Analyzing The Bitcoin Rebound: Signs Of A Long-Term Trend?

Table of Contents

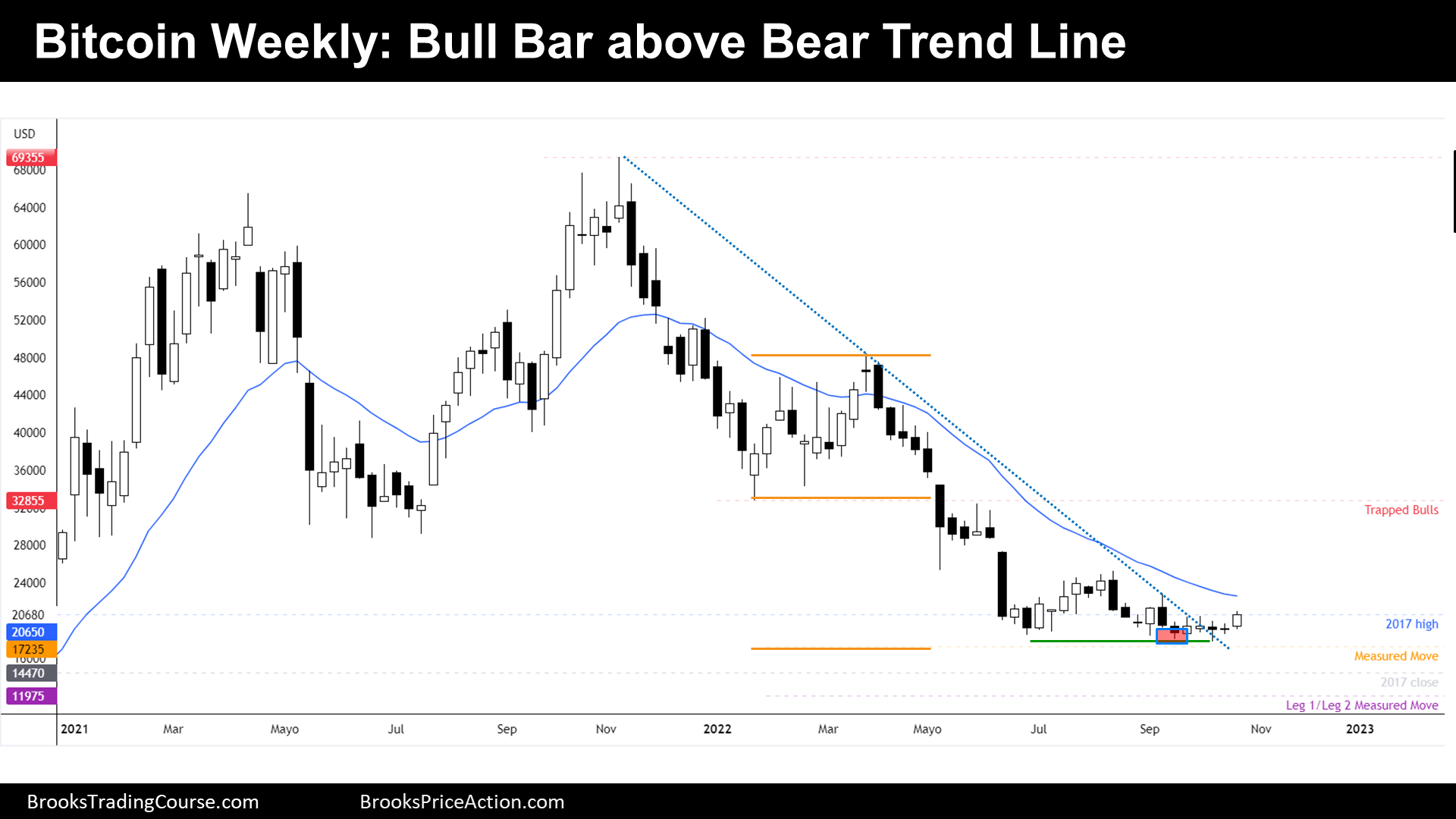

Technical Analysis of the Bitcoin Rebound

Analyzing Bitcoin's price movements through a technical lens is crucial for gauging the strength and longevity of the current rebound. This involves examining chart patterns and key indicators.

Chart Patterns and Indicators

Technical analysis of Bitcoin charts often involves identifying recurring patterns and using indicators to predict future price movements.

- Bullish Chart Patterns: The emergence of bullish chart patterns, such as a double bottom or an inverse head and shoulders, can signal a potential reversal of the bearish trend and suggest a sustained upward trajectory. Confirmation of these patterns through subsequent price action and volume is crucial.

- Indicator Analysis: Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages provide signals about momentum and potential trend reversals. A rising RSI above 50, a bullish MACD crossover, and price moving above key moving averages can all be interpreted as bullish signals.

- Support and Resistance Levels: Identifying support and resistance levels is key. A successful break above a significant resistance level often signals increased buying pressure and the potential for further price appreciation. Conversely, a failure to break through resistance could indicate the rebound's limitations. Successful retests of support levels, after a price increase, further validate the strength of the upward trend. Analyzing Bitcoin chart analysis requires a keen eye for detail and a comprehensive understanding of technical indicators.

Keyword Integration: Bitcoin chart analysis, technical indicators Bitcoin, Bitcoin price prediction, Bitcoin support levels.

Volume Confirmation

Price movements alone are not enough; volume confirmation is essential. High trading volume during the rebound signifies strong buying pressure and validates the price increase.

