Apple Stock And Tariffs: Assessing The Risk To Buffett's Investment

Table of Contents

Apple's Global Supply Chain and Tariff Vulnerability

Apple's reliance on a global supply chain, heavily concentrated in China, makes it particularly vulnerable to tariffs. The company's "global supply chain" strategy, while efficient for cost reduction, creates significant exposure to trade disputes. This vulnerability is amplified by the escalating trade tensions between major global economies. Let's consider the following:

- China Manufacturing: A substantial portion of Apple's products, including the iconic iPhone and its crucial components, are manufactured in China. Tariffs imposed on goods from China directly increase Apple's production costs.

- Tariff Impact on Components: Many critical iPhone components, like processors, memory chips, and displays, are sourced from various countries, some of which are subject to tariffs. This multifaceted supply chain makes calculating the total tariff impact complex.

- Increased Production Costs: Tariffs translate directly into higher production costs for Apple. These increased expenses can significantly affect Apple's profitability, potentially leading to reduced margins and impacting its stock price. For example, a tariff on a crucial component could ripple through the entire production process, ultimately increasing the final cost of the iPhone.

Specific examples of tariff-affected components include:

- Certain semiconductor components sourced from Taiwan or South Korea.

- Display panels from various Asian countries.

- Rare earth minerals essential for various electronic components.

Impact of Tariffs on Apple's Profitability and Stock Price

Analyzing historical data reveals a correlation between tariff changes and fluctuations in Apple's stock performance. While not a direct causal relationship, periods of increased trade tension often coincide with periods of market volatility affecting Apple's stock price.

Potential scenarios under different tariff regimes include:

- Best-Case Scenario: A de-escalation of trade tensions, leading to reduced or eliminated tariffs. This could boost Apple's profitability and stock price.

- Worst-Case Scenario: Significant tariff increases coupled with retaliatory measures from other countries, resulting in substantial production cost increases and reduced consumer demand. This could severely impact Apple's profitability and lead to a decline in its stock price.

- Most Likely Scenario: A continued period of trade uncertainty, with fluctuating tariffs and ongoing negotiations. This could lead to moderate increases in production costs, requiring Apple to balance price increases with maintaining consumer demand. The price elasticity of demand for Apple products will be a critical factor in this scenario.

Apple may attempt to offset tariff costs through price increases, but this carries the risk of reduced consumer demand. The balance between maintaining profit margins and preserving market share will be crucial in navigating the challenges posed by tariffs.

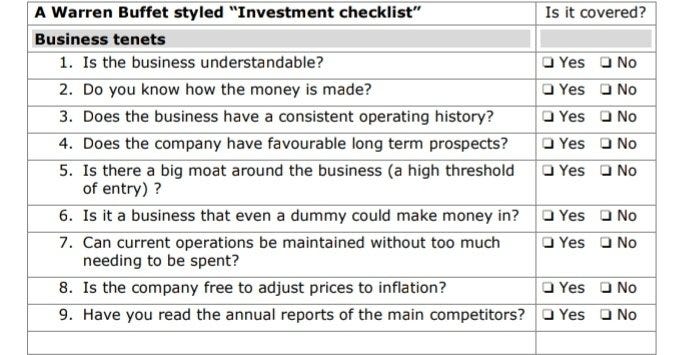

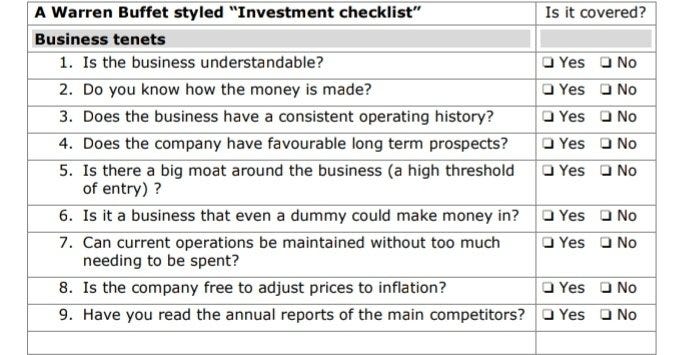

Buffett's Investment Strategy and Risk Tolerance

Warren Buffett, known for his long-term investment philosophy and value investing approach, typically prioritizes companies with strong fundamentals and sustainable competitive advantages. His substantial investment in Apple reflects his confidence in the company's long-term prospects. However, the current level of tariff uncertainty represents a deviation from his usual preference for predictable investment environments.

