Apple Stock Prediction: $254? Is AAPL A Buy Near $200?

Table of Contents

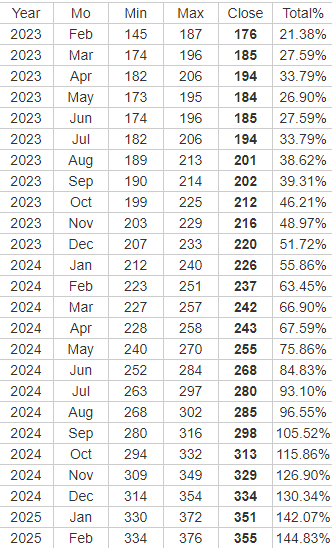

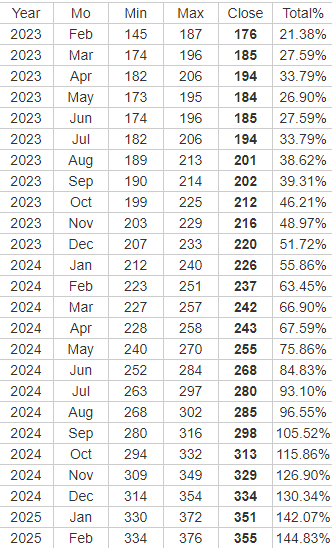

Apple, a tech giant dominating the global market, has seen its stock price fluctuate recently. Trading near $200, the question on many investors' minds is: could AAPL reach $254? This article delves into an Apple stock prediction, analyzing whether AAPL stock is a worthwhile investment at its current price point, considering the potential for significant growth. We'll examine Apple's financial performance, future product launches, market trends, and overall risk assessment to determine if this prediction is realistic and if investing in AAPL is the right move for you. Key factors like "Apple Stock Prediction," "AAPL Stock," and the current "Apple Stock Price" will be central to our analysis.

2. Apple's Financial Performance & Future Projections: Analyzing AAPL's Growth Potential

H2: Recent Earnings Reports and Revenue Growth:

Apple's recent quarterly earnings reports paint a picture of continued growth, although the pace might be slowing compared to previous boom years. Analyzing key metrics like Earnings Per Share (EPS), total revenue, and profit margins provides valuable insight. For example, while revenue growth may show a slight deceleration, the company continues to demonstrate strong profitability.

- AAPL earnings: Consistent positive earnings demonstrate the company's financial strength.

- Apple revenue growth: Even with a slight slowdown, revenue growth remains impressive, suggesting a robust market position.

- Apple profit margin: High profit margins indicate efficient operations and pricing power.

H2: Product Pipeline and Innovation:

Apple's innovative product pipeline is a crucial driver of future growth. Upcoming releases like the iPhone 15 series, new Apple Watch models, and potential advancements in the Mac lineup promise to capture significant market share.

- Apple iPhone: The iPhone remains Apple's flagship product and a major revenue contributor. New models and features continue to drive sales.

- Apple Watch sales: The Apple Watch continues to expand its market share in the wearable technology segment.

- Apple innovation: Investments in AR/VR, AI, and other cutting-edge technologies suggest a strong commitment to future innovation, which is likely to yield significant returns.

- New Apple products: The introduction of new products and services contributes to revenue diversification and sustained growth.

H2: Market Analysis and Competitive Landscape:

Apple maintains a strong position in the tech market, despite facing stiff competition from Samsung, Google, and other tech giants. Analyzing "Apple market share" against competitors is essential. The competitive landscape is dynamic, with new technologies constantly emerging.

- Apple market share: Apple holds significant market share across several key product categories.

- Tech market competition: Competition is fierce, requiring Apple to continuously innovate and adapt.

- Apple competitors: Analyzing competitor strategies and performance is vital for assessing Apple's future prospects.

3. Valuation and Risk Assessment: Is AAPL Overvalued at Current Prices?

H2: Price-to-Earnings Ratio (P/E) and Other Key Metrics:

To determine whether AAPL is overvalued, we need to analyze key valuation metrics. The Price-to-Earnings ratio (P/E ratio) is a common metric, comparing the stock price to its earnings per share. Other metrics like the Price-to-Sales ratio (P/S) and PEG ratio offer additional insights.

- AAPL valuation: Comparing Apple's valuation to its historical data and industry peers helps determine whether it's currently undervalued or overvalued.

