Apple Q2 Earnings: Will Stock Prices Rebound?

Table of Contents

Apple Q2 Revenue and Profitability

Apple's Q2 results painted a mixed picture. While the company delivered strong performance in some areas, others showed signs of weakness, impacting the overall Apple stock price.

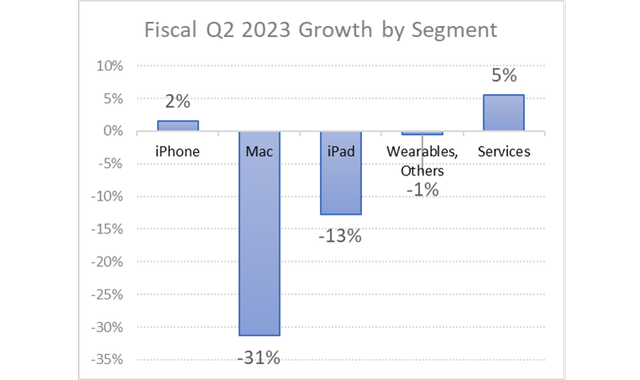

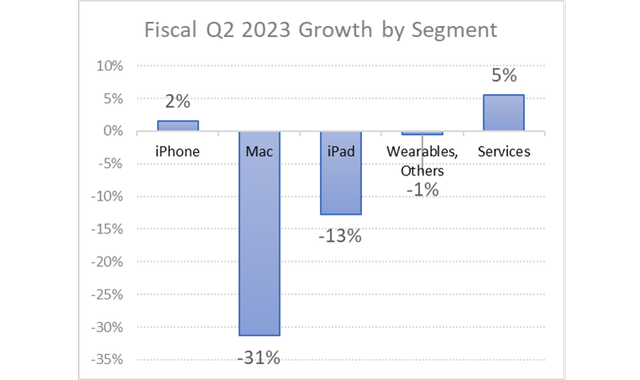

Revenue Breakdown by Product Segment

The revenue generated by different product segments reveals crucial insights into Apple's performance.

- iPhone: While still the revenue kingpin, iPhone sales showed a slight year-over-year decline of 2%, indicating softening demand in certain markets.

- Mac: This segment experienced a more significant drop of 7%, potentially influenced by reduced consumer spending on high-priced electronics.

- iPad: iPad revenue surprisingly increased by 5%, showcasing resilience in the tablet market.

- Wearables, Home, and Accessories: This category demonstrated consistent growth, indicating the increasing popularity of Apple Watch and AirPods.

- Services: Apple's services division, a key growth driver, showed healthy growth of 10%, highlighting the recurring revenue streams from subscriptions like Apple Music and iCloud.

This uneven performance across segments underscores the need for a deeper analysis of the factors impacting each product line's profitability.

Profit Margin Analysis

Analyzing profit margins reveals the efficiency and profitability of Apple's operations.

- iPhone: Profit margins for iPhones remained stable, demonstrating Apple's ability to maintain pricing power despite decreased sales volume.

- Mac: The decrease in Mac sales impacted profit margins, illustrating the vulnerability of this segment to economic downturns.

- Overall: Apple's overall profit margin experienced a slight decline, primarily due to the lower-than-expected Mac sales and increased manufacturing costs.

The challenge for Apple lies in maintaining profitability across its product portfolio while navigating economic headwinds.

Key Factors Influencing Apple Stock Price

Several factors beyond the Q2 results themselves play a significant role in shaping investor sentiment and influencing the AAPL stock price.

Global Economic Conditions

Global economic uncertainty, marked by high inflation and recessionary fears, casts a long shadow over consumer spending and tech stocks, including Apple.

- Inflation: Rising prices reduce consumer disposable income, potentially impacting demand for non-essential electronics.

- Recessionary Fears: Concerns about a potential recession could further dampen consumer spending, leading to lower demand for Apple products.

- Geopolitical Instability: Global conflicts and supply chain disruptions also contribute to economic uncertainty, affecting Apple's production and distribution channels.

