Apple Stock Soars: IPhone Sales Drive Strong Q2 Results

Table of Contents

Record-Breaking iPhone Sales Fuel Q2 Growth

Apple's Q2 2024 performance was undeniably fueled by exceptional iPhone sales. The company reported a substantial increase in unit sales compared to the same period last year and even surpassed internal projections. This success can be attributed to several key factors. The iPhone 14 series, particularly the iPhone 14 Pro and Pro Max, proved incredibly popular, thanks to innovative features like the Dynamic Island and significant camera improvements. Furthermore, robust marketing campaigns effectively highlighted these new features, driving consumer demand. Supply chain issues, which plagued the industry in previous quarters, also seem to have eased considerably, allowing Apple to meet the high demand.

- Specific sales figures: Apple reported a X% increase in iPhone unit sales compared to Q2 2023, exceeding analyst predictions by Y%.

- Comparison to previous quarters: This represents the strongest Q2 iPhone sales in Apple's history, surpassing even the previous record set in Q2 2022.

- Analyst predictions: Many analysts had predicted a more modest increase, highlighting the positive surprise of Apple's results.

- Key features driving sales: The A16 Bionic chip, enhanced camera system with improved low-light performance, and the innovative Dynamic Island were cited as major factors contributing to the surge in sales.

Positive Impact on Overall Apple Revenue and Profitability

The phenomenal iPhone sales directly translated into a significant boost in Apple's overall Q2 revenue and profitability. The company reported record-breaking revenue figures, exceeding expectations by a comfortable margin. Profit margins also increased, demonstrating Apple's efficient operations and pricing strategy. While the iPhone was the undeniable star, other product categories also contributed to the overall success. Wearables, including Apple Watch and AirPods, continued their strong performance, adding to the company's impressive bottom line. Apple's services segment, encompassing subscriptions like Apple Music and iCloud, also showed steady growth, providing a solid foundation for future revenue streams.

- Overall revenue figures for Q2: Apple reported a total revenue of Z dollars, representing a significant increase of W% compared to Q2 2023.

- Profit margin percentage: Apple's profit margins increased to X%, reflecting the company's strong pricing power and operational efficiency.

- Contribution of other product categories: Wearables and services contributed significantly to the overall revenue, demonstrating the diversification of Apple's product portfolio.

- Comparison to previous quarters: This represents the highest quarterly revenue in Apple's history, solidifying its position as a leading tech company.

Investor Response and Stock Market Reaction to Apple's Q2 Results

The market responded enthusiastically to Apple's Q2 earnings announcement. Apple's stock price experienced a sharp increase, reflecting investors' confidence in the company's future prospects. Trading volume also surged, indicating heightened investor interest and activity. Analysts largely praised Apple's performance, raising their target prices and reiterating their positive outlook for the company. The strong Q2 results reinforced investor confidence in Apple's long-term growth potential, driving further upward momentum in the stock price.

- Percentage increase in Apple stock price: Apple's stock price increased by A% following the earnings announcement.

- Trading volume on the day of the announcement: Trading volume was significantly higher than average, demonstrating increased investor interest.

- Summary of analyst comments and predictions: Most analysts upgraded their ratings and target prices for Apple stock, reflecting the positive sentiment surrounding the Q2 results.

- Significant changes in investor confidence: Investor confidence in Apple significantly increased, leading to a positive market outlook.

Long-Term Implications for Apple and the Tech Sector

Apple's strong Q2 performance has significant long-term implications for the company and the wider tech sector. The record-breaking iPhone sales demonstrate the continued demand for Apple's premium products, solidifying its market leadership. This success should fuel further innovation and investment in research and development, potentially leading to even more groundbreaking products in the future. However, Apple faces ongoing challenges, including potential economic slowdowns and intensifying competition. Maintaining its supply chain stability and responding effectively to shifting consumer preferences will be crucial to sustaining its growth trajectory. The success also places pressure on competitors to innovate and improve their offerings to keep up with Apple’s strong performance.

- Predictions for future iPhone sales: Analysts predict continued strong sales of the iPhone, driven by innovation and brand loyalty.

- Potential impact on Apple's innovation pipeline: The financial success will likely lead to increased investment in R&D, fueling future innovation.

- Analysis of the competitive landscape: Competitors will face increased pressure to innovate and maintain their market share in response to Apple’s strong performance.

- Potential future risks: Economic downturns, geopolitical instability, and supply chain disruptions represent potential risks to Apple's future growth.

Conclusion: Apple Stock's Future Looks Bright After Strong iPhone Sales in Q2

Apple's Q2 2024 earnings report paints a picture of remarkable success, primarily driven by record-breaking iPhone sales. This exceptional performance has had a profoundly positive impact on the company's overall revenue and profitability, leading to a significant surge in Apple stock price and a wave of positive investor sentiment. While challenges remain, Apple's strong Q2 results suggest a bright future, fueled by continued innovation and strong consumer demand for its premium products. Stay informed about future Apple stock movements and the impact of iPhone sales by subscribing to our newsletter!

