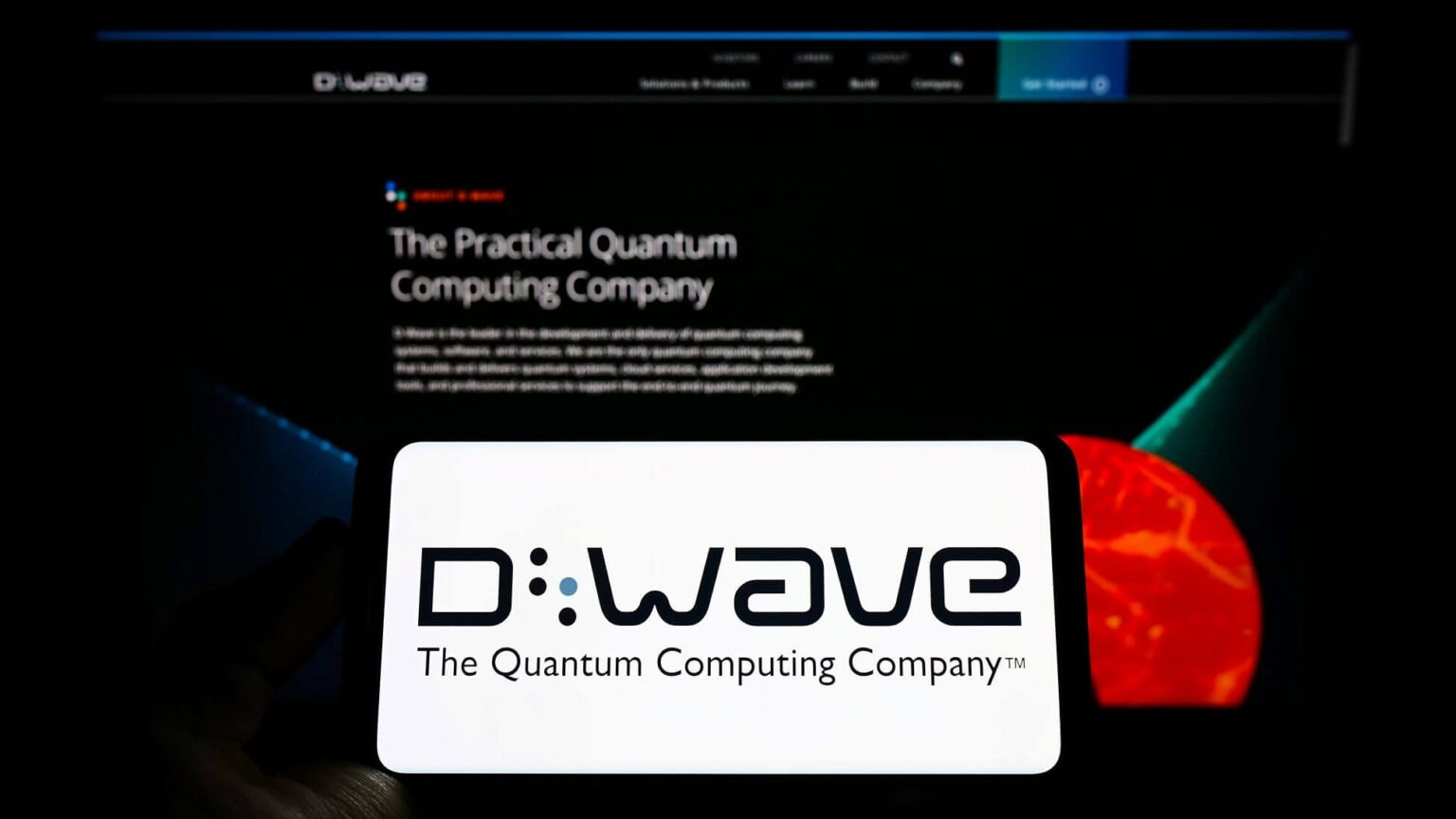

Analyzing The D-Wave Quantum (QBTS) Stock Crash Of Monday

Table of Contents

Market-Wide Factors Contributing to the QBTS Stock Crash

Several market-wide factors likely contributed to the QBTS stock crash on Monday. Understanding these broader trends is crucial for a complete picture.

Broader Market Sentiment

The overall market sentiment on Monday played a significant role. A general downturn in technology stocks could have disproportionately affected a high-growth company like D-Wave.

- Nasdaq Composite: The Nasdaq Composite, a key technology index, experienced a [insert percentage change]% decline on Monday.

