Apple Stock Forecast: $254 Price Target - Time To Invest?

Table of Contents

Analyzing the $254 Apple Stock Price Target

The $254 Apple stock price target originates from [Name of Analyst/Firm], a reputable source known for its in-depth market analysis. Their methodology relies on a discounted cash flow (DCF) model, projecting Apple's future cash flows based on several key assumptions. These include projected growth rates for iPhone sales, expansion in the services sector (Apple Music, iCloud, etc.), and continued success in the wearables market (Apple Watch, AirPods). The model also incorporates assumptions about Apple's market share, operating margins, and capital expenditures.

- Analyst's rationale for the $254 target: [Analyst/Firm] believes Apple's robust ecosystem, strong brand loyalty, and innovative product pipeline will drive substantial growth in the coming years, justifying the $254 price target.

- Key factors influencing the target price: New product launches, such as the anticipated advancements in AR/VR technology and continued innovation in the iPhone line, are major factors. Positive market trends in the tech sector also play a significant role.

- Comparison to other analyst predictions and the average price target: While the $254 price target is ambitious, it falls within the range of predictions from other analysts. Comparing this figure to the average price target provides valuable context and helps gauge overall market sentiment towards Apple stock.

Apple's Financial Performance and Future Outlook

Apple's recent financial reports reveal consistent revenue growth and healthy profit margins. The iPhone remains a significant revenue driver, but the services segment is showing impressive growth, highlighting Apple's diversification strategy. Wearables, Home, and Accessories also contribute substantially, demonstrating the success of Apple's expansion into complementary product categories.

- Recent quarterly earnings and year-over-year growth: [Insert data on recent quarterly earnings and year-over-year growth rates]. This data provides a concrete picture of Apple's financial strength.

- Key performance indicators (KPIs) and their trends: Tracking KPIs such as revenue growth, earnings per share (EPS), and gross margins reveals important trends in Apple's business performance.

- Discussion of new product innovation and its potential impact: Apple's ongoing innovation, with anticipated advancements in areas like AR/VR and further improvements to its existing product lines, fuels expectations for continued growth.

Market Sentiment and Investor Confidence

Currently, investor sentiment towards Apple stock is generally positive. However, market conditions can significantly impact investor confidence. Geopolitical events, economic fluctuations, and changes in interest rates all play a role in shaping market sentiment and influencing the Apple stock price. Any negative news affecting the tech sector as a whole could also negatively impact Apple.

- Current Apple stock valuation (P/E ratio, market capitalization): Analyzing Apple's valuation metrics in relation to historical data and compared to competitors helps determine whether the stock is currently undervalued or overvalued.

- Comparison to industry peers and competitors: Comparing Apple's performance to other tech giants provides context and helps assess its competitive position within the industry.

- Overall market outlook and its influence on tech stocks: The broader market outlook plays a crucial role in influencing investor decisions. A positive market outlook usually enhances investor confidence in tech stocks.

Risks and Considerations Before Investing in Apple Stock

While the $254 price target presents a potentially lucrative opportunity, it's crucial to acknowledge potential downsides. Apple stock, like any investment, carries risk. Market corrections, increased competition, or unforeseen supply chain disruptions could negatively affect Apple's stock price.

- Potential risks associated with the $254 price target not being reached: The $254 price target is a prediction, not a guarantee. Investors need to be prepared for the possibility that the price may not reach this level.

- Factors that could negatively impact Apple's stock price: Increased competition, economic downturns, or negative regulatory changes could all put downward pressure on Apple's stock price.

- Importance of risk tolerance and investment goals: Before investing in Apple stock, investors should carefully consider their risk tolerance and investment goals to determine if this investment aligns with their overall financial strategy.

Conclusion: Should You Invest in Apple Stock at this Price Target?

Our analysis of the $254 Apple stock price target reveals a compelling investment opportunity, but also highlights inherent risks. Apple’s financial performance, innovative product pipeline, and generally positive market sentiment support the potential for growth. However, market volatility and the unpredictable nature of the stock market must be considered. The $254 price target represents a possible upside, but it's not a certainty. Therefore, before investing, conduct thorough research, assess your risk tolerance, and consider diversifying your portfolio. Is the Apple stock $254 price target a signal to invest? The answer depends on your individual circumstances and investment strategy. Consider Apple stock as part of a diversified portfolio after conducting your due diligence.

