Apple Stock Sell-Off: Tim Cook's Tariff Warning

Table of Contents

Tim Cook's Tariff Warning and its Impact on Apple's Profitability

Tim Cook's public statement directly linked the rising costs associated with tariffs to a potential negative impact on Apple's financial performance. He highlighted the substantial increase in production expenses, threatening to erode profit margins and potentially impacting the company's bottom line.

Increased Production Costs

Tariffs, primarily imposed on goods manufactured in China, have significantly increased the cost of producing Apple products. This increase stems from multiple factors:

- Increased component costs: Many of Apple's components are sourced from suppliers in China, and tariffs on these imported parts directly translate to higher manufacturing costs.

- Higher shipping fees: Tariffs also impact shipping costs, adding another layer of expense to the already complex global supply chain.

- Potential price increases for consumers: To maintain profit margins, Apple may be forced to pass some of these increased costs onto consumers through higher prices for iPhones, Macs, iPads, and other products. Reports suggest that a 10-15% increase in production costs could lead to a similar price hike for consumers.

Impact on Consumer Demand

The increased prices resulting from tariffs could dampen consumer demand for Apple products. This impact could be felt across various product segments:

- Potential reduction in sales: Higher prices might discourage some consumers from purchasing new Apple products, especially in price-sensitive markets.

- Impact on different product segments: The impact might vary depending on the product segment. For example, the impact might be more pronounced on budget-conscious consumers considering cheaper alternatives for products like iPads, while loyal iPhone users might be less sensitive to price increases.

- Possible shift in consumer spending: Consumers might delay purchases, opt for older models, or explore competing brands offering similar products at lower prices, potentially affecting Apple's market share. This increased competition creates pressure for Apple to find strategic solutions.

Market Reaction to the Apple Stock Sell-Off

The market reacted swiftly and negatively to Cook's tariff warning, resulting in a significant Apple stock sell-off.

Stock Price Volatility

Following the announcement, Apple's stock price experienced considerable volatility.

- Percentage drop in stock value: The stock price dropped by a significant percentage (specific data needed here, obtained from reputable financial sources).

