Analysis: The Semiconductor ETF Market Before And After The Recent Spike

Table of Contents

Semiconductor ETFs offer investors diversified exposure to the semiconductor industry, a crucial sector driving technological advancements across various applications, from smartphones and computers to automobiles and medical devices. Understanding their performance is vital for investors seeking to participate in this growth sector, mitigating risk, and capitalizing on opportunities. This article aims to dissect the market's behavior before and after the recent price increase, examining performance comparisons, market drivers, and shifts in investor sentiment.

The Semiconductor ETF Market Before the Spike

Market Trends and Performance Leading Up to the Spike

In the months leading up to the recent surge, the semiconductor ETF market exhibited a mixed performance. While there was overall growth in certain segments, stagnation and volatility characterized much of the market. The period was marked by ongoing supply chain disruptions and geopolitical uncertainties, leading to fluctuations in ETF prices. Specifically, the leading Semiconductor ETFs, such as SMH and SOXX, experienced moderate growth with periods of significant correction.

- Average monthly returns: Varied between 1% and -2% depending on the specific ETF and the month.

- Volatility levels: Standard deviation ranged from 3% to 5%, reflecting the market's uncertainty.

- Key influencing factors: The ongoing global chip shortage, US-China trade tensions, and the war in Ukraine played a significant role in influencing market sentiment and performance.

Investor Sentiment and Market Expectations Before the Spike

Investor sentiment towards Semiconductor ETFs was largely cautious before the spike. While some analysts maintained a bullish outlook, citing long-term growth potential fueled by technological advancements, a significant portion expressed concerns over supply chain constraints and geopolitical risks. This cautious optimism was reflected in mixed analyst ratings, with some upgrades and downgrades.

- Relevant news articles or analyst reports: Publications highlighted the ongoing supply chain challenges and the potential for prolonged delays in semiconductor production.

- Data on ETF inflows and outflows: While some capital inflow was observed, it was generally less aggressive than in previous bull markets, suggesting a degree of investor hesitation.

- Summary of prevailing investor narratives: The dominant narrative centered on the need to carefully manage risk due to the uncertain geopolitical and economic climate.

The Semiconductor ETF Market After the Spike

Immediate Impact of the Spike on ETF Prices

The recent spike in semiconductor prices triggered an immediate and significant reaction in the ETF market. Both SMH and SOXX experienced sharp price increases within a short period.

- Percentage change in ETF prices: SMH and SOXX saw increases ranging from 15% to 20% within a week.

- Comparison of different ETF performances: While both major ETFs experienced a similar upward trajectory, the exact magnitude of the price increase varied slightly depending on their specific holdings.

- Timeframe of the price movement: The sharp increase happened over a period of just a few trading sessions, indicating a rapid shift in market sentiment.

Market Drivers and Long-Term Implications

Several factors contributed to the recent spike. Increased demand from various sectors, particularly data centers and automotive manufacturing, combined with persistent supply constraints fueled price increases. Technological advancements driving demand for high-performance chips also played a critical role.

- Analysis of supply and demand dynamics: The imbalance between surging demand and constrained supply created a perfect storm for price increases.

- Discussion of long-term growth prospects: Despite the recent spike, the long-term growth prospects for the semiconductor industry remain strong, driven by ongoing technological advancements and increasing demand across multiple sectors.

- Identification of potential risks: Geopolitical instability, an economic slowdown, and potential future supply chain disruptions pose risks that investors need to consider.

Post-Spike Investor Sentiment and Market Behavior

The price spike led to a shift in investor sentiment. While some investors profited from the increase, others expressed concern over the sustainability of this growth. Trading volume increased significantly in the short term as investors reacted to the price volatility.

- Analysis of investor sentiment indicators: Increased volatility led to a mix of bullish and bearish sentiment.

- Data on ETF trading volumes: Trading volume surged immediately after the spike.

- Discussion of changes in investment strategies: Some investors adjusted their portfolios to either capitalize on further growth or to mitigate potential risks.

Conclusion

Our analysis reveals a stark contrast between the Semiconductor ETF market before and after the recent spike. While the pre-spike period was marked by cautious optimism and moderate volatility, the post-spike period saw rapid price increases driven by increased demand and persistent supply chain challenges. The long-term outlook for the semiconductor industry remains positive, although investors must remain aware of geopolitical risks and potential economic headwinds. Understanding the intricacies of the Semiconductor ETF market is crucial for successful investing. Continue your research into specific Semiconductor ETFs like SMH and SOXX and make informed decisions based on your risk tolerance and investment goals.