Featured Posts

-

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 25, 2025

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 25, 2025 -

Alexandria International Airport And England Airpark Partner For Ae Xplore Global Campaign

May 25, 2025

Alexandria International Airport And England Airpark Partner For Ae Xplore Global Campaign

May 25, 2025 -

Understanding The Kyle Walker Mystery Women And Annie Kilner Story

May 25, 2025

Understanding The Kyle Walker Mystery Women And Annie Kilner Story

May 25, 2025 -

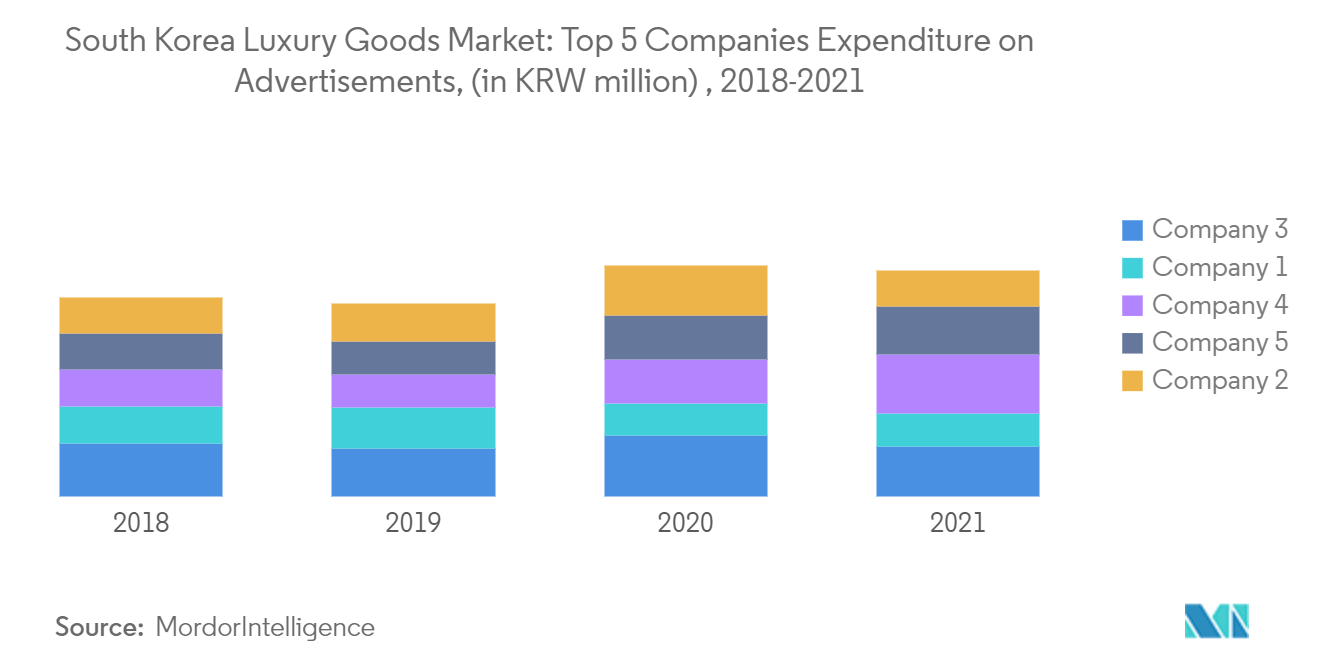

