Analyzing Uber Technologies (UBER) As A Long-Term Investment

Table of Contents

Uber's Financial Performance and Growth Trajectory

Revenue Growth and Profitability

Uber's revenue growth has been significant, fueled by the expansion of its ride-sharing and Uber Eats services. However, profitability remains a challenge. While revenue consistently increases, achieving consistent net income has proven difficult due to high operational costs, intense competition, and significant investments in new technologies. Analyzing Uber's financial statements reveals a complex picture.

- Uber Revenue: [Insert data on Uber's revenue growth over the past few years, ideally with a chart illustrating the trend. Source the data appropriately.] This shows impressive year-over-year growth, particularly in the Uber Eats segment.

- Uber Earnings: [Include data on Uber's net income or loss over the same period, again with a chart for visualization. Source the data.] Note any periods of profitability or significant losses.

- Key Revenue Streams: Uber's revenue is primarily generated from ride-hailing services, Uber Eats (food delivery), and freight transportation. The relative contribution of each segment should be analyzed for a complete picture of Uber's financial health.

- Financial Milestones: Highlight any significant financial achievements or setbacks, such as major funding rounds, acquisitions, or periods of substantial loss. This context is crucial for a nuanced understanding of Uber's financial trajectory.

Debt and Cash Flow

Understanding Uber's debt levels and cash flow is crucial for assessing its long-term financial sustainability. High debt levels could limit future investment opportunities, while strong cash flow suggests financial health and potential for growth.

- Uber Debt: [Provide data on Uber's total debt, ideally showing the trend over time. Source the data.] Analyze the debt-to-equity ratio to gauge the company's financial leverage.

- Uber Cash Flow: [Include data on Uber's free cash flow (FCF), highlighting positive or negative trends. Source the data.] A healthy positive FCF demonstrates the company's ability to generate cash from operations, vital for future investments and potential dividends. Analyze the implications of this FCF for future growth and investor returns.

- Uber Financial Health: The overall financial health of Uber requires a careful consideration of both its revenue growth and its ability to manage its debt and generate sufficient cash flow.

Market Position and Competitive Landscape

Market Share and Dominance

Uber holds a significant market share in the ride-sharing and food delivery industries globally, although its dominance varies regionally. However, the competitive landscape is fiercely contested.

- Uber Market Share: [Insert data showing Uber's market share in key geographic regions for both ride-sharing and food delivery, compared to competitors like Lyft, DoorDash, and Didi Chuxing. Source the data.] Visual aids (charts) are highly beneficial here.