- S&P 500: The broader S&P 500 also saw a [insert percentage change]% drop, indicating a wider market correction.

- Tech Sector News: Negative news concerning interest rate hikes or broader economic concerns could have fueled selling pressure across the technology sector, impacting QBTS.

The correlation between the overall market performance and QBTS's decline suggests that market sentiment played a considerable role in the crash. The negative performance of broader indices likely amplified the impact on QBTS.

Sector-Specific Trends

The quantum computing sector itself may have experienced a downturn, exacerbating QBTS's fall. While still nascent, the sector's performance is increasingly correlated to the broader technology market.

- Competitor Performance: [Insert names of other publicly traded quantum computing companies] also experienced [insert percentage change] declines on Monday, suggesting a sector-wide correction. Comparing their performance to QBTS's provides context for the severity of QBTS's drop.

- Sector-Specific News: Any negative news regarding the quantum computing field, such as setbacks in technological development or funding challenges for competitors, could have influenced investor sentiment towards QBTS.

Analyzing sector-specific trends helps determine whether the QBTS crash was an isolated event or part of a wider industry trend.

Company-Specific News and Developments Impacting QBTS

In addition to market-wide forces, several company-specific factors could have contributed to the QBTS stock crash. Analyzing these internal factors offers a more nuanced understanding of the situation.

Lack of Positive News or Earnings Reports

The absence of positive news or encouraging earnings reports before or on Monday could have dampened investor enthusiasm.

- Press Releases: D-Wave's recent press releases (if any) should be reviewed to assess their impact on investor confidence. Any lack of positive announcements around product launches or partnerships could have contributed to the downturn.

- Financial Announcements: Any delays or disappointments regarding financial results, even if not explicitly negative, can trigger sell-offs in the stock market.

Analyzing investor sentiment in the period leading up to the crash is crucial in understanding the absence of positive news as a contributing factor.

Analyst Downgrades or Negative Reports

Negative analyst reports or downgrades can significantly impact a stock's price.

- Analyst Reports: Identifying specific reports from analysts (e.g., from Morgan Stanley, Goldman Sachs, etc.) and their rationale for downgrades provides valuable insight.

- Rating Changes: Any changes in ratings from "buy" to "hold" or "sell" could have directly contributed to the selling pressure on QBTS shares.

Direct quotes from these reports would strengthen the analysis and highlight the specific concerns of market analysts.

Potential Insider Trading or Other Significant Events

While requiring careful investigation, unusual trading activity or significant internal events could offer clues to the crash. (This section requires responsible reporting and avoids speculation unless supported by verifiable evidence.)

- SEC Filings: Any relevant SEC filings related to insider trading or other significant events should be examined.

- Transparency and Verification: It’s vital to emphasize the importance of verifying information from reliable sources and avoiding unsubstantiated claims.

Transparency and responsible reporting are crucial in analyzing sensitive issues such as insider trading.

Long-Term Implications for QBTS and Quantum Computing Investments

The QBTS stock crash has significant implications for both the company and the broader quantum computing investment landscape.

Investor Sentiment and Future Investment

The crash will likely impact investor confidence in D-Wave and potentially the entire quantum computing sector.

- Stock Price Recovery: The speed and extent of any recovery in the QBTS stock price will depend on several factors, including the company's future performance and market sentiment.

- Fundraising Capabilities: The crash could make it more challenging for D-Wave to raise further capital, impacting its research and development efforts.

Long-term investor sentiment will be key to determining whether this is a temporary setback or a more significant challenge for the company.

The Future of Quantum Computing Technology

The crash does not necessarily reflect the inherent potential of quantum computing technology.

- Technological Challenges: Quantum computing is a complex field, facing significant technological hurdles.

- Future Breakthroughs: The potential for future breakthroughs remains substantial, regardless of short-term market fluctuations.

Maintaining a balanced perspective on the long-term prospects of the field is crucial.

Conclusion

The D-Wave Quantum (QBTS) stock crash was a complex event stemming from an interplay of market-wide factors, such as broader market sentiment and sector-specific trends, and company-specific news. Understanding both macro and micro influences is vital for interpreting stock market fluctuations. While Monday's drop was significant, it doesn't negate the long-term potential of quantum computing. Stay informed about developments in the field, carefully analyze market conditions and company news before making investment decisions related to D-Wave Quantum or other quantum computing stocks. Further research on D-Wave Quantum and the quantum computing industry is crucial for informed investment choices.

