Analyzing Palantir Stock Before The May 5th Earnings Announcement

Table of Contents

H2: Palantir's Recent Performance and Market Sentiment

Palantir's stock price has experienced considerable volatility in the lead-up to the May 5th earnings announcement. Understanding this movement is crucial for assessing the current market sentiment. Let's examine some key factors:

-

Stock Price Fluctuations: [Insert chart showing PLTR stock price over the past three months]. The chart illustrates periods of both growth and decline, highlighting the inherent risk associated with PLTR. Analyzing the reasons behind these fluctuations is vital for informed decision-making.

-

Recent News Impacts: Recent news events, such as new contract wins (especially significant government contracts), strategic partnerships, product launches (like updates to Foundry), and any regulatory changes, have directly influenced investor confidence and, consequently, the stock price. Positive news generally boosts the stock, while negative news can lead to declines.

-

Market Sentiment Analysis: Analyzing social media sentiment (using tools that track mentions and sentiment scores for PLTR), news articles discussing Palantir, and the consensus among financial analysts offers a valuable gauge of market sentiment. A predominantly positive sentiment suggests optimism, whereas a negative sentiment indicates potential concerns.

-

Analyst Ratings and Price Targets: [Insert summary table of recent analyst ratings and price targets for PLTR]. A range of price targets indicates varying opinions on PLTR's future valuation.

H2: Key Financial Metrics to Watch in the Earnings Report

The upcoming earnings report will unveil crucial financial data. Investors should closely monitor the following metrics:

