Apple Stock: Key Levels And Q2 Earnings Report Preview

Table of Contents

Key Support and Resistance Levels for Apple Stock

Understanding support and resistance levels is fundamental to technical analysis of Apple stock. These levels represent price points where buying or selling pressure is expected to be particularly strong.

Identifying Crucial Support Levels

Support levels act as a floor, preventing further price declines in Apple stock. A break below a significant support level often signals a bearish trend.

- $160: This level has historically acted as strong support for AAPL. On multiple occasions in the past year, the stock bounced back from this price point. For example, on October 26th, 2023, a significant volume surge accompanied the stock's rebound from $160 after a period of negative news surrounding the tech sector.

- $150: This represents a more critical support level. A break below $150 could trigger further selling pressure and indicate a more significant downturn in the Apple stock price. Historical data shows that a breach of this level has historically led to increased volatility in AAPL stock.

- $140: This is a crucial psychological support level and represents a strong potential area for buyers to step in. A break below this level could signal a more substantial correction for the AAPL stock price.

Pinpointing Key Resistance Levels

Resistance levels act as a ceiling, hindering price increases in Apple stock. A break above a significant resistance level often signals a bullish trend.

- $180: This level has repeatedly acted as resistance for AAPL stock in recent months. Several attempts to break above this level have been met with selling pressure.

- $190: This is a psychologically important resistance level for many investors. Breaking above this would signal considerable bullish momentum and could trigger further upward price movements. Past breaches above this level have been correlated with positive news regarding Apple product launches or strong quarterly reports.

- $200: This represents a significant resistance level. Overcoming this would signal strong bullish sentiment and potentially trigger a more significant price rally for Apple stock.

Technical Indicators to Watch

Technical indicators provide additional insights into potential price movements. Using these in conjunction with support and resistance levels enhances the accuracy of price predictions.

- RSI (Relative Strength Index): An RSI above 70 suggests overbought conditions, while below 30 suggests oversold conditions. These can signal potential price reversals.

- MACD (Moving Average Convergence Divergence): MACD crossovers (bullish or bearish) can indicate changes in momentum.

- 50-Day and 200-Day Moving Averages: Crossovers of these moving averages can be strong indicators of bullish or bearish trends. A "golden cross" (50-day crossing above the 200-day) is usually considered bullish, while a "death cross" (50-day crossing below the 200-day) is bearish. Monitoring these averages is vital for understanding long-term Apple stock price trends.

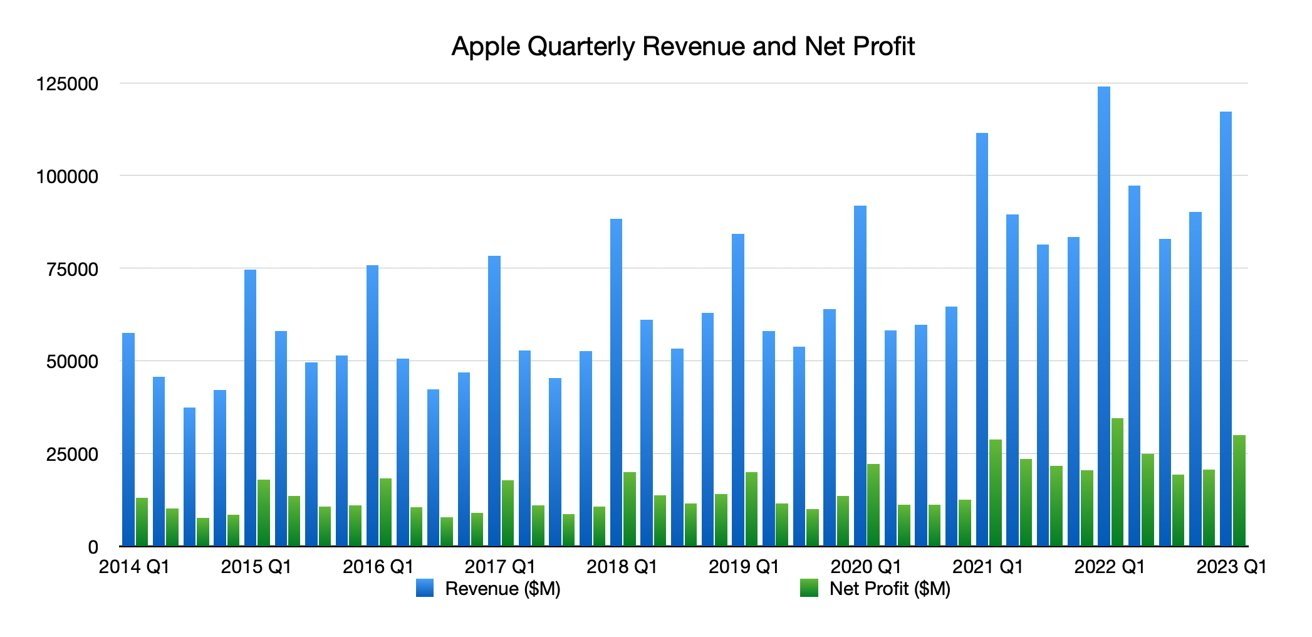

Q2 Earnings Report Preview: What to Expect

The Q2 earnings report will be a key event influencing Apple stock price. Analysts' predictions and potential catalysts will shape the market's reaction.

