Apple Stock: Navigating The Uncertainty Before Q2 Results

Table of Contents

Analyzing Recent Market Trends Affecting Apple Stock

Several significant market trends are influencing the current performance and future trajectory of Apple stock. Understanding these trends is crucial for anticipating Q2 results and making sound investment choices.

Impact of Inflation and Consumer Spending

Inflation is a major headwind for the consumer electronics market. Rising prices for goods and services reduce consumer disposable income, potentially impacting demand for Apple products. This could affect sales across the board, from iPhones and Macs to iPads and wearables.

- Price Increases: Apple, like many other companies, has faced increased pressure to raise prices to offset rising production costs. This may lead to decreased consumer demand, particularly in price-sensitive markets.

- Shifting Consumer Preferences: Consumers may prioritize essential spending over discretionary purchases like new electronics, leading to a potential slowdown in Apple product sales.

Supply Chain Disruptions and Their Influence

Ongoing supply chain disruptions continue to pose a challenge for Apple's production and sales. Difficulties in procuring essential components can lead to production delays, impacting inventory levels and product availability.

- Component Shortages: Specific components, such as advanced chips and certain display technologies, remain in short supply, affecting the production of various Apple devices.

- Geographic Impact: Disruptions in specific regions can significantly impact Apple's ability to manufacture and ship products, leading to potential sales shortfalls.

Competitive Landscape and Market Share

Apple faces strong competition across its various product lines. Competitors are constantly innovating and introducing new products, putting pressure on Apple's market share. Understanding the competitive dynamics is crucial for assessing Apple's future performance.

- Android Smartphone Competition: Android manufacturers continue to offer compelling alternatives to iPhones, especially in price-sensitive markets.

- PC Market Competition: The PC market is highly competitive, with players like Microsoft and various other manufacturers vying for market share.

Key Factors to Consider Before the Q2 Earnings Report

Several key factors should be considered before the Q2 earnings report to get a comprehensive picture of Apple's performance and the outlook for Apple stock.

Pre-release Analyst Predictions and Expectations

Analysts' predictions provide valuable insights into the market's expectations for Apple's Q2 earnings. However, it's essential to consider the range of predictions and potential variations.

- Earnings Per Share (EPS): Analysts offer a range of EPS estimates, reflecting differing opinions on Apple's performance.

- Revenue Projections: Similar variations exist in revenue projections, reflecting uncertainty about sales growth across different product categories.

Evaluating Apple's Recent Product Launches and Their Success

The success of recently launched products significantly influences Q2 results. Assessing their market reception and sales figures is crucial.

- iPhone 14 Sales: The performance of the iPhone 14 series will be a major factor influencing overall revenue.

- New Mac and iPad Models: The sales of any new Mac or iPad models released also contribute significantly to Apple's financial performance.

