Analyzing Apple Stock's Performance Before Q2 Report

Table of Contents

Recent Market Trends Impacting Apple Stock

Apple stock, like other tech stocks, is susceptible to broader market fluctuations. Understanding these trends is crucial for predicting Apple's Q2 performance. Several factors play a significant role:

-

Market Volatility: Recent market volatility, driven by factors like interest rate hikes and geopolitical instability, has created uncertainty across the tech sector. This volatility directly impacts investor sentiment towards Apple stock, leading to price fluctuations. High volatility often means increased risk for Apple investment.

-

Tech Stock Performance: The overall performance of the tech sector significantly influences Apple's stock price. If the broader tech market experiences a downturn, Apple stock is likely to be affected, regardless of its individual performance. Monitoring the Nasdaq Composite and other tech indices is vital for understanding the context of Apple's performance.

-

Interest Rates and Inflation: Rising interest rates and persistent inflation impact consumer spending. As borrowing becomes more expensive, consumers may delay large purchases like new iPhones or Macs, potentially affecting Apple's sales figures and, consequently, its stock price. This makes understanding economic indicators crucial for Apple Stock analysis.

-

Geopolitical Events and Economic News: Significant geopolitical events and unexpected economic news can create market uncertainty, affecting investor confidence and impacting Apple stock. For example, global supply chain disruptions or international trade disputes could influence Apple's production and sales, directly affecting its Apple stock performance.

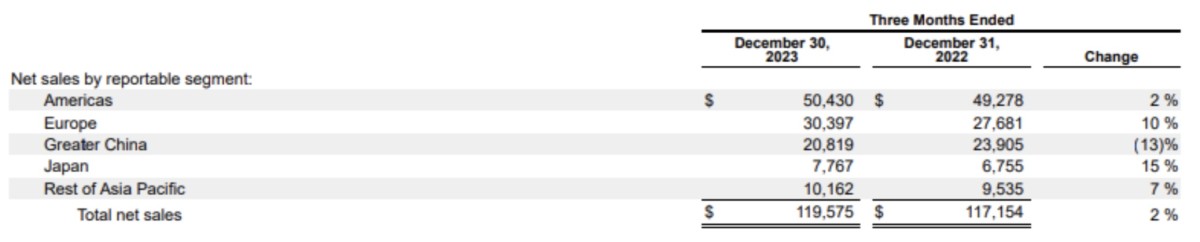

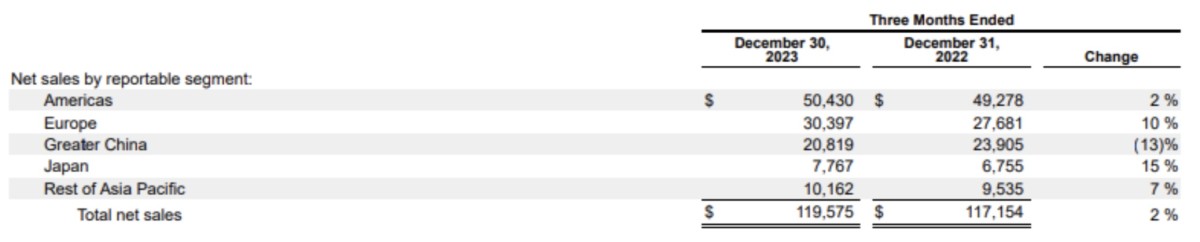

(Insert relevant chart here showing correlation between market indices like the Nasdaq and Apple's stock price)

Apple's Pre-Q2 Performance Indicators

Analyzing Apple's performance indicators leading up to the Q2 report gives investors a clearer picture of its financial health and potential future performance. Key indicators include:

-

iPhone Sales: iPhone sales remain the cornerstone of Apple's revenue. Pre-release sales data, analyst estimates, and reports on iPhone demand provide vital clues regarding Q2 expectations. A strong iPhone sales performance typically translates into positive momentum for Apple stock.

