Analyzing The Impact Of ‘Liberation Day’ Tariffs On Stock Performance

Table of Contents

Immediate Market Reactions to Liberation Day Tariffs

The announcement and implementation of the Liberation Day tariffs triggered immediate volatility in the stock market. Investors reacted swiftly, causing significant short-term fluctuations in stock prices across various sectors.

Sector-Specific Analysis

The impact of the Liberation Day tariffs wasn't uniform across all sectors. Some industries experienced sharper declines than others, highlighting the diverse vulnerabilities within the global economy.

-

Technology stocks: Initially experienced a downturn, reflecting concerns about supply chain disruptions and increased costs for imported components. However, many tech giants showed a gradual recovery as they adapted their strategies. Examples include companies like [insert example company name 1] and [insert example company name 2] who saw initial dips but recovered within [timeframe].

-

Agricultural stocks: Faced prolonged negative impacts due to reduced export opportunities and retaliatory tariffs imposed by other countries. This sector, particularly [mention specific agricultural products], suffered significantly. Companies like [insert example company name 3] in [mention country] reported significant losses.

-

Manufacturing stocks: Showed mixed results. Companies heavily reliant on imported raw materials or intermediate goods experienced significant cost increases, impacting profitability. Those with diversified supply chains and domestic production capabilities fared better. For example, [insert example company name 4] successfully mitigated the impact by shifting production.

Investor Sentiment and Market Volatility

Investor fear and uncertainty played a crucial role in driving market fluctuations following the Liberation Day tariff announcement. The uncertainty surrounding the long-term economic implications led to a sell-off in certain sectors, increasing market volatility.

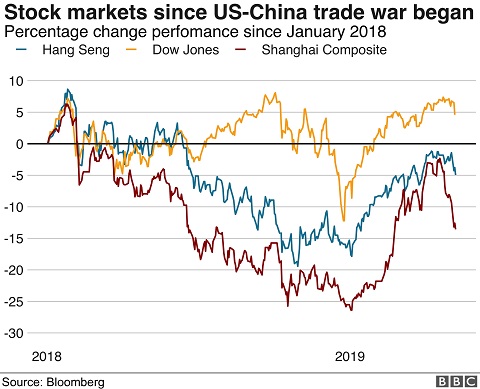

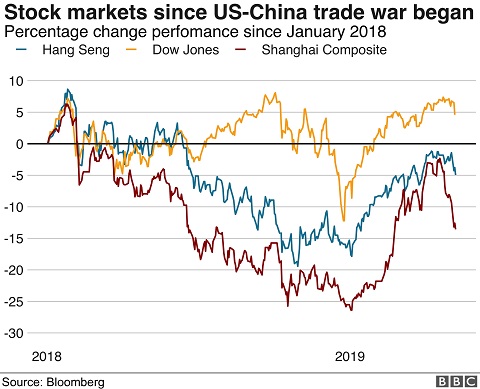

- Market Indices: The Dow Jones Industrial Average and the S&P 500 experienced sharp drops immediately following the announcement, reflecting widespread investor concern. [Insert data on percentage drops and recovery].

- Volatility Measures: [mention specific volatility indices, e.g., VIX] spiked significantly, indicating increased investor anxiety. [Insert chart or graph visually representing market volatility].

Long-Term Effects of Liberation Day Tariffs on Stock Performance

The long-term effects of the Liberation Day tariffs continue to unfold, revealing a complex picture of corporate adaptation and economic adjustment.

Corporate Restructuring and Adaptation

Many companies have undertaken significant restructuring and adaptation strategies to mitigate the negative impacts of the tariffs.

- Reshoring and Nearshoring: Some companies relocated production facilities to reduce reliance on imports, a strategy known as reshoring or nearshoring. This led to increased investment in domestic manufacturing.

- Supply Chain Diversification: Companies actively sought to diversify their supply chains, reducing their dependence on single sources of raw materials or components. [Mention specific examples].

- Price Adjustments: Many companies adjusted their pricing strategies to offset increased costs associated with the tariffs, impacting consumer prices.

Impact on Economic Growth and Stock Valuation

The Liberation Day tariffs have had a measurable impact on macroeconomic indicators, which in turn influenced stock valuations.

- GDP Growth: The tariffs contributed to a slowdown in GDP growth in some countries, reducing overall investor confidence. [Include specific data].

- Inflation: Increased import costs fueled inflationary pressures, impacting corporate profitability and investor expectations. [Include relevant data].

- Stock Valuations: Lower GDP growth and higher inflation negatively impacted the valuations of companies in affected sectors.

Regulatory Changes and Their Influence

Subsequent policy changes and regulatory adjustments have also played a role in shaping stock market responses.

- Government Subsidies: Some governments offered subsidies or incentives to companies affected by the tariffs, helping to mitigate the negative impact. [Cite examples].

- Trade Negotiations: Ongoing trade negotiations and agreements have influenced investor sentiment and expectations regarding the long-term effects of the tariffs. [Discuss relevant trade agreements].

Predicting Future Responses to Similar Economic Policies

Forecasting market reactions to future trade policies requires a multifaceted approach, combining statistical modeling with an understanding of geopolitical factors.

Developing Predictive Models

Statistical models can help predict market responses to similar economic policies. However, these models have limitations.

- Model Limitations: Predictive models often struggle to account for unforeseen events or changes in investor sentiment.

- Data Quality: The accuracy of predictive models relies heavily on the quality and availability of historical data.

The Role of Geopolitical Factors

Geopolitical events and international relations significantly influence market sentiment.

- International Relations: Strained relationships between countries can heighten uncertainty and increase market volatility.

- Political Stability: Political instability in key regions can disrupt supply chains and impact investor confidence.

Conclusion

This analysis of the impact of "Liberation Day" tariffs on stock performance reveals a complex interplay of immediate market reactions and long-term adjustments. The tariffs have had a demonstrably uneven impact across different sectors, highlighting the need for diversified investment strategies. Understanding investor sentiment and adapting to evolving economic conditions are crucial for navigating future market fluctuations caused by similar economic policies. By continuing to monitor the long-term effects and refining predictive models, investors can better prepare for the potential implications of future "Liberation Day" tariffs or other trade policy changes. Further research into the specifics of "Liberation Day" tariffs and their influence on individual companies will provide a more granular understanding of this complex issue. For a deeper dive into the specifics and to stay updated on the evolving effects of Liberation Day tariffs and related trade policies, continue your research and stay informed.

Featured Posts

-

Cleveland Browns Add Experienced Wideout And Returner

May 08, 2025

Cleveland Browns Add Experienced Wideout And Returner

May 08, 2025 -

Posthaste Addressing The Overvalued Canadian Dollar

May 08, 2025

Posthaste Addressing The Overvalued Canadian Dollar

May 08, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Gelecegi Ve Alternatifleri

May 08, 2025

Bitcoin Madenciliginin Azalan Karliligi Gelecegi Ve Alternatifleri

May 08, 2025 -

Dwp Announces Six Month Universal Credit Rule Change

May 08, 2025

Dwp Announces Six Month Universal Credit Rule Change

May 08, 2025 -

Alex Caruso Nba Playoff History Made In Thunder Game 1 Win

May 08, 2025

Alex Caruso Nba Playoff History Made In Thunder Game 1 Win

May 08, 2025