April's French Consumer Spending: A Disappointing Rise

Table of Contents

Inflationary Pressures and Their Impact on Spending

The primary driver behind the sluggish growth in French consumer spending is undoubtedly the ongoing inflationary pressure. Soaring prices for essential goods and services are significantly impacting household budgets, forcing consumers to re-evaluate their spending habits.

Rising Food and Energy Prices

The relentless increase in food and energy prices has dealt a considerable blow to French consumers' purchasing power.

- Specific examples of price increases: Fuel prices rose by an average of 15% year-on-year in April, while the price of staple foods like bread and milk increased by 8% and 10% respectively.

- Data on consumer confidence indices: Consumer confidence indices, reflecting public sentiment toward the economy, have fallen consistently over the past months, indicating growing concerns about inflation and its impact on household finances. This decreased confidence directly translates to reduced spending.

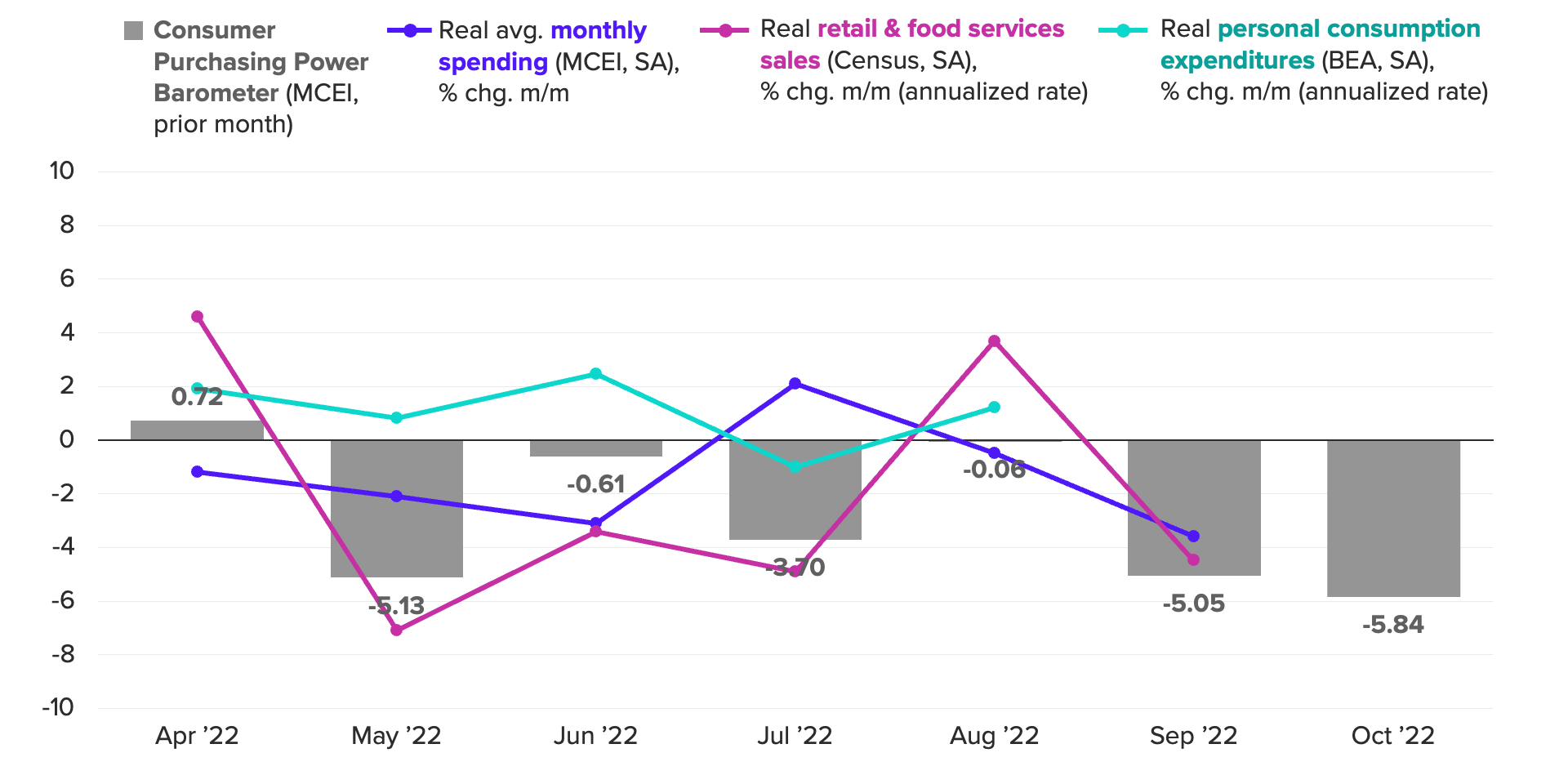

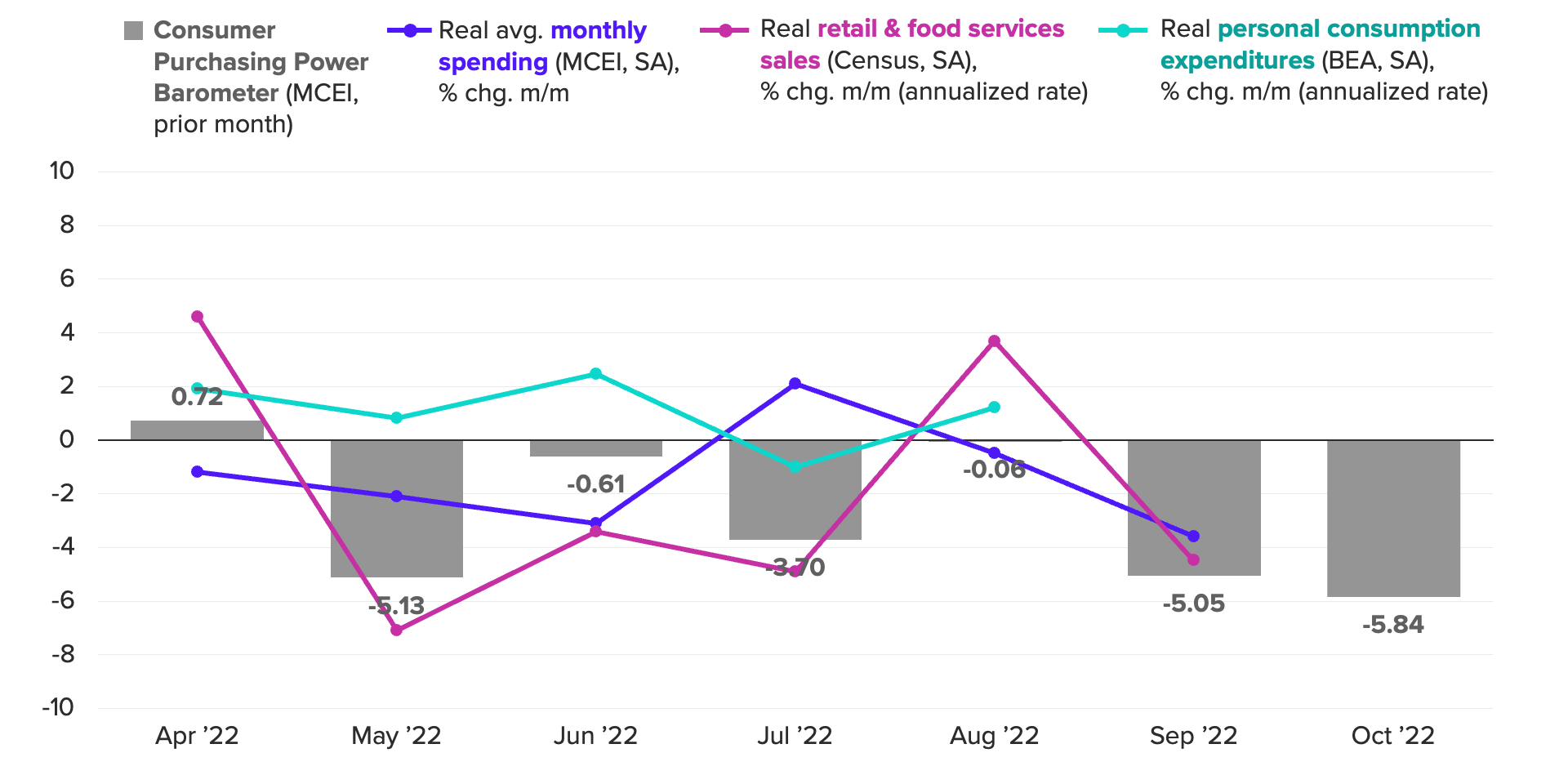

Reduced Purchasing Power

Inflation has eroded the purchasing power of many French households, leading to a reduction in discretionary spending. Wage growth has failed to keep pace with inflation, leaving consumers with less money to spend after essential expenses.

- Statistics comparing wage growth to inflation rates: Wage growth in France has lagged behind inflation by approximately 3 percentage points in the past year, meaning real wages are effectively falling.

- Examples of spending cutbacks in specific sectors: Spending in sectors like restaurants, leisure activities (including tourism), and entertainment has shown a noticeable decrease, as consumers prioritize essential goods and services. This shift is clearly visible in decreased restaurant bookings and a lower demand for non-essential items.

