Analysis: The House Republicans' Trump Tax Plan

Table of Contents

Individual Tax Rate Changes

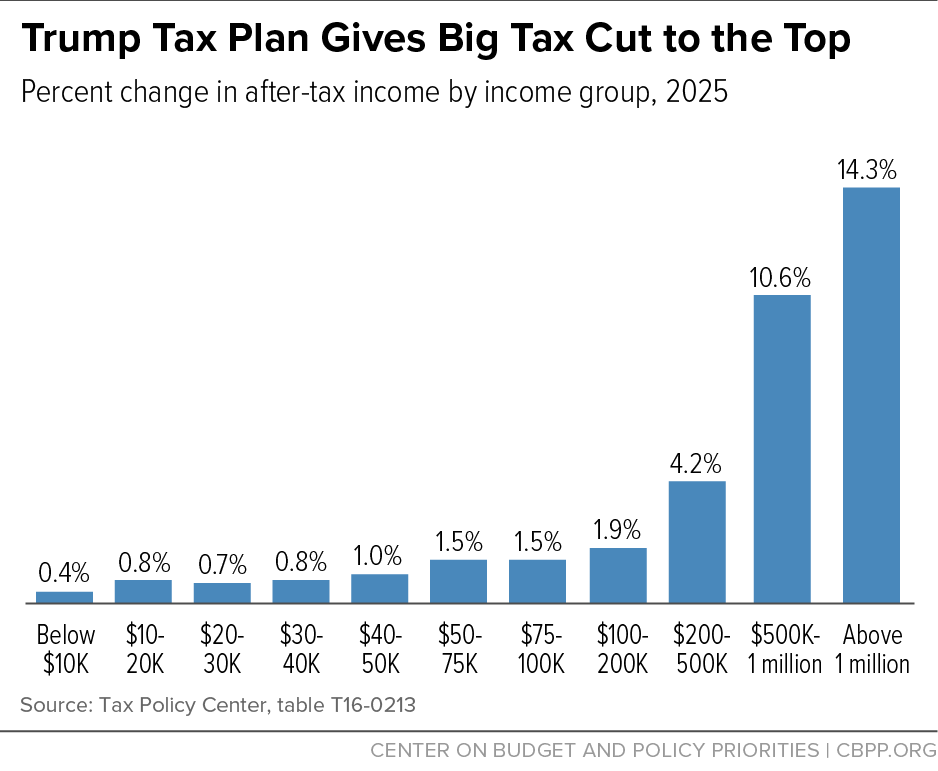

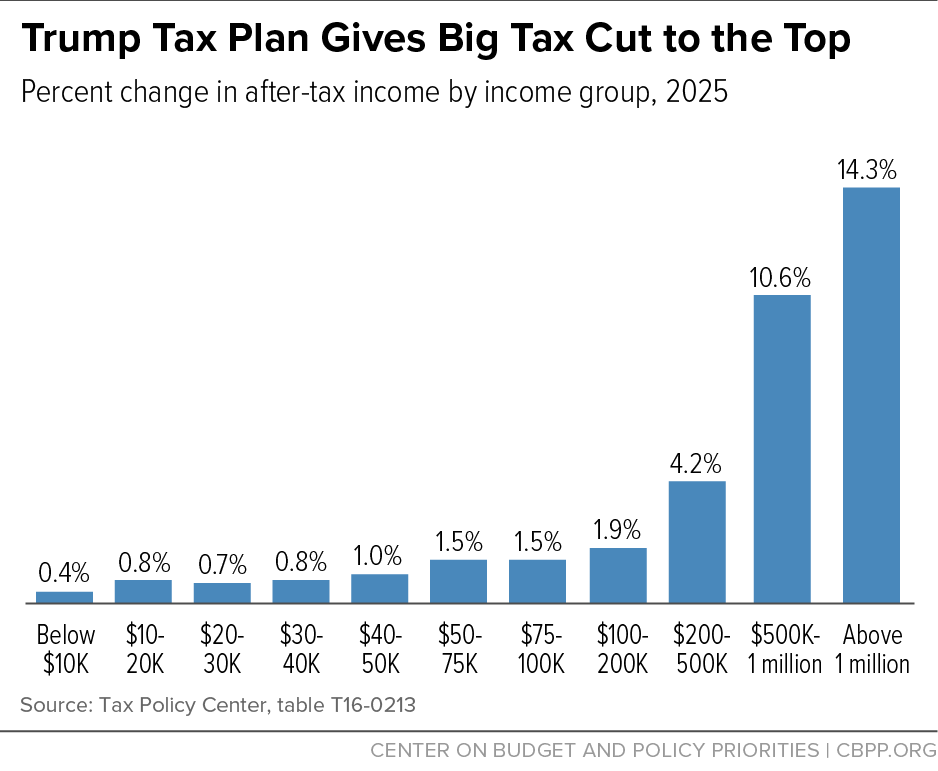

The House Republicans' Trump Tax Plan proposed significant changes to individual income tax brackets. These changes aimed to simplify the tax code and provide tax relief, particularly for higher-income earners. However, the actual impact varied widely depending on income level.

- Specific Percentage Changes for Each Bracket: While the exact percentages varied depending on the specific iteration of the plan, the general approach involved consolidating the existing tax brackets and lowering the rates for many brackets.

- Potential Increase or Decrease in Tax Liability: High-income earners generally experienced significant tax cuts, while the tax liability for lower and middle-income earners saw a more modest reduction or, in some cases, a slight increase.