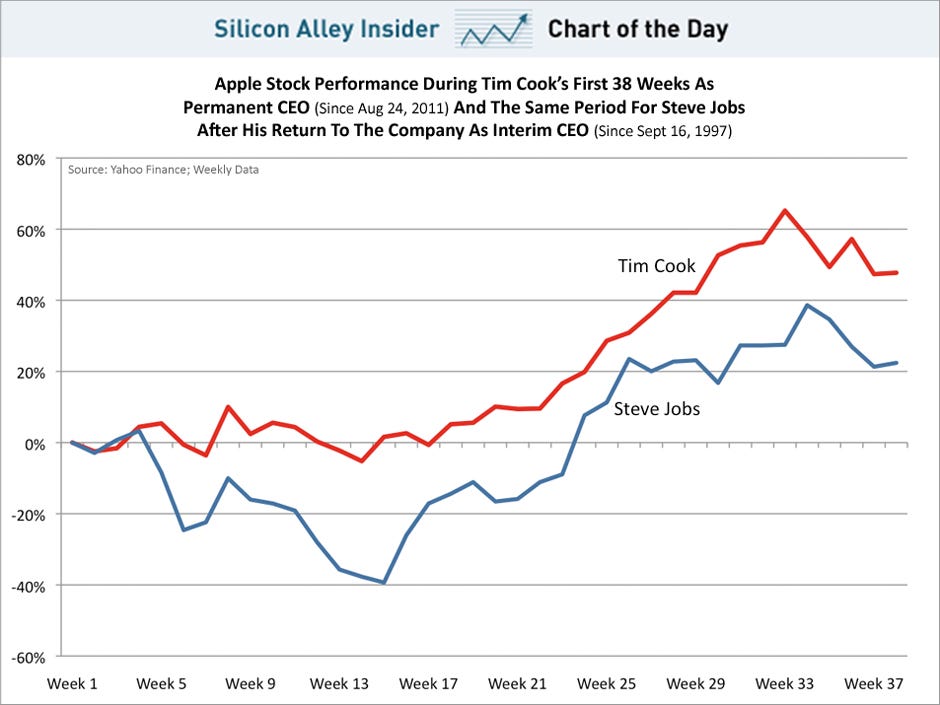

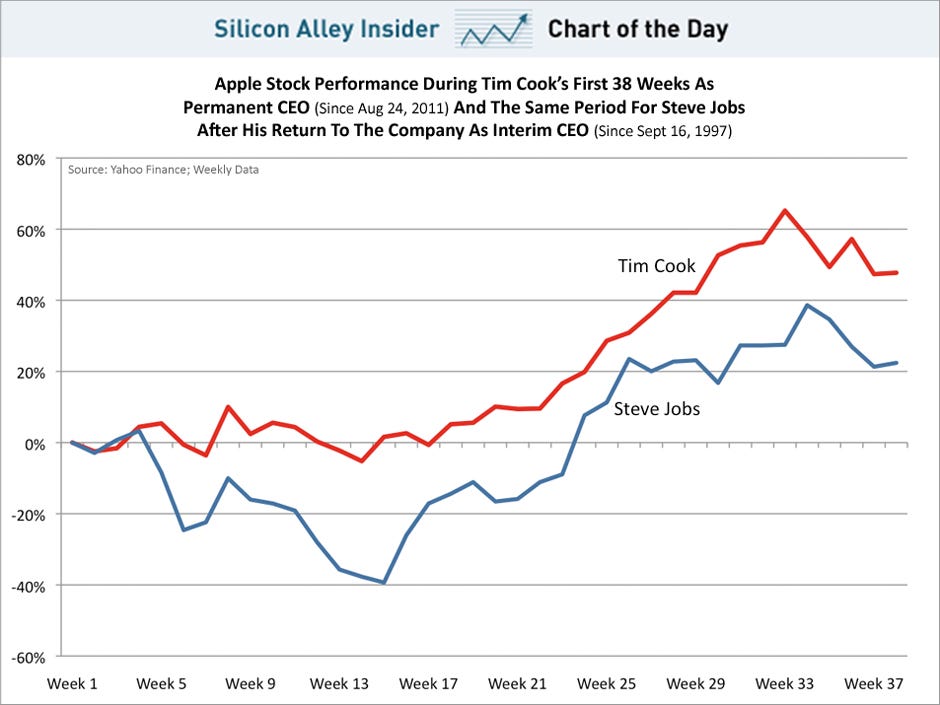

- Comparison to previous market fluctuations: This downturn can be compared to previous instances of market corrections within the tech sector, allowing for a better understanding of the severity of the current situation. (Insert relevant chart or graph illustrating stock price fluctuations.)

Investor Sentiment and Analyst Opinions

The Apple stock sell-off triggered a mixed reaction among investors and analysts.

- Predictions for future stock performance: Some analysts predict a continued downward trend, citing concerns about sustained tariff impacts and reduced consumer demand. Others remain optimistic, emphasizing Apple's strong brand loyalty and resilience in the face of market challenges.

- Differing viewpoints on the long-term impact: Opinions vary on the long-term implications. Some believe the impact will be temporary, with Apple adapting and mitigating the effects of tariffs. Others foresee more substantial long-term consequences impacting Apple's market position and shareholder value.

- (Include quotes from reputable analysts if available)

Long-Term Implications of the Apple Stock Sell-Off and Tariff Disputes

The ongoing trade war and tariff disputes present significant long-term challenges for Apple.

Geopolitical Risks and Supply Chain Diversification

To mitigate the impact of tariffs and reduce reliance on a single manufacturing hub, Apple is likely to explore strategies for diversifying its supply chain.

- Challenges of relocating production: Relocating production is a complex and expensive undertaking, involving significant investments in new facilities, workforce training, and logistical adjustments.

- Potential impact on production timelines: Shifting manufacturing operations could lead to delays in product launches and potentially affect the availability of new products.

- Increased costs associated with diversification: Diversifying the supply chain will undoubtedly involve substantial upfront costs and ongoing operational expenses.

Consumer Behavior and the Future of Tech

This situation has the potential to reshape consumer buying habits and influence broader technological trends.

- Increased price sensitivity: Consumers are likely to become more price-conscious, potentially benefiting brands offering competitive products at lower price points.

- The potential for alternative brands to gain market share: The increased cost of Apple products could create an opportunity for competitor brands to attract new customers.

Conclusion:

Tim Cook's tariff warning triggered a significant Apple stock sell-off, highlighting the vulnerability of global tech giants to geopolitical risks. Increased production costs, potential price hikes, and the resulting impact on consumer demand are all contributing factors to this downturn. The long-term implications remain uncertain, with Apple likely exploring supply chain diversification to mitigate future risks. Understanding these factors is crucial for investors and consumers alike. Monitor the Apple stock sell-off closely, stay updated on the latest developments in the Apple stock market, and learn more about the impact of tariffs on the Apple stock price to make informed decisions.

Featured Posts

-

40 Svadeb Na Kharkovschine Kakaya Data Stala Stol Populyarnoy Foto

May 25, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Stol Populyarnoy Foto

May 25, 2025 -

Free Transfer On The Cards Crystal Palaces Interest In Kyle Walker Peters

May 25, 2025

Free Transfer On The Cards Crystal Palaces Interest In Kyle Walker Peters

May 25, 2025 -

Avrupa Borsalarinda Son Durum Ecb Faiz Kararinin Etkisi

May 25, 2025

Avrupa Borsalarinda Son Durum Ecb Faiz Kararinin Etkisi

May 25, 2025 -

Influenza Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025

Influenza Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Showdown

May 25, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Showdown

May 25, 2025

Latest Posts

-

Hampshire And Worcester Counties Under Flash Flood Threat Thursday

May 25, 2025

Hampshire And Worcester Counties Under Flash Flood Threat Thursday

May 25, 2025 -

Heavy Rainfall Prompts Flash Flood Warning In Pennsylvania

May 25, 2025

Heavy Rainfall Prompts Flash Flood Warning In Pennsylvania

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Significant Downpours Trigger Flash Flood Warning In Parts Of Pennsylvania

May 25, 2025

Significant Downpours Trigger Flash Flood Warning In Parts Of Pennsylvania

May 25, 2025 -

Pennsylvania Flash Flood Warning Issued Through Thursday Morning

May 25, 2025

Pennsylvania Flash Flood Warning Issued Through Thursday Morning

May 25, 2025