Analysis Of Trump's Oil Price Views: Goldman Sachs' Social Media Scrutiny

Table of Contents

Trump's Statements on Oil Prices: A Historical Overview

Throughout his presidency and beyond, Donald Trump frequently commented on oil prices, employing various platforms – from Twitter to formal speeches – to express his opinions. His "Trump oil policy" often intertwined with broader energy policy pronouncements. A careful analysis reveals a mixed bag of statements, sometimes appearing to favor lower prices, other times seemingly unconcerned or even suggesting a preference for higher prices depending on the prevailing geopolitical climate and the perceived impact on the US economy. His statements weren't always consistent, reflecting the fluctuating nature of the global energy market and his shifting political priorities.

- October 26, 2018: Trump tweeted his displeasure at rising oil prices, blaming OPEC. This tweet immediately impacted the oil market, causing a slight dip in futures prices. ("Trump tweets oil" significantly impacted market sentiment).

- June 2019: In an interview, Trump expressed optimism about US energy independence, potentially implying a less urgent need for lower oil prices. This seemingly bullish statement contributed to a period of relative price stability.

- August 2020: Amidst the COVID-19 pandemic, Trump's statements on oil prices were less frequent, reflecting the uncertainty of the market at that time. The "Trump energy policy" seemed to take a backseat during this crisis.

Categorizing his statements definitively as pro-high or pro-low prices is difficult. His views often seemed dictated by immediate political and economic considerations rather than a consistent, long-term energy strategy. His pronouncements were often more focused on the immediate impact of oil prices on the US economy and less on the intricacies of oil price prediction and global market dynamics.