Featured Posts

-

Miami Open Final Sabalenka Defeats Pegula

May 13, 2025

Miami Open Final Sabalenka Defeats Pegula

May 13, 2025 -

Hollywoods Pay Disparity The Case Of Colin Jost And Scarlett Johansson

May 13, 2025

Hollywoods Pay Disparity The Case Of Colin Jost And Scarlett Johansson

May 13, 2025 -

New Taverna Brings Taste Of Greece To Portola Valley

May 13, 2025

New Taverna Brings Taste Of Greece To Portola Valley

May 13, 2025 -

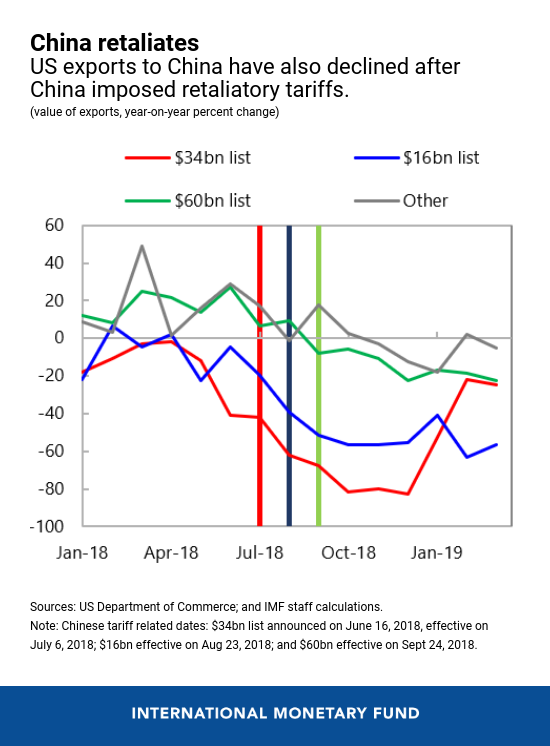

The Implications Of A U S China Tariff Rollback For American Businesses And Consumers

May 13, 2025

The Implications Of A U S China Tariff Rollback For American Businesses And Consumers

