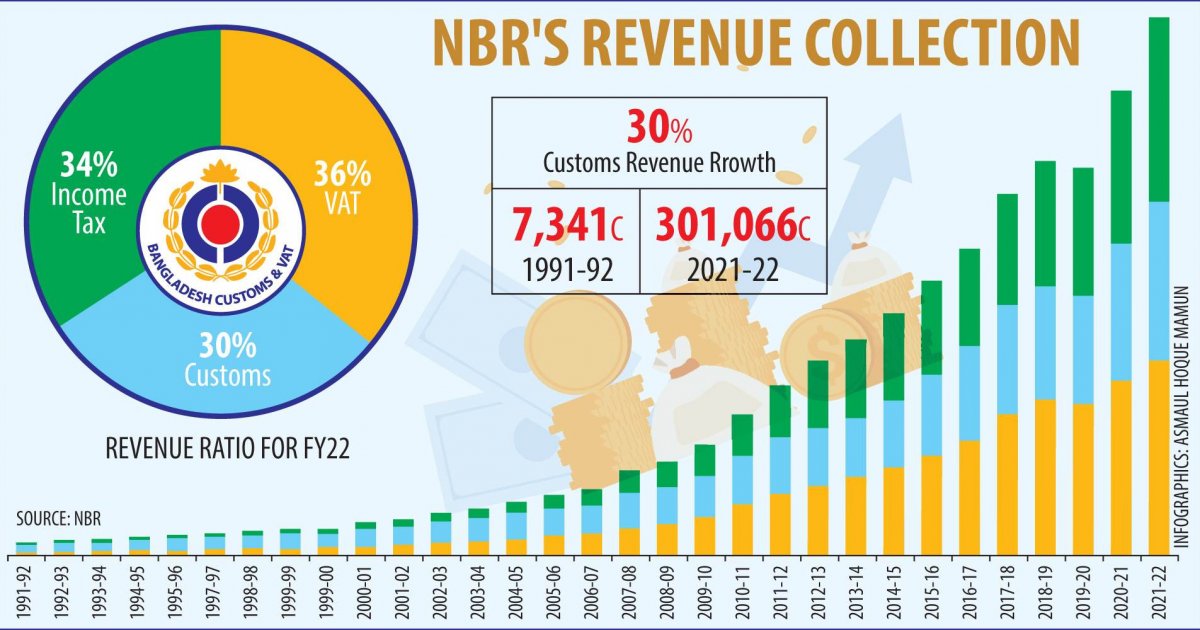

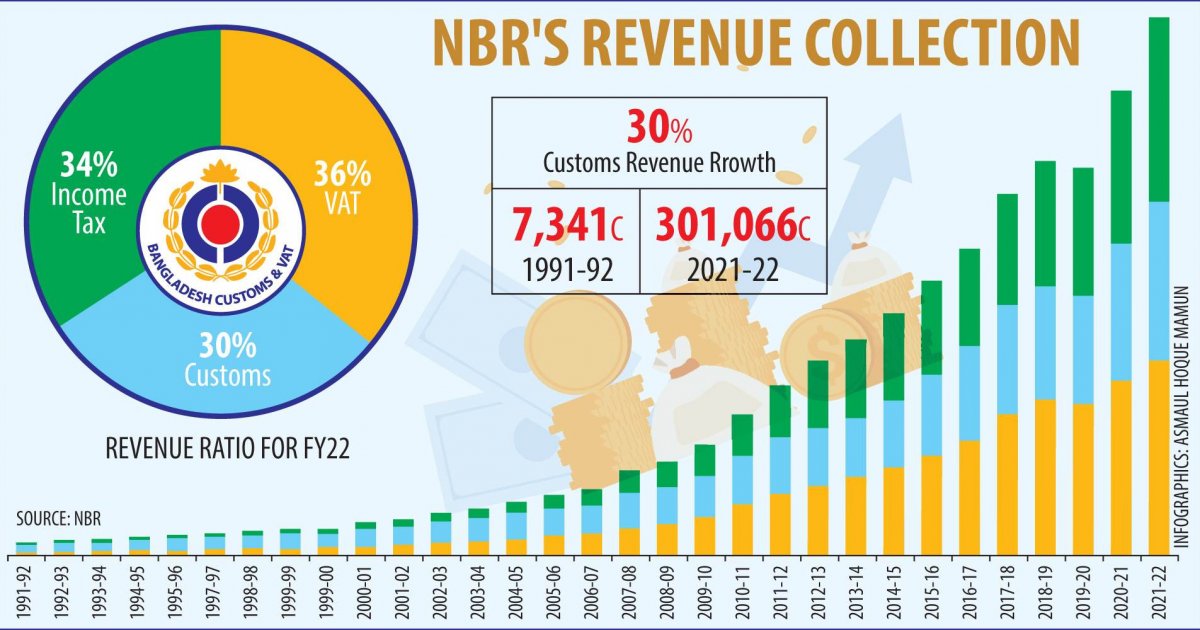

- Contributing Factors: Post-pandemic pent-up demand, a recovery in global supply chains, and increased business investment all contributed to the higher import volumes. A visual representation of import data across these sectors would further clarify this trend. (Insert chart/graph here visualizing import growth by category) Keywords: Import volume, import growth, consumer goods imports, product imports.

Impact of Tariffs and Trade Policies on Revenue

Existing tariffs and recent adjustments in trade policies played a significant role in boosting U.S. Customs Duty Revenue. While some tariffs were implemented to protect domestic industries, they also generate revenue for the government.

- Tariff-Affected Goods: Specific examples include tariffs on certain types of steel, aluminum, and consumer electronics which significantly contributed to the overall revenue increase. Quantifying the contribution of these specific tariffs would provide a more precise picture. (Insert data on tariff revenue contribution here).

- Tariff Rate Changes: Any recent increases or adjustments to existing tariff rates during this period should be highlighted. (Mention specific changes and their impact on revenue).

- Trade Disputes and Negotiations: Ongoing trade disputes or negotiations could influence future revenue streams. The impact of these unresolved trade issues on future import duties should be considered. Keywords: Tariffs, trade policy, trade disputes, import tariffs, customs duties.

Economic Factors Contributing to High Customs Duty Revenue

The record-breaking U.S. Customs Duty Revenue in April is inextricably linked to the overall health of the US economy. Strong economic indicators point to robust consumer spending and business investment, directly translating into higher import demand.

- Economic Data: Relevant economic data points to support this claim should be included here. This includes GDP growth figures, consumer confidence index data, and business investment statistics for April. (Insert relevant economic data here).

