Apple Stock Performance: Q2 Earnings Beat Forecasts

Table of Contents

Revenue Growth Surpasses Expectations

Apple's Q2 revenue growth significantly exceeded predictions, driven by strong performance across multiple product lines.

Strong iPhone Sales Drive Revenue

- iPhone sales reached [insert actual or estimated sales figures], surpassing the previous quarter's figures by [percentage] and exceeding analyst expectations by [percentage].

- The iPhone 14 Pro Max and iPhone 14 Pro models continued to be significant contributors to overall sales, demonstrating strong consumer demand for premium features.

- Apple saw notable market share gains in key regions, solidifying its position as a leading smartphone manufacturer. This growth in iPhone sales is a key driver of the overall positive Apple stock performance.

Services Revenue Continues to Expand

Apple's services sector, encompassing the App Store, Apple Music, iCloud, Apple TV+, and other subscription services, continues its impressive growth trajectory.

- Services revenue grew by [percentage] year-over-year, reaching [insert actual or estimated revenue figures].

- Increased subscriber numbers across various services, coupled with the introduction of new subscription options and content, contributed significantly to this expansion. This consistent growth in Apple services reinforces the strength of the Apple ecosystem.

- The App Store remains a key revenue driver within the services segment, benefiting from both increased app downloads and in-app purchases.

Wearables and Accessories Maintain Momentum

Apple's wearables segment, including the Apple Watch and AirPods, maintained its positive momentum.

- Sales of the Apple Watch Series 8 and Apple Watch Ultra exceeded expectations, highlighting the continued popularity of smartwatches.

- AirPods sales remained robust, with strong demand driven by features like spatial audio and improved noise cancellation.

- New product launches and innovative features within the wearables sector have solidified Apple's position in this rapidly growing market.

Key Factors Contributing to Positive Earnings

Several key factors contributed to Apple's remarkably positive Q2 earnings.

Effective Supply Chain Management

Apple's ability to navigate ongoing supply chain disruptions and component shortages proved crucial to its success. Effective logistics and strategic partnerships helped mitigate potential production bottlenecks and ensure product availability.

Strong Brand Loyalty

Apple's strong brand loyalty continues to drive high demand for its products. Consumers consistently demonstrate a preference for the Apple ecosystem, fueling consistent sales across product categories. This brand loyalty translates directly into strong Apple stock performance.

Successful Product Launches

The successful launch of new products, such as the [mention specific new products], contributed significantly to revenue growth and reinforced Apple's innovative capabilities.

Impact on Apple Stock Price

The Q2 earnings report had an immediate and positive impact on Apple's stock price.

- Following the release of the earnings report, Apple's stock price experienced a [percentage]% increase.

- Investor sentiment improved significantly, with analysts upgrading their price targets for Apple stock.

- The positive earnings fueled speculation about future growth and potential for further stock price appreciation, creating positive Apple stock performance forecasts.

Future Outlook and Predictions

Apple's guidance for upcoming quarters indicates continued growth, although potential challenges remain.

- While Apple projects continued revenue growth, it acknowledges potential headwinds from macroeconomic factors and global economic uncertainty.

- Analysts predict ongoing strength in the services segment and continued demand for iPhones, but warn of potential slower growth in other product categories.

- The overall outlook for Apple remains positive, driven by its robust brand, innovative products, and effective management.

Conclusion: Apple Stock Performance: A Positive Outlook

Apple's Q2 earnings report showcased exceptionally strong performance, exceeding expectations and demonstrating resilience in a challenging economic environment. Strong iPhone sales, expanding services revenue, and effective supply chain management were key contributors to this success, significantly impacting Apple stock price. While future challenges exist, the overall outlook remains positive, fueled by Apple's brand strength and innovation. Stay informed on the latest Apple stock performance and Apple earnings reports to make informed investment decisions. Learn more about Apple stock price trends and analysis on [link to relevant resource].

Featured Posts

-

Unprecedented Global Forest Loss The Devastating Impact Of Wildfires

May 24, 2025

Unprecedented Global Forest Loss The Devastating Impact Of Wildfires

May 24, 2025 -

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025 -

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 24, 2025

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 24, 2025 -

Aex Rally Positieve Marktbewegingen Na Trumps Uitstel

May 24, 2025

Aex Rally Positieve Marktbewegingen Na Trumps Uitstel

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owner Convicted Of Faking Test Results

May 24, 2025

Covid 19 Pandemic Lab Owner Convicted Of Faking Test Results

May 24, 2025 -

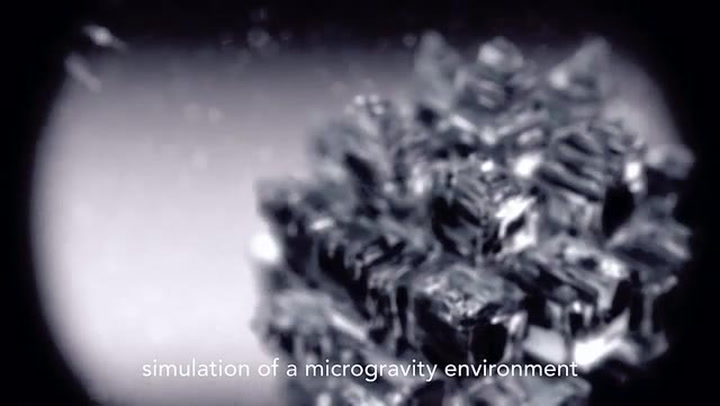

Improving Drug Development Through Space Grown Crystals

May 24, 2025

Improving Drug Development Through Space Grown Crystals

May 24, 2025 -

Microsoft Email Ban On Palestine Sparks Employee Outrage And Debate

May 24, 2025

Microsoft Email Ban On Palestine Sparks Employee Outrage And Debate

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Rumored Open Ai Jony Ive Ai Hardware Deal Fact Or Fiction

May 24, 2025

The Rumored Open Ai Jony Ive Ai Hardware Deal Fact Or Fiction

May 24, 2025