Analyzing The D-Wave Quantum (QBTS) Stock Decrease On Thursday

Table of Contents

Market Sentiment and Investor Reaction to Recent News

The overall market sentiment surrounding quantum computing stocks, while generally optimistic for long-term growth, can be quite volatile. The QBTS stock decrease on Thursday likely reflects a confluence of factors impacting investor confidence in the short term. Several news items and announcements may have contributed to this negative sentiment:

-

Negative press coverage impacting QBTS: Any negative news stories, even if not directly related to D-Wave's core business, can impact investor perception and lead to selling pressure. Scrutiny of the company's financial performance or technological advancements can significantly influence the stock price.

-

Competitor advancements affecting investor confidence: The quantum computing field is highly competitive. Announcements of breakthroughs or significant funding rounds by competitors can negatively affect investor confidence in D-Wave, leading to a reassessment of QBTS’s market position.

-

General market downturn affecting tech stocks: A broader downturn in the technology sector, influenced by macroeconomic factors, can drag down even promising companies like D-Wave. This correlation between the overall market and QBTS is important to consider.

-

Lack of significant near-term revenue projections for QBTS: Investors often react negatively to companies that don't show clear paths to near-term profitability. If D-Wave's financial projections don't meet investor expectations, it can lead to sell-offs.

D-Wave Quantum's Financial Performance and Future Outlook

D-Wave's recent financial reports are crucial to understanding the QBTS stock price decline. Analyzing key metrics like revenue growth, research and development (R&D) spending, and profitability is essential. Several challenges could be contributing to the current situation:

-

Analysis of revenue growth (or lack thereof): Slow or declining revenue growth can signal concerns about the company's ability to generate sufficient income to support its operations and future growth.

-

Examination of R&D spending compared to revenue: High R&D expenditure is common in the quantum computing sector, but if this spending significantly outweighs revenue, it can raise concerns about sustainability.

-

Discussion of potential partnerships or collaborations: Strategic partnerships can significantly influence a company's financial performance and market position. The absence of such collaborations, or news of failed partnerships, can impact investor sentiment.

-

Assessment of the company's long-term strategic vision: Investors need to be confident in a company's long-term vision and strategy. Uncertainty about D-Wave's future direction can trigger selling pressure.

The Impact of Macroeconomic Factors on QBTS Stock

Broader macroeconomic conditions significantly impact the stock market, and the QBTS stock decrease is no exception. Factors such as interest rate hikes, inflation, and global economic uncertainty can influence investor risk appetite:

-

Correlation between overall market performance and QBTS stock: The performance of QBTS often mirrors the overall market trend. A general market downturn can lead to investors selling off even promising stocks like QBTS to reduce risk.

-

Impact of interest rate increases on tech sector investments: Higher interest rates generally make borrowing more expensive, reducing investments in growth-oriented sectors like technology, including quantum computing.

-

Influence of inflation on investor risk appetite: High inflation erodes purchasing power and increases uncertainty, leading investors to favor less risky investments, potentially impacting QBTS stock.

-

Geopolitical events affecting investor sentiment towards QBTS: Global geopolitical events can create market instability, influencing investor sentiment and risk tolerance, and thus impacting the price of QBTS.

Technical Analysis of the QBTS Stock Chart

A brief look at the technical aspects of the QBTS stock chart can offer additional insights into Thursday's drop. While a deep dive into technical analysis is beyond this article's scope, observing key indicators can be informative:

-

Analysis of trading volume on Thursday: High trading volume on Thursday would suggest a significant number of investors were actively buying or selling QBTS stock, contributing to the price volatility.

-

Identification of key support and resistance levels: Support and resistance levels represent price points where buying or selling pressure is expected to be strong. Breaks below key support levels often signal further downward pressure.

-

Interpretation of relevant candlestick patterns: Candlestick patterns, which reflect price movements over specific time periods, can provide insights into potential price trends.

-

Comparison to historical price movements: Comparing Thursday's drop to historical price movements in QBTS can help determine whether the decrease was unusually significant or within a normal range of fluctuation.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Decrease and What's Next

The D-Wave Quantum (QBTS) stock decrease on Thursday resulted from a combination of factors. Negative market sentiment, concerns about D-Wave's financial performance and future outlook, and the influence of broader macroeconomic conditions all played a role. It’s crucial to consider both company-specific factors and the overall market climate when analyzing stock performance. While the future of QBTS remains uncertain, continued monitoring and analysis are crucial. The quantum computing industry is still in its early stages, making volatility expected. However, long-term potential remains significant.