Assessing the Overall Economic Outlook

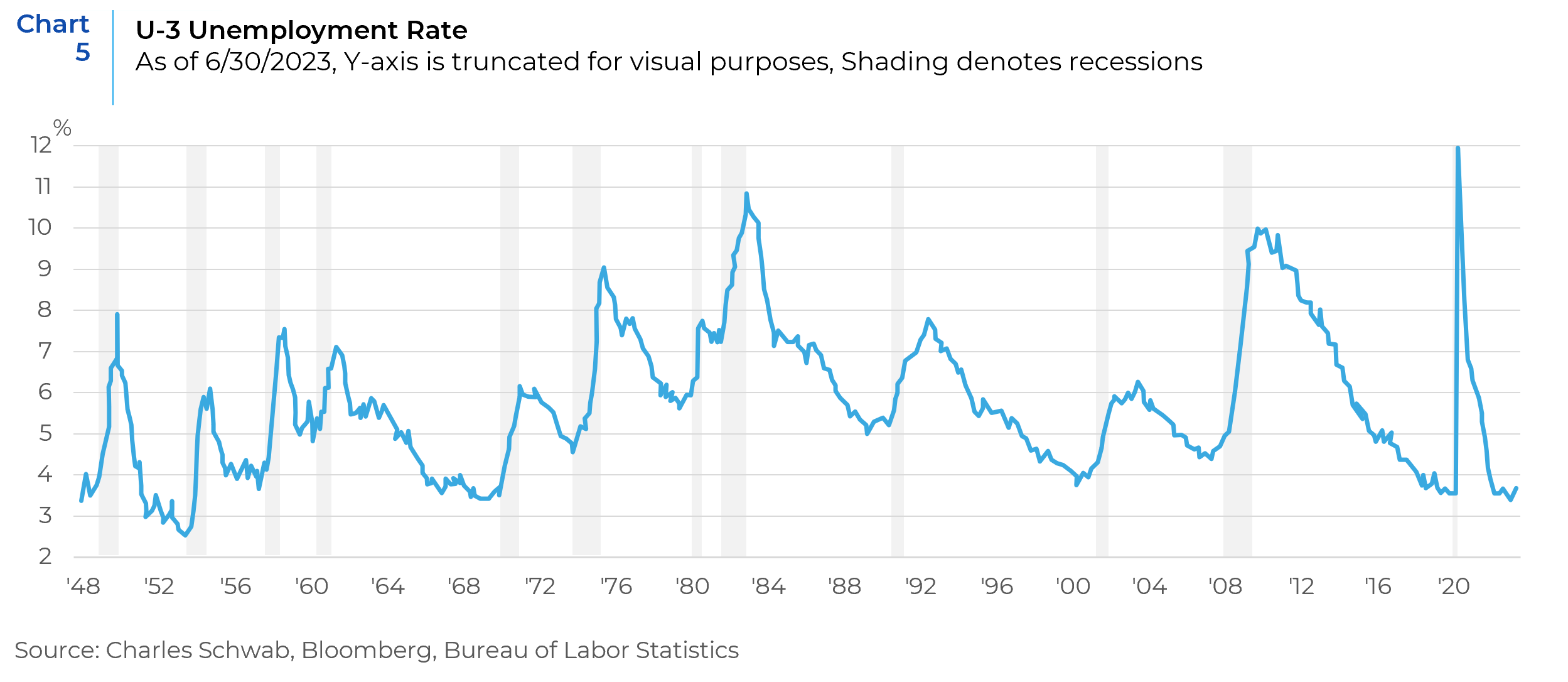

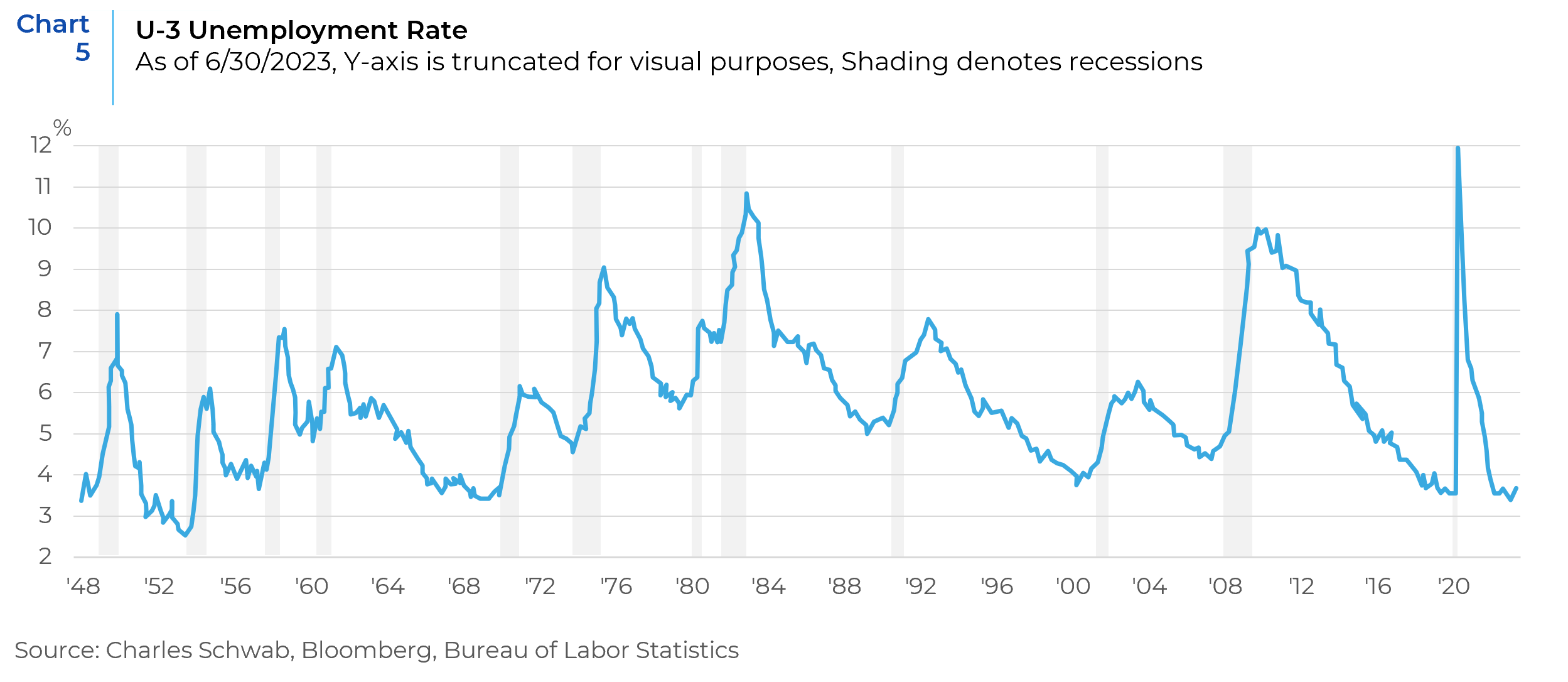

The broader macroeconomic environment significantly impacts Apple's performance. Analyzing key economic indicators helps assess potential risks and opportunities.

- Interest Rate Hikes: Rising interest rates can affect consumer spending and impact demand for Apple products.

- Global Economic Growth: Slower global economic growth could also negatively affect Apple's sales.

Strategies for Navigating Uncertainty in Apple Stock

Navigating the uncertainty surrounding Apple stock requires a well-defined investment strategy that incorporates risk management and careful analysis.

Diversification and Risk Management

Diversification is essential for managing risk in any investment portfolio. Don't put all your eggs in one basket.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Stop-Loss Orders: A stop-loss order automatically sells your shares if the price falls below a predetermined level, limiting potential losses.

Fundamental vs. Technical Analysis for Apple Stock

Both fundamental and technical analysis can be used to evaluate Apple stock. Each approach has its strengths and weaknesses.

- Fundamental Analysis: Focuses on the company's financial health, earnings, and future growth prospects.

- Technical Analysis: Focuses on price charts and other market data to identify trends and predict future price movements.

Long-Term vs. Short-Term Investment Strategies

The choice between a long-term or short-term investment strategy depends on your risk tolerance and investment goals.

- Long-Term Strategy: Suitable for investors with a higher risk tolerance and a long-term perspective on Apple's growth.

- Short-Term Strategy: More suitable for investors seeking quicker returns and willing to accept higher risk.