- Impact on Standard Deduction and Personal Exemptions: The plan often included adjustments to the standard deduction and personal exemptions, further influencing the overall tax burden for different income levels. These changes sometimes offset other reductions or increases in tax liability.

Analyzing the individual income tax rates proposed under this plan reveals a complex picture, with significant implications for the distribution of wealth and the overall economic landscape. Keywords such as individual income tax rates, tax brackets, tax liability, and standard deduction are crucial for understanding this section’s nuances.

Corporate Tax Rate Reductions

A key component of the House Republicans' Trump Tax Plan was a substantial reduction in the corporate tax rate. The proposed cuts aimed to stimulate economic growth by incentivizing businesses to invest, hire, and expand.

- The Proposed Corporate Tax Rate Percentage: The plan proposed a significant reduction in the corporate tax rate, aiming for a lower rate than what had been previously in place. This aimed to make the US more competitive on the global stage.

- Comparison with Previous Corporate Tax Rates: The planned decrease marked a substantial shift from prior corporate tax rates, signifying a major change in taxation policy for businesses.

- Arguments For and Against the Reduction: Proponents argued that lower corporate taxes would boost investment, job creation, and economic growth. Opponents, however, raised concerns about the potential increase in the national debt and the disproportionate benefit to large corporations.

The proposed corporate tax rate reductions under the House Republicans' Trump Tax Plan were a significant aspect of the plan, sparking considerable debate around corporate tax rate, business tax cuts, economic growth, and national debt.

Impact on Specific Demographics

The House Republicans' Trump Tax Plan had a varied effect on different segments of the population. Analyzing the impact on specific demographics reveals potential winners and losers under the plan's provisions.

- Specific Examples of How the Plan Affects Families with Children: The tax plan often included provisions aimed at benefiting families with children, such as expanded child tax credits. The effectiveness and reach of these provisions, however, varied widely.

- Analysis of the Impact on Retirement Savings: The plan's effects on retirement savings could be complex and varied depending on individual circumstances and the specific provisions related to retirement accounts.

- Discussion of Potential Consequences for Low-Income Individuals and Families: Low-income individuals and families experienced mixed effects, with some benefits potentially offset by other changes in the tax system.

Understanding the tax impact on various demographics—family tax, senior tax, low-income tax, and associated tax benefits—is critical for a complete picture of the House Republicans' Trump Tax Plan's consequences.

Long-Term Economic Projections

The long-term economic consequences of the House Republicans' Trump Tax Plan remain a subject of debate among economists. Forecasting the impact on key economic indicators is challenging but crucial.

- GDP Growth Projections: Projections for GDP growth varied significantly depending on the economic models used and the assumptions made about factors like investment and consumer spending.

- Government Debt Projections: A major concern surrounding the plan involved its potential effect on the national debt and deficit, with projections often suggesting an increase in government borrowing.

- Potential Impact on Inflation Rates: Economists expressed varied views on the potential impact of the tax plan on inflation rates, with differing perspectives on how changes in consumer spending and investment could affect price levels.

Analyzing the economic forecast, national debt, budget deficit, inflation, and the long-term economic impact reveals a picture of uncertainty and significant potential consequences.

Political and Social Implications

Beyond its economic effects, the House Republicans' Trump Tax Plan had profound political and social implications. These consequences extended beyond purely fiscal considerations.

- Political Party Stances on the Plan: The plan was strongly supported by the Republican party but faced opposition from the Democratic party, highlighting the deeply partisan nature of tax policy debates.

- Public Opinion Polls on the Plan: Public opinion on the plan was mixed, with varying levels of support among different demographics and regions.

- Potential Impact on Social Programs: Concerns were raised about the potential effects on social programs due to potential reductions in government revenue.

Understanding the political impact, social impact, income inequality, public opinion, and election impact of the House Republicans' Trump Tax Plan is vital for a holistic appreciation of its legacy.

Conclusion: Understanding the House Republicans' Trump Tax Plan

This analysis of the House Republicans' Trump Tax Plan reveals a complex and multifaceted policy with far-reaching consequences. The plan’s effects on individual tax burdens, corporate profitability, specific demographics, and long-term economic growth trajectories remain contentious issues. Understanding these potential impacts is essential for informed civic participation. We urge you to delve deeper into the details of this significant piece of legislation, engage in respectful political discourse, and contact your representatives to voice your concerns and opinions on the House Republicans' Trump Tax Plan. Share this article to help increase awareness and foster informed discussion.

Featured Posts

-

Cody Poteets Abs Challenge Victory A Chicago Cubs Spring Training Highlight

May 16, 2025

Cody Poteets Abs Challenge Victory A Chicago Cubs Spring Training Highlight

May 16, 2025 -

Unlock Mlb Dfs Success May 8th Sleeper Picks And Value Plays

May 16, 2025

Unlock Mlb Dfs Success May 8th Sleeper Picks And Value Plays

May 16, 2025 -

Toxic Chemicals From Ohio Train Derailment Extended Building Contamination

May 16, 2025

Toxic Chemicals From Ohio Train Derailment Extended Building Contamination

May 16, 2025 -

The Legacy Of Presidential Pardons Trumps Second Term And Beyond

May 16, 2025

The Legacy Of Presidential Pardons Trumps Second Term And Beyond

May 16, 2025 -

Pley Off N Kh L Karolina Razgromila Vashington

May 16, 2025

Pley Off N Kh L Karolina Razgromila Vashington

May 16, 2025