Analyzing The Bitcoin Price: Trump's Speech And The Potential For $100K BTC

Table of Contents

Trump's Influence on Market Sentiment

Analyzing Trump's Statements and their Impact on Investor Confidence

Trump's pronouncements, whether on economic policy, regulation, or even social media, can significantly impact investor confidence and, consequently, the Bitcoin price. His rhetoric often influences market sentiment, creating waves of both fear and greed.

- Example 1: (Insert a specific example of a Trump statement and its immediate effect on Bitcoin's price, citing a reputable news source). This event highlighted the immediate impact of his words on the cryptocurrency market.

- Example 2: (Insert another example and its effect, citing a source). This illustrates how even seemingly unrelated comments can trigger significant price fluctuations.

The media plays a crucial role in amplifying Trump's influence. News outlets often interpret and disseminate his statements, shaping public perception and further influencing the price of Bitcoin. This creates a feedback loop where media coverage itself impacts market sentiment and, ultimately, the Bitcoin price. Understanding this dynamic is crucial for any Bitcoin analysis. Keywords: Trump Bitcoin, market sentiment, investor confidence, price volatility, crypto news.

Macroeconomic Factors and Bitcoin's Price

Inflation and the Safe-Haven Narrative

Bitcoin is often touted as a hedge against inflation. Its limited supply of 21 million coins makes it an attractive alternative to fiat currencies, particularly when inflation erodes purchasing power.

- Inflation and Bitcoin: High inflation rates could drive investors towards Bitcoin as a store of value, potentially increasing its price.

- Trump's Policies: (Discuss how Trump's past economic policies, or potential future policies if relevant, could affect inflation and consequently Bitcoin's price. Support with data or analysis from reputable economic sources).

- Historical Correlation: Historically, there's some evidence of a correlation between macroeconomic uncertainty and Bitcoin's price. However, it's not a straightforward relationship. (Provide data or examples illustrating this correlation, noting any limitations).

Keywords: Bitcoin inflation hedge, macroeconomic factors, Bitcoin price prediction, safe haven asset, economic uncertainty.

Regulatory Uncertainty and its Impact

The Role of Government Regulation in Bitcoin's Price

Government regulation plays a pivotal role in shaping the Bitcoin price. Uncertainty surrounding regulatory frameworks creates volatility, while clear, consistent policies can foster growth and stability.

- Potential Regulatory Changes: (Discuss potential regulatory changes under a hypothetical scenario and their potential implications for Bitcoin adoption and price. For example, consider scenarios like increased regulation, decreased regulation, or a complete ban.)

- Investor Confidence: Regulatory clarity boosts investor confidence, attracting more institutional investment and potentially driving up the price. Conversely, ambiguity creates uncertainty and can lead to price drops.

- Global Regulatory Landscape: Comparing regulatory approaches in different countries provides insights into the impact of various policies on market dynamics. (Provide examples of different countries' approaches and their consequences).

Keywords: Bitcoin regulation, regulatory uncertainty, crypto policy, government intervention, Bitcoin legality.

Technical Analysis and the $100K Bitcoin Target

Chart patterns, indicators, and price projections

Technical analysis involves studying historical price patterns and indicators to predict future price movements. While not foolproof, it can provide valuable insights.

- Key Indicators: (Discuss specific technical indicators like moving averages, Relative Strength Index (RSI), and other relevant metrics. Explain how these indicators can signal potential price trends.)

- Chart Patterns: (Identify significant chart patterns (e.g., head and shoulders, double tops/bottoms) that may suggest future price movements. Include visuals if possible.)

- Support and Resistance: (Analyze historical price data to identify potential support and resistance levels that could influence future price action.)

- Bullish and Bearish Scenarios: Present a balanced view acknowledging both the potential for Bitcoin to reach $100K BTC and the risks involved. Accurate price prediction remains challenging due to the inherent volatility of the cryptocurrency market.

Keywords: Bitcoin technical analysis, $100K Bitcoin price target, Bitcoin chart analysis, crypto trading, price prediction.

Conclusion: Analyzing the Bitcoin Price: Trump's Speech and the $100K BTC Potential

In conclusion, the Bitcoin price is influenced by a complex interplay of factors, including Trump's statements, macroeconomic conditions, regulatory uncertainty, and technical analysis. While the potential for Bitcoin to reach $100K BTC exists, it's crucial to acknowledge the considerable uncertainties involved. Trump's speeches can impact market sentiment, while macroeconomic factors and regulatory changes can significantly alter Bitcoin's trajectory. Technical analysis can offer insights into potential price movements, but it's not a crystal ball. Conduct thorough research and understand the risks before making any Bitcoin investment decisions. Continue to analyze the Bitcoin price and its correlation with global events to make informed choices in this dynamic market. Conduct your own thorough Bitcoin price analysis and consider the impact of both global events and technical indicators before investing in cryptocurrency trading. The potential for $100K BTC is real, but careful analysis is crucial.

Featured Posts

-

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025 -

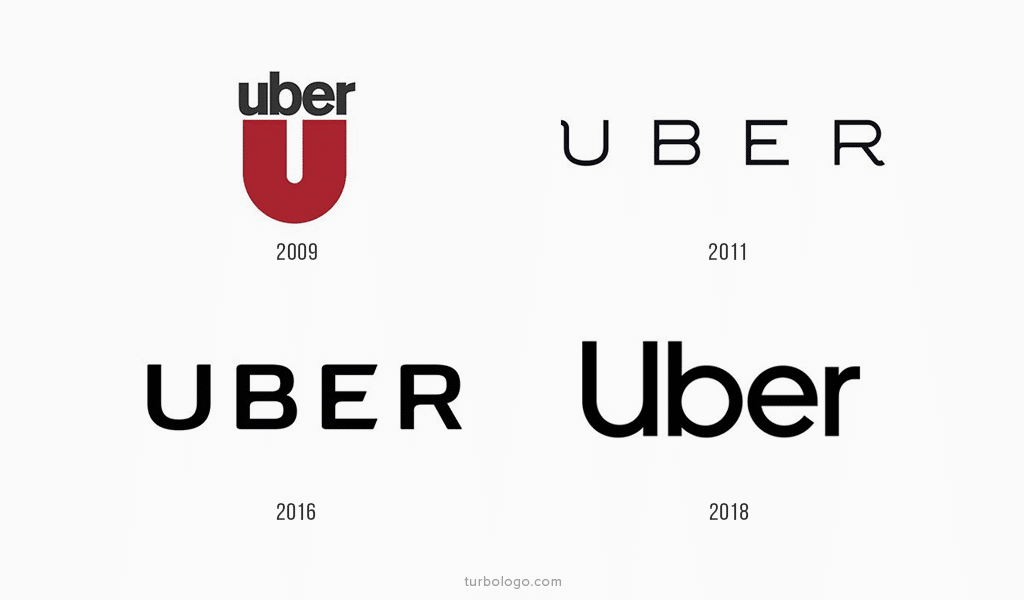

Uber Big Change Auto Service Now Cash Only

May 08, 2025

Uber Big Change Auto Service Now Cash Only

May 08, 2025 -

This Spac Stock Is Taking On Micro Strategy A Detailed Investment Analysis

May 08, 2025

This Spac Stock Is Taking On Micro Strategy A Detailed Investment Analysis

May 08, 2025 -

Decline In Taiwanese Investment In Us Bond Etfs

May 08, 2025

Decline In Taiwanese Investment In Us Bond Etfs

May 08, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Neden Ve Ne Yapmali

May 08, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Neden Ve Ne Yapmali

May 08, 2025