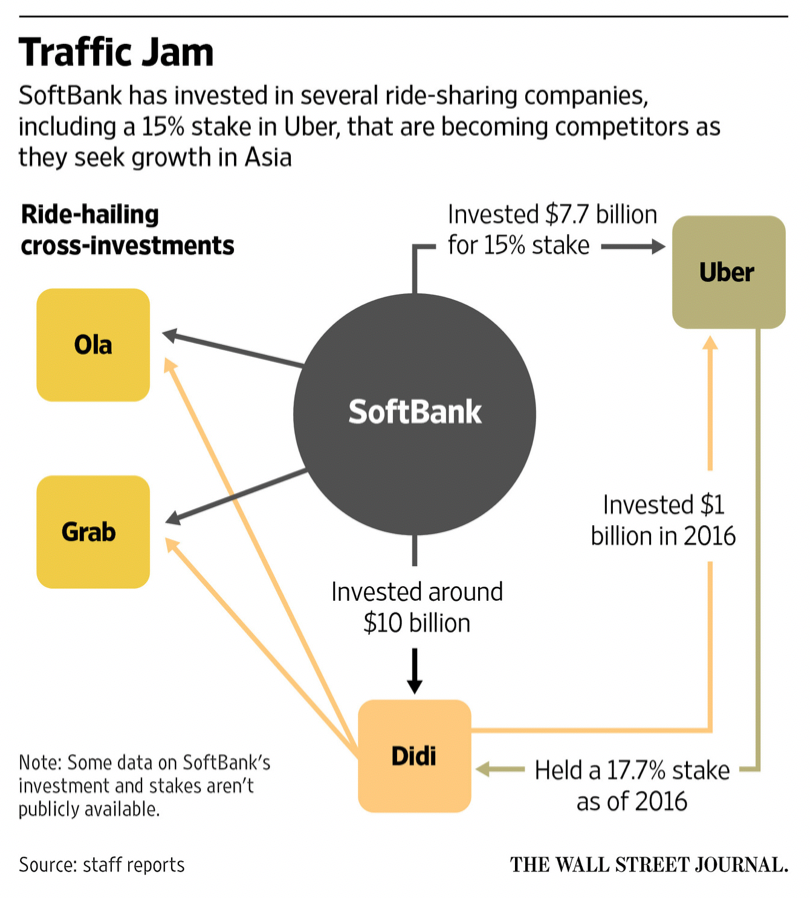

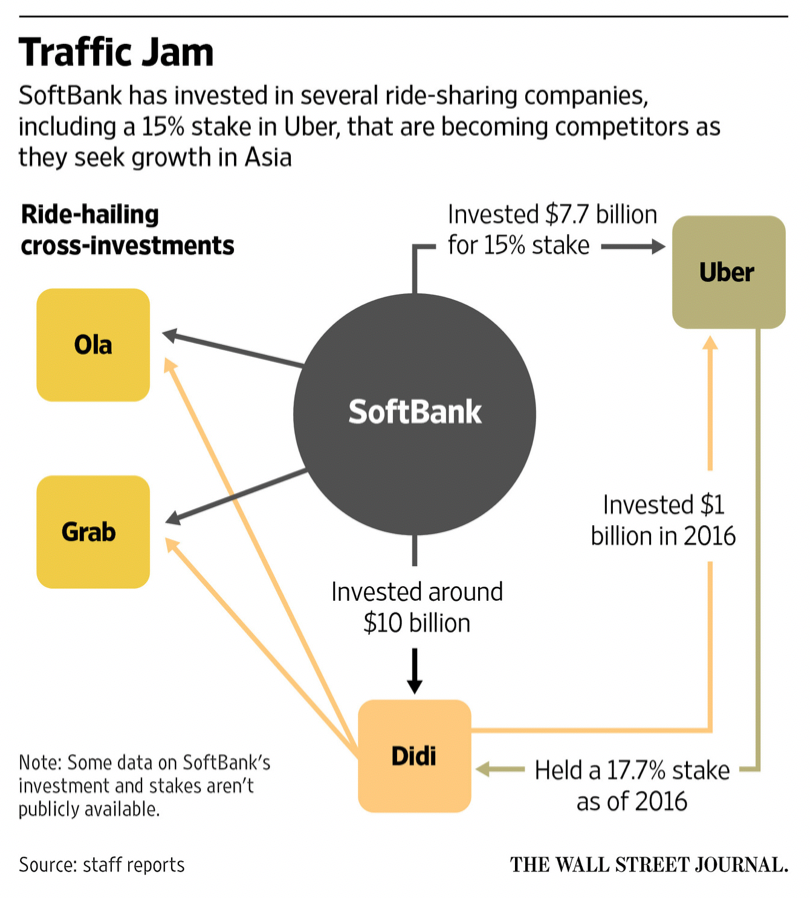

- Uber Competitors: Analyze the competitive strengths and weaknesses of key competitors. Understanding the competitive dynamics is vital for evaluating Uber's long-term prospects.

- Ride-Sharing Market: The ride-sharing market itself is dynamic, with emerging players and evolving regulatory landscapes influencing Uber's position.

Competitive Advantages and Disadvantages

Uber's competitive advantages include strong brand recognition, network effects (more drivers attract more riders, and vice versa), and significant investments in technology. However, intense competition, regulatory hurdles, and profitability challenges pose significant threats.

- Uber Competitive Advantage: Its vast network and brand recognition are significant assets. Its technological investments, including its mapping technology and driver apps, also contribute to its competitive edge.

- Uber Strategy: Discuss Uber's strategies for maintaining its competitive advantage, such as investments in autonomous vehicle technology and expansion into new markets and services.

- Uber Innovation: Analyze Uber's investment in technological innovation and how this impacts its competitive landscape. The development and deployment of autonomous vehicles are a key factor to consider.

Future Growth Potential and Long-Term Outlook

Expansion into New Markets and Services

Uber's future growth hinges on its ability to expand into new geographic markets and diversify into new services beyond ride-sharing and food delivery.

- Uber Future Growth: Expansion into underserved markets and emerging economies presents substantial opportunities.

- Uber Expansion: Discuss the challenges and opportunities associated with expanding into new geographical areas, considering regulatory hurdles and cultural differences.

- Uber New Services: The exploration of new services, such as autonomous vehicles, logistics, and micromobility solutions, could significantly impact its long-term growth trajectory. Discuss the potential risks and rewards of each.

Technological Advancements and Innovation

Technological advancements are central to Uber's future. The potential impact of autonomous vehicles alone is transformative.

- Uber Technology: The company's investments in AI, machine learning, and data analytics are crucial for optimizing operations and improving the user experience.

- Uber AI: Discuss how AI and machine learning are used to improve efficiency, predict demand, and enhance the overall rider and driver experience.

- Uber Autonomous Vehicles: The development and implementation of autonomous vehicle technology could significantly reduce operational costs and redefine Uber's business model, but also present significant technological and regulatory challenges.

Conclusion: Is Investing in Uber a Long-Term Play?

Analyzing Uber as a long-term investment requires careful consideration of its impressive revenue growth, challenges in achieving sustained profitability, fierce competition, and ambitious plans for expansion and technological innovation. While its market dominance and brand recognition are significant strengths, intense competition, regulatory uncertainty, and the substantial investments required for future growth create considerable risk.

The decision of whether to pursue an Uber long-term investment is ultimately a personal one. This analysis highlights key factors to consider. Before making any investment decisions related to Uber long-term investment opportunities, conduct your own thorough due diligence. Further research into Uber's stock performance, financial reports, and industry trends is highly recommended to inform your own Uber investment strategy and help you determine if long-term Uber stock aligns with your risk tolerance and financial goals.

Featured Posts

-

Detroit Pistons Vs New York Knicks Performance Breakdown And Predictions

May 17, 2025

Detroit Pistons Vs New York Knicks Performance Breakdown And Predictions

May 17, 2025 -

Tenis Efsanesi Novak Djokovic 37 Yasinda Zirvede Kalmanin Yollari

May 17, 2025

Tenis Efsanesi Novak Djokovic 37 Yasinda Zirvede Kalmanin Yollari

May 17, 2025 -

Analyzing Ubers Resilience Will The Stock Survive A Recession

May 17, 2025

Analyzing Ubers Resilience Will The Stock Survive A Recession

May 17, 2025 -

Navigating Late Student Loan Payments And Their Credit Consequences

May 17, 2025

Navigating Late Student Loan Payments And Their Credit Consequences

May 17, 2025 -

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Mira Vaga Na Copa 2026

May 17, 2025

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Mira Vaga Na Copa 2026

May 17, 2025