Stay informed about future fluctuations in the D-Wave Quantum (QBTS) stock price by continuing to follow our analysis and exploring related resources on quantum computing investments. Understanding the complexities of the quantum computing market and staying updated on the latest news are vital for any investor considering QBTS or other quantum computing stocks.

Featured Posts

-

Asbh Biarritz Pro D2 Mentalite Et Performance

May 20, 2025

Asbh Biarritz Pro D2 Mentalite Et Performance

May 20, 2025 -

Michael Strahan And Good Morning America Understanding His Unexpected Departure

May 20, 2025

Michael Strahan And Good Morning America Understanding His Unexpected Departure

May 20, 2025 -

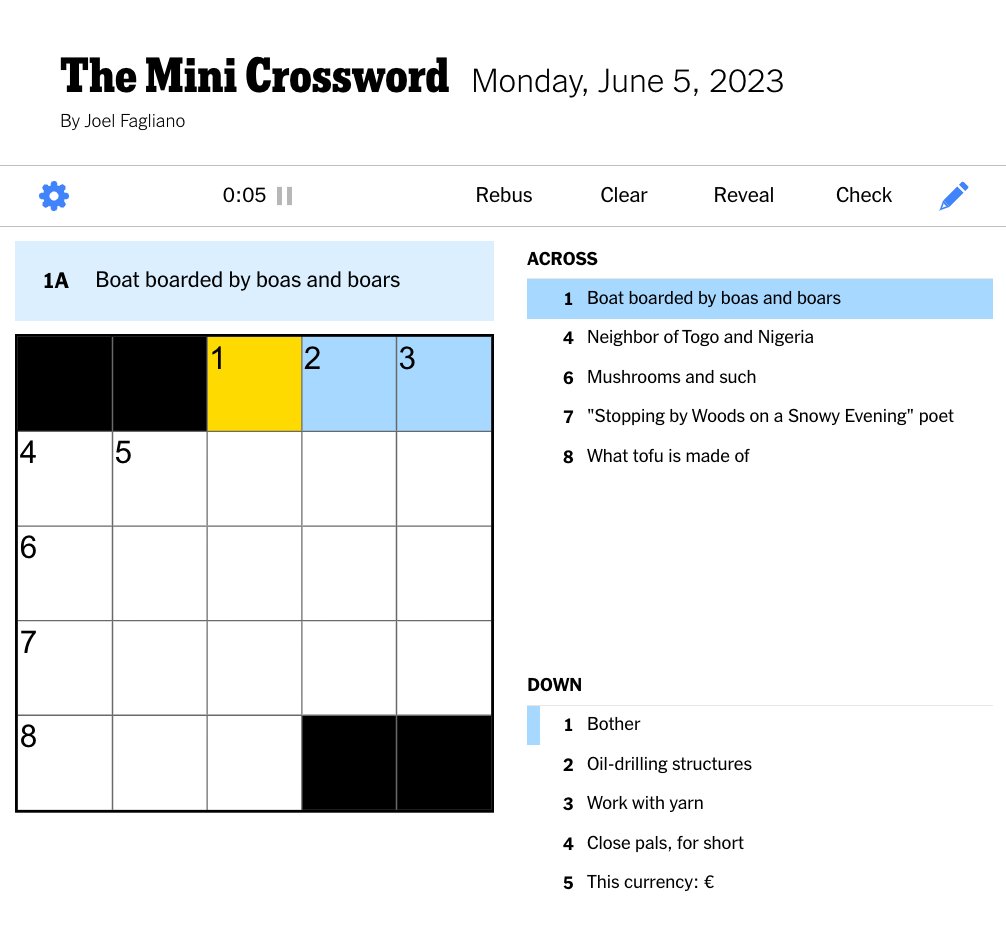

Todays Nyt Mini Crossword March 27 Answers

May 20, 2025

Todays Nyt Mini Crossword March 27 Answers

May 20, 2025 -

Le Mass Un Nouveau Marche Pour Les Technologies Spatiales En Afrique

May 20, 2025

Le Mass Un Nouveau Marche Pour Les Technologies Spatiales En Afrique

May 20, 2025 -

Cobolli Claims First Atp Title In Bucharest

May 20, 2025

Cobolli Claims First Atp Title In Bucharest

May 20, 2025

Latest Posts

-

Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Blog Home Office Alebo Kancelaria Prehlad Vyhod A Nevyhod Pre Manazment

May 20, 2025

Blog Home Office Alebo Kancelaria Prehlad Vyhod A Nevyhod Pre Manazment

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Ekdilosi Gia Ti Megali Tessarakosti Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025

Ekdilosi Gia Ti Megali Tessarakosti Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025 -

Ap

May 20, 2025

Ap

May 20, 2025