- Correlation: A clear correlation exists between a healthy US economy and increased customs duty revenue. When consumer and business confidence is high, spending increases, which, in turn, fuels demand for imported goods.

- Economic Health and Import Demand: Strong economic conditions directly translate to higher import demand, leading to increased revenue from import duties. Keywords: US economy, economic growth, consumer spending, business investment, economic indicators.

Implications of Record U.S. Customs Duty Revenue

The record $16.3 billion in U.S. Customs Duty Revenue presents both opportunities and challenges. While it signifies a strong economy, it also raises concerns about potential inflationary pressures.

- Positive Aspects: The surplus revenue can be used to fund crucial government programs, including infrastructure projects and social initiatives. This creates potential for positive economic effects across various sectors.

- Potential Negative Aspects: Increased import duties can lead to higher prices for consumers, impacting their purchasing power and potentially dampening future demand. Furthermore, increased tariffs can negatively impact business competitiveness by increasing their input costs. Keywords: Budget surplus, government spending, economic impact, business impact, consumer impact.

Conclusion: Understanding the Record $16.3 Billion in U.S. Customs Duty Revenue

The record $16.3 billion in U.S. Customs Duty Revenue in April was a confluence of factors: significantly increased import volumes, the impact of existing and adjusted tariff policies, and a robust US economy characterized by strong consumer spending and business investment. Understanding this interplay is crucial for policymakers and businesses alike. This substantial revenue influx presents opportunities for government investment and economic growth, but also necessitates a careful consideration of potential inflationary pressures and their impact on consumers and businesses. To stay informed about future U.S. Customs Duty Revenue analysis and the implications of US trade policies, subscribe to our newsletter or follow our updates. Understanding import duties and analyzing U.S. trade revenue are critical in comprehending the broader economic landscape.