-

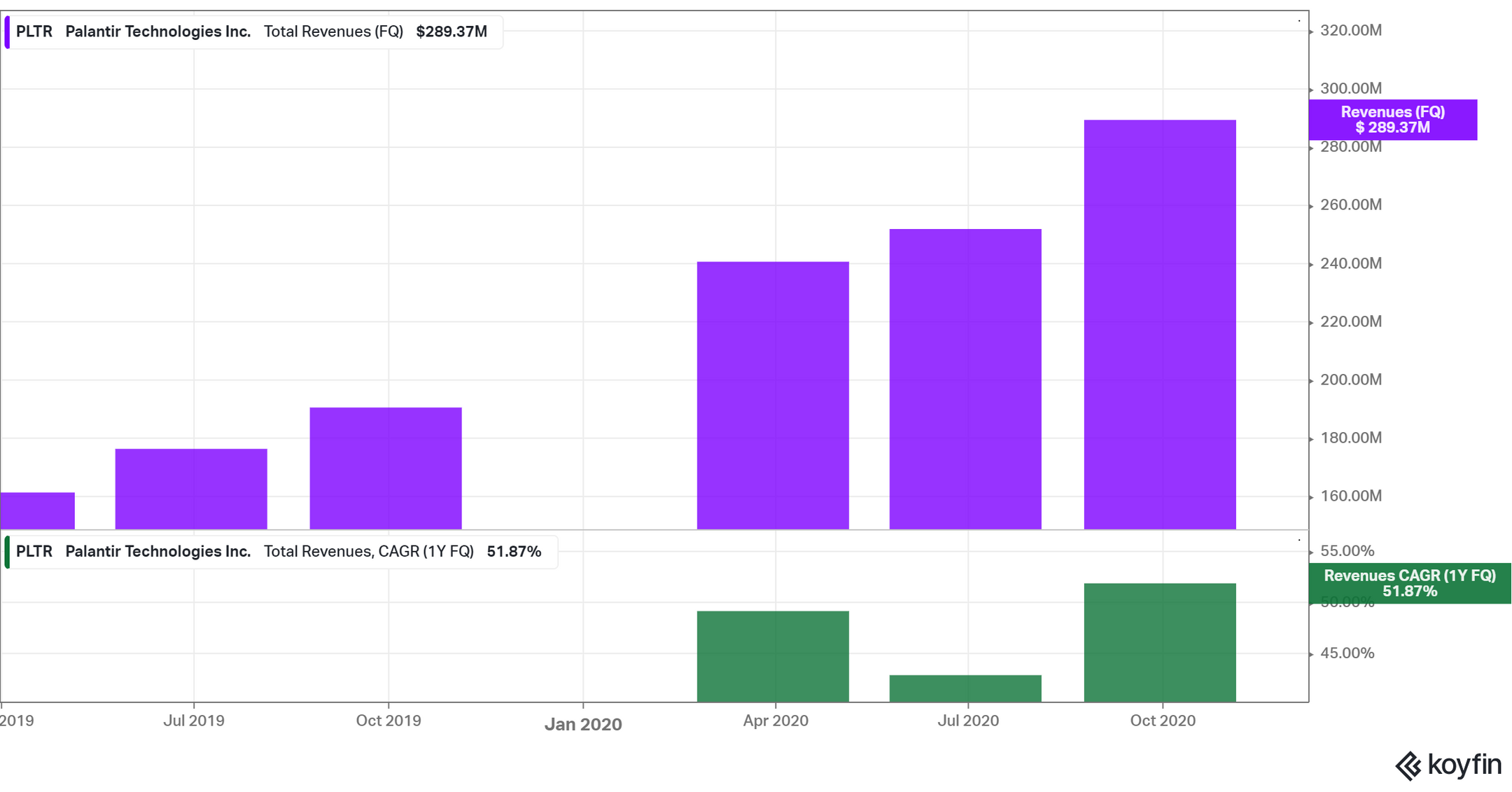

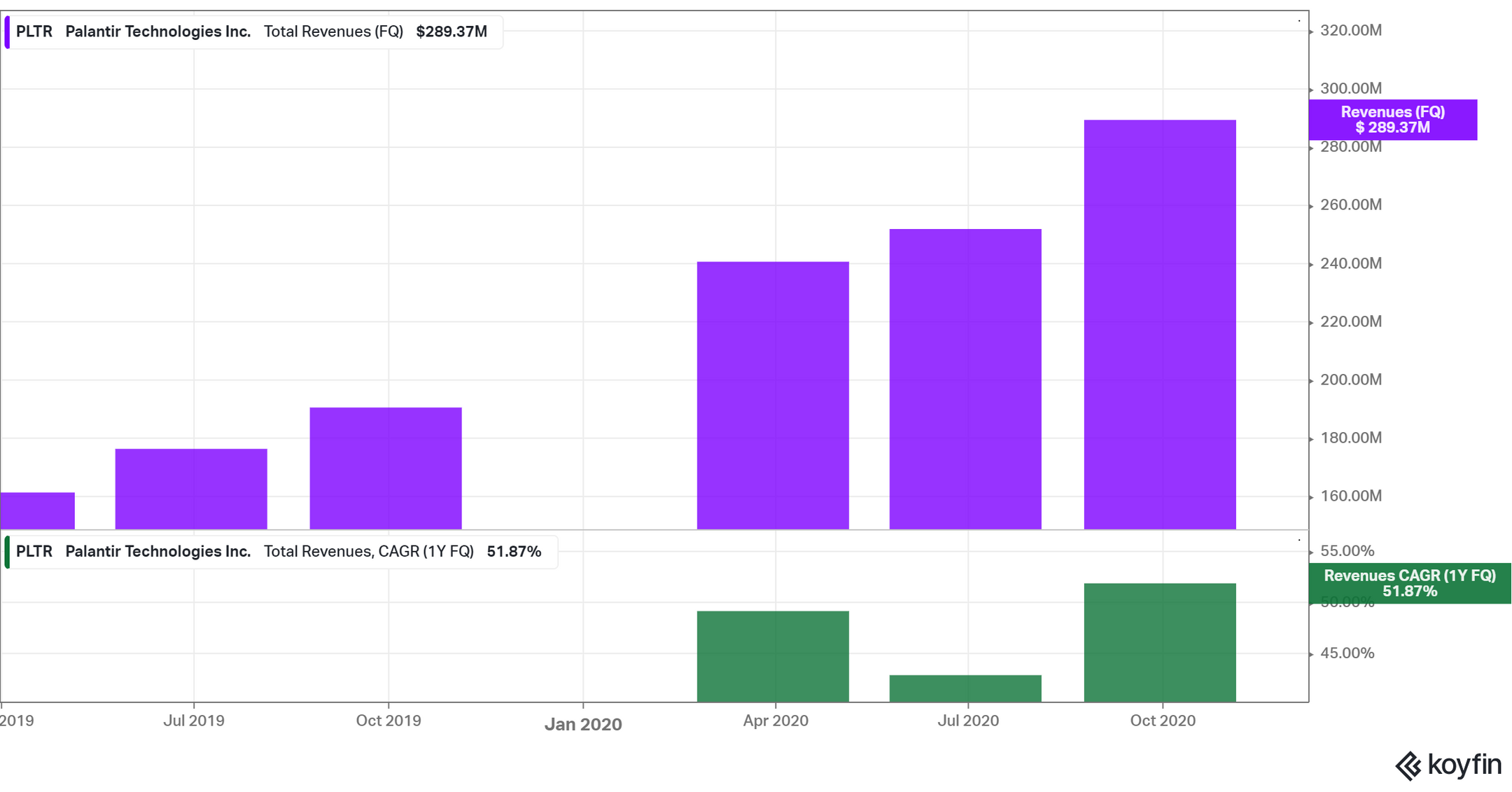

Revenue Growth: Analyzing the year-over-year and quarter-over-quarter revenue growth is essential to gauge Palantir's overall performance and market penetration. Sustained high growth is a positive indicator. [Insert analysis of Palantir's revenue growth compared to previous quarters and industry competitors].

-

Operating Margin: This metric reflects Palantir's profitability and efficiency. An improving operating margin suggests increased cost control and better operational performance.

-

Net Income: Profitability is paramount. A positive net income demonstrates Palantir's ability to generate profit after considering all expenses.

-

Cash Flow: Strong cash flow indicates the company's financial health and its ability to reinvest in growth initiatives, acquire other companies, or repay debt. [Insert discussion of the company's profitability and its path to sustainable growth].

Any significant deviation from analyst expectations in these metrics will likely trigger significant stock price movement.

H2: Assessing Palantir's Long-Term Growth Potential

Palantir's long-term success hinges on several factors:

-

Disruptive Technology: Palantir’s platform, particularly Foundry, is positioned to disrupt the big data and AI markets. Its ability to integrate and analyze complex datasets offers significant potential across various industries.

-

Competitive Landscape: Analyzing Palantir's competitive advantages against other players in the big data analytics space is crucial. Its focus on government and enterprise clients, along with its strong security features, gives it a competitive edge. [Insert analysis of Palantir's key partnerships and their contribution to long-term growth].

-

Emerging Technologies: The adoption and integration of emerging technologies like AI and machine learning will be pivotal for Palantir's future growth. [Insert discussion of the potential of Palantir's Foundry platform and its applications across various industries].

H2: Risk Factors to Consider Before Investing in Palantir Stock

Investing in Palantir involves certain risks:

-

