Analyzing Japan's Steep Bond Yield Curve: Risks And Opportunities

Table of Contents

Understanding Japan's Bond Market Dynamics

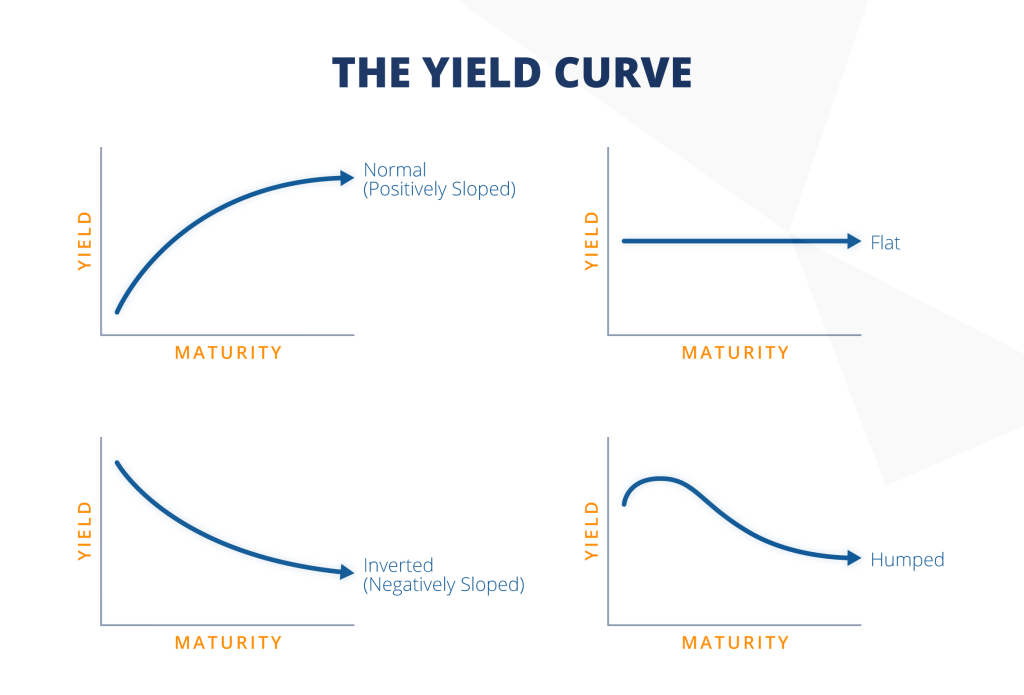

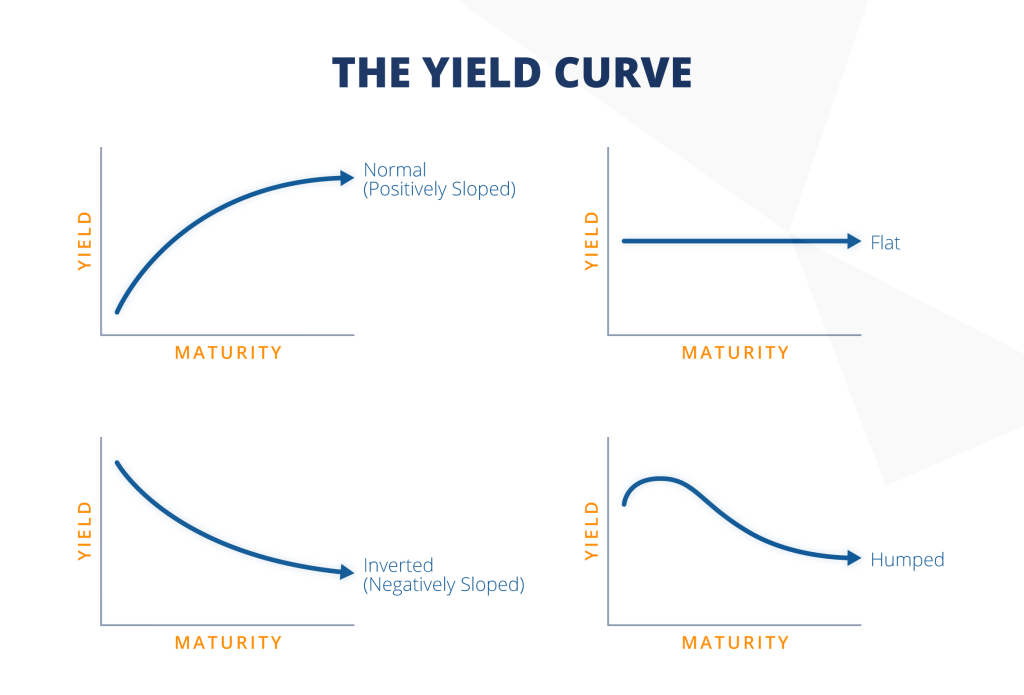

Japan's bond market is dominated by Japanese Government Bonds (JGBs), which are considered low-risk and highly liquid assets. The steepness of the yield curve – the difference between short-term and long-term JGB yields – is a key indicator of market sentiment and future economic expectations. Several factors contribute to this current steepness:

-

Monetary Policy Decisions by the Bank of Japan (BOJ): The BOJ's prolonged quantitative and qualitative monetary easing (QQE) program, aimed at stimulating inflation, has kept short-term interest rates exceptionally low. This policy, while intending to boost the economy, has created a significant yield differential between short and long-term bonds. Recent policy shifts towards allowing greater yield fluctuation are altering this dynamic.

