Analyzing Elon Musk's Net Worth Change: 100 Days Under Trump

Table of Contents

Initial Market Reaction to the Trump Presidency and its Impact on Elon Musk's Net Worth

The immediate market response to Trump's election and inauguration was a mixture of optimism and uncertainty. This volatility directly impacted Elon Musk's net worth, primarily through its effects on Tesla and SpaceX valuations.

-

Stock market volatility in the first 100 days: The period witnessed significant fluctuations in the stock market, with the Dow Jones Industrial Average experiencing both sharp rises and falls. This uncertainty created a volatile environment for Tesla stock, causing substantial daily swings in its price.

-

Impact of Trump's regulatory policies on Tesla's automotive sector: Trump's focus on deregulation had mixed effects. While potentially easing some manufacturing burdens, it also raised concerns about environmental regulations crucial to Tesla's electric vehicle mission. This uncertainty impacted investor confidence.

-

Effect on SpaceX's government contracts and space exploration initiatives: SpaceX, heavily reliant on government contracts for its launch services, saw potential shifts depending on the Trump administration's space exploration priorities. Changes in NASA funding and defense spending influenced SpaceX's overall valuation and, consequently, Musk's net worth.

-

Specific dates and percentage changes in net worth: While precise daily net worth figures are difficult to pinpoint, analyses from reputable financial news sources during this period showed considerable fluctuations, often correlating directly with changes in Tesla's stock price. For example, a significant drop in Tesla stock in early 2017 directly translated into a decrease in Musk's net worth.

The Role of Regulatory Changes and Policy Shifts

Trump's proposed tax cuts and deregulation significantly influenced the business environment. These policies had a notable impact on both Tesla and SpaceX, affecting Musk's overall financial picture.

-

Specific tax policies and their influence: The proposed corporate tax cuts could have positively influenced Tesla's profitability, boosting investor confidence and increasing its stock valuation. Conversely, any changes affecting research and development tax credits could have had a contrasting effect.

-

Impact of deregulation on manufacturing and energy sectors: Deregulation in the energy sector, particularly regarding fossil fuels, could have presented both opportunities and challenges for Tesla. Increased competition from fossil fuel-based energy sources might impact Tesla's market share.

-

Analysis of any potential conflicts or advantages: Trump's focus on infrastructure development could have benefited Tesla through increased demand for electric vehicles and energy storage solutions. Simultaneously, any changes to environmental regulations could create hurdles for Tesla's long-term goals.

-

Mention any relevant executive orders and their effects: Executive orders related to environmental regulations or infrastructure spending directly impacted Tesla's prospects and consequently, Musk's net worth.

Global Economic Factors and their Influence on Elon Musk's Net Worth

Global economic trends during the first 100 days of the Trump administration played a significant role in shaping Musk's net worth. Currency fluctuations and international trade dynamics added further complexity.

-

Influence of global supply chains on Tesla's production: Tesla's global supply chains made it vulnerable to fluctuations in currency exchange rates and international trade tensions. Changes in these factors could directly impact production costs and profitability.

-

Impact of international trade agreements on SpaceX's international projects: SpaceX's international projects, involving collaborations and launches from various countries, were potentially affected by international trade policies and agreements negotiated during this period.

-

Effects of global economic uncertainty on investor sentiment towards Tesla stock: Global economic uncertainty during the transition period influenced investor sentiment, impacting Tesla's stock price and thus Musk's net worth. Negative global sentiment could lead to a drop in investment in risky assets like Tesla stock.

-

Consider the impact of oil prices and energy markets: Oil prices and the broader energy market heavily influence investor perception of the electric vehicle sector. Fluctuations in oil prices directly impacted investor sentiment toward Tesla, thereby impacting Musk’s net worth.

Media Coverage and Public Perception

Media portrayal and public opinion heavily influenced investor sentiment towards Tesla and SpaceX. This influence, especially through social media, had a measurable effect on Elon Musk's net worth.

-

Examples of positive and negative media coverage: Positive coverage highlighting Tesla's technological advancements and SpaceX's achievements boosted investor confidence. Conversely, negative media surrounding production delays or controversies negatively impacted stock prices.

-

Impact of Elon Musk's public statements and actions: Musk's outspoken nature and public actions often generated significant media attention, both positive and negative, directly influencing investor sentiment and Tesla's stock price.

-

Analyze the correlation between media sentiment and stock prices: A clear correlation often existed between positive media coverage and increased Tesla stock prices, directly impacting Musk's net worth. Conversely, negative media often resulted in a decline.

-

Assess the effect of controversies and news cycles: News cycles surrounding Tesla production challenges or Musk's public statements created significant volatility in Tesla stock and consequently, affected Musk's net worth.

