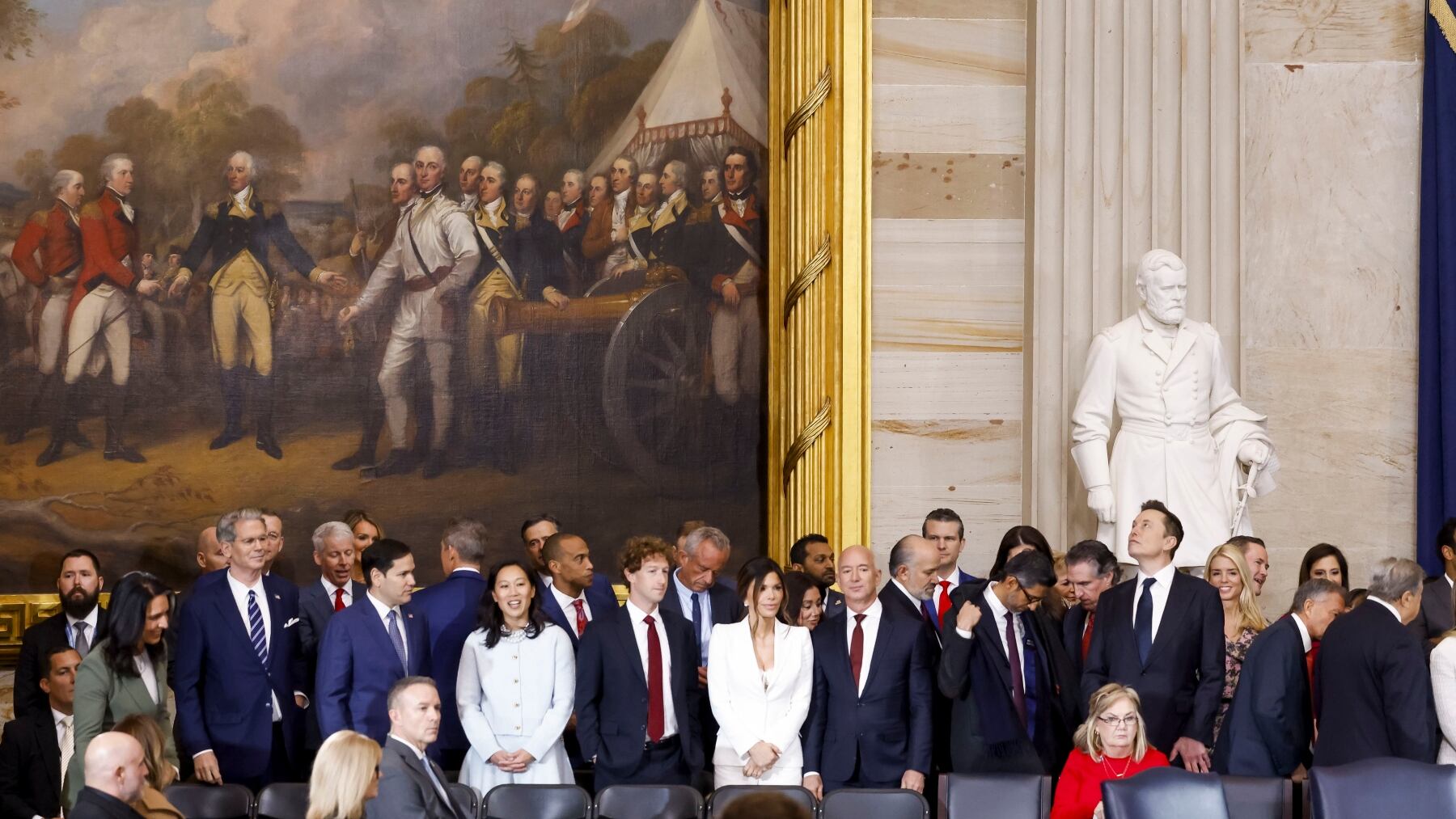

Analyzing The Net Worth Losses Of Elon Musk, Jeff Bezos, And Mark Zuckerberg After Trump's Inauguration

Table of Contents

Elon Musk's Post-Inauguration Financial Performance

Tesla Stock Volatility

Trump's presidency brought significant volatility to Tesla's stock price, directly impacting Elon Musk's net worth. His policies, particularly those related to environmental regulations and tax incentives, created uncertainty within the automotive and renewable energy sectors.

- Environmental Regulations: Trump's administration rolled back several Obama-era environmental regulations, initially seen as potentially beneficial for automakers, but ultimately created uncertainty for Tesla's long-term sustainability initiatives. This uncertainty affected investor confidence.

- Tax Incentives: Changes in tax policies under the Trump administration impacted the availability of subsidies and tax credits for electric vehicles, influencing the demand for Tesla cars and consequently its stock performance.

- Significant Stock Price Fluctuations: Tesla's stock experienced dramatic ups and downs during this period, reflecting the fluctuating market sentiment around the company's performance and the broader economic climate shaped by the new administration. Analyzing these fluctuations provides key insights into the impact of the "net worth losses post-Trump inauguration" on Musk specifically.

