Apple Stock Dips Below Crucial Levels Before Q2 Earnings

Table of Contents

Technical Analysis: Identifying Crucial Support Levels Breached

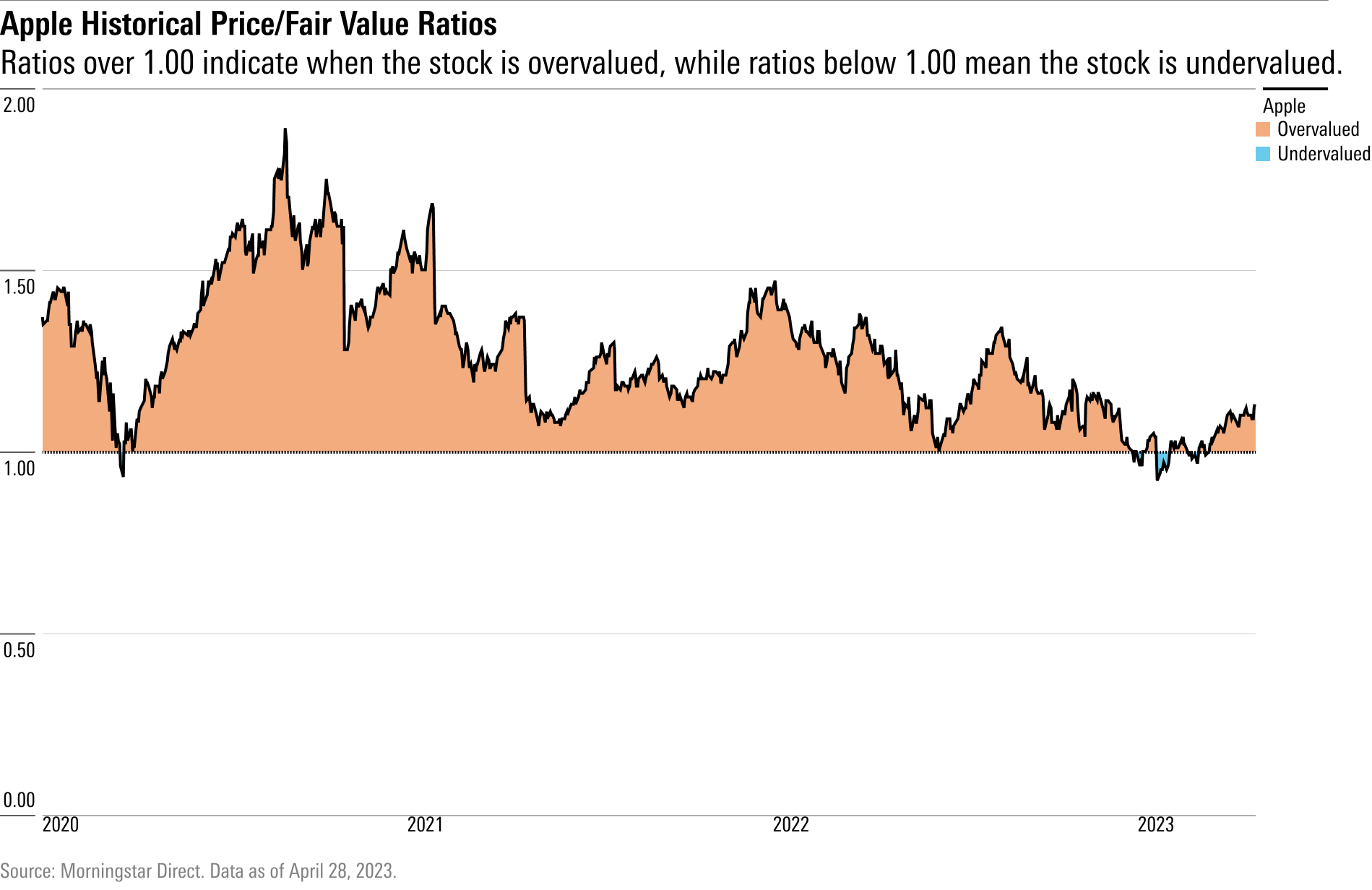

Understanding "crucial support levels" is vital for interpreting stock price movements. These levels represent price points where a significant number of buyers are likely to enter the market, preventing further price declines. In Apple's case, the recent dip breached several key support levels, signaling a potential bearish trend. While specific price points are subject to constant change and depend on the timeframe used, a breach below, for instance, the $160 mark (adjust to current relevant price points) triggered significant selling pressure.

- Technical Indicators: Several technical indicators, including moving averages (e.g., the 50-day and 200-day moving averages crossing downwards), RSI (Relative Strength Index) indicating oversold conditions, and MACD (Moving Average Convergence Divergence) showing bearish divergence, suggested a weakening trend in AAPL stock before the dip.

- Historical Significance: The breached support levels held significance based on previous price actions. Their breakdown suggests a potential shift in market sentiment, potentially signaling a more extended correction.

- Trading Volume: Increased trading volume accompanying the price drop confirmed the selling pressure and amplified the significance of the breach. High volume breakdowns often signal a stronger and more sustainable price decline than low-volume moves.