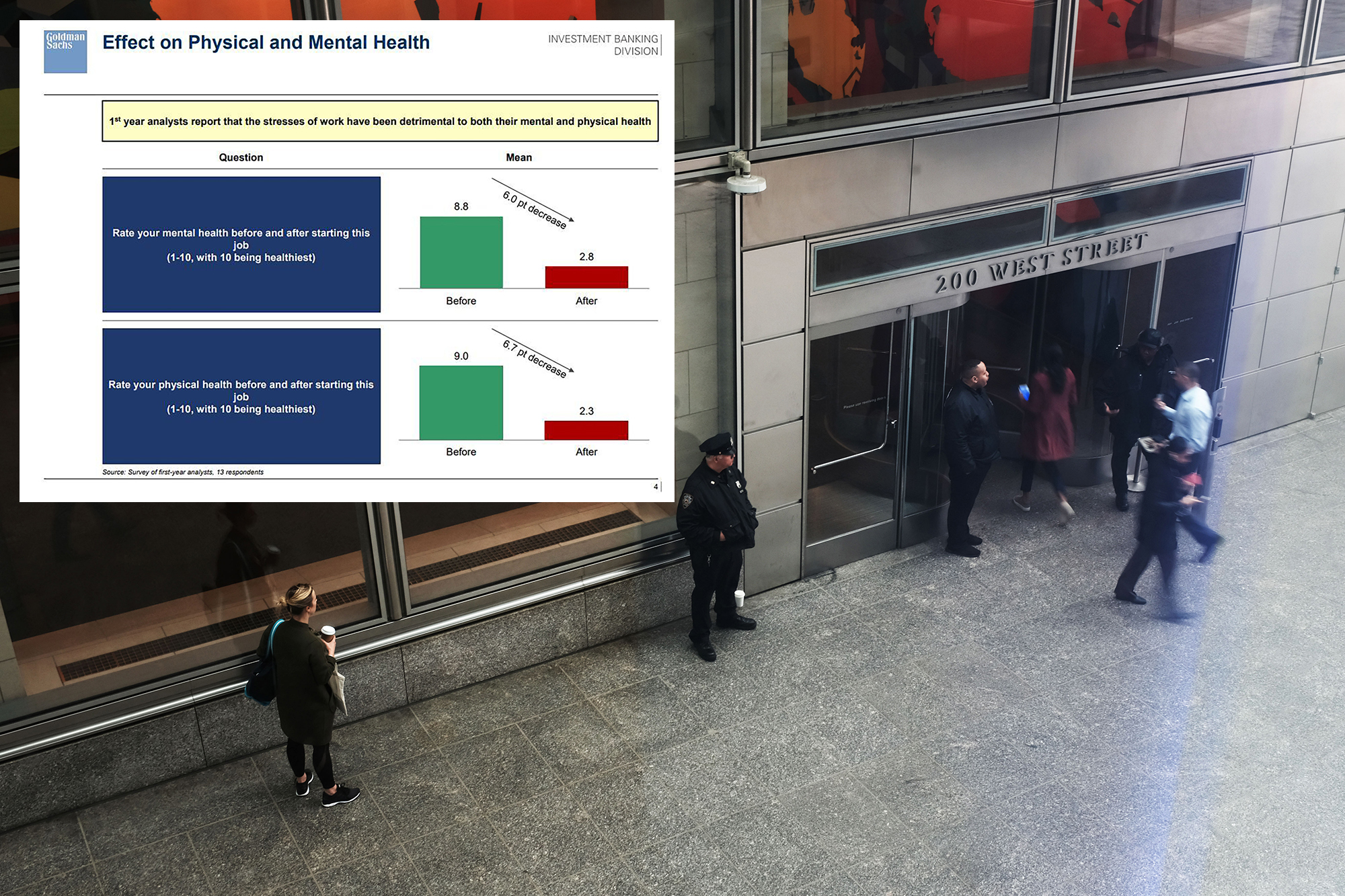

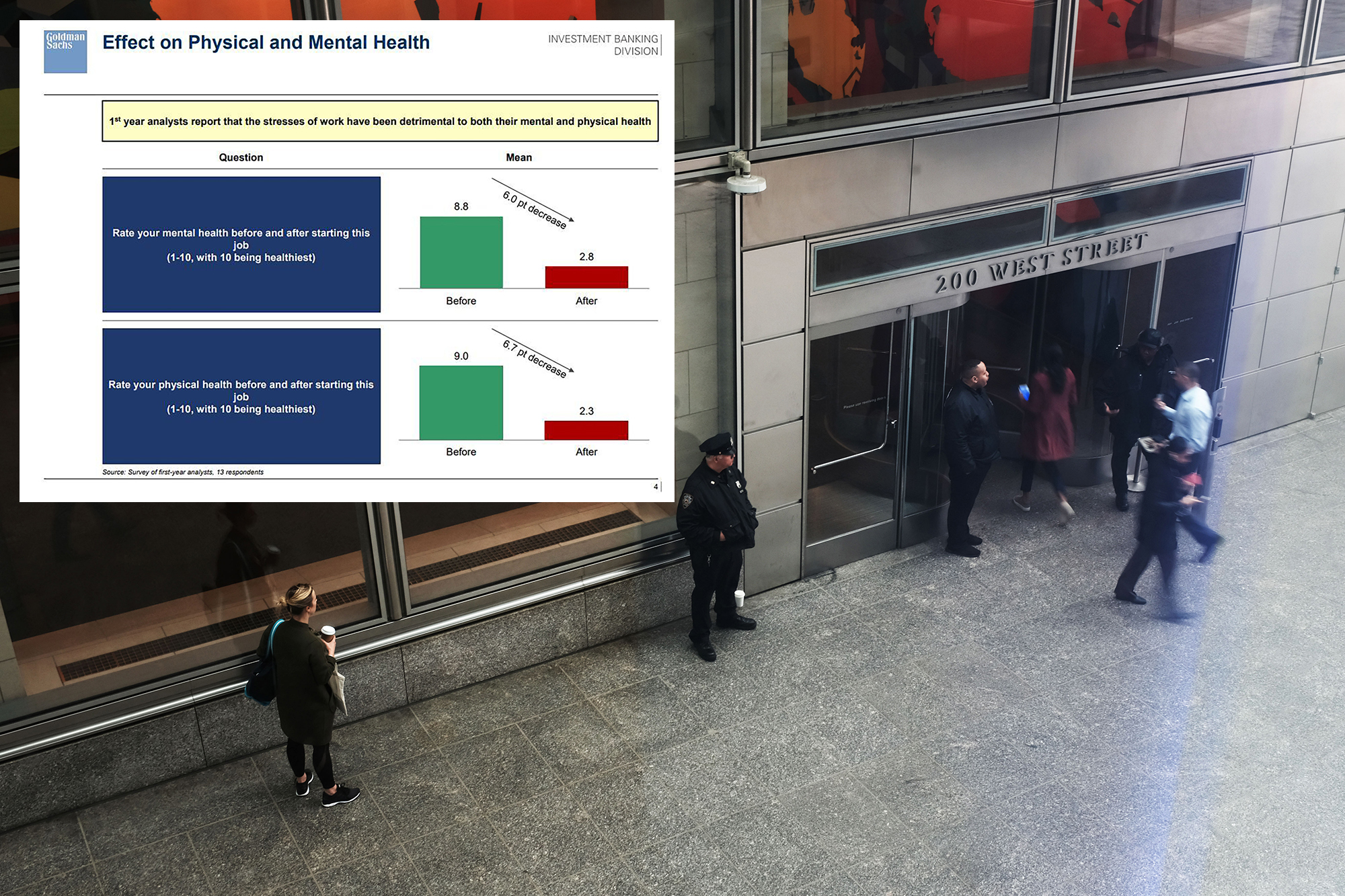

Goldman Sachs' Social Media Engagement and Analysis

Goldman Sachs, a leading global investment bank, maintains a strong presence on social media platforms like Twitter and LinkedIn, regularly disseminating financial news and analysis, including commentary on oil prices. Their engagement with "Trump oil policy" reveals a more nuanced and data-driven approach compared to Trump's often more direct and opinionated pronouncements.

