Analysis Of The Trump Tax Cut Bill Unveiled By House Republicans

Table of Contents

Individual Income Tax Changes

The Trump tax cuts significantly altered the individual income tax system. These changes impacted taxpayers across various income levels, resulting in a complex interplay of benefits and drawbacks.

Changes to Tax Brackets

The House Republican tax plan adjusted the existing tax brackets, aiming to lower marginal tax rates for many individuals. While specific percentages varied, the general effect was a reduction in the tax burden for many, particularly those in higher income brackets.

- Lower rates: Several tax brackets saw significant percentage point reductions. This meant less tax owed for income falling within those brackets.

- Impact on different income levels: The impact varied widely depending on income level. Higher-income earners saw more substantial tax savings in dollar terms, although percentage reductions might have been smaller for some lower brackets.

- Example: A family earning $100,000 might have seen a reduction of X dollars in their annual tax liability, while a family earning $500,000 might have saved Y dollars. These changes were significant, driving discussions around tax cuts for individuals and their impact on individual income tax.

Standard Deduction and Personal Exemptions

A key element of the tax simplification efforts was the increase in the standard deduction and the elimination of personal exemptions.

- Increased standard deduction: This change simplified tax filing for many, making it unnecessary to itemize deductions for a larger segment of the population.

- Elimination of personal exemptions: While simplifying the tax code, this elimination disproportionately affected larger families.

- Impact on families: Families with many dependents experienced a net loss in tax benefits due to the elimination of personal exemptions, even with the increased standard deduction. These changes are important for understanding the impact on tax deductions and tax fairness.

Child Tax Credit Modifications

The child tax credit underwent modifications, impacting families with children. The changes aimed to provide increased family tax relief.

- Increased credit amount: The maximum amount of the child tax credit was increased, offering more financial assistance to families.

- Eligibility requirements: While the amount was increased, some potential eligibility changes were proposed, affecting certain families.

- Impact on low-income families: This credit provided some much needed relief to many families, but debates continued about its effectiveness in truly lifting families out of poverty.

Corporate Tax Rate Reduction

A cornerstone of the Trump tax cuts was the significant reduction in the corporate tax rate. This had a substantial impact on businesses and the economy.

Impact of Lower Corporate Tax Rates

The drastic reduction in the corporate tax rate was intended to stimulate business investment and economic growth. Proponents argued that the lower rates would encourage companies to expand, hire more workers, and increase investment in capital projects.

- Intended effects: Lower tax burdens on corporations were expected to free up capital for these purposes, leading to a rise in jobs and economic activity.

- Potential criticisms: Critics argued that the tax cuts disproportionately benefited large corporations at the expense of smaller businesses and that the increased profits did not always translate into higher wages or increased investments.

- Impact on business tax cuts: The analysis of the effect of these business tax cuts has been a subject of ongoing debate.

International Tax Provisions

The bill also included provisions related to international taxation, attempting to encourage the repatriation of foreign earnings.

- Repatriation of profits: The aim was to incentivize American companies to bring their profits earned overseas back to the U.S., boosting domestic investment.

- Changes to foreign tax credits: Modifications to foreign tax credits aimed to level the playing field for businesses operating both domestically and internationally.

- Impact on global competitiveness: The effects of these provisions on the global competitiveness of American businesses have been a subject of ongoing analysis.

Potential Economic Impacts and Criticisms

The economic effects of the Trump tax cuts remain a subject of intense debate, with differing viewpoints on their impact on economic growth, income inequality, and the national debt.

Projected Economic Growth

Proponents pointed to projected increases in GDP growth as evidence of the bill's success. However, these projections varied widely depending on the economic model used and assumptions made.

- Job creation: Supporters cited increased job creation as a direct result of the tax cuts, arguing it demonstrated the stimulative effect of lower taxes.

- Increased investment: Proponents highlighted increased business investment as evidence of the tax cuts' success in encouraging companies to expand.

- Economic stimulus: The effect of the tax cuts on economic stimulus remains a complex issue, with studies providing differing conclusions.

Distributional Effects and Inequality

Critics argued that the tax cuts exacerbated income inequality, disproportionately benefiting the wealthy while offering minimal relief to low- and middle-income families.

- Who benefits most: Analysis suggests that high-income individuals and corporations benefited the most from the tax cuts.

- Negative impact on lower-income households: Critics pointed to the lack of significant tax relief for lower-income families and the potential for increased inequality.

- Tax fairness: This aspect of the legislation continues to be a source of significant debate regarding tax fairness and wealth distribution.

National Debt Concerns

A major concern surrounding the Trump tax cuts was their potential impact on the national debt. The significant revenue loss caused by the tax cuts added to the already substantial budget deficit.

- Increased deficit: The reduction in tax revenue resulted in a larger budget deficit, leading to concerns about long-term fiscal sustainability.

- Fiscal responsibility: Critics questioned the fiscal responsibility of implementing such significant tax cuts without corresponding spending cuts.

- Government spending: The potential impact of increased government spending further compounded concerns about the nation's fiscal future.