- Long-Term Investment: Buffett's investment in Apple is clearly a long-term play. While short-term fluctuations in stock price related to tariffs might be concerning for some investors, Buffett's horizon is much longer.

- Risk Management: While known for taking calculated risks, Buffett also emphasizes risk management. The level of uncertainty generated by fluctuating tariffs is a factor that needs to be considered within his broader portfolio strategy.

- Portfolio Diversification: Buffett's vast portfolio is well-diversified, reducing the overall impact of any single investment. While Apple is a significant holding, it's not the only investment. This diversification helps mitigate the risk associated with any specific sector or geopolitical event like tariff wars.

Alternative Investment Opportunities and Market Sentiment

Given the uncertainties surrounding tariffs and their potential impact on Apple stock, investors may explore alternative investment opportunities within the tech sector or in less tariff-sensitive industries.

- Alternative Investments: Companies with more localized supply chains or those less reliant on international trade may offer a degree of insulation from tariff-related risks.

- Market Sentiment: Market sentiment towards Apple stock and the broader tech sector is influenced by trade tensions. Negative sentiment can lead to capital flight from the sector.

- Capital Allocation: Investors are actively reassessing capital allocation decisions, considering the potential for reduced returns from heavily tariff-exposed investments. This may lead to a shift towards more stable asset classes.

Conclusion

The impact of tariffs on Apple stock and Warren Buffett's investment presents a complex scenario. Apple's reliance on a global supply chain makes it vulnerable to trade tensions, impacting its production costs and potentially its profitability. While Buffett's long-term investment strategy and portfolio diversification offer some protection, the ongoing trade uncertainty presents a risk to his Apple investment. Understanding the interplay between Apple stock and tariffs is crucial for informed investment decisions. Conduct thorough due diligence before investing in Apple stock or any other assets subject to global trade uncertainties. Carefully analyze the potential impact of tariffs on any investment, considering diverse scenarios and adjusting your strategy accordingly. Continue to monitor the evolution of global trade policies and their potential impact on your portfolio.

Featured Posts

-

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 24, 2025

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 24, 2025 -

Guccis New Designer Kering Announces Sales Drop And September Debut

May 24, 2025

Guccis New Designer Kering Announces Sales Drop And September Debut

May 24, 2025 -

Apple Stock Price Prediction 254 Is Apple A Buy At 200

May 24, 2025

Apple Stock Price Prediction 254 Is Apple A Buy At 200

May 24, 2025 -

Philips Shareholders Updates On The 2025 Annual General Meeting

May 24, 2025

Philips Shareholders Updates On The 2025 Annual General Meeting

May 24, 2025 -

Brazils Banking Sector Transformed Brb And Banco Master Merge To Create A Major Player

May 24, 2025

Brazils Banking Sector Transformed Brb And Banco Master Merge To Create A Major Player

May 24, 2025

Latest Posts

-

South Africa Applauds Ramaphosas Composure Exploring Other Responses To The White House Incident

May 24, 2025

South Africa Applauds Ramaphosas Composure Exploring Other Responses To The White House Incident

May 24, 2025 -

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025 -

Air Traffic Controllers Point To Trump Administration Policy For Newark Airport Issues

May 24, 2025

Air Traffic Controllers Point To Trump Administration Policy For Newark Airport Issues

May 24, 2025 -

Trump Tax Bill Passes House Despite Late Amendments

May 24, 2025

Trump Tax Bill Passes House Despite Late Amendments

May 24, 2025 -

Anonymity At Trumps Exclusive Memecoin Dinner

May 24, 2025

Anonymity At Trumps Exclusive Memecoin Dinner

May 24, 2025