Factors Contributing to the Apple Stock Dip

Several factors contributed to the recent decline in Apple stock price. These factors encompass macroeconomic conditions, sector-specific headwinds, and company-specific concerns:

-

Macroeconomic Factors: Global economic uncertainty, persistent inflation, and rising interest rates have dampened investor confidence across various sectors, including technology. Concerns about a potential recession are impacting consumer spending, directly affecting demand for discretionary items like Apple products.

-

Sector-Specific Headwinds: The smartphone market is experiencing slowing growth. Increased competition from Android manufacturers, particularly in emerging markets, is putting pressure on Apple's sales figures. Supply chain disruptions and component shortages continue to present challenges for Apple’s production and delivery capabilities.

-

Company-Specific Concerns: While Apple remains a tech giant, concerns around potential delays in new product launches or the overall impact of economic headwinds on sales projections could contribute to negative sentiment among investors.

- Inflation's Impact: Higher inflation reduces consumer purchasing power, potentially limiting demand for premium-priced Apple devices.

- Competitive Pressure: Android manufacturers offer increasingly competitive products at lower price points, eroding Apple's market share in certain segments.

- Supply Chain Challenges: Continued supply chain disruptions can lead to production delays and negatively impact Apple's revenue projections.

Investor Sentiment and Market Reaction

The Apple stock dip has triggered mixed reactions from investors. Some see it as an opportunity to buy at lower prices, while others are concerned about further declines.

-

Analyst Predictions: Analyst ratings and price targets for AAPL stock vary considerably, reflecting the uncertainty surrounding the future outlook. Some analysts remain bullish, highlighting Apple's strong brand and long-term growth potential, while others have expressed concerns due to the current macroeconomic climate and potential sector-specific challenges.

-

Sell-offs and Buying Opportunities: The price drop has led to significant sell-offs by some investors, while others have been taking advantage of what they perceive as a buying opportunity.

-

Institutional Activity: Monitoring institutional investor activity (large-scale buying or selling) can provide insight into the overall market sentiment towards Apple. Significant institutional selling could indicate further downside potential, while strong buying could suggest that the dip presents a buying opportunity.

- Analyst Opinions: A range of price targets and ratings reflects the diversity of opinion among market analysts.

- Short Interest: Tracking short interest (the number of shares sold short) in AAPL provides an indicator of investor sentiment. High short interest can signal potential upward pressure if the stock price rebounds.

- Institutional Investor Activity: Large-scale trades by institutional investors, like mutual funds and hedge funds, can influence the direction of AAPL stock.

Expectations for Q2 Earnings and their Impact on the Stock Price

The upcoming Q2 earnings report will be crucial for determining the future trajectory of Apple stock. Investors will be closely watching key metrics:

-

Key Metrics: Revenue growth, earnings per share (EPS), iPhone sales, services revenue, and guidance for the next quarter will be closely scrutinized.

-

Earnings Scenarios: The Q2 earnings could exceed, meet, or fall short of analysts' consensus estimates. A positive earnings surprise could boost the stock price, while a negative surprise might exacerbate the recent decline.

-

Future Growth Drivers: The earnings report will offer insights into Apple’s long-term growth strategy and potential future growth drivers, influencing investor sentiment and shaping the stock's future performance.

- Consensus Estimates: Analysts' consensus estimates for Q2 earnings provide a benchmark against which actual results will be compared.

- Positive/Negative Surprise: Exceeding or falling short of expectations will significantly impact investor sentiment and the stock price.

- Future Growth: Apple's strategy for future growth, including new product launches and expansion into new markets, will be a significant factor for investors.

Conclusion: Apple Stock's Future After the Dip – What to Watch For

The recent Apple stock dips below crucial levels before Q2 earnings, driven by a confluence of macroeconomic factors, sector-specific headwinds, and investor sentiment, highlight the uncertainties surrounding Apple’s near-term performance. The breach of crucial support levels adds to the concern. The upcoming Q2 earnings report holds immense significance. A strong performance could reverse the downward trend, while a disappointing report could lead to further declines. Maintaining a cautious outlook and carefully monitoring relevant economic indicators, analyst reports, and the overall market sentiment is crucial for navigating this period of uncertainty. Stay updated on Apple's Q2 earnings and the subsequent stock price movements by following reputable financial news sources and conducting your own thorough research. Remember, this analysis is for informational purposes and should not be construed as financial advice.