Conclusion: Making Informed Decisions about Apple Stock

The performance of Apple stock leading up to the Q2 results is influenced by a complex interplay of factors, including inflation, supply chain issues, competition, and the overall economic outlook. Careful analysis of these factors, coupled with sound risk management strategies, is crucial for making informed investment decisions. By understanding the key factors discussed above, you can make more informed decisions regarding your Apple stock holdings and navigate the uncertainty surrounding the Q2 results. Thorough research and a well-defined investment plan are essential for success in the ever-changing world of Apple stock investing.

Featured Posts

-

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 25, 2025 -

Escape To The Country Stars Chiswick Home Garden Feature

May 25, 2025

Escape To The Country Stars Chiswick Home Garden Feature

May 25, 2025 -

Analysis Former French Prime Ministers Views On Macron

May 25, 2025

Analysis Former French Prime Ministers Views On Macron

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Analysis And Insights

May 25, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Analysis And Insights

May 25, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 25, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 25, 2025

Latest Posts

-

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025 -

From Poop Papers To Podcast Gold Ai Driven Content Transformation

May 25, 2025

From Poop Papers To Podcast Gold Ai Driven Content Transformation

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025 -

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025 -

Will Elon Musk Continue To Support Dogecoin

May 25, 2025

Will Elon Musk Continue To Support Dogecoin

May 25, 2025