Apple Stock (AAPL) Price Targets: Key Levels To Watch

Table of Contents

Current Apple Stock (AAPL) Price and Market Sentiment

As of [Insert Current Date], the Apple Stock (AAPL) price is approximately $[Insert Current Price]. This represents a [Percentage Change]% change from [Previous Significant Price Point] and reflects the current market sentiment surrounding the tech giant. Recent market trends have been influenced by several key factors impacting Apple's stock price.

-

Recent Product Launches and Announcements: The recent release of the [mention recent product, e.g., iPhone 15] and [mention another recent product or service, e.g., Apple Vision Pro] has [positively/negatively] impacted investor confidence and consequently, the AAPL stock price. Market reaction to these launches often provides valuable insights into investor expectations and future price movements.

-

Significant Earnings Reports and Their Impact: Apple's [most recent quarter] earnings report revealed [mention key figures, e.g., EPS, revenue growth]. This [positive/negative] surprise [increased/decreased] investor confidence, leading to a [rise/fall] in the AAPL share price. Analyzing these reports and comparing them to previous quarters and analyst expectations is critical for understanding the Apple stock price trajectory.

-

Analyst Ratings and Overall Market Sentiment: Currently, analysts hold a [mention overall sentiment – bullish, bearish, or neutral] outlook on AAPL. [Mention specific analyst firms and their ratings]. This diverse range of opinions underscores the complexity of predicting the future Apple stock price and highlights the need for thorough independent research. [Include a relevant chart or graph showing recent price action and analyst ratings].

Key Resistance Levels for Apple Stock (AAPL)

Resistance levels are price points where the stock price has historically struggled to break through, encountering strong selling pressure. Identifying these levels is crucial for understanding potential price ceilings and predicting future movements.

-

Short-Term Resistance: Key short-term resistance levels for Apple Stock could be situated around $[Price Point 1] and $[Price Point 2]. A sustained break above these levels could signal a stronger bullish trend.

-

Long-Term Resistance: Historically, AAPL has encountered strong resistance around $[Price Point 3], representing a significant psychological barrier for many investors. Breaking through this level could potentially unlock further upward momentum.

-

Breaking Through Resistance: Successfully breaching a resistance level often signifies a shift in market sentiment, potentially indicating a sustained upward trend in the Apple stock price. This usually happens after a period of consolidation and increased buying pressure. [Include a chart visually representing these resistance levels].

Key Support Levels for Apple Stock (AAPL)

Support levels represent price points where buying pressure tends to outweigh selling pressure, preventing a further decline in the stock price. Identifying support levels is crucial for gauging potential price floors and assessing risk.

-

Short-Term Support: In the short term, Apple stock might find support near $[Price Point 4] and $[Price Point 5]. A breach below these levels could trigger further downward pressure.

-

Long-Term Support: Historically, Apple has found support around $[Price Point 6]. This level represents a significant floor, and breaking below it could signal a more bearish long-term outlook.

-

Breaking Through Support: Breaking below a significant support level is often viewed as a bearish signal, potentially indicating a trend reversal and further price decline. This often occurs after a period of sustained selling pressure and decreased investor confidence. [Include a chart highlighting support levels on the AAPL price chart].

Factors Influencing Apple Stock (AAPL) Price Targets

Numerous factors beyond the company's immediate performance influence Apple stock price targets.

-

Macroeconomic Factors: Interest rate hikes by central banks, inflation rates, and overall economic growth significantly impact investor sentiment towards technology stocks, including AAPL. A robust economy generally favors higher stock prices, while uncertainty can trigger selling.

-

Company Fundamentals: Apple's financial health, including revenue growth, profitability margins, and innovative product pipeline, directly influences its stock price. Strong earnings, expanding market share, and successful new product launches positively affect investor confidence.

-

Technological Advancements and Competition: The fast-paced technological landscape presents both opportunities and threats. Apple's ability to innovate and maintain a competitive edge against rivals like [mention key competitors, e.g., Samsung, Google] is critical for maintaining a high stock price. [Mention the impact of specific technologies, like AI or VR/AR, on Apple and its stock.]

Long-Term Apple Stock (AAPL) Price Predictions and Projections

Several analysts offer long-term price predictions for Apple stock, with estimates varying significantly. It's crucial to remember that these are just predictions and not financial advice.

-

Potential Long-Term Price Targets: Some analysts project long-term Apple stock price targets ranging from $[Lower Bound] to $[Upper Bound] within [Timeframe, e.g., the next 5 years]. These projections are based on various assumptions regarding future revenue growth, market share, and technological advancements.

-

Underlying Assumptions: These long-term projections depend on numerous assumptions, including the continued success of new product launches, the maintenance of strong margins, and favorable macroeconomic conditions. Significant deviations from these assumptions could greatly affect the accuracy of these predictions.

-

Conduct Your Own Research: Before investing in Apple stock (or any stock), always conduct thorough independent research. Consider consulting with a qualified financial advisor who can assist you in making investment decisions based on your risk tolerance and financial goals.

Conclusion

This article explored key price targets for Apple Stock (AAPL), examining both resistance and support levels. We analyzed current market sentiment, significant influencing factors, and potential long-term projections. Remember that all investment decisions carry risk. Stay informed about Apple Stock (AAPL) price targets and market trends to make well-informed investment decisions. Continue your research and consider consulting a financial advisor before making any investment in Apple Stock (AAPL) or any other stock.