Analyst Expectations and Consensus Estimates

Analysts offer a range of expectations for Apple's Q2 earnings. While consensus estimates are valuable, it's crucial to understand the range of predictions.

- Revenue: Estimates currently range from $81 billion to $85 billion.

- EPS (Earnings Per Share): Estimates generally hover around $1.20 to $1.25.

- iPhone Sales: Analysts expect continued strong sales, but perhaps slightly lower year-over-year growth due to macroeconomic factors.

- Services Revenue: This segment is expected to continue its consistent growth, driven by increased subscriptions and in-app purchases.

Potential Catalysts for Stock Movement

Several factors could significantly impact the Apple stock price after the earnings report.

- Positive Catalysts: Strong iPhone sales exceeding expectations, robust growth in services revenue, announcements of new innovative products (e.g., new AR/VR headset), positive guidance for future quarters.

- Negative Catalysts: Lower-than-expected iPhone sales, weaker-than-anticipated services revenue growth, supply chain disruptions impacting production, negative macroeconomic conditions (e.g., recession), increased competition from Android device manufacturers.

Post-Earnings Reaction and Trading Strategy

The market's reaction will depend on whether Apple's Q2 earnings beat or miss analyst expectations.

- Beat Expectations: A significant positive surprise could send the Apple stock price soaring, potentially breaking through key resistance levels. A buy-the-dip strategy could be considered if a temporary pullback occurs after the initial surge.

- Meet Expectations: A report meeting expectations may result in a relatively neutral market reaction, with the price consolidating near current levels. A hold strategy would be prudent.

- Miss Expectations: A significant miss could trigger a sharp decline, potentially breaking through key support levels. A sell-the-rally or a wait-and-see approach would be advisable. Risk management is crucial in this scenario. Consider setting stop-loss orders to limit potential losses.

Conclusion

Understanding key support and resistance levels ($140, $150, $160, $180, $190, $200), analyzing technical indicators (RSI, MACD, moving averages), and anticipating potential catalysts impacting AAPL stock are crucial for navigating the upcoming Apple earnings report. The range of analyst expectations for revenue and EPS underscores the importance of considering multiple scenarios and having a well-defined trading strategy before the release of the Q2 earnings. Remember, conducting thorough research and considering consultation with a financial advisor are essential before making any investment decisions.

Call to Action: Stay informed about Apple stock and its upcoming earnings report. Conduct thorough research, utilize technical analysis, and consider consulting a financial advisor before making any investment decisions related to Apple stock (AAPL). Continue to monitor key levels and indicators for potential trading opportunities surrounding Apple's Q2 earnings announcement. Remember that past performance is not indicative of future results, and all investments carry risk.

Featured Posts

-

Brest Urban Trail Portrait Des Acteurs Cles

May 25, 2025

Brest Urban Trail Portrait Des Acteurs Cles

May 25, 2025 -

Recent Photos Annie Kilners Sparkling New Ring And Its Significance

May 25, 2025

Recent Photos Annie Kilners Sparkling New Ring And Its Significance

May 25, 2025 -

New York Times Connections Hints And Answers March 18 2025 646

May 25, 2025

New York Times Connections Hints And Answers March 18 2025 646

May 25, 2025 -

Lauryn Goodman Explains Shocking Italy Move Following Kyle Walker Transfer

May 25, 2025

Lauryn Goodman Explains Shocking Italy Move Following Kyle Walker Transfer

May 25, 2025 -

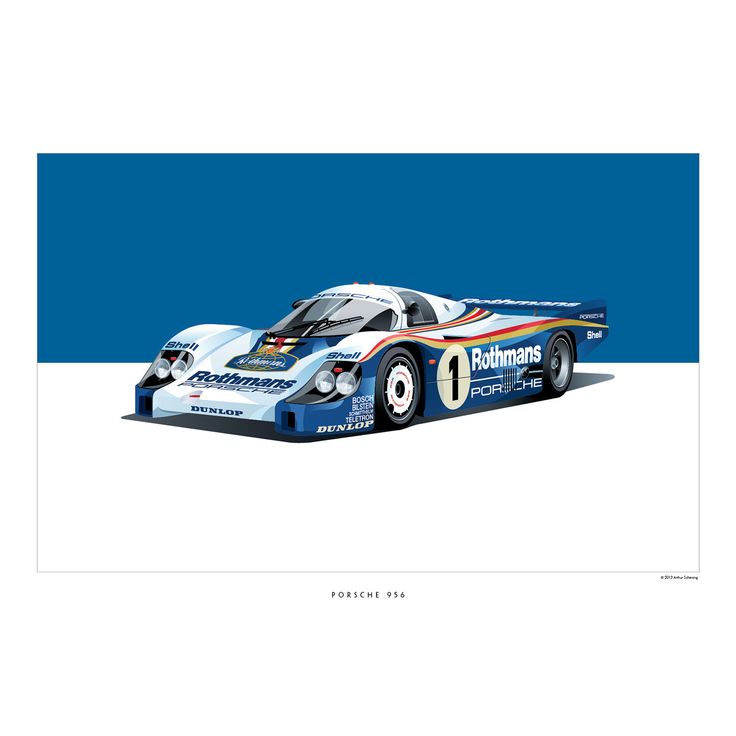

Porsche 956 Nin Muezedeki Oezel Sergisi

May 25, 2025

Porsche 956 Nin Muezedeki Oezel Sergisi

May 25, 2025

Latest Posts

-

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025