Apple Stock: Q2 Earnings And Price Predictions

Table of Contents

Q2 Earnings Report Analysis

Apple's Q2 2024 earnings report provided a mixed bag for investors. A thorough analysis is crucial for understanding the current trajectory of the Apple stock price.

Revenue and Earnings Per Share (EPS)

Apple reported [Insert Actual Revenue Figures Here] in revenue for Q2 2024, representing a [Insert Percentage Change]% change compared to Q2 2023. The Earnings Per Share (EPS) came in at [Insert Actual EPS Figures Here], exceeding analyst expectations of [Insert Analyst Expectation for EPS Here] by [Insert Difference].

-

Key Revenue Drivers:

- iPhone sales remained a significant contributor, although growth slowed compared to previous quarters. This indicates a possible market saturation and increased competition.

- The Services segment continued its strong performance, demonstrating the growing importance of recurring revenue streams for Apple.

- Wearables, Home, and Accessories showed [Insert Growth Percentage or Decline] growth, indicating [Analyze the implication of this growth or decline].

-

Unexpected Performance:

- [Mention any specific product category or geographical region that performed significantly better or worse than expected, and explain why.]

-

Guidance for Future Quarters: Apple provided guidance for Q3 2024, projecting [Insert Apple's Guidance for Revenue and/or EPS]. This suggests [Analyze the implication of Apple's Guidance].

Key Performance Indicators (KPIs)

Beyond revenue and EPS, several other KPIs offer a comprehensive view of Apple's financial health.

-

Gross Margin: Apple reported a gross margin of [Insert Actual Gross Margin]% in Q2 2024, [Compare to previous quarter and industry benchmarks]. This indicates [Analyze implication of the gross margin].

-

Operating Income: Operating income reached [Insert Actual Operating Income], showcasing [Analyze implication of operating income].

-

Cash Flow: Strong free cash flow remains a key strength for Apple, providing resources for future investments, share buybacks, and dividend payments. Q2 saw [Insert Actual Cash Flow figures].

-

KPI Comparisons: Compared to competitors like Samsung and Microsoft, Apple's [mention specific KPIs] are [favorable/unfavorable] indicating [Analyze the competitive landscape].

-

Potential Concerns: While Apple's overall performance was positive, potential concerns include [Mention any potential long-term challenges, such as competition in specific markets or supply chain vulnerabilities].

Impact of Global Economic Conditions

Global macroeconomic factors played a role in Apple's Q2 performance.

-

Inflation and Interest Rates: Rising inflation and interest rates impacted consumer spending, potentially influencing demand for Apple products, especially higher-priced items.

-

Supply Chain Issues: While supply chain disruptions seem to be easing, lingering challenges could still affect production and availability of certain products.

-

Geopolitical Risks: Geopolitical uncertainties, such as the ongoing conflict in Ukraine, create uncertainty for the global economy and could impact Apple's future performance.

-

Mitigation Strategies: Apple has implemented various strategies to mitigate these risks, including diversifying its supply chain and focusing on cost optimization.

-

Long-Term Impact: The long-term impact of these macroeconomic conditions remains uncertain, and could significantly influence the Apple stock price predictions.

Apple Stock Price Predictions

Predicting the future price of Apple stock requires analyzing various factors and considering different perspectives.