- Apple P/E ratio: Analyzing Apple's P/E ratio in relation to its historical average and industry benchmarks is crucial.

- Stock valuation metrics: Utilizing multiple valuation metrics provides a more comprehensive assessment of AAPL's valuation.

H2: Identifying Potential Risks:

Investing in any stock involves risk. Several factors could impact Apple's future performance:

- Apple risk assessment: Thoroughly evaluating potential risks is crucial for informed investment decisions.

- Economic risks: Economic downturns could impact consumer spending and affect Apple's sales.

- Supply chain risk: Disruptions to Apple's supply chain could impact production and sales.

4. Apple Stock Prediction: Reaching $254 – A Realistic Target?

H2: Analyst Predictions and Price Targets:

Many financial analysts offer price targets for AAPL, providing various "Apple stock forecast" scenarios. These predictions should be viewed with caution, as they reflect varying methodologies and assumptions. A range of price targets often exists.

- AAPL price target: Analyst price targets should be considered along with your own analysis and risk tolerance.

- Apple stock forecast: Various forecasts are available, but a diversified approach is key to investing decisions.

- Analyst predictions: Consider the rationale behind analyst predictions before drawing conclusions.

H2: Factors Supporting the $254 Prediction:

Several factors could contribute to AAPL reaching $254: strong financial performance, successful new product launches, and positive market sentiment. Sustained "Apple stock growth" hinges on these factors.

- Apple stock growth: Sustained revenue growth and expanding profit margins are vital.

- AAPL potential: The vast potential of the Apple ecosystem and ongoing innovation drive the $254 prediction.

- Apple stock price prediction: The $254 prediction rests on several optimistic assumptions about the future.

H2: Potential Challenges to Reaching $254:

Several factors could prevent AAPL from reaching $254, including:

- Apple stock challenges: Economic slowdowns, increased competition, or negative market sentiment present challenges.

- AAPL risks: These risks must be carefully considered before investing.

- Market volatility: Market fluctuations can significantly impact stock prices.

5. Conclusion: Is AAPL a Buy Near $200? Your Next Steps for Investing in Apple Stock

Our analysis suggests that while AAPL offers significant growth potential, driven by a strong financial performance and an innovative product pipeline, reaching $254 depends on several factors, including macroeconomic conditions and the competitive landscape. Investing in AAPL involves both potential upside and considerable downside risks. The "Apple stock prediction" of $254 remains a possibility, but not a certainty. Before investing in AAPL stock near $200, conduct thorough research, assess your risk tolerance, and consider your personal investment goals. Remember, this is not financial advice, and you should consult a financial professional before making any investment decisions. Consider your own "Apple stock prediction" carefully before acting on this information.

Featured Posts

-

Porsche Indonesia Menyambut Classic Art Week 2025

May 25, 2025

Porsche Indonesia Menyambut Classic Art Week 2025

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025 -

Prepustanie V Nemecku Najvaecsie Spolocnosti Redukuju Pracovne Miesta

May 25, 2025

Prepustanie V Nemecku Najvaecsie Spolocnosti Redukuju Pracovne Miesta

May 25, 2025 -

Avrupa Daki Borsalarin Guenluek Performansi Karisik Sonuclar

May 25, 2025

Avrupa Daki Borsalarin Guenluek Performansi Karisik Sonuclar

May 25, 2025 -

Svadby Na Kharkovschine 600 Brakov Za Mesyats Chto Eto Znachit

May 25, 2025

Svadby Na Kharkovschine 600 Brakov Za Mesyats Chto Eto Znachit

May 25, 2025

Latest Posts

-

Bradford And Wyoming Counties Under Flash Flood Warning Due To Thunderstorms

May 25, 2025

Bradford And Wyoming Counties Under Flash Flood Warning Due To Thunderstorms

May 25, 2025 -

Wednesday Coastal Flood Advisory Update For Southeast Pennsylvania

May 25, 2025

Wednesday Coastal Flood Advisory Update For Southeast Pennsylvania

May 25, 2025 -

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday Evening

May 25, 2025

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday Evening

May 25, 2025 -

Southeast Pa Coastal Flood Advisory Issued For Wednesday

May 25, 2025

Southeast Pa Coastal Flood Advisory Issued For Wednesday

May 25, 2025 -

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025