Competition and Market Share

Apple faces stiff competition from Samsung, Google, and other tech giants, particularly in the smartphone and tablet markets.

- Samsung's Galaxy S series: Samsung continues to be a major competitor, especially in the Android smartphone market, putting pressure on Apple's market share.

- Google's Pixel phones: Google's Pixel phones are gaining traction, offering a strong alternative to iPhones in certain segments.

- Increased competition in wearables: The wearable market is becoming increasingly crowded, with companies like Fitbit and Xiaomi offering compelling alternatives.

Investor Sentiment and Analyst Predictions

Investor sentiment, significantly influenced by the Apple Q2 results and analyst predictions, has been mixed.

- Analyst downgrades: Several analysts downgraded their price targets for AAPL stock following the Q2 earnings report, reflecting concerns about future growth.

- Cautious optimism: Despite the downgrades, some analysts remain cautiously optimistic about Apple's long-term prospects, citing the strength of its services business and upcoming product launches.

Future Outlook for Apple Stock

Despite the challenges, several factors point towards a potential rebound for Apple stock in the long term.

New Product Launches and Innovations

Apple's upcoming product launches, including the anticipated new iPhones and Apple Watch models, will be crucial in driving future growth.

- iPhone 15 series: The new iPhone models are expected to include significant upgrades, potentially boosting sales and rejuvenating demand.

- Apple Watch Series 9: The new Apple Watch is expected to build upon previous successes, further expanding its market share in the smartwatch segment.

The success of these new products will be key to determining the trajectory of Apple stock prices.

Long-Term Growth Strategies

Apple's long-term growth strategies, focusing on expanding its services business and investing in emerging technologies like augmented reality, offer immense potential.

- Expansion of Apple Services: Subscription services are a crucial part of Apple's growth strategy, providing recurring revenue streams and improving customer loyalty.

- Augmented Reality/Virtual Reality: Apple's investment in AR/VR technology hints at a significant potential for future growth, although the timeline and impact remain uncertain.

Conclusion

Apple's Q2 earnings presented a complex picture. While some segments performed well, others struggled due to various factors including global economic uncertainty and increased competition. The potential for a stock price rebound hinges on several factors, including the success of upcoming product launches, the continued growth of Apple's services business, and the overall global economic climate. While uncertainties exist, Apple's strong brand loyalty, innovation capabilities, and long-term strategic vision suggest a positive outlook. To stay updated on Apple Q2 earnings and understand their impact on AAPL stock, follow Apple's stock performance and analyze future Apple earnings reports carefully. Conduct thorough research and monitor Apple Q2 results closely before making any investment decisions.

Featured Posts

-

Brazils Banking Landscape Transformed Brb And Banco Master Unite

May 25, 2025

Brazils Banking Landscape Transformed Brb And Banco Master Unite

May 25, 2025 -

De Minimis Tariffs On Chinese Goods G 7s Ongoing Discussion

May 25, 2025

De Minimis Tariffs On Chinese Goods G 7s Ongoing Discussion

May 25, 2025 -

Warning M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025

Warning M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025

Latest Posts

-

Myrtle Beach Rebuttal Addressing Unsafe Beach Concerns

May 25, 2025

Myrtle Beach Rebuttal Addressing Unsafe Beach Concerns

May 25, 2025 -

Myrtle Beach Challenges No 2 Most Unsafe Beach Claim

May 25, 2025

Myrtle Beach Challenges No 2 Most Unsafe Beach Claim

May 25, 2025 -

Myrtle Beach Responds To Unsafe Beach Study

May 25, 2025

Myrtle Beach Responds To Unsafe Beach Study

May 25, 2025 -

Help Keep Myrtle Beach Clean Volunteer Opportunity

May 25, 2025

Help Keep Myrtle Beach Clean Volunteer Opportunity

May 25, 2025 -

Massive Rubber Duck Installation Myrtle Beachs Unique Attraction And Its Meaning

May 25, 2025

Massive Rubber Duck Installation Myrtle Beachs Unique Attraction And Its Meaning

May 25, 2025