SpaceX and Other Ventures

While Tesla's stock performance heavily influenced Musk's overall net worth, his other ventures, SpaceX, Neuralink, and The Boring Company, played a role, albeit a less dominant one, in mitigating potential losses.

- SpaceX Contracts: SpaceX continued to secure lucrative contracts from both government and private sectors, providing a degree of financial stability amidst the market fluctuations impacting Tesla.

- Neuralink Progress: While still in its early stages, Neuralink's progress and funding rounds might have slightly offset some of the losses seen in Tesla.

- The Boring Company Performance: The Boring Company, focused on infrastructure projects, did not significantly impact Musk's overall net worth during this period, contributing minimally to offsetting any losses.

Jeff Bezos and Amazon's Response to the New Administration

Regulatory Scrutiny and Antitrust Concerns

The Trump administration's focus on antitrust issues created a challenging environment for Amazon. Increased regulatory scrutiny and investigations into Amazon's business practices affected investor confidence and impacted Bezos' net worth.

- Specific Antitrust Concerns: Investigations into Amazon's monopolistic practices and its treatment of third-party sellers raised concerns amongst investors and regulators.

- Investigations and Impact on Investor Confidence: The threat of hefty fines and potential breakups weighed heavily on Amazon's stock price, resulting in a period of relative underperformance compared to previous years. This directly affected Bezos's net worth, contributing to the "net worth losses post-Trump inauguration" phenomenon.

Amazon's Diversification Strategy

Amazon's diversified business model, encompassing Amazon Web Services (AWS), e-commerce, and numerous other ventures, proved a significant buffer against the negative market trends.

- Growth in Different Sectors: The consistent growth of AWS, despite the challenges faced by other parts of Amazon, helped to mitigate the overall impact on the company's valuation and Bezos's net worth.

- Analysis of Diversification's Impact: Amazon's diversification strategy demonstrated the importance of reducing reliance on single revenue streams in navigating uncertain political and economic landscapes.

Mark Zuckerberg and Facebook (Meta) in the Post-Inauguration Era

Social Media Regulation and Public Opinion

Facebook (now Meta) faced increasing regulatory scrutiny and public backlash during the Trump administration, impacting its stock price and Zuckerberg's net worth.

- Examples of Regulatory Challenges: Growing concerns about data privacy, misinformation, and the spread of extremist content led to increased regulatory pressure on Facebook globally.

- Controversies Affecting Facebook's Reputation: Numerous controversies, including the Cambridge Analytica scandal, significantly damaged Facebook's reputation and investor confidence, resulting in a decline in its stock valuation.

- Investor Reactions: Negative news and regulatory challenges directly impacted investor sentiment, leading to fluctuations in Facebook's stock price. These fluctuations contributed to the overall impact of "net worth losses post-Trump inauguration" on Mark Zuckerberg.

Facebook's Strategic Shifts

Facebook's strategic pivot towards the metaverse, under the Meta rebranding, aimed to diversify its revenue streams and mitigate its reliance on advertising.

- Metaverse Investments: Significant investments in the metaverse, while promising long-term growth, also incurred substantial short-term costs that impacted the company's financial performance.

- Advertising Revenue Fluctuations: Fluctuations in advertising revenue, a primary source of Facebook's income, further amplified the impact of regulatory and reputational challenges.

- Impact on Long-Term Valuation: The long-term impact of Facebook's strategic shifts on its valuation and Zuckerberg's net worth remains to be seen, but the initial period after Trump's inauguration saw considerable challenges.

Comparative Analysis of Net Worth Changes

A comparative analysis reveals that while all three individuals experienced fluctuations in their net worth following Trump's inauguration, the extent and nature of these changes differed significantly. A detailed chart comparing percentage changes in net worth over the period is needed for a comprehensive analysis. Factors such as industry-specific regulatory changes and each company's diversification strategies played crucial roles in shaping the outcomes. Common factors included general market volatility and shifts in investor confidence, while unique challenges included industry-specific regulations and controversies.

Conclusion:

This analysis of the net worth fluctuations of Elon Musk, Jeff Bezos, and Mark Zuckerberg following Trump's inauguration reveals a complex interplay between political climate, market forces, and individual business strategies. While all three experienced volatility, the specific impact varied based on their respective industries and corporate responses. Understanding these dynamics offers valuable insights into the sensitivity of significant net worths to broader political and economic shifts. Further research is needed to explore the long-term consequences. To delve deeper into the intricacies of net worth losses post-Trump inauguration, continue your research using credible financial news sources.

Featured Posts

-

Selling Sunset Star Highlights Post Fire Rent Increases In La

May 10, 2025

Selling Sunset Star Highlights Post Fire Rent Increases In La

May 10, 2025 -

Merlin And Arthur A Medieval Tale Hidden In Plain Sight On A Book Cover

May 10, 2025

Merlin And Arthur A Medieval Tale Hidden In Plain Sight On A Book Cover

May 10, 2025 -

Best Elizabeth Arden Skincare Deals At Walmart

May 10, 2025

Best Elizabeth Arden Skincare Deals At Walmart

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Headlines

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Headlines

May 10, 2025 -

Bessents Warning Us Debt Limit Measures May Expire In August

May 10, 2025

Bessents Warning Us Debt Limit Measures May Expire In August

May 10, 2025