Analyzing Palantir Stock (PLTR) Before May 5th: Risks And Rewards

Table of Contents

Palantir's Financial Performance and Recent Earnings

Analyzing Palantir's recent earnings reports is paramount before considering any investment. Examining key financial metrics provides a clear picture of the company's health and growth trajectory. Let's look at some pre-May 5th data (replace with actual data):

-

Revenue Growth Rate: A YoY and QoQ analysis reveals the rate at which Palantir's revenue is increasing. Sustained high growth indicates strong market demand and successful business strategies. Conversely, slowing growth could signal challenges in market penetration or competition.

-

Profit Margins: Gross, operating, and net profit margins illustrate Palantir's efficiency in converting revenue into profit. Improving margins signify improved cost management and operational excellence.

-

Debt Levels and Interest Expense: High debt levels can burden a company's financial health. Analyzing debt levels and interest expense helps assess Palantir's financial leverage and its ability to manage its financial obligations.

-

Free Cash Flow Generation: Free cash flow (FCF) represents the cash a company generates after covering its operating expenses and capital expenditures. Strong FCF generation demonstrates financial stability and the ability to fund future growth initiatives.

-

Comparison to Competitors: Benchmarking Palantir's performance against competitors like Snowflake (SNOW) and Databricks provides valuable context and highlights areas of strength and weakness. Identifying where Palantir excels or lags behind its competitors is critical in assessing its future potential.

Palantir's Market Position and Competitive Landscape

Palantir operates in the highly competitive big data analytics and government contracting sectors. Understanding its market share and competitive advantages is critical.

-

Market Size and Growth Potential: The overall size and projected growth of the big data analytics market significantly impact Palantir's potential for expansion and revenue generation.

-

Key Competitors and their Strengths/Weaknesses: Analyzing competitors such as Snowflake, Databricks, and other players in the government contracting space reveals Palantir's relative strengths and weaknesses. This includes assessing their technological capabilities, market reach, and financial resources.

-

Palantir's Unique Selling Propositions (USPs): Palantir's proprietary technology, particularly its expertise in data integration and analysis for government and commercial clients, constitutes a key competitive advantage. Understanding these USPs is essential to evaluating its long-term viability.

-

Barriers to Entry: The presence of high barriers to entry, such as significant capital investment requirements and the need for specialized expertise, can protect Palantir's market position.

Future Growth Prospects and Catalysts for PLTR Stock

Palantir's future growth hinges on its strategic initiatives and external factors.

-

New Product Developments and their Market Potential: Palantir's ongoing investments in research and development (R&D) and new product launches are crucial drivers of future growth. The market acceptance and success of these new offerings will significantly impact its future trajectory.

-

Expansion into New Markets or Customer Segments: Exploring new market opportunities, both geographically and across industries, provides avenues for diversification and expansion.

-

Strategic Partnerships and Collaborations: Strategic alliances with other technology companies can provide access to new technologies, customer bases, and market opportunities.

-

Potential Impact of Geopolitical Uncertainty: Geopolitical events and government policies can heavily influence Palantir's government contracting business. Analyzing these potential impacts is crucial for assessing the risks and rewards.

Risks Associated with Investing in Palantir Stock (PLTR)

Investing in Palantir carries inherent risks. Before May 5th (or the relevant date), it's vital to consider:

-

Valuation Multiples: Comparing Palantir's price-to-earnings (P/E) and price-to-sales (P/S) ratios to industry peers provides insight into its relative valuation. A high valuation may indicate the market is pricing in significant future growth, but it also increases the risk of a significant price correction.

-

Dependence on Government Contracts: Palantir's reliance on government contracts exposes it to the risks associated with government budget cuts, contract renewals, and regulatory changes.

-

Intense Competition: The big data analytics market is extremely competitive. The potential for increased competition to erode Palantir's market share and profitability is a significant risk.

-

Potential Regulatory Risks: Changes in regulations, particularly those related to data privacy and security, could impact Palantir's business operations and profitability. Staying informed about relevant regulations is crucial.

Conclusion: Final Thoughts on Analyzing Palantir Stock (PLTR) Before May 5th

Analyzing Palantir stock (PLTR) before May 5th (or the relevant date) requires a thorough assessment of its financial performance, market position, future growth prospects, and inherent risks. While Palantir boasts innovative technology and significant growth potential, investors must carefully weigh the potential rewards against the considerable risks, including its valuation, dependence on government contracts, and intense competition. Conducting your own due diligence is crucial. Review Palantir's SEC filings, consult with a financial advisor, and stay informed about market developments before making any investment decisions. Make informed decisions about your Palantir (PLTR) investment strategy before May 5th.