Featured Posts

-

Ai Stuwt Relx Door Economische Recessie Positieve Vooruitzichten Tot 2025

May 24, 2025

Ai Stuwt Relx Door Economische Recessie Positieve Vooruitzichten Tot 2025

May 24, 2025 -

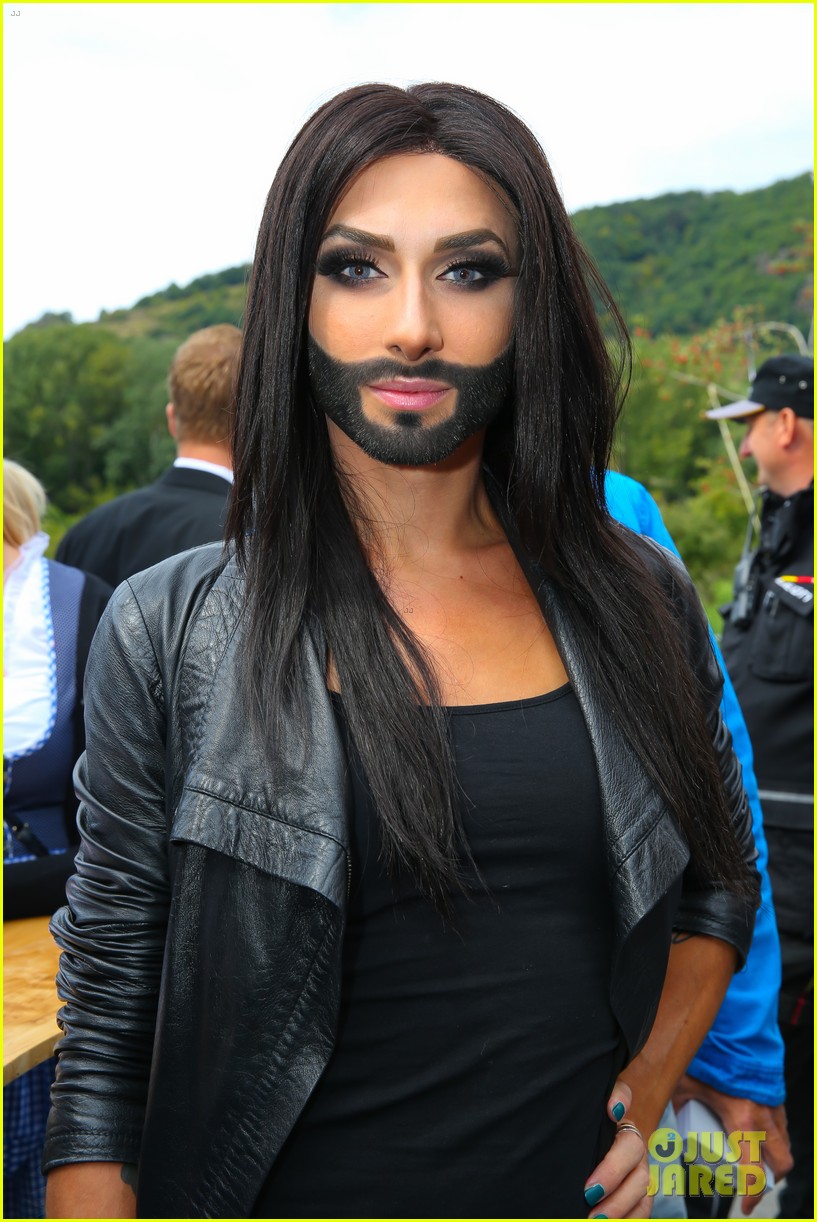

Conchita Wurst And Jj At Eurovision Village 2025 Concert Details

May 24, 2025

Conchita Wurst And Jj At Eurovision Village 2025 Concert Details

May 24, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

Frances Ruling Party Moves To Ban Hijabs In Public For Girls Under The Age Of 15

May 24, 2025

Frances Ruling Party Moves To Ban Hijabs In Public For Girls Under The Age Of 15

May 24, 2025 -

The Ultimate Guide To Ferrari Enthusiast Gear

May 24, 2025

The Ultimate Guide To Ferrari Enthusiast Gear

May 24, 2025

Latest Posts

-

Gen Zs Marketing Maven How Alix Earles Dancing With The Stars Appearance Amplified Her Brand

May 24, 2025

Gen Zs Marketing Maven How Alix Earles Dancing With The Stars Appearance Amplified Her Brand

May 24, 2025 -

Washington D C Museum Shooting Israeli Embassy Staff Casualties

May 24, 2025

Washington D C Museum Shooting Israeli Embassy Staff Casualties

May 24, 2025 -

Universals Epic Theme Park A 7 Billion Challenge To Disneys Dominance

May 24, 2025

Universals Epic Theme Park A 7 Billion Challenge To Disneys Dominance

May 24, 2025 -

House Passes Tax Bill Impact On Stock Market Today And Bonds

May 24, 2025

House Passes Tax Bill Impact On Stock Market Today And Bonds

May 24, 2025 -

Nfl Relents The Tush Push Celebration Survives The Ban

May 24, 2025

Nfl Relents The Tush Push Celebration Survives The Ban

May 24, 2025