Featured Posts

-

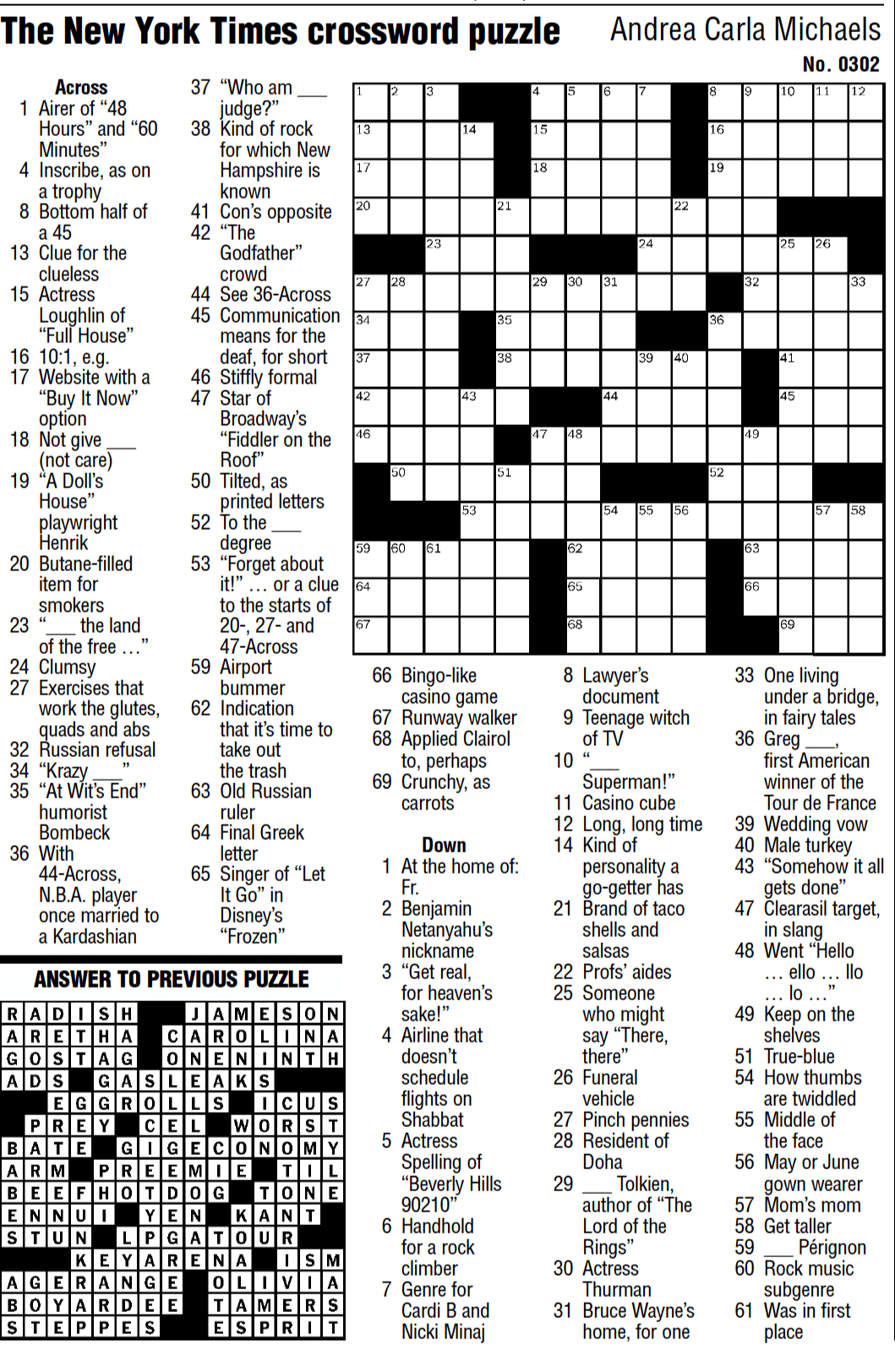

Todays Nyt Mini Crossword May 9th Answers

May 20, 2025

Todays Nyt Mini Crossword May 9th Answers

May 20, 2025 -

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Thursdays Market Impact

May 20, 2025

D Wave Quantum Qbts Stock Performance Thursdays Market Impact

May 20, 2025 -

Rashford Scores Twice As Manchester United Defeat Aston Villa In Fa Cup Clash

May 20, 2025

Rashford Scores Twice As Manchester United Defeat Aston Villa In Fa Cup Clash

May 20, 2025 -

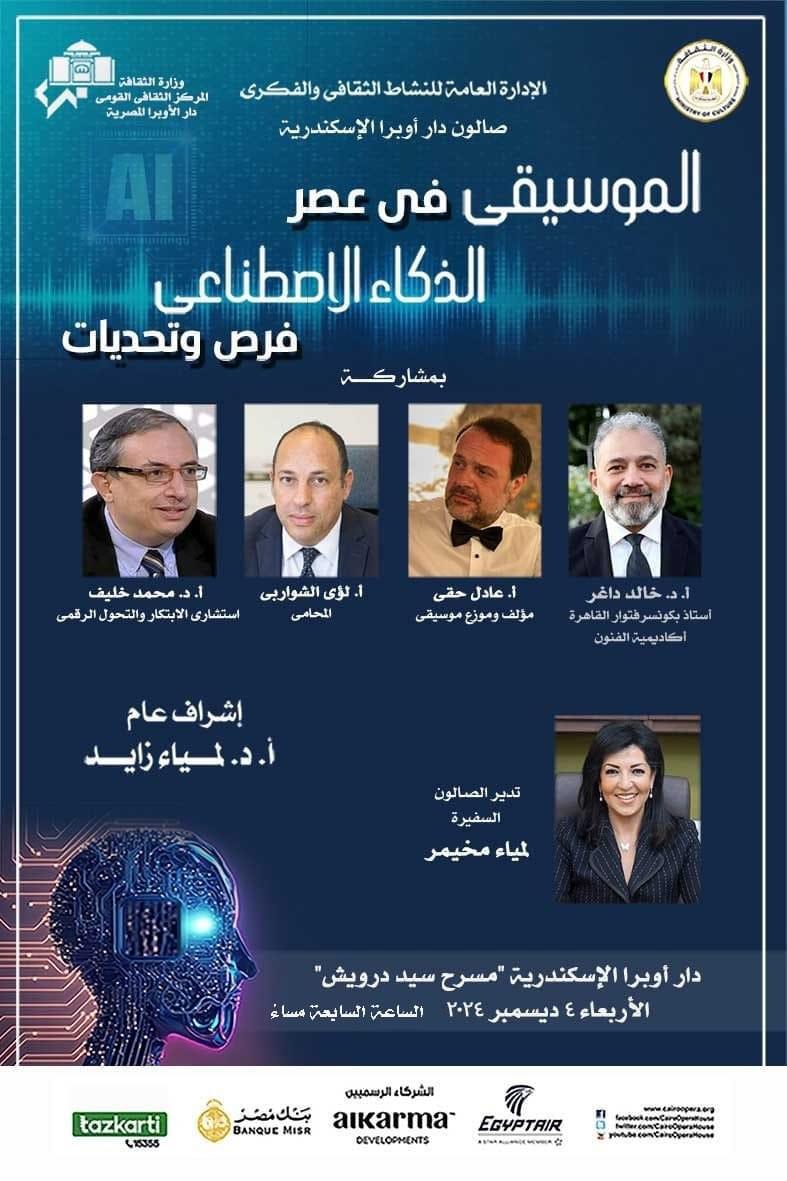

Aemal Ajatha Krysty Tuead Intajha Bwastt Aldhkae Alastnaey Frs Wthdyat

May 20, 2025

Aemal Ajatha Krysty Tuead Intajha Bwastt Aldhkae Alastnaey Frs Wthdyat

May 20, 2025

Latest Posts

-

Protomagia Sto Oropedio Evdomos Apodraste Stin Omorfia Tis Fysis

May 20, 2025

Protomagia Sto Oropedio Evdomos Apodraste Stin Omorfia Tis Fysis

May 20, 2025 -

Oropedio Evdomos Organoste Tin Teleia Eksormisi Gia Tin Protomagia

May 20, 2025

Oropedio Evdomos Organoste Tin Teleia Eksormisi Gia Tin Protomagia

May 20, 2025 -

Oneiriki Poreia Kroyz Azoyl Kai Giakoymakis Ston Teliko Champions League

May 20, 2025

Oneiriki Poreia Kroyz Azoyl Kai Giakoymakis Ston Teliko Champions League

May 20, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia Plirofories And Symvoyles

May 20, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia Plirofories And Symvoyles

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn To Tropaio

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn To Tropaio

May 20, 2025