May 13, 2025 -

Eva Longorias Travel Series Gets Release Date Watch The Trailer

May 13, 2025

Eva Longorias Travel Series Gets Release Date Watch The Trailer

May 13, 2025

Latest Posts

-

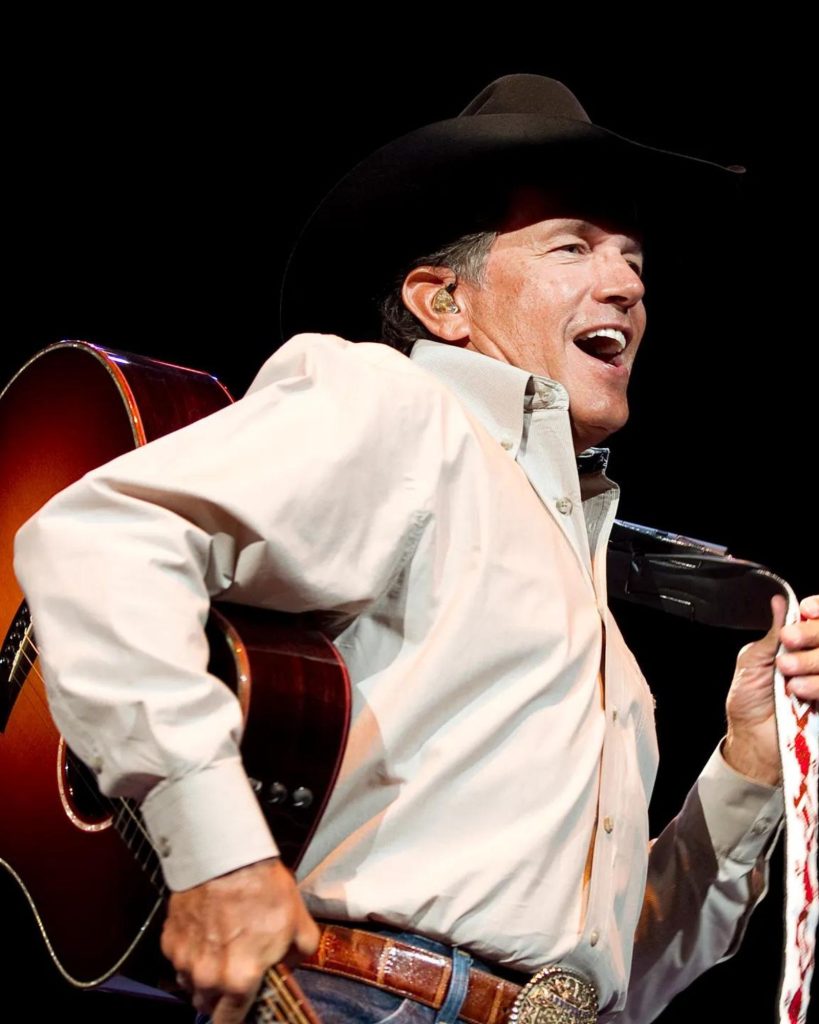

Country Legend George Strait Makes Surprise Dairy Queen Appearance

May 14, 2025

Country Legend George Strait Makes Surprise Dairy Queen Appearance

May 14, 2025 -

George Straits Dairy Queen Visit Photo With Employee Goes Viral

May 14, 2025

George Straits Dairy Queen Visit Photo With Employee Goes Viral

May 14, 2025 -

Parker Mc Collums Bold Claim Targeting George Straits Throne

May 14, 2025

Parker Mc Collums Bold Claim Targeting George Straits Throne

May 14, 2025 -

The Future Of Country Music Mc Collums Ambitious Bid For The Top Spot

May 14, 2025

The Future Of Country Music Mc Collums Ambitious Bid For The Top Spot

May 14, 2025 -

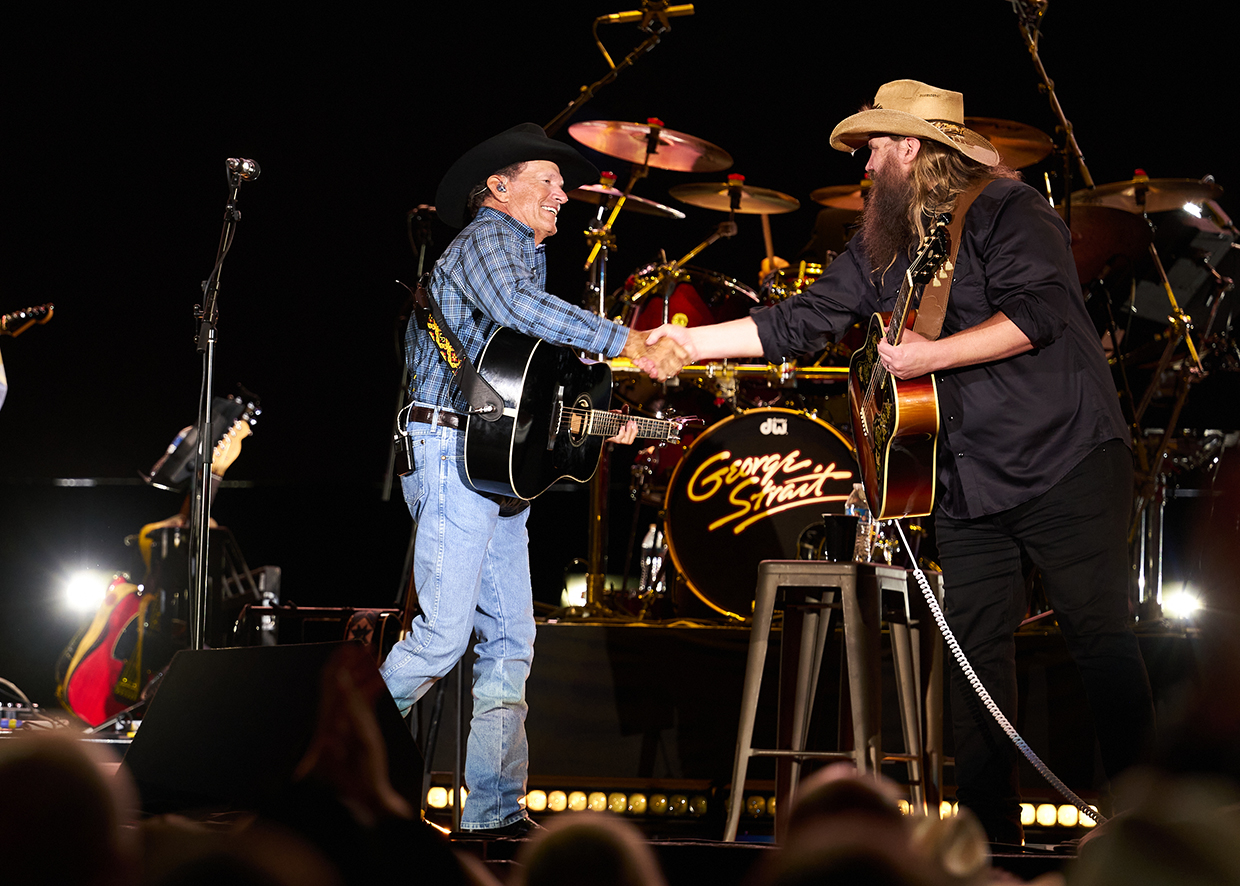

2025 Stadium Tour George Strait And Chris Stapletons Announced Dates

May 14, 2025

2025 Stadium Tour George Strait And Chris Stapletons Announced Dates

May 14, 2025