Analysis: Trump Tariffs And The $174 Billion Decline In Billionaire Net Worth

Table of Contents

The Mechanism of Tariff-Induced Wealth Loss

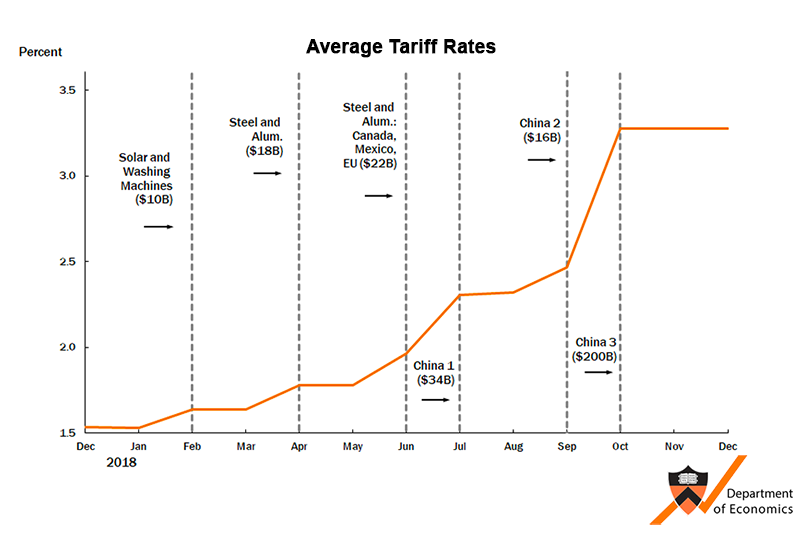

Trump tariffs, designed to protect domestic industries by increasing import costs, inadvertently triggered a chain reaction leading to substantial losses for many billionaires. The impact stemmed from several interconnected factors:

-

Increased Business Costs and Reduced Profits: Tariffs directly increased the cost of imported goods and raw materials for businesses. This squeezed profit margins, impacting the bottom line and leading to lower stock valuations for companies heavily reliant on imports. For example, many retail giants saw reduced profit margins due to increased costs on imported goods.

-

Global Supply Chain Disruptions: The imposition of tariffs disrupted established global supply chains. Businesses faced delays, increased transportation costs, and difficulties in sourcing materials, leading to production bottlenecks and reduced profitability. This ripple effect significantly impacted businesses with extensive international operations.

-

Increased Inflation and Eroded Purchasing Power: Tariffs contributed to increased inflation as the costs of imported goods were passed on to consumers. This erosion of purchasing power negatively impacted investment returns, affecting the net worth of billionaires whose wealth is largely tied to the performance of assets susceptible to inflation.

-

Industry-Specific Impacts: Sectors like retail, heavily reliant on imported goods, were particularly hard-hit. The manufacturing sector also faced increased input costs, impacting their profitability and valuations. These are just two examples of the far-reaching consequences of Trump tariffs.

Specific Billionaire Industries Affected by Trump Tariffs

The impact of Trump tariffs wasn't uniform across all billionaire industries. Certain sectors felt the brunt of the economic fallout more acutely:

-

Retail Billionaires: Retail giants, relying heavily on imported goods, faced significantly increased costs, leading to reduced profits and lower stock prices. This directly impacted the net worth of billionaires with substantial holdings in retail companies.

-

Tech Billionaires: Many technology companies depend on global supply chains for components and manufacturing. Tariffs disrupted these supply chains, increasing costs and potentially delaying product launches, affecting the valuation of technology companies and the net worth of their billionaire owners.

-

Manufacturing Billionaires: Manufacturers faced increased input costs due to tariffs on imported raw materials and components, leading to decreased production and reduced profitability. This directly impacted the net worth of billionaires involved in manufacturing businesses.

For instance, analyses showed a significant percentage decrease in net worth for billionaires heavily invested in sectors like apparel and consumer goods directly impacted by the tariffs. Specific examples (though requiring detailed research to confirm exact figures which are beyond the scope of this article) could demonstrate the impact on individual billionaires and their companies.

Long-Term Economic Consequences of the Tariff-Induced Wealth Decline

The $174 billion decline in billionaire net worth wasn't an isolated incident; it had broad economic ramifications:

-

Impact on Investment and Economic Growth: Reduced billionaire wealth can lead to decreased investment, hindering economic growth. Less investment translates to fewer job opportunities and slower overall economic expansion.

-

Exacerbated Wealth Inequality: The disproportionate impact of tariffs on certain industries amplified existing wealth inequality. While some billionaires saw minimal effects, others faced significant losses, widening the gap between the ultra-wealthy and the rest of the population.

-

Relationship to Consumer Prices: The increased costs associated with tariffs were passed on to consumers in the form of higher prices, contributing to inflation and reducing consumer purchasing power. This created a domino effect throughout the economy.

-

Overall Impact on GDP: The combination of reduced investment, decreased consumer spending, and supply chain disruptions likely contributed to a slowdown in GDP growth. Precise quantification requires a complex economic model that accounts for multiple interacting factors beyond the scope of this analysis.

Comparing the Trump Tariff Impact to Other Economic Factors

Isolating the impact of Trump tariffs from other economic factors is crucial for a comprehensive analysis. The COVID-19 pandemic, for example, simultaneously impacted global markets and contributed to economic uncertainty. Fluctuations in global markets also played a role in the changes in billionaire net worth, making it complex to pinpoint the exact contribution of the Trump tariffs alone. A thorough analysis would require sophisticated econometric modeling to control for these other variables and isolate the specific effect of tariffs. Comparing the magnitude of the tariff-related wealth decline with other economic events, like previous recessions, provides valuable context for understanding its relative significance.

Conclusion

The Trump administration's tariff policies resulted in a significant $174 billion decline in billionaire net worth, a substantial consequence largely stemming from increased business costs, disrupted supply chains, and increased inflation. This decline had far-reaching economic implications, potentially impacting investment, exacerbating wealth inequality, and influencing consumer prices and overall GDP growth. While separating the precise impact of Trump tariffs from other concurrent economic factors necessitates further, in-depth analysis, the sheer scale of the wealth decline underscores the profound effects of trade policies on the economy and wealth distribution. Understanding the complex relationship between trade policy and wealth distribution is crucial. Further research into the long-term effects of Trump tariffs and their impact on billionaire net worth is essential for informed economic policymaking. Continue exploring the analysis of tariff effects on different economic sectors to fully comprehend the consequences.

Featured Posts

-

Edmonton Oilers Star Leon Draisaitls Injury Update Playoffs Possible

May 10, 2025

Edmonton Oilers Star Leon Draisaitls Injury Update Playoffs Possible

May 10, 2025 -

From Scatological Documents To Podcast Success An Ai Powered Solution

May 10, 2025

From Scatological Documents To Podcast Success An Ai Powered Solution

May 10, 2025 -

Leon Draisaitls Century Oilers Win Against Islanders In Overtime

May 10, 2025

Leon Draisaitls Century Oilers Win Against Islanders In Overtime

May 10, 2025 -

Bear Market Bets Falter Wall Streets Strong Comeback

May 10, 2025

Bear Market Bets Falter Wall Streets Strong Comeback

May 10, 2025 -

Barys San Jyrman Msyrt Nhw Ktabt Altarykh Alawrwby

May 10, 2025

Barys San Jyrman Msyrt Nhw Ktabt Altarykh Alawrwby

May 10, 2025