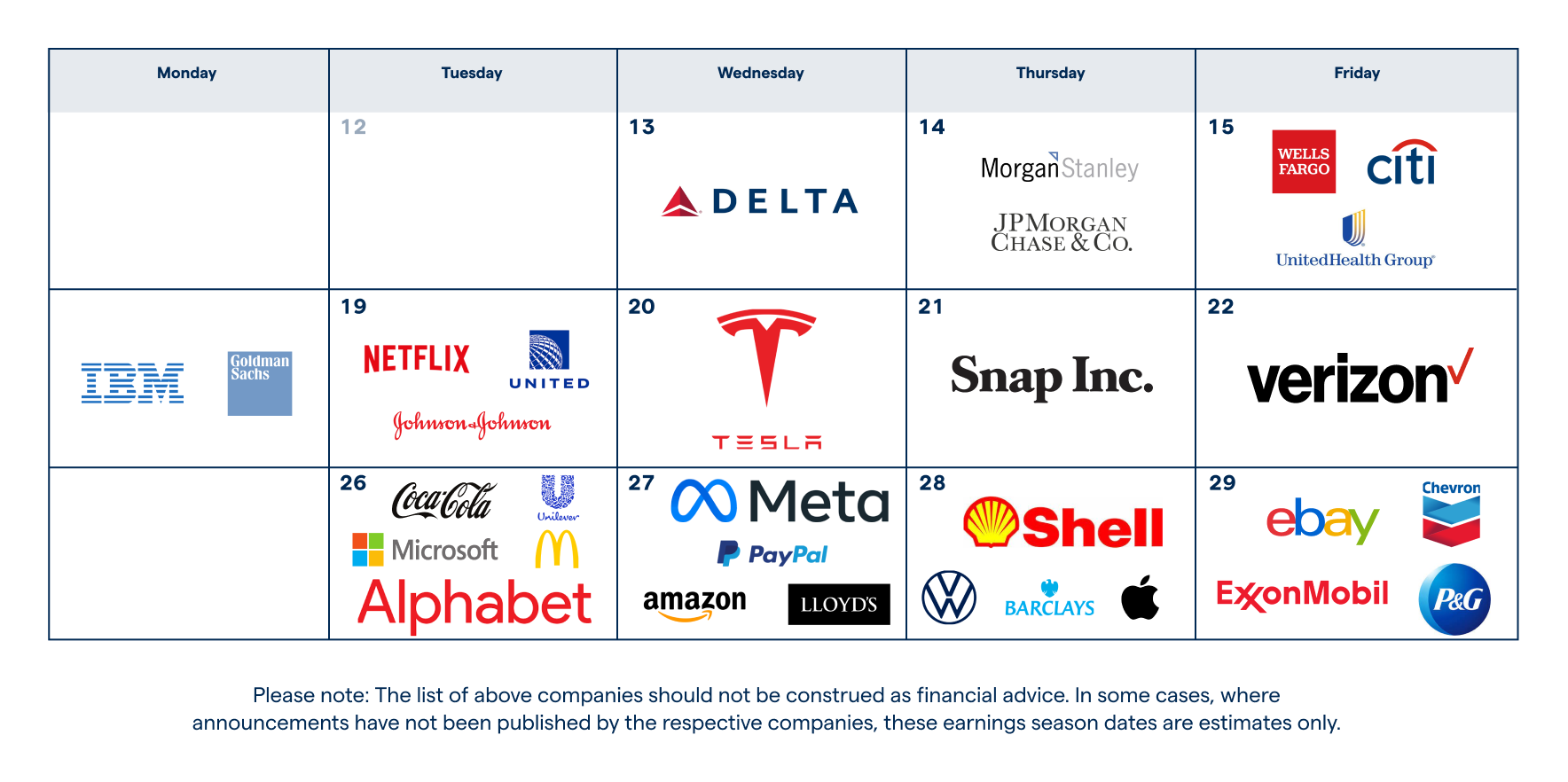

Analyst Forecasts

Financial analysts offer a range of Apple stock price predictions.

- Target Prices: [List predictions from reputable sources, including their target prices and timelines. Example: Goldman Sachs predicts a price of $200 by the end of 2024, while Morgan Stanley forecasts $180.]

- Underlying Assumptions: These predictions are based on different assumptions regarding Apple's future growth rate, market share, and margins.

- Risks and Uncertainties: It's important to note that these are only predictions, and actual results may vary significantly due to unforeseen circumstances.

Factors Influencing Price Predictions

Several factors are expected to significantly influence Apple stock price.

- Product Launches: The upcoming iPhone 15 launch and potential new MacBooks will significantly impact investor sentiment and stock price.

- Technological Innovation: Apple's continued investment in research and development will drive future growth and innovation. Areas like augmented reality and electric vehicles are potential future drivers of growth.

- Competitive Landscape: Increasing competition from companies like Samsung and Google could put downward pressure on Apple's market share and profitability.

- Market Sentiment: Overall market conditions and investor sentiment toward the tech sector will also play a crucial role.

Investment Strategies

Based on the Q2 earnings and price predictions, investors can consider different strategies.

- Long-Term Investment: For long-term investors with a high risk tolerance, Apple stock remains an attractive option due to its strong brand, recurring revenue streams, and potential for long-term growth.

- Short-Term Trading: Short-term trading based on news and market movements requires careful analysis and a high degree of risk tolerance.

- Diversification: Diversifying investments across various asset classes is always recommended to mitigate risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Conclusion

Apple's Q2 earnings report provides valuable insights into the company's performance and future outlook. While the predictions for Apple stock vary among analysts, understanding the key drivers behind these forecasts—including revenue growth, KPIs, macroeconomic conditions, and future product launches—is crucial for informed investment decisions. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions regarding Apple stock. Stay informed about future earnings reports and market analysis to make the most well-informed decisions concerning your Apple stock investments. Keep a close eye on Apple stock news and analysis to make optimal decisions about your Apple stock portfolio.

Featured Posts

-

Escape To The Country A Step By Step Relocation Guide

May 24, 2025

Escape To The Country A Step By Step Relocation Guide

May 24, 2025 -

Kto Skolko Let V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Kto Skolko Let V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

May 24, 2025

Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

May 24, 2025 -

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

San Franciscos Anchor Brewing Shuts Its Doors After 127 Years

May 24, 2025

San Franciscos Anchor Brewing Shuts Its Doors After 127 Years

May 24, 2025

Latest Posts

-

A Deep Dive Into Data How Ai Creates A Poop Podcast From Repetitive Documents

May 24, 2025

A Deep Dive Into Data How Ai Creates A Poop Podcast From Repetitive Documents

May 24, 2025 -

Ai Generated Poop Podcast Extracting Meaning From Repetitive Scatological Documents

May 24, 2025

Ai Generated Poop Podcast Extracting Meaning From Repetitive Scatological Documents

May 24, 2025 -

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025 -

Covid 19 Pandemic Lab Owner Convicted Of Faking Test Results

May 24, 2025

Covid 19 Pandemic Lab Owner Convicted Of Faking Test Results

May 24, 2025 -

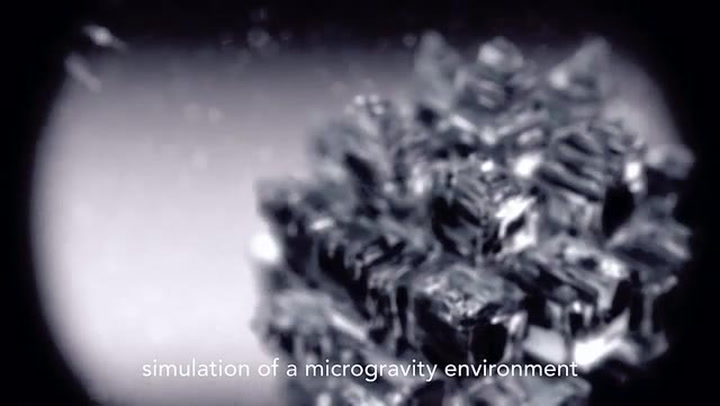

Improving Drug Development Through Space Grown Crystals

May 24, 2025

Improving Drug Development Through Space Grown Crystals

May 24, 2025