Are BMW And Porsche Losing Ground In China? An Industry Analysis

Table of Contents

Declining Sales Figures and Market Share

The recent performance of BMW and Porsche in China reveals a concerning trend: slowing growth and shrinking market share. Understanding the specifics is crucial to assessing their long-term viability in this dynamic environment.

BMW's Performance in China

BMW's sales in China, while still substantial, have shown a significant deceleration compared to previous years. Year-on-year growth has dwindled, impacting their overall market share within the luxury segment. This slowdown reflects a complex interplay of factors.

- Sales figures for key BMW models: While specific numbers fluctuate quarterly, overall growth rates for popular models like the 3 Series and X5 have plateaued or even declined in recent years. This contrasts sharply with the explosive growth seen in previous years.

- Comparison with previous years: A clear downward trend in year-over-year growth is observable, indicating a saturation point or a shift in consumer preference. Detailed charts illustrating this decline are readily available from industry analysts and financial news sources.

- Factors affecting sales: The Chinese economy has experienced fluctuations recently, affecting consumer confidence and impacting luxury purchases. Government policies, such as changes in new car taxes or import tariffs, also influence the final price and desirability of BMW vehicles.

Porsche's Position in the Chinese Luxury Market

Porsche, while still considered a desirable luxury brand, faces similar challenges. While maintaining a strong brand image, its growth trajectory in China has also flattened.

- Sales figures for key Porsche models: Models like the Cayenne and Macan remain popular, but their sales growth isn't mirroring the pace of previous years. This suggests increasing competition and a shift in market dynamics.

- Comparison with competitors like Audi and Mercedes-Benz: Audi and Mercedes-Benz, also established luxury players, have implemented various strategies, including aggressive marketing and electrification initiatives, to maintain or even increase their market share, thus putting pressure on Porsche.

- Impact of new model launches and marketing campaigns: Porsche's marketing campaigns and the launch of new models have shown mixed results in boosting sales. The effectiveness of their strategies in attracting and retaining Chinese customers requires further examination.

The Rise of Domestic Chinese Automakers

A key factor in the potential decline of BMW and Porsche is the emergence of highly competitive domestic Chinese automakers. These brands are no longer simply offering budget-friendly alternatives.

Competition from Local Brands

The rise of Chinese luxury brands such as Nio, Xpeng, and Li Auto represents a substantial threat. These companies leverage cutting-edge technology, sophisticated designs, and aggressive marketing to capture a significant portion of the market.

- Examples of successful Chinese luxury brands: Nio's battery swap technology, Xpeng's advanced driver-assistance systems, and Li Auto's extended-range electric vehicles all showcase their technological prowess.

- Their market share gains: The market share captured by these domestic brands directly translates to decreased market share for established players like BMW and Porsche.

- Technological advantages, and pricing strategies: Chinese automakers often offer competitive pricing along with advanced technology features, making them highly attractive to Chinese consumers.

Attractiveness of Domestic Brands to Chinese Consumers

Several factors contribute to the growing popularity of domestic brands amongst Chinese consumers.

- Consumer preferences: A growing sense of national pride and a preference for supporting local businesses drives sales for domestic brands.

- Brand loyalty shifts: Younger generations of Chinese consumers are less tied to established foreign brands, leading to a shift in brand loyalty.

- Impact of government policies supporting local brands: Government incentives and subsidies for domestic automakers contribute significantly to their competitive advantage.

The Electrification Challenge

The rapid expansion of the Chinese electric vehicle (EV) market presents a significant challenge for BMW and Porsche.

The Growing Demand for Electric Vehicles (EVs) in China

China's EV market is booming, driven by government incentives, growing environmental awareness, and technological advancements.

- EV market share growth in China: The percentage of EVs in overall vehicle sales is steadily increasing, indicating a huge shift in consumer demand.

- Government incentives for EV adoption: Subsidies and tax breaks for EV purchases make them increasingly attractive to Chinese buyers.