-

Inflationary Pressures and Expectations: While inflation in Japan remains relatively subdued compared to other developed nations, growing inflationary pressures and shifting expectations are impacting long-term bond yields. Investors are demanding higher returns to compensate for potential future inflation erosion of principal.

-

Government Borrowing Needs: Japan's substantial government debt necessitates significant borrowing, increasing the supply of JGBs and potentially influencing their yields. The government's fiscal policies play a critical role in shaping the bond market's trajectory.

-

Global Economic Conditions and their Impact on Investor Sentiment: Global economic uncertainties, such as rising interest rates in other countries and geopolitical instability, can impact investor confidence in JGBs, leading to fluctuations in their yields and influencing the overall yield curve slope.

Analyzing the historical context of yield curve movements in Japan reveals cyclical patterns influenced by shifts in monetary policy, economic growth, and global events. Understanding this historical perspective is vital for interpreting the current steep yield curve.

Risks Associated with a Steep Yield Curve in Japan

A steep yield curve, while offering potential opportunities, also presents several substantial risks:

-

Increased Borrowing Costs for the Japanese Government: A steepening curve implies higher interest rates on future government borrowing, increasing the strain on Japan's already substantial public debt. This can lead to fiscal challenges and potentially necessitate austerity measures.

-

Potential for Higher Inflation and its Impact on the Economy: While currently subdued, a steepening yield curve can signal growing inflationary expectations. Uncontrolled inflation could erode purchasing power and negatively impact economic growth.

-

Risk of a Bond Market Correction or Sudden Shifts in Investor Sentiment: The current environment of low interest rates makes the Japanese bond market susceptible to sudden shifts in investor sentiment. A rapid reversal of the current trend could cause significant volatility and losses.

-

Implications for the Stability of the Japanese Financial System: Japanese banks, holding substantial amounts of JGBs, could face significant losses if interest rates rise sharply, impacting their capital adequacy and overall stability. This risk extends to other financial institutions as well.

The vulnerability of Japanese banks to rising interest rates is particularly noteworthy. Their significant holdings of JGBs are vulnerable to losses in a rising rate environment, potentially impacting their profitability and lending capacity. Similarly, Japanese pension funds and other long-term investors relying on JGBs for stable returns face the risk of capital erosion.

Investment Opportunities Presented by a Steep Yield Curve

Despite the risks, Japan's steep yield curve presents compelling investment opportunities for those with a high-risk tolerance and sophisticated understanding of the market:

-

Strategies for Profiting from Interest Rate Differentials: The significant spread between short-term and long-term yields creates opportunities for investors employing strategies such as carry trades and yield curve trading.

-

Opportunities in Japanese Government Bonds (JGBs) and Related Derivatives: While carrying inherent risk, selectively investing in specific JGB maturities can yield attractive returns, particularly if one can accurately predict future yield movements. Derivatives such as interest rate swaps and futures contracts can also provide opportunities for hedging and speculation.

-

Potential for Higher Returns in Certain Sectors of the Japanese Economy: A steep yield curve can positively impact certain sectors, such as the financial sector, which could benefit from wider interest rate margins. This warrants a sector-specific analysis.

Effective risk management is paramount. Diversification across asset classes and the use of hedging strategies are crucial for mitigating potential losses. Thorough due diligence and understanding of the underlying economic forces driving the yield curve are absolutely essential.

Comparative Analysis with Other Developed Economies

Comparing Japan's yield curve with those of other major economies, such as the US and Europe, reveals significant differences. The prolonged period of ultra-low interest rates in Japan stands in contrast to the more normalized yield curves seen in other developed markets. These differences primarily stem from the unique monetary policies, fiscal situations, and inflation dynamics prevalent in each economy. A deeper comparative analysis is vital to understanding the global context of Japan's unique market conditions.

Conclusion: Navigating Japan's Steep Bond Yield Curve

Japan's steep bond yield curve presents a complex landscape of both risks and rewards. While opportunities exist for sophisticated investors, the potential for losses is equally significant. Careful analysis of market dynamics, including monetary policy shifts, inflation expectations, and global economic conditions, is critical for informed decision-making. Risk management strategies, diversification, and professional financial advice are crucial before engaging in any investment related to Japan's steep bond yield curve. Continuous monitoring of Japan's steep bond yield curve dynamics is essential for adjusting investment strategies and mitigating potential risks. Conduct thorough research and consult with financial professionals before making any investment decisions. Further reading on Japanese monetary policy and JGB market analysis is highly recommended.

Featured Posts

-

Knicks Vs Pistons Bet365 Bonus Code Nypbet And Series Prediction

May 17, 2025

Knicks Vs Pistons Bet365 Bonus Code Nypbet And Series Prediction

May 17, 2025 -

Investing In Uber Technologies Uber What To Consider

May 17, 2025

Investing In Uber Technologies Uber What To Consider

May 17, 2025 -

From Behind To Victory Bayern Munichs Win Over Stuttgart

May 17, 2025

From Behind To Victory Bayern Munichs Win Over Stuttgart

May 17, 2025 -

Andor Planned Book Scrapped Over Ai Copyright Issues

May 17, 2025

Andor Planned Book Scrapped Over Ai Copyright Issues

May 17, 2025 -

Detroit Pistons Vs New York Knicks Key Factors Determining Their Success

May 17, 2025

Detroit Pistons Vs New York Knicks Key Factors Determining Their Success

May 17, 2025