Featured Posts

-

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Emergency

May 13, 2025

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Emergency

May 13, 2025 -

Kostyuk Prizval Sandu Razreshit Simionu Vyezd V Moldovu Vizit Buduschego Prezidenta Rumynii

May 13, 2025

Kostyuk Prizval Sandu Razreshit Simionu Vyezd V Moldovu Vizit Buduschego Prezidenta Rumynii

May 13, 2025 -

Record Crowd Sees Inter Miami Edge Columbus Crew 1 0

May 13, 2025

Record Crowd Sees Inter Miami Edge Columbus Crew 1 0

May 13, 2025 -

Byd Challenges Ford The Future Of Electric Vehicles In Brazil And Beyond

May 13, 2025

Byd Challenges Ford The Future Of Electric Vehicles In Brazil And Beyond

May 13, 2025 -

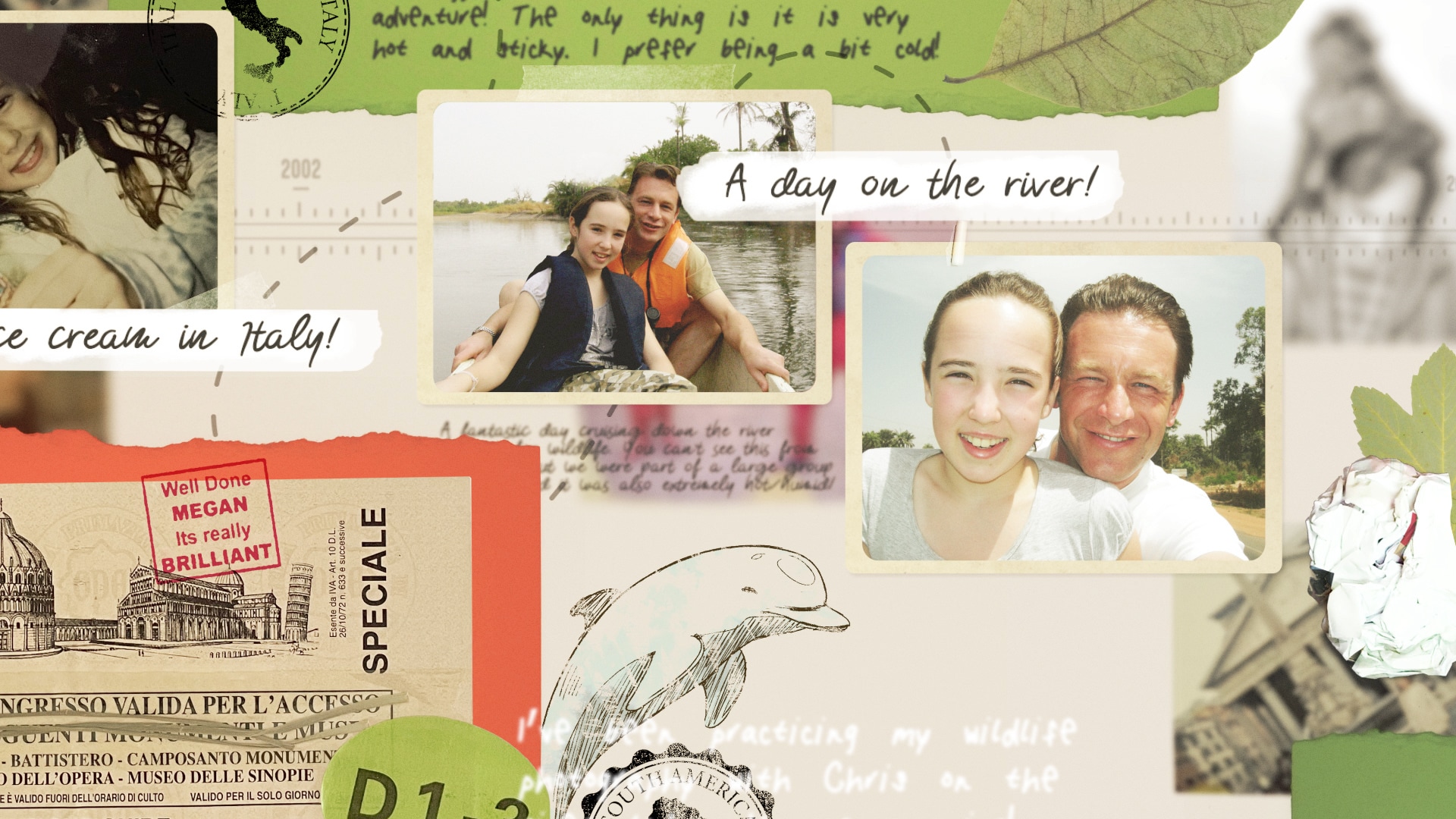

The Summer Chris And Meg Went Wild

May 13, 2025

The Summer Chris And Meg Went Wild

May 13, 2025

Latest Posts

-

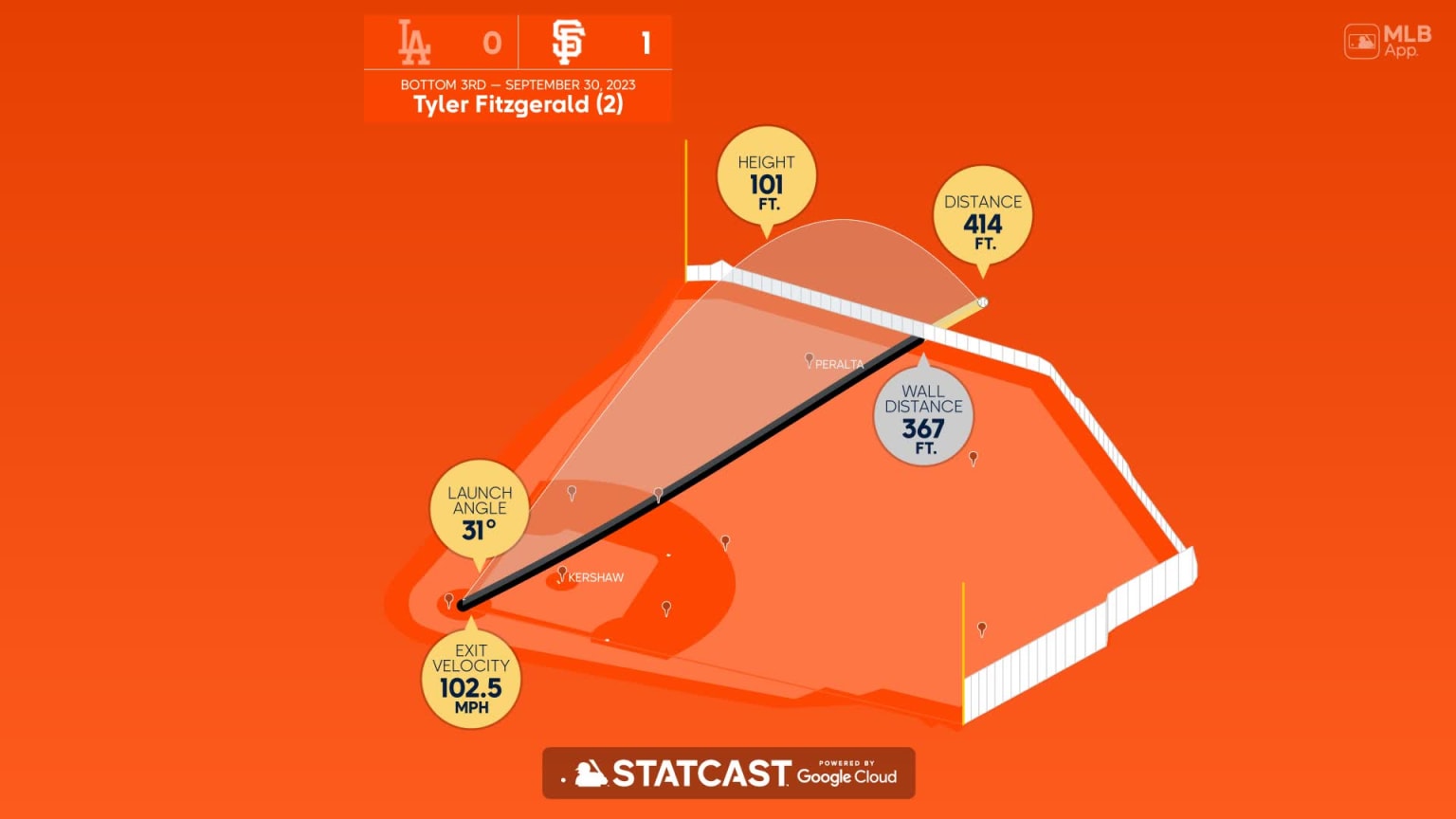

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025