Financial Strain On Paris Impact Of Luxury Goods Market Decline

May 25, 2025

Financial Strain On Paris Impact Of Luxury Goods Market Decline

May 25, 2025 -

Monaco Corruption Investigating The Princes Finances

May 25, 2025

Monaco Corruption Investigating The Princes Finances

May 25, 2025

Latest Posts

-

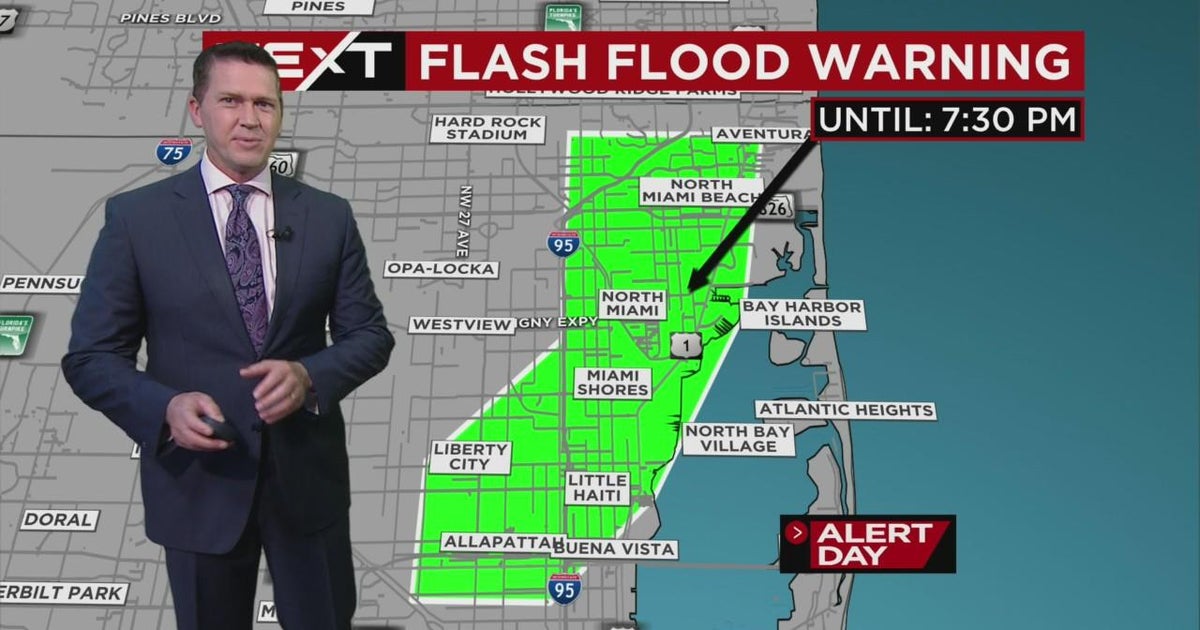

Protecting Yourself A Guide To Flash Flood Warnings And Alerts

May 25, 2025

Protecting Yourself A Guide To Flash Flood Warnings And Alerts

May 25, 2025 -

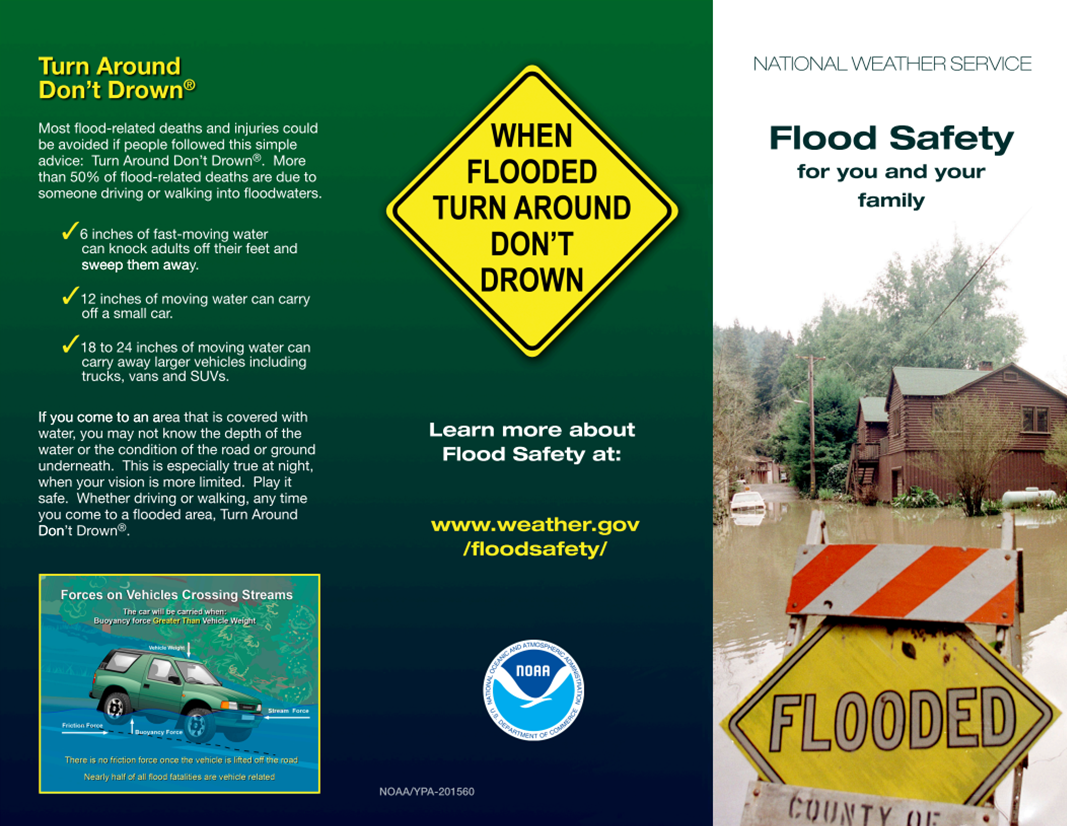

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025 -