-

Services Revenue: Apple's services segment (including Apple Music, iCloud, and App Store) demonstrates consistent growth and increasingly contributes significantly to overall profitability. Analyzing the growth trajectory of this sector is crucial for Apple stock analysis and gauging future performance.

-

Mac, iPad, and Wearables Sales: While iPhone sales dominate, analyzing the performance of Macs, iPads, and wearables provides a more holistic view of Apple's product portfolio and market reach. Growth in these sectors can indicate the health of Apple's overall ecosystem.

-

Supply Chain Issues: Any ongoing supply chain disruptions or component shortages could significantly impact Apple's ability to meet demand and affect its Q2 results. This is a critical risk factor to consider when analyzing Apple stock.

-

New Product Launches: Any new product launches or major software updates leading up to the Q2 report can significantly influence investor sentiment and stock performance. Positive reception for new products often translates into a boost in Apple stock price.

Analyst Predictions and Sentiment Towards Apple Stock

Understanding analyst predictions and overall investor sentiment is a crucial aspect of analyzing Apple stock before the Q2 report.

-

Analyst Ratings and Stock Price Targets: Consulting analyst reports from reputable financial institutions provides insights into their expectations for Apple's Q2 earnings and future stock price performance. Comparing different analysts' price targets can help gauge the range of potential outcomes.

-

Investor Sentiment: Gauging investor sentiment – whether it's bullish (positive), bearish (negative), or neutral – reveals the overall market expectation regarding Apple's stock. This is often reflected in news articles, social media discussions, and investor forums.

-

Buy/Sell Recommendations: Tracking the buy/sell recommendations from major financial institutions provides further insights into the overall sentiment surrounding Apple stock. A high number of "buy" recommendations generally suggests a positive outlook.

Identifying Potential Risks and Opportunities

While analyzing Apple stock's strengths is essential, understanding potential risks and opportunities is equally crucial.

-

Potential Risks:

- Increased Competition: Intense competition from Android device manufacturers presents a constant challenge.

- Economic Slowdown: A global or regional economic slowdown could negatively impact consumer spending on Apple products.

- Regulatory Changes: Changes in regulations, particularly concerning data privacy or antitrust concerns, could affect Apple's operations.

-

Potential Opportunities:

- Growth in Emerging Markets: Expanding into and penetrating emerging markets presents a significant opportunity for future growth.

- Technological Innovation: Advancements in areas like augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) offer significant growth potential.

- Expansion into New Services: Expanding its services portfolio through new offerings can lead to increased revenue streams and improved profitability.

Conclusion

Analyzing Apple stock's performance before the Q2 report requires a multifaceted approach. By considering broader market trends, Apple's internal performance indicators, analyst predictions, and potential risks and opportunities, investors can develop a more informed perspective on Apple stock. Remember to consider all these factors before making any investment decisions. Stay informed about Apple's Q2 results and continue analyzing Apple stock's performance to refine your investment strategies. Remember to conduct thorough research before investing in Apple stock or any other stock.

Featured Posts

-

Marylands Aubrey Wurst Shines In 11 1 Win Against Delaware Softball

May 25, 2025

Marylands Aubrey Wurst Shines In 11 1 Win Against Delaware Softball

May 25, 2025 -

Finding Your Dream Home In The Countryside Budget Friendly Options Under 1m

May 25, 2025

Finding Your Dream Home In The Countryside Budget Friendly Options Under 1m

May 25, 2025 -

Glastonbury 2024 Unconfirmed Us Band Performance Ignited Online Speculation

May 25, 2025

Glastonbury 2024 Unconfirmed Us Band Performance Ignited Online Speculation

May 25, 2025 -

Following Walker Sighting Annie Kilner Debuts Impressive Diamond Ring

May 25, 2025

Following Walker Sighting Annie Kilner Debuts Impressive Diamond Ring

May 25, 2025 -

Escape To The Country Stars Chiswick Home Garden Feature

May 25, 2025

Escape To The Country Stars Chiswick Home Garden Feature

May 25, 2025

Latest Posts

-

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025