Featured Posts

-

Court Rejects Trumps Claims Against Elite Law Firms

May 25, 2025

Court Rejects Trumps Claims Against Elite Law Firms

May 25, 2025 -

Paris Facing Economic Headwinds Luxury Sector Slowdown

May 25, 2025

Paris Facing Economic Headwinds Luxury Sector Slowdown

May 25, 2025 -

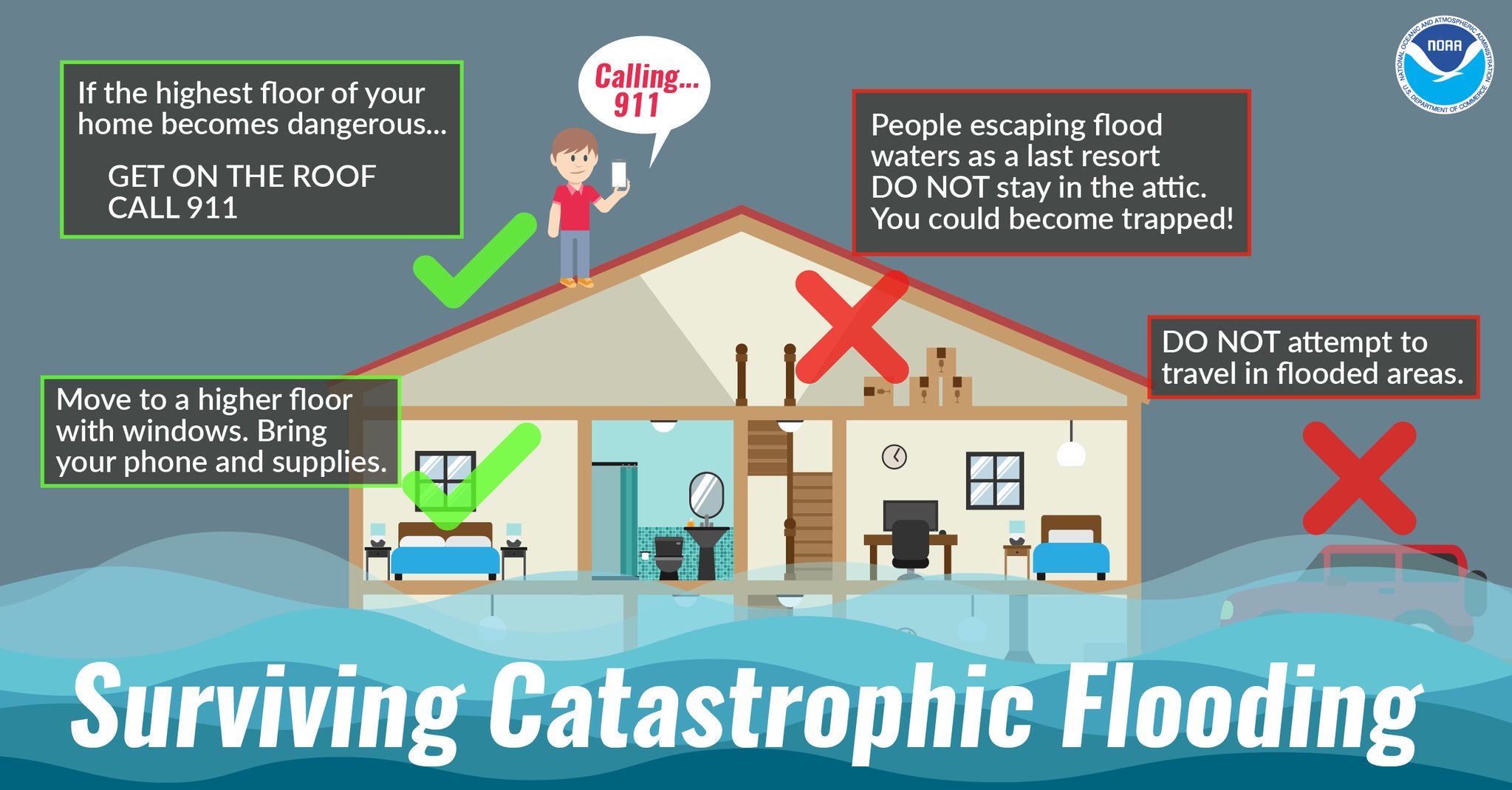

Staying Safe During Flash Floods A Comprehensive Guide To Flood Warnings

May 25, 2025

Staying Safe During Flash Floods A Comprehensive Guide To Flood Warnings

May 25, 2025 -

Media Company Sues Cohere For Copyright Infringement The Case Details

May 25, 2025

Media Company Sues Cohere For Copyright Infringement The Case Details

May 25, 2025 -

Trumps Influence On Republican Dealmaking

May 25, 2025

Trumps Influence On Republican Dealmaking

May 25, 2025

Latest Posts

-

Hampshire And Worcester Counties Under Flash Flood Threat Thursday

May 25, 2025

Hampshire And Worcester Counties Under Flash Flood Threat Thursday

May 25, 2025 -

Heavy Rainfall Prompts Flash Flood Warning In Pennsylvania

May 25, 2025

Heavy Rainfall Prompts Flash Flood Warning In Pennsylvania

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Significant Downpours Trigger Flash Flood Warning In Parts Of Pennsylvania

May 25, 2025

Significant Downpours Trigger Flash Flood Warning In Parts Of Pennsylvania

May 25, 2025 -

Pennsylvania Flash Flood Warning Issued Through Thursday Morning

May 25, 2025

Pennsylvania Flash Flood Warning Issued Through Thursday Morning

May 25, 2025