Government Measures and Their Effectiveness

The French government has implemented various aid packages to cushion the blow of inflation on households. However, the effectiveness of these measures remains a subject of debate.

Government Aid Packages

Several support schemes have been introduced to alleviate the financial strain on French citizens.

- Details of government support schemes: These include energy subsidies targeting low-income households, temporary tax breaks, and targeted assistance for vulnerable populations.

- Assessment of the reach and effectiveness of these schemes: While these initiatives offer some relief, their reach is limited, and many households remain significantly impacted by the cost-of-living crisis. The effectiveness is debatable as the aid hasn't fully offset the impact of rising prices.

Impact of Interest Rate Hikes

The European Central Bank's recent interest rate hikes have further tightened borrowing conditions, impacting consumer spending and borrowing capacity.

- Explain how higher interest rates affect mortgages and loans: Higher interest rates increase the cost of borrowing for mortgages and loans, making it more expensive for consumers to finance purchases.

- Data on consumer borrowing and credit card debt: Data indicates a slowdown in consumer borrowing, reflecting a reluctance to take on additional debt in the face of rising interest rates. Credit card debt is also showing a slower growth rate than previous years.

Sector-Specific Analysis of Spending Trends

Analyzing French consumer spending requires a sector-specific approach to understand the nuanced impact of inflation.

Durable Goods vs. Non-Durable Goods

A significant divergence is observed between spending on durable and non-durable goods.

- Statistics illustrating spending changes in each sector: Spending on durable goods, such as cars and appliances, has decreased significantly, reflecting consumers' hesitation to make large purchases. Conversely, spending on non-durable goods, like food and clothing, has remained relatively stable, albeit at a lower level than expected.

- Analysis of factors driving the observed trends: This difference highlights the prioritization of essential goods over discretionary purchases amid economic uncertainty.

Tourism and Leisure Spending

The tourism and leisure sectors have also felt the pinch of inflation and reduced consumer confidence.

- Data on hotel bookings, airline tickets, etc.: Data reveals a decline in bookings for domestic and international travel, indicating reduced spending on leisure activities.

- Comparison with previous years: Compared to pre-pandemic levels, the tourism sector still lags significantly, indicating a prolonged impact of economic uncertainty and inflation on consumer behavior.

Conclusion

April's disappointing rise in French consumer spending underscores the significant challenges facing French households. The combined impact of persistent inflation, the limited effectiveness of government aid, and rising interest rates has dampened consumer confidence, leading to reduced spending across various sectors. The divergence between spending on durable and non-durable goods highlights the prioritization of essential needs over discretionary purchases. This trend warrants close monitoring as it significantly impacts economic growth and overall stability. Stay updated on the latest trends in French consumer spending and learn more about the factors driving changes in French consumer spending to better understand the evolving economic landscape.

Featured Posts

-

Ella Mills Path To Digital Detox An Ongoing Process

May 29, 2025

Ella Mills Path To Digital Detox An Ongoing Process

May 29, 2025 -

Who Should Play Lucius Malfoy Jason Isaacs Shares His Top Choice

May 29, 2025

Who Should Play Lucius Malfoy Jason Isaacs Shares His Top Choice

May 29, 2025 -

Telus Announces 5 Billion Investment In Network Infrastructure Over Five Years

May 29, 2025

Telus Announces 5 Billion Investment In Network Infrastructure Over Five Years

May 29, 2025 -

Remy Cointreaus Vallat Resigns Marilly Appointed As New Chief Executive

May 29, 2025

Remy Cointreaus Vallat Resigns Marilly Appointed As New Chief Executive

May 29, 2025 -

Queensland Music Awards Response To Antisemitism Claims

May 29, 2025

Queensland Music Awards Response To Antisemitism Claims

May 29, 2025

Latest Posts

-

Monte Carlo Masters Alcaraz Through To Final

May 31, 2025

Monte Carlo Masters Alcaraz Through To Final

May 31, 2025 -

Alcaraz Cruises To Monte Carlo Final A Dominant Performance

May 31, 2025

Alcaraz Cruises To Monte Carlo Final A Dominant Performance

May 31, 2025 -

Monte Carlo Masters Alcaraz Triumphs Over Davidovich Fokina Advances To Final

May 31, 2025

Monte Carlo Masters Alcaraz Triumphs Over Davidovich Fokina Advances To Final

May 31, 2025 -

Alcaraz Reaches First Monte Carlo Masters Final

May 31, 2025

Alcaraz Reaches First Monte Carlo Masters Final

May 31, 2025 -

Tsitsipas Defeats Berrettini Medvedev Moves On At Indian Wells

May 31, 2025

Tsitsipas Defeats Berrettini Medvedev Moves On At Indian Wells

May 31, 2025