Goldman Sachs' social media activity surrounding Trump's comments on oil prices generally involved detailed analysis rather than direct public rebuttal. Their reports often integrated Trump's statements into broader macroeconomic forecasts, considering multiple factors such as geopolitical tensions, supply chain disruptions, and OPEC decisions. They seldom directly countered Trump’s statements; instead, they offered counterpoints through sophisticated market analysis.

- Example 1: Following a Trump tweet about oil prices, Goldman Sachs published a report on LinkedIn analyzing the potential market impact, citing various economic indicators to support their conclusions.

- Example 2: Goldman Sachs used Twitter to share market updates, often referencing significant geopolitical events that might influence oil prices, but without directly mentioning Trump’s tweets or statements.

The Impact of Social Media Scrutiny on Market Sentiment

Goldman Sachs’ sophisticated analysis, disseminated through their significant social media presence, arguably exerted a moderating influence on market sentiment. Their data-driven approach likely helped investors to critically evaluate Trump's less rigorously supported statements. Social media amplified both the initial impact of Trump's comments and the subsequent analyses by Goldman Sachs, contributing to a more informed—though possibly more volatile—market.

- Example: A sharp drop in oil prices following one of Trump's tweets was partly attributed to Goldman Sachs' subsequent analysis highlighting the tweet's lack of substantive economic basis.

This highlights the growing power of social media in shaping "market sentiment" and influencing "oil market volatility." It also demonstrates the crucial role of independent financial analysis in tempering the impact of political statements on commodity markets.

Alternative Perspectives on Trump's Influence on Oil Prices

While Goldman Sachs offered a specific viewpoint, many other analysts and experts weighed in on Trump’s influence on oil prices. Their analyses often diverged, highlighting the inherent complexity of attributing price movements to a single factor. Some emphasized the limitations of predicting oil prices based on political pronouncements alone, stressing the impact of geopolitical factors such as the Iran nuclear deal or tensions in the Middle East. Others focused on the impact of Trump's broader policies, such as deregulation, on US energy production.

- Expert A: Argued that Trump's tweets, though attention-grabbing, had little lasting impact on actual oil prices.

- Expert B: Highlighted the impact of Trump's trade policies on global energy markets, influencing "energy market trends."

- Expert C: Focused on the influence of "geopolitical risk" on oil price volatility, demonstrating how the political climate and Trump's actions within it played a part.

Conclusion: Understanding the Interplay Between Politics, Social Media, and Oil Prices

Analyzing "Trump's oil price views" reveals a complex interplay between political commentary, social media scrutiny, and market behavior. Goldman Sachs' engagement, while offering a counterpoint to less rigorously supported opinions, highlighted the amplification effect of social media on both initial statements and subsequent analyses. Remember, multiple perspectives are crucial when analyzing the intricate relationship between political rhetoric, financial analysis, and energy market fluctuations. For a deeper understanding of "Trump's impact on oil," continued research and critical analysis of various sources are essential. Delve further into resources analyzing "oil price analysis" and "financial market analysis" to develop a well-rounded understanding of these intricate dynamics.

Featured Posts

-

A Conversation With Two Max Muncys

May 16, 2025

A Conversation With Two Max Muncys

May 16, 2025 -

Pembangunan Giant Sea Wall Solusi Lindungi Warga Pesisir Dari Bencana

May 16, 2025

Pembangunan Giant Sea Wall Solusi Lindungi Warga Pesisir Dari Bencana

May 16, 2025 -

Township Water Contamination Causes Concerns And Solutions

May 16, 2025

Township Water Contamination Causes Concerns And Solutions

May 16, 2025 -

Watch 3 Star Wars Andor Episodes Now Free On You Tube

May 16, 2025

Watch 3 Star Wars Andor Episodes Now Free On You Tube

May 16, 2025 -

Avertisment Apa De Robinet Romania Zone Cu Risc Crescut

May 16, 2025

Avertisment Apa De Robinet Romania Zone Cu Risc Crescut

May 16, 2025