Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's core argument against viewing high valuations solely as negative hinges on several interconnected factors that support current market levels. They contend that a nuanced understanding is crucial, moving beyond a simplistic interpretation of high price-to-earnings ratios.

-

Low Interest Rates: Historically low interest rates significantly influence stock valuations. When borrowing costs are low, companies can invest more readily, increasing earnings and making stocks relatively more attractive compared to bonds. This fuels higher price-to-earnings ratios (P/E), a key metric in assessing stock market valuations. Lower discount rates also increase the present value of future earnings, supporting higher valuations.

-

Strong Corporate Earnings: Robust corporate profits are a fundamental underpinning of current stock prices. Many companies have reported strong earnings growth, justifying, at least in part, the higher valuations. This sustained earnings growth provides a solid foundation for supporting current market levels, even if valuations appear historically high.

-

Technological Innovation: Technological advancements continue to drive economic growth and create new opportunities for innovation and profitability. Many high-growth sectors, fueled by technological advancements, often exhibit high valuations reflecting their future potential. This positive feedback loop can sustain elevated valuations in the long term.

-

Long-Term Growth Potential: BofA emphasizes the potential for sustained economic growth, which justifies, in their view, current valuations. They project continued positive economic