Conclusion

This analysis provides a comprehensive overview of the factors that influenced Elon Musk's net worth during the crucial first 100 days of the Trump presidency. We've examined the intertwined effects of market reactions, regulatory changes, global economic trends, and media perception. Understanding the interplay between these elements is crucial to analyzing the "Elon Musk net worth Trump" relationship.

To further understand the complex dynamics impacting Elon Musk's financial success and the wider implications for the business world, continue exploring the evolving relationship between political climates and market fluctuations. Further research into the Elon Musk net worth Trump relationship, including a deeper dive into specific policy impacts and market responses, will provide deeper insights into this fascinating case study.

Featured Posts

-

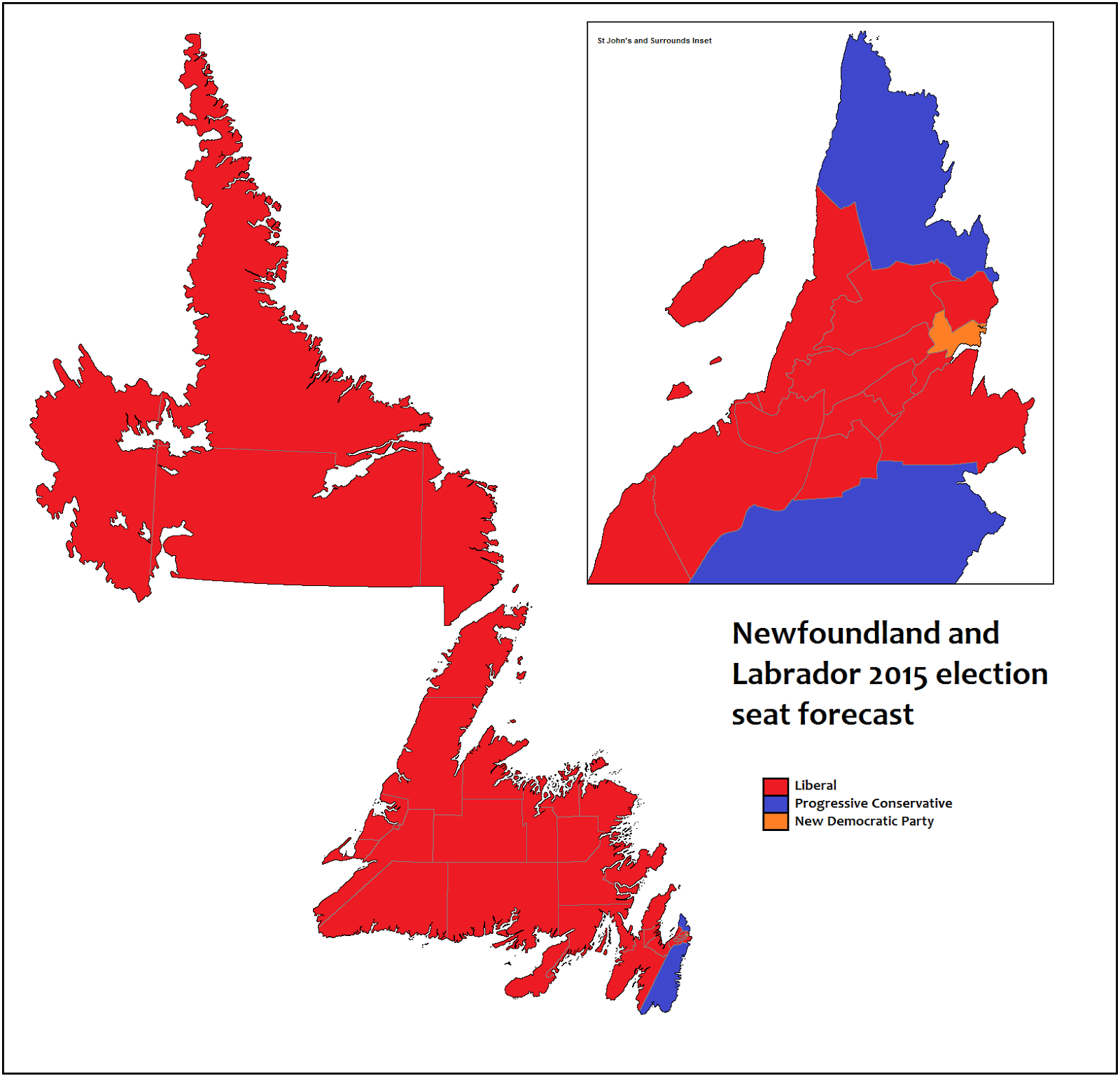

Get To Know Your Nl Federal Election Candidates

May 09, 2025

Get To Know Your Nl Federal Election Candidates

May 09, 2025 -

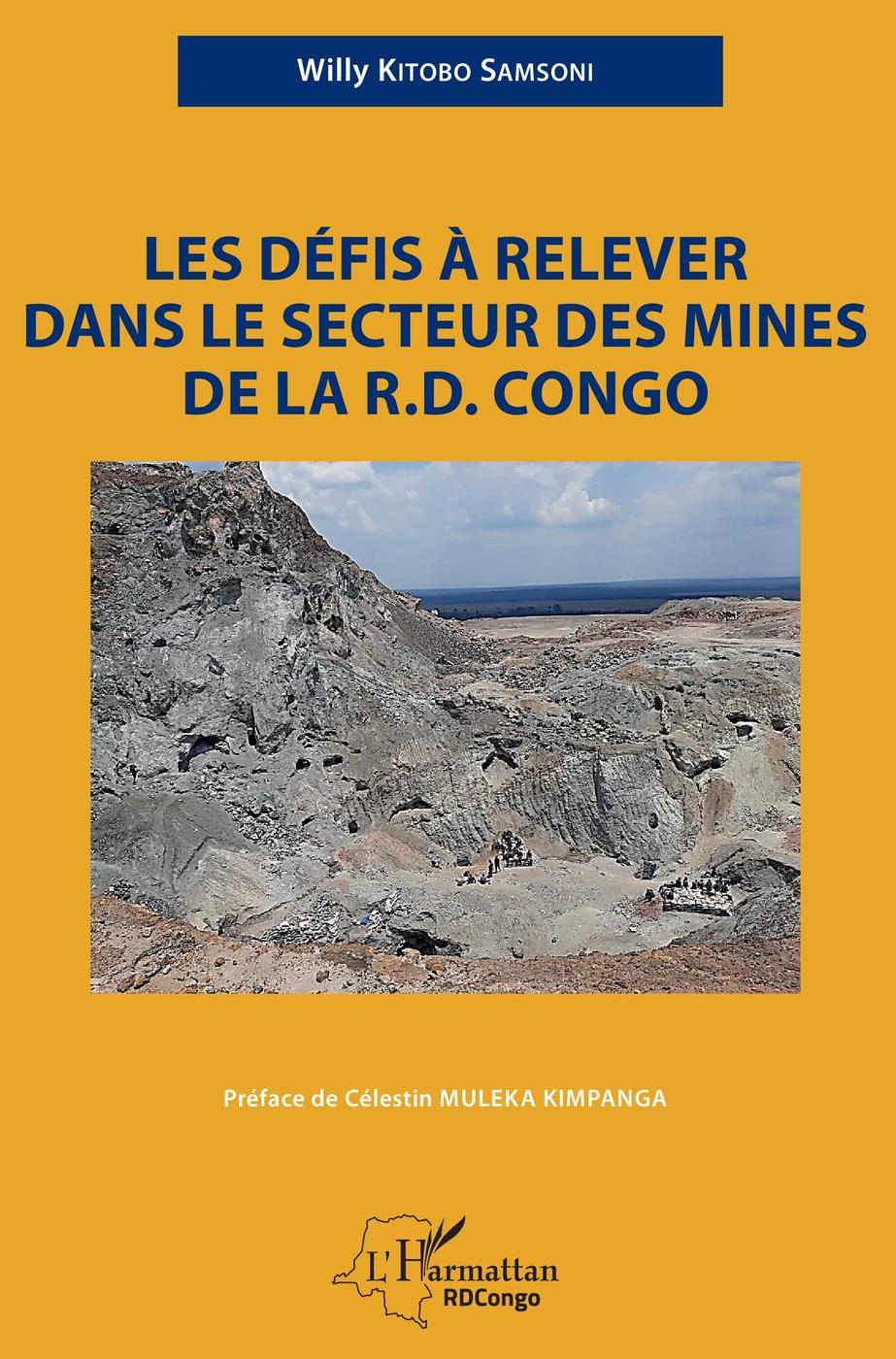

Plantation De Vignes A Dijon 2500 M Dans Le Secteur Des Valendons

May 09, 2025

Plantation De Vignes A Dijon 2500 M Dans Le Secteur Des Valendons

May 09, 2025 -

127 Years Of Brewing History Anchor Brewing Company To Close Its Doors

May 09, 2025

127 Years Of Brewing History Anchor Brewing Company To Close Its Doors

May 09, 2025 -

Skisesongen Rammes Av Mild Vinter Flere Stenginger

May 09, 2025

Skisesongen Rammes Av Mild Vinter Flere Stenginger

May 09, 2025 -

Price Gouging Allegations Surface After La Fires A Selling Sunset Perspective

May 09, 2025

Price Gouging Allegations Surface After La Fires A Selling Sunset Perspective

May 09, 2025