- High Volume vs. Low Volume: A substantial increase in trading volume accompanying a price rise suggests genuine market interest and a higher likelihood of the trend continuing. Conversely, price increases accompanied by low volume often signal weak buying pressure and are more prone to reversals. This analysis helps to differentiate between real buying pressure and artificial price manipulation.

- Implications for Future Price Action: Sustained high volume during upward price movements strengthens the case for a long-term trend. However, a decline in volume despite continued price increases can be a warning sign of a potential weakening trend and potential reversal.

Keyword Integration: Bitcoin trading volume, Bitcoin price action, high volume Bitcoin.

Fundamental Factors Driving the Bitcoin Rebound

Beyond technical analysis, fundamental factors significantly impact Bitcoin's price. These factors include institutional adoption and macroeconomic conditions.

Institutional Adoption and Investment

The growing interest from institutional investors is a crucial factor influencing Bitcoin's price stability and potential for long-term growth.

- Examples of Institutional Adoption: Companies like MicroStrategy and Grayscale Investments have made significant Bitcoin purchases, signaling a growing belief in Bitcoin as a valuable asset. These large-scale investments inject significant capital into the market, providing support and influencing the price.

- Impact of Large-Scale Investments: Institutional investments not only boost prices but also contribute to market stability by reducing volatility and increasing liquidity. Their long-term investment strategies contribute to a more mature and stable market environment.

- Long-Term Implications: Continued institutional adoption is widely considered a positive sign for Bitcoin's long-term prospects, implying greater price stability and sustained growth.

Keyword Integration: Institutional Bitcoin investment, Bitcoin adoption, Microstrategy Bitcoin, Grayscale Bitcoin.

Regulatory Developments and Global Macroeconomic Factors

Regulatory changes and global macroeconomic conditions play a significant role in shaping Bitcoin's price trajectory.

- Positive and Negative Regulatory Developments: Clear and favorable regulatory frameworks can boost investor confidence and drive adoption. Conversely, negative regulatory announcements or uncertain regulatory environments can lead to price corrections.

- Bitcoin as a Safe Haven: During periods of economic uncertainty or inflation, Bitcoin's characteristics as a decentralized and scarce asset can drive investors seeking a safe haven. Macroeconomic factors like inflation rates and general economic instability often correlate with changes in Bitcoin’s price.

- Correlation Analysis: Analyzing the correlation between Bitcoin's price and various macroeconomic indicators, such as inflation rates and stock market performance, is crucial for understanding the factors driving price movements.

Keyword Integration: Bitcoin regulation, Bitcoin inflation hedge, macroeconomic factors Bitcoin.

On-Chain Data and Network Activity

Analyzing on-chain data provides insights into the health and strength of the Bitcoin network itself.

Analyzing Bitcoin Network Metrics

Several key on-chain metrics offer valuable insights into the underlying strength of the Bitcoin network.

- Transaction Fees: High transaction fees can indicate increased network activity and demand. However, excessively high fees can also discourage transactions.

- Mining Difficulty: Mining difficulty reflects the competitiveness of Bitcoin mining. A rising difficulty shows a healthy and secure network.

- Hash Rate: The hash rate is a measure of the computational power securing the network. A high hash rate suggests a robust and secure network.

- Correlation with Price Movements: Changes in these metrics often correlate with price movements, providing a deeper understanding of the market dynamics.

Keyword Integration: Bitcoin on-chain data, Bitcoin hash rate, Bitcoin transaction fees, Bitcoin mining difficulty.

Miner Behavior and Supply Dynamics

Miner behavior and supply dynamics also significantly impact Bitcoin's long-term price trend.

- Miner Capitulation: When miners sell their Bitcoin at a loss due to low prices, it can signal a potential market bottom.

- Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, is a significant event that can influence supply and demand dynamics, often resulting in price appreciation in the long term.

- Supply and Demand: The interplay of supply and demand remains a fundamental driver of Bitcoin's price. The fixed supply of 21 million Bitcoins creates scarcity, which can drive price appreciation over the long term.

Keyword Integration: Bitcoin miner capitulation, Bitcoin halving, Bitcoin supply and demand.

Conclusion

The Bitcoin rebound presents a complex picture, with both technical and fundamental factors contributing to the upward movement. While analyzing chart patterns, institutional investment, regulatory environment, and on-chain data offers valuable insights, predicting the future of Bitcoin remains inherently challenging. Further observation of key indicators and sustained positive trends are essential to confirm whether this rebound signals a genuine long-term shift. Continue to monitor the Bitcoin market and further your research on Bitcoin analysis to form your own informed opinion on this evolving situation. Understanding Bitcoin price action requires continuous monitoring and a comprehensive approach encompassing technical and fundamental analysis.

Featured Posts

-

Partly Cloudy Skies Your Daily Weather Guide

May 08, 2025

Partly Cloudy Skies Your Daily Weather Guide

May 08, 2025 -

The Recent Bitcoin Mining Boom Causes And Implications

May 08, 2025

The Recent Bitcoin Mining Boom Causes And Implications

May 08, 2025 -

Colin Cowherds Persistent Criticism Of Jayson Tatum Is He Underrated

May 08, 2025

Colin Cowherds Persistent Criticism Of Jayson Tatum Is He Underrated

May 08, 2025 -

Enjoy Cashback And Support Local Businesses With Uber Kenya

May 08, 2025

Enjoy Cashback And Support Local Businesses With Uber Kenya

May 08, 2025 -

Recent Developments F4 Elden Ring Possum And Superman

May 08, 2025

Recent Developments F4 Elden Ring Possum And Superman

May 08, 2025