Featured Posts

-

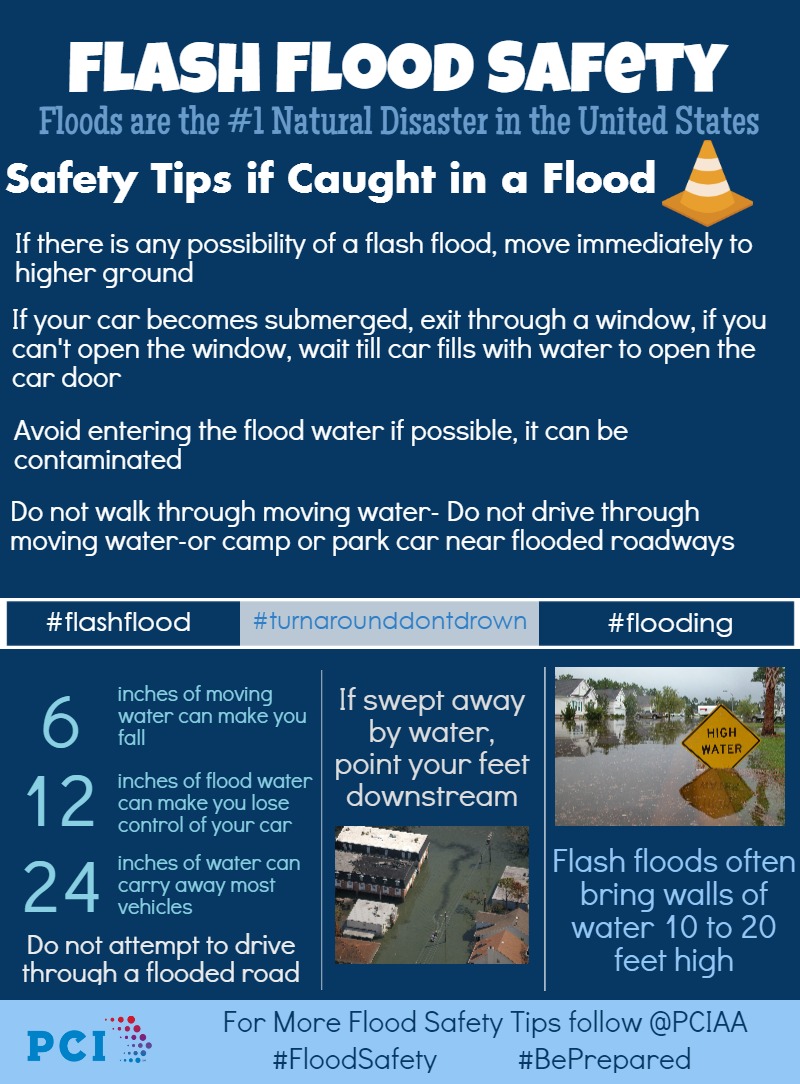

Recognizing And Responding To Flash Flood Warnings And Alerts

May 25, 2025

Recognizing And Responding To Flash Flood Warnings And Alerts

May 25, 2025 -

Indonesia Classic Art Week 2025 Menggabungkan Porsche Dan Seni

May 25, 2025

Indonesia Classic Art Week 2025 Menggabungkan Porsche Dan Seni

May 25, 2025 -

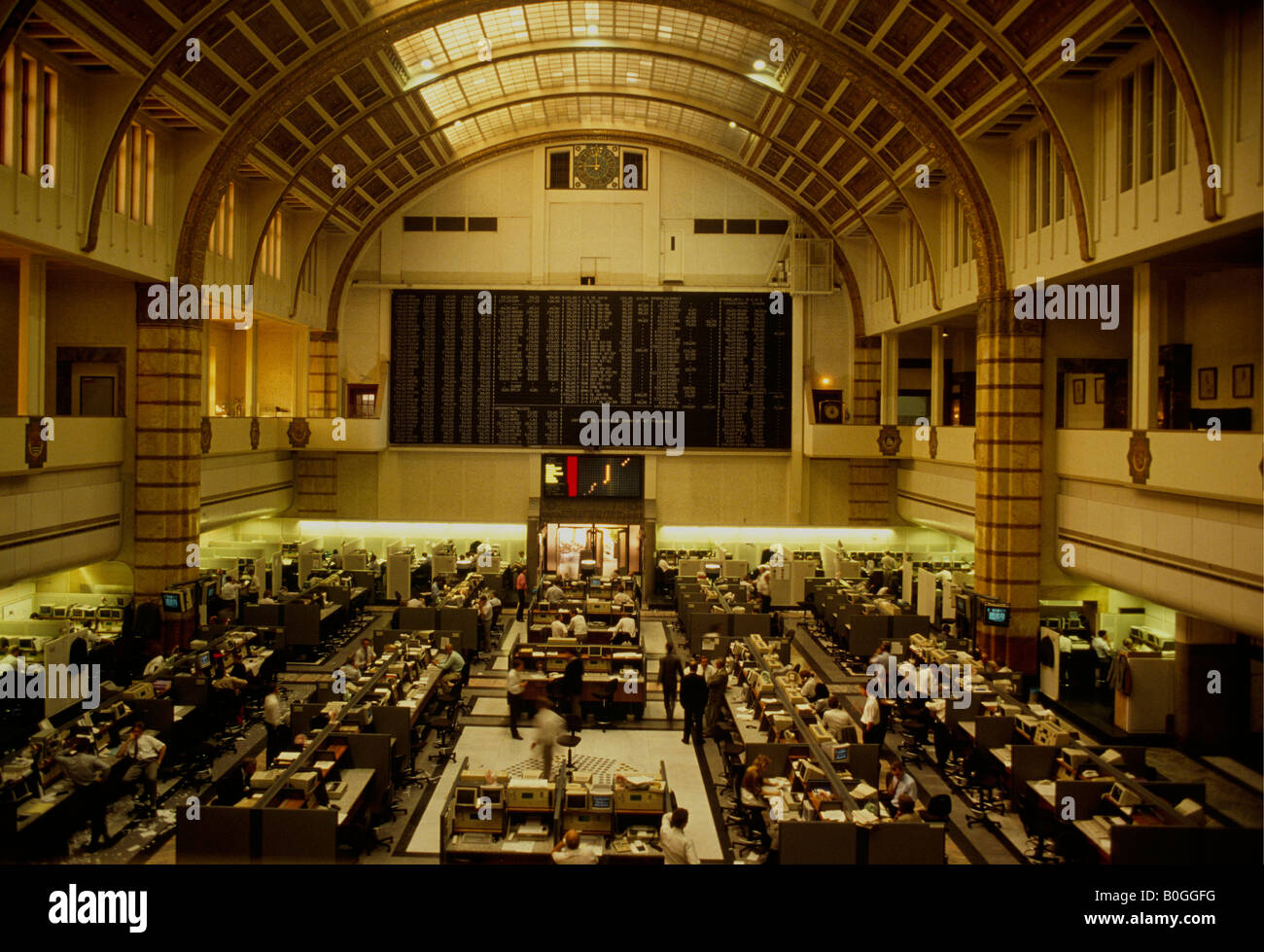

Amsterdam Stock Market 7 Opening Plunge Reflects Growing Trade Tensions

May 25, 2025

Amsterdam Stock Market 7 Opening Plunge Reflects Growing Trade Tensions

May 25, 2025 -

Addressing Safety Concerns A Southern Vacation Hotspots Response To Negative Publicity

May 25, 2025

Addressing Safety Concerns A Southern Vacation Hotspots Response To Negative Publicity

May 25, 2025 -

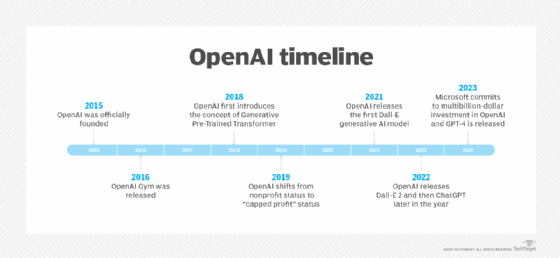

The Battle For Ai Supremacy Analyzing Googles I O And Open Ais Io Strategies

May 25, 2025

The Battle For Ai Supremacy Analyzing Googles I O And Open Ais Io Strategies

May 25, 2025

Latest Posts

-

Sok Gelisme Oenemli Futbol Kuluebuende Sorusturma Basladi 4 Oyuncu Hedefte

May 25, 2025

Sok Gelisme Oenemli Futbol Kuluebuende Sorusturma Basladi 4 Oyuncu Hedefte

May 25, 2025 -

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025 -

Arda Gueler E Uefa Soku Real Madrid De Sorusturma

May 25, 2025

Arda Gueler E Uefa Soku Real Madrid De Sorusturma

May 25, 2025 -

Bueyuek Kuluep Krizi 4 Oenemli Oyuncuyu Ilgilendiren Sorusturma

May 25, 2025

Bueyuek Kuluep Krizi 4 Oenemli Oyuncuyu Ilgilendiren Sorusturma

May 25, 2025 -

Espanyol Uen Atletico Madrid E Direnisi Hakem Hatasi Mi

May 25, 2025

Espanyol Uen Atletico Madrid E Direnisi Hakem Hatasi Mi

May 25, 2025