Featured Posts

-

Discover The Elizabeth Stewart And Lilysilk Spring Capsule Collection

May 10, 2025

Discover The Elizabeth Stewart And Lilysilk Spring Capsule Collection

May 10, 2025 -

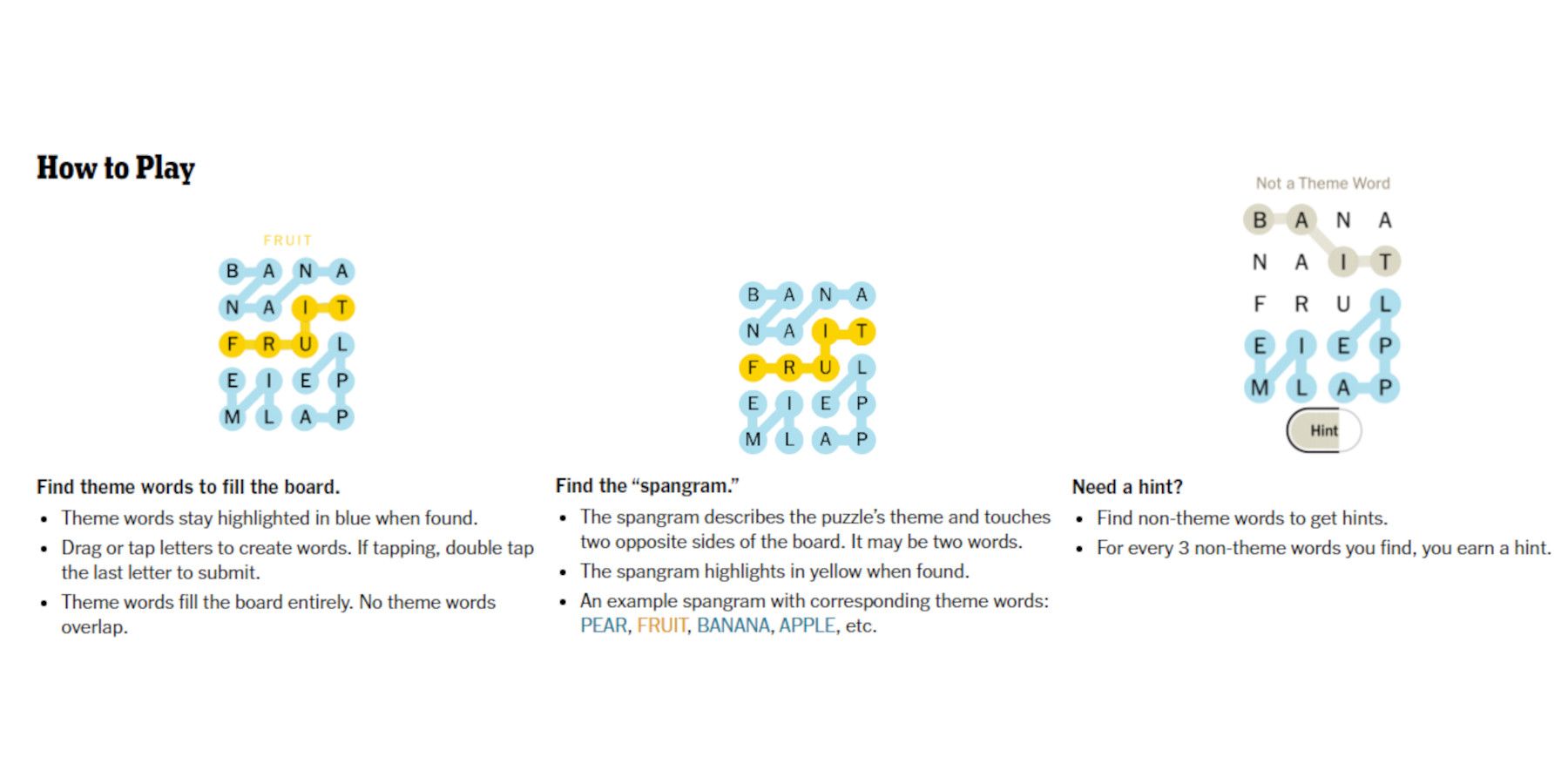

Solve Nyt Strands Wednesday March 12 Game 374 Hints And Answers

May 10, 2025

Solve Nyt Strands Wednesday March 12 Game 374 Hints And Answers

May 10, 2025 -

Analysis Broadcoms Proposed V Mware Price Hike An Extreme Increase

May 10, 2025

Analysis Broadcoms Proposed V Mware Price Hike An Extreme Increase

May 10, 2025 -

From Entrepreneur To Billionaire The Business Acumen Of Elon Musk

May 10, 2025

From Entrepreneur To Billionaire The Business Acumen Of Elon Musk

May 10, 2025 -

Strictly Scandal Costs Wynne Evans Go Compare Role

May 10, 2025

Strictly Scandal Costs Wynne Evans Go Compare Role

May 10, 2025