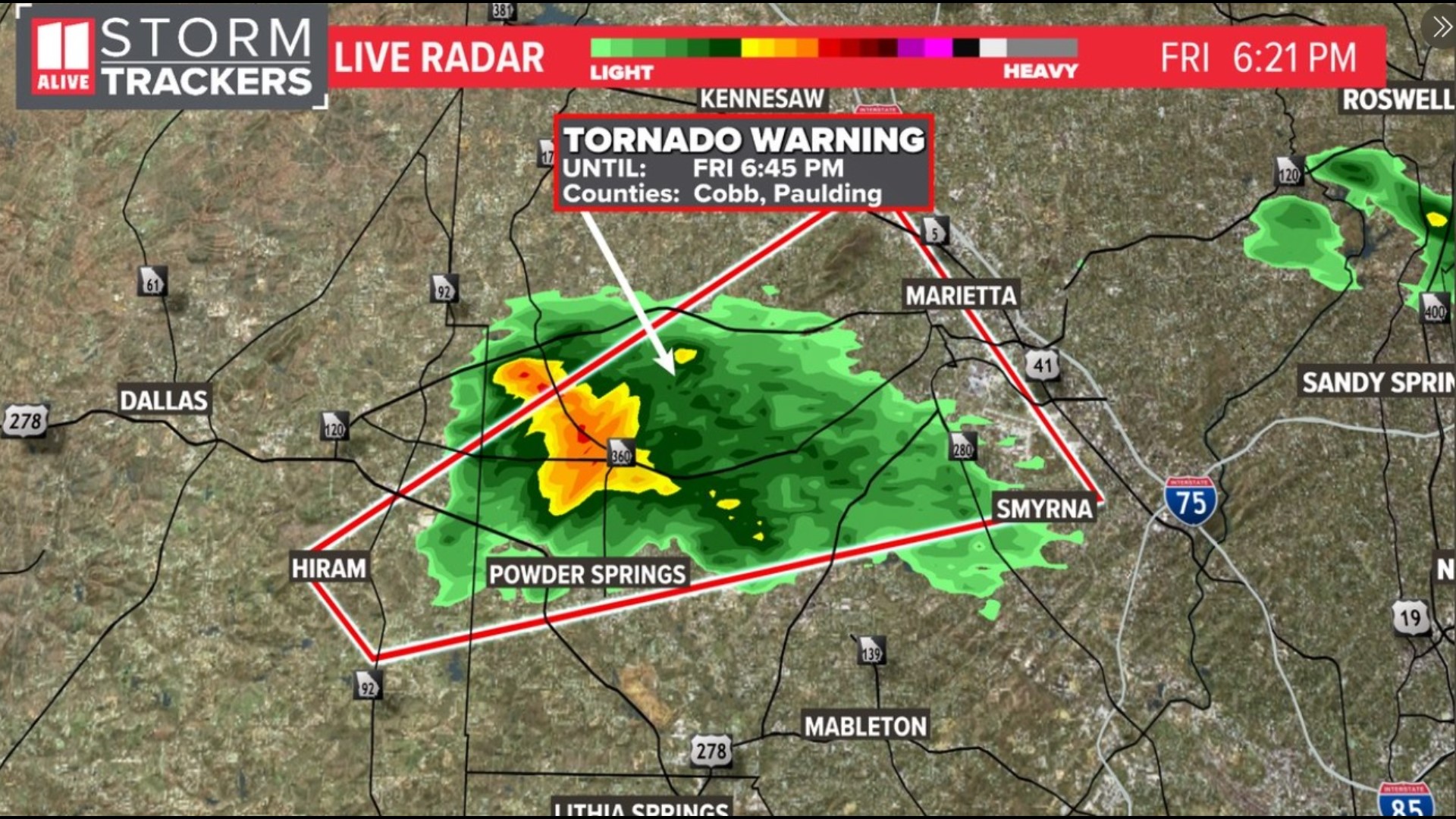

Flash Flood Warnings And April 2 Tornado Count Update April 4 2025

May 25, 2025

Flash Flood Warnings And April 2 Tornado Count Update April 4 2025

May 25, 2025 -

Understanding Flash Floods How To Respond To Flood Warnings And Alerts

May 25, 2025

Understanding Flash Floods How To Respond To Flood Warnings And Alerts

May 25, 2025 -

Canada Posts Service Issues Drive Growth In The Alternative Delivery Sector

May 25, 2025

Canada Posts Service Issues Drive Growth In The Alternative Delivery Sector

May 25, 2025