Apple Stock: Wedbush Analyst Maintains Bullish Stance Despite Lower Price Target – What Does It Mean For Investors?

Table of Contents

Wedbush's Bullish Stance on Apple Stock

Wedbush Securities is a highly respected financial analyst firm with a long history of providing insightful market commentary and investment recommendations. Their recent report on Apple stock continues to project positive growth for the company, highlighting several key factors underpinning their bullish stance.

-

Original price target vs. revised price target: While Wedbush has lowered its price target for Apple stock, the adjustment is relatively minor, reflecting a cautious approach to current macroeconomic headwinds rather than a fundamental shift in their belief in Apple's long-term potential. The specific figures should be referenced from the original report (insert link to report if available).

-

Key factors contributing to Wedbush's positive outlook: Wedbush's confidence stems primarily from Apple's consistently strong iPhone sales, the robust and rapidly expanding revenue stream generated by its services segment (including Apple Music, iCloud, and the App Store), and anticipation for future product innovation, notably in the augmented reality (AR) and virtual reality (VR) markets.

-

Specific product lines or market segments driving their confidence: The iPhone remains a key driver of Apple's performance, consistently capturing significant market share. However, the growth of the services segment is particularly noteworthy, showcasing Apple’s diversification and ability to generate recurring revenue. Future AR/VR products are expected to represent a significant new revenue stream.

-

Quantifiable data to support their claims: Wedbush likely cites specific sales projections, market share data, and growth forecasts in their full report to support their claims. (Again, a link to the report would be beneficial here).

Analyzing the Lowered Price Target for Apple Stock

The reduction in Wedbush's price target for Apple stock is not a sign of pessimism but rather a reflection of the current economic climate. Several factors contribute to this cautious adjustment:

-

Macroeconomic headwinds impacting tech stocks: Global economic uncertainty, inflation, and potential interest rate hikes create headwinds for all tech stocks, including Apple. These factors can influence consumer spending and investment decisions.

-

Potential impact of global economic uncertainty on Apple sales: A weakening global economy might impact consumer demand for Apple products, particularly higher-priced items like iPhones and Macs.

-

Competitive pressures from Android devices and other tech companies: Competition from Android device manufacturers and other technology companies remains a factor that needs to be considered in any Apple stock analysis.

-

Difference between a price target adjustment and a change in overall outlook: It's crucial to understand that a price target adjustment is different from a complete change in outlook. Wedbush's lowered target does not signal a bearish outlook; instead, it demonstrates a measured approach given the current macroeconomic environment. It still represents a positive outlook compared to a neutral or negative prediction.

Implications for Investors in Apple Stock

Wedbush's report provides valuable insights for investors considering Apple stock:

-

Recommendations for long-term vs. short-term investors: Long-term investors might view the lowered price target as a potential buying opportunity, given Apple’s history of innovation and market leadership. Short-term investors might adopt a more cautious approach, potentially taking profits or waiting for clearer market signals.

-

Strategies for managing risk within an investment portfolio: Diversification is key. Investors shouldn't over-allocate their portfolios to any single stock, including Apple stock.

-

Importance of considering individual financial circumstances and goals: Investment decisions should always align with individual financial goals, risk tolerance, and time horizon.

-

Links to reliable resources for further financial research: Investors should supplement their research with information from the Securities and Exchange Commission (SEC) filings (link to SEC EDGAR database), reputable financial news sources, and other analyst reports.

Alternative Perspectives on Apple Stock

It's important to note that other analysts may hold different views on Apple stock. Reviewing multiple reports from different firms provides a more balanced perspective. (Include links to other reputable analyst reports here).

Conclusion

Wedbush's maintained bullish stance on Apple stock, despite a slightly reduced price target, suggests continued long-term potential. While external factors like macroeconomic headwinds influence the market, the core strengths of Apple – its innovative products, robust services segment, and strong brand loyalty – remain a significant driver for positive growth. Understanding the nuances of Apple stock requires careful consideration of market analysis and a diversified investment strategy. Stay informed on the latest developments in Apple stock and make informed decisions based on your individual financial objectives. Continue researching Apple stock and its performance to make sound investment choices.

Featured Posts

-

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025 -

Amsterdam Stock Market Three Day Losing Streak 11 Drop

May 24, 2025

Amsterdam Stock Market Three Day Losing Streak 11 Drop

May 24, 2025 -

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Nouveautes Technologiques A Decouvrir

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Nouveautes Technologiques A Decouvrir

May 24, 2025 -

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025

Latest Posts

-

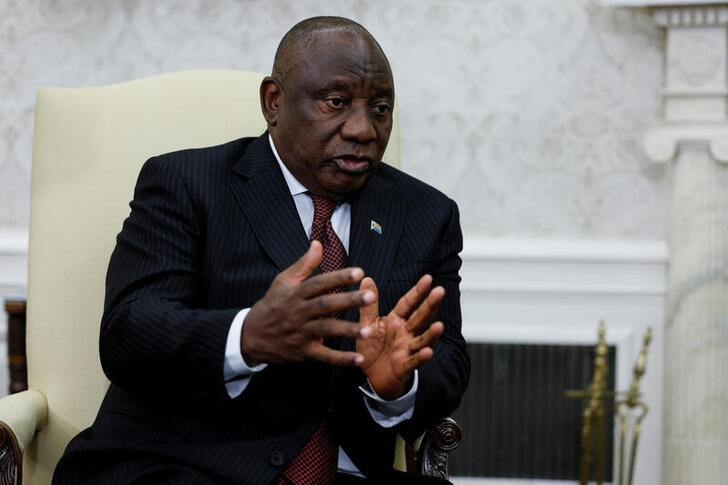

The White House Incident Evaluating President Ramaphosas Actions And Potential Alternatives

May 24, 2025

The White House Incident Evaluating President Ramaphosas Actions And Potential Alternatives

May 24, 2025 -

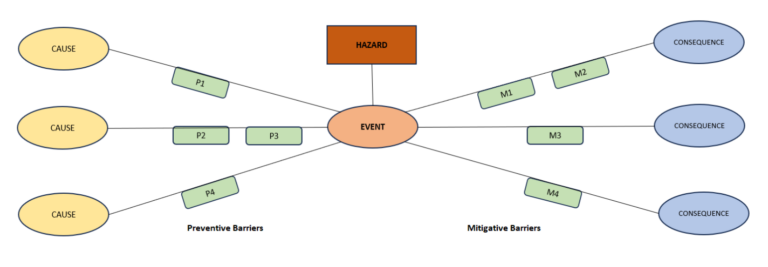

The Reality Of Airplane Accidents Visualizing Risk And Safety Measures

May 24, 2025

The Reality Of Airplane Accidents Visualizing Risk And Safety Measures

May 24, 2025 -

House Approves Trump Tax Bill After Final Revisions

May 24, 2025

House Approves Trump Tax Bill After Final Revisions

May 24, 2025 -

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025 -

Analyzing Ramaphosas White House Encounter What Other Options Were Available

May 24, 2025

Analyzing Ramaphosas White House Encounter What Other Options Were Available

May 24, 2025