High Valuation: Palantir's current valuation might be considered high by some investors, representing a potential risk if the company fails to meet growth expectations.

-

Competition: The data analytics market is competitive. New entrants and existing players pose a significant challenge to Palantir's market share.

-

Regulatory Scrutiny: Operating in the government and enterprise sectors exposes Palantir to increased regulatory scrutiny, which could impact its business operations. [Insert assessment of Palantir's debt levels and its impact on financial health]. [Insert discussion of potential regulatory hurdles in specific markets].

Conclusion: Making Informed Decisions About Palantir Stock

Analyzing Palantir stock requires a balanced assessment of its recent performance, upcoming earnings, long-term growth potential, and inherent risks. While Palantir holds immense promise in the big data and AI space, investors must carefully weigh the potential upside against the potential downsides before committing their capital. The May 5th earnings announcement will be a crucial data point, but remember that effective investment decisions require ongoing monitoring and analysis. Stay informed on Palantir's future performance by regularly reviewing financial news and analysis, and remember the importance of conducting your own thorough research before making any investment decisions related to analyzing Palantir stock.

Featured Posts

-

Analyzing Nigel Farages Reform Party Action Or Rhetoric

May 09, 2025

Analyzing Nigel Farages Reform Party Action Or Rhetoric

May 09, 2025 -

Unexpected Daycare Costs The Story Of A 3 000 Babysitter Bill

May 09, 2025

Unexpected Daycare Costs The Story Of A 3 000 Babysitter Bill

May 09, 2025 -

Quelles Chances Pour Les Ecologistes Aux Municipales De Dijon En 2026

May 09, 2025

Quelles Chances Pour Les Ecologistes Aux Municipales De Dijon En 2026

May 09, 2025 -

Brekelmans Inzet Voor India Doelen En Uitdagingen

May 09, 2025

Brekelmans Inzet Voor India Doelen En Uitdagingen

May 09, 2025 -

Wynne Evans Dropped From Go Compare Ads After Sex Slur Scandal

May 09, 2025

Wynne Evans Dropped From Go Compare Ads After Sex Slur Scandal

May 09, 2025