Analyzing Palantir Stock Before Its May 5th Earnings Report

Table of Contents

Palantir Technologies (PLTR) is set to release its earnings report on May 5th, making this a crucial time for investors to analyze its stock. This article delves into key factors influencing Palantir's stock price, helping you make informed decisions before the announcement. We'll explore recent performance, future growth potential, and potential risks to give you a comprehensive overview for your investment strategy. This Palantir stock analysis will cover crucial aspects to consider before the earnings release.

Palantir's Recent Performance & Key Metrics

Revenue Growth and Profitability

Analyzing Palantir's financial performance requires a close look at revenue growth and profitability trends. Recent quarters have shown a mixed bag, with growth rates fluctuating depending on contract wins and the mix of government versus commercial clients. Understanding these nuances is crucial for a thorough Palantir stock analysis.

- Revenue Growth: Examining the quarterly and annual revenue growth rates reveals the overall trajectory of the company's financial health. Significant increases suggest strong demand for Palantir's data analytics platforms, while slower growth could indicate market saturation or competitive pressures.

- Profit Margins: Analyzing profit margins (gross, operating, and net) provides insights into Palantir's efficiency and cost management. Improving margins indicate a positive trend, while declining margins might warrant further investigation.

- Government vs. Commercial: Palantir's revenue is derived from both government contracts and commercial partnerships. The balance between these two revenue streams significantly impacts overall performance. A heavy reliance on government contracts might expose the company to funding fluctuations, while a strong commercial presence indicates broader market acceptance.

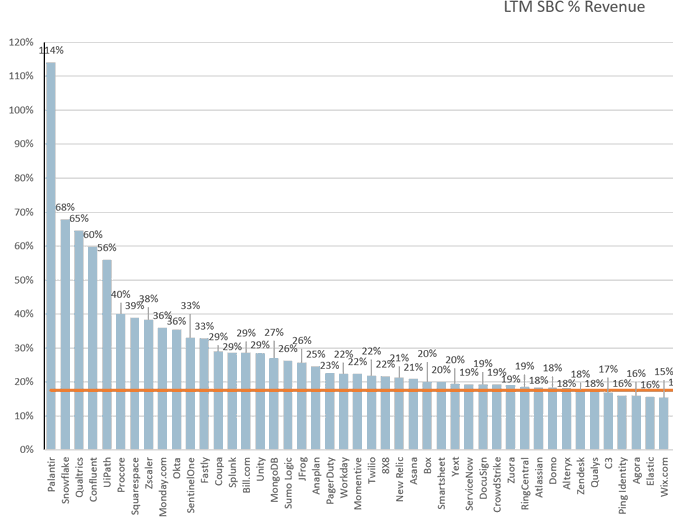

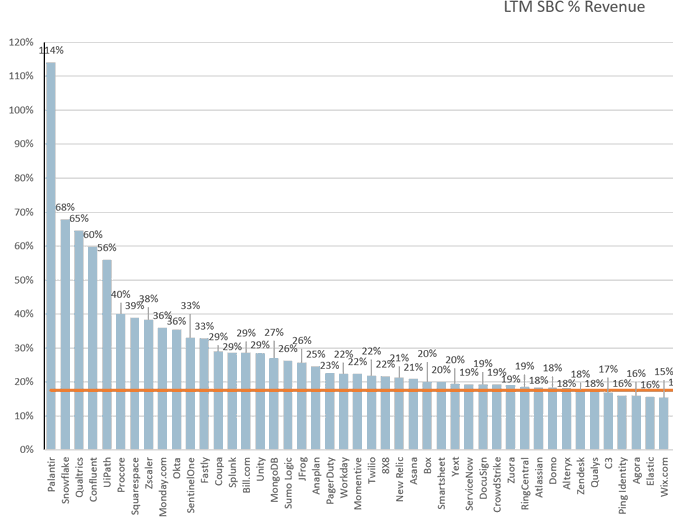

- Industry Comparison: Comparing Palantir's performance against competitors like Databricks, Snowflake, and Splunk provides context and allows for a more informed assessment of its position within the data analytics market.

- Key Financial Data (Example):

- Q4 2022 Revenue: [Insert Actual Figure]

- Year-over-Year Revenue Growth: [Insert Actual Figure]%

- Net Income (or Loss): [Insert Actual Figure]

- EPS: [Insert Actual Figure]

Customer Acquisition and Retention

Understanding Palantir's customer acquisition and retention strategies is vital for predicting future revenue streams. Strong customer acquisition indicates market demand, while high retention demonstrates customer satisfaction and the effectiveness of Palantir's solutions.

- New Customer Acquisition: The number of new customers acquired in recent quarters provides insight into the growth rate and market penetration of Palantir's offerings. A consistently high number of new customers is a positive indicator.

- Customer Churn: High customer churn rates suggest potential problems with product satisfaction or pricing. Analyzing churn rates and identifying the reasons behind customer attrition are essential for evaluating Palantir's long-term sustainability.

- Customer Base Diversity: The balance between government and commercial customers diversifies Palantir's revenue streams, reducing reliance on a single sector and mitigating risks associated with funding fluctuations or policy changes.

- Long-Term Contracts: Securing long-term contracts with both government and commercial clients provides revenue predictability and reduces the vulnerability to short-term market fluctuations.

- Key Customer Metrics (Example):

- Number of new customers acquired in Q4 2022: [Insert Actual Figure]

- Customer churn rate: [Insert Actual Figure]%

- Average contract length: [Insert Actual Figure]

Growth Prospects and Future Outlook

Expansion into New Markets

Palantir's future growth hinges on its ability to expand into new markets and industries. Analyzing its expansion plans and the potential market size in these new areas is crucial for a thorough Palantir stock analysis.

- New Industry Targets: Identifying the industries Palantir is targeting for expansion (e.g., healthcare, finance, energy) provides a glimpse into its strategic vision and growth potential.

- Geographic Expansion: Palantir's expansion into new geographic regions increases its market reach and reduces dependence on specific markets.

- Market Size and Opportunity: Assessing the potential market size and growth rate in the targeted industries and regions provides an estimate of the revenue growth opportunities.

- Expansion Challenges: Expansion into new markets involves challenges such as regulatory hurdles, competition, and the need for local expertise. Understanding these potential challenges is crucial.

- Key Target Markets (Example): Healthcare, Finance, Energy, International markets (e.g., Asia, Europe).

Technological Advancements and Innovation

Palantir's continued investment in research and development is essential for maintaining its competitive advantage in the data analytics market. Analyzing its technological advancements and innovation is a critical part of any Palantir stock analysis.

- R&D Spending: Monitoring Palantir's R&D investment reveals its commitment to innovation and its ability to adapt to evolving market trends.

- New Product Releases: The release of new products and features enhances Palantir's offerings and allows it to cater to a wider range of customer needs.

- Competitive Advantage: Evaluating Palantir's technological advantages over its competitors (e.g., superior algorithms, data integration capabilities) is crucial for assessing its long-term growth prospects.

- New Technologies (Example): AI-powered analytics, cloud-based solutions, advanced data visualization tools.

Government Contracts and Funding

Government contracts form a significant portion of Palantir's revenue. Understanding the dynamics of government spending and the potential impact on Palantir's future performance is critical.

- Contract Portfolio: Analyzing the size and duration of Palantir's government contracts provides insight into its revenue stability.

- Government Spending: Changes in government budgets and spending priorities can directly impact Palantir's revenue stream.

- Risk Mitigation: Palantir's strategies to diversify its revenue base and reduce reliance on government contracts should be considered.

- Key Government Contracts (Example): [Insert Examples of Major Government Contracts if available]

Potential Risks and Challenges

Competition and Market Saturation

The data analytics market is highly competitive. Identifying key competitors and assessing the potential for market saturation is vital for any Palantir stock analysis.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of Palantir's main competitors provides a benchmark for its performance and market positioning.

- Competitive Landscape: Assessing the overall competitive landscape and the potential for increased competition from new entrants or existing players is essential.

- Competitive Strategies: Understanding how Palantir differentiates itself from competitors and maintains a competitive edge is crucial.

- Main Competitors (Example): Databricks, Snowflake, Splunk, other data analytics companies.

Economic Downturn and Market Volatility

Economic downturns and market volatility can significantly impact Palantir's business. Assessing the company's resilience to economic fluctuations is crucial for a complete Palantir stock analysis.

- Economic Sensitivity: Evaluating how sensitive Palantir's business is to economic downturns and recessions helps investors understand its potential vulnerability.

- Market Volatility: Assessing how Palantir's stock price reacts to market volatility provides insight into its risk profile.

- Inflation and Interest Rates: Analyzing the impact of inflation and interest rate changes on Palantir's financial performance and investment appeal is important.

- Economic Risks (Example): Reduced government spending, decreased commercial demand, increased borrowing costs.

Conclusion

Analyzing Palantir stock before its May 5th earnings report requires a holistic view of its recent performance, future growth prospects, and potential risks. This analysis has explored key financial metrics, growth strategies, and potential challenges impacting Palantir's stock price.

Call to Action: Stay informed about Palantir Technologies and its upcoming earnings report. Continue your research and analysis of Palantir stock to make well-informed investment decisions. Remember to conduct thorough due diligence before investing in any stock, including Palantir. Begin your in-depth Palantir stock analysis today!

Featured Posts

-

Trumps Britain Trade Deal What To Expect

May 09, 2025

Trumps Britain Trade Deal What To Expect

May 09, 2025 -

Legendata Bekam Nenadminat Talent I Veshtina

May 09, 2025

Legendata Bekam Nenadminat Talent I Veshtina

May 09, 2025 -

11 Lojtaret Me Te Mire Te Psg Se Dhe Rendesia E Tyre Ne Fushe

May 09, 2025

11 Lojtaret Me Te Mire Te Psg Se Dhe Rendesia E Tyre Ne Fushe

May 09, 2025 -

St Albert Dinner Theatres New Production A Fast Flying Farce

May 09, 2025

St Albert Dinner Theatres New Production A Fast Flying Farce

May 09, 2025 -

Nl Federal Election Candidate Profiles And Platforms

May 09, 2025

Nl Federal Election Candidate Profiles And Platforms

May 09, 2025