- The challenges faced by legacy automakers in transitioning to EVs: Established brands face challenges in adapting their manufacturing processes, supply chains, and overall business models to accommodate the EV revolution.

BMW and Porsche's EV Strategies in China

Both BMW and Porsche are investing heavily in their EV lineups, but their success in the Chinese market remains to be seen.

- Sales of BMW and Porsche EVs in China: While sales figures for their EVs are growing, they need to accelerate significantly to keep pace with the overall EV market growth.

- Comparison with competitors' EV offerings: Competitors, both domestic and international, offer a wider array of EV options with varying price points and features.

- Challenges in building EV charging infrastructure: The availability of adequate charging infrastructure remains a challenge for wider EV adoption.

Economic and Geopolitical Factors

Broader economic and geopolitical factors also play a significant role in shaping the automotive landscape in China.

The Impact of the Chinese Economy on Luxury Car Sales

Fluctuations in the Chinese economy directly affect consumer spending on luxury goods.

- Correlation between economic indicators and luxury car sales: Economic downturns tend to lead to a decline in luxury car sales, and vice versa.

- Impact of trade tensions and geopolitical uncertainty: International trade disputes or global uncertainty can also negatively impact the sales of foreign brands.

Government Regulations and Policies

Government policies, including regulations and tariffs, exert significant influence on the automotive market.

- Specific examples of regulations affecting luxury car sales: Import tariffs or emission standards can increase the cost of luxury vehicles, making them less attractive.

- Potential future policy changes and their likely impact: Future changes to policies could further influence the market share of both domestic and foreign brands.

Conclusion

The Chinese automotive market is a dynamic and fiercely competitive landscape. While BMW and Porsche maintain a significant presence, the increasing dominance of domestic Chinese automakers, the rapid growth of the EV market, and broader economic and geopolitical factors pose significant challenges. Their continued success hinges on their ability to adapt to these evolving conditions, innovate aggressively, understand and respond to shifting consumer preferences, and effectively navigate the complexities of the Chinese market. To stay informed about the latest developments affecting BMW China and Porsche China, and the wider luxury car market, continue to monitor industry news and analysis focusing on the key trends discussed above.

Featured Posts

-

Greenland False News Denmark Points Finger At Russia Heightening Us Tensions

Apr 26, 2025

Greenland False News Denmark Points Finger At Russia Heightening Us Tensions

Apr 26, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Company To Shut Down

Apr 26, 2025

127 Years Of Brewing History Ends Anchor Brewing Company To Shut Down

Apr 26, 2025 -

Europes Ai Strategy Under Pressure From The Trump Administration

Apr 26, 2025

Europes Ai Strategy Under Pressure From The Trump Administration

Apr 26, 2025 -

Turning Poop Into Profit How Ai Digests Repetitive Scatological Documents For Podcast Success

Apr 26, 2025

Turning Poop Into Profit How Ai Digests Repetitive Scatological Documents For Podcast Success

Apr 26, 2025 -

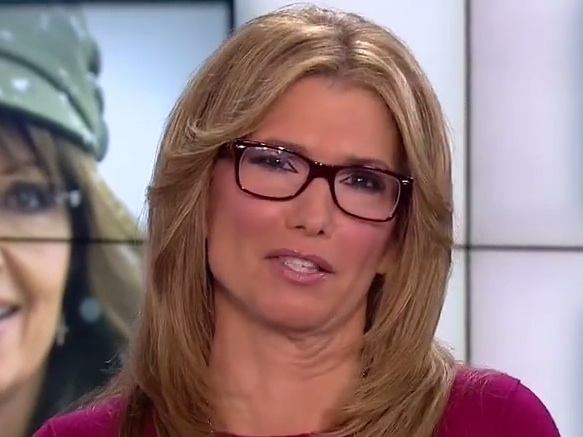

Cnn Anchor Reveals Top Florida Vacation Spot

Apr 26, 2025

Cnn Anchor Reveals Top Florida Vacation Spot

Apr 26, 2025