Conclusion: Understanding the Trump Tax Cut Bill’s Legacy

The House Republican tax plan, a key component of the Trump administration's economic agenda, brought about substantial changes to the American tax system. This analysis reveals that the Trump tax cuts had a complex and multifaceted impact, affecting different segments of the population and the economy in varying ways. While proponents highlighted the potential for increased economic growth and job creation, critics pointed to concerns about income inequality, the national debt, and the overall tax fairness of the policy. The long-term consequences of these changes continue to unfold, making it essential to conduct further research and engage in informed discussions regarding this significant piece of legislation. We urge you to explore additional resources such as the Congressional Budget Office reports and reputable news sources to gain a more complete understanding of the implications of the Trump tax cuts and their ongoing legacy.

Featured Posts

-

Four Walls Appoints New Chief Executive Officer

May 13, 2025

Four Walls Appoints New Chief Executive Officer

May 13, 2025 -

Den Of Thieves 2 Check Netflix Streaming Status This Week

May 13, 2025

Den Of Thieves 2 Check Netflix Streaming Status This Week

May 13, 2025 -

Kim Kardashians Swimsuit Campaign Tory Lanez Song Controversy Explained

May 13, 2025

Kim Kardashians Swimsuit Campaign Tory Lanez Song Controversy Explained

May 13, 2025 -

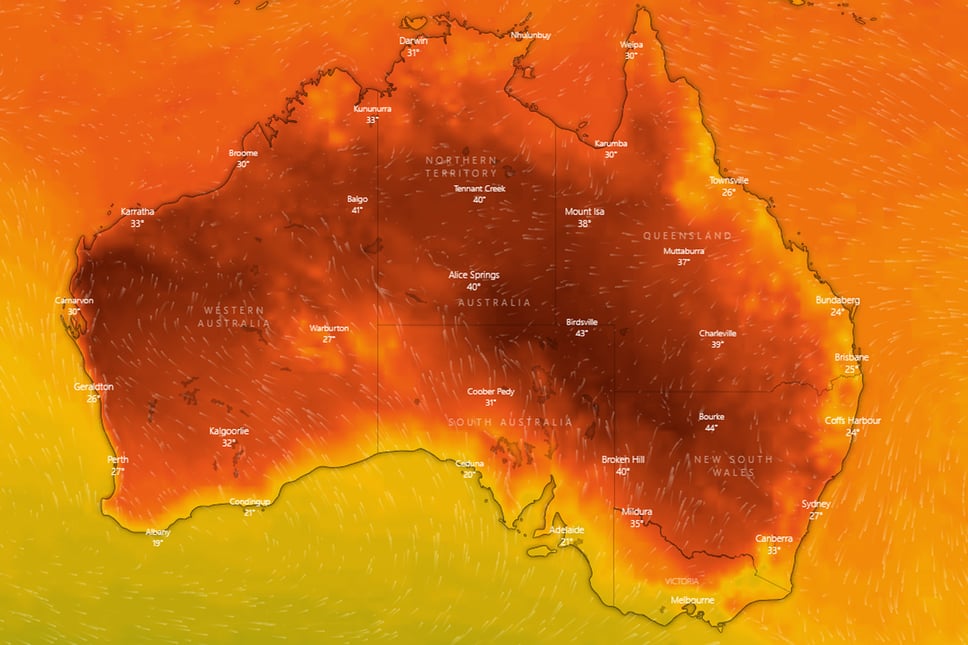

Historic Heatwave Record Breaking Temperatures In La And Orange Counties

May 13, 2025

Historic Heatwave Record Breaking Temperatures In La And Orange Counties

May 13, 2025 -

Mcus Black Widow Scarlett Johansson Comments On Potential Return

May 13, 2025

Mcus Black Widow Scarlett Johansson Comments On Potential Return

May 13, 2025

Latest Posts

-

Catch John Barrys From York With Love At Your Local Everyman

May 14, 2025

Catch John Barrys From York With Love At Your Local Everyman

May 14, 2025 -

John Barrys From York With Love An Everyman Film Event

May 14, 2025

John Barrys From York With Love An Everyman Film Event

May 14, 2025 -

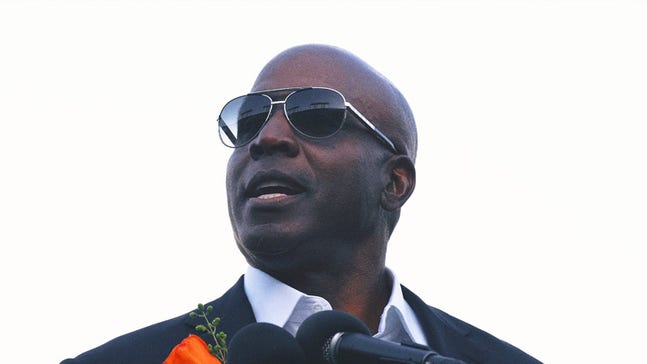

The Get Off My Lawn Vibe Barry Bonds And His Comments On Shohei Ohtanis Success

May 14, 2025

The Get Off My Lawn Vibe Barry Bonds And His Comments On Shohei Ohtanis Success

May 14, 2025 -

Everyman Cinema Presents John Barry From York With Love

May 14, 2025

Everyman Cinema Presents John Barry From York With Love

May 14, 2025 -

Bonds Vs Ohtani A Generational Talent Comparison And The Get Off My Lawn Controversy

May 14, 2025

Bonds Vs Ohtani A Generational Talent Comparison And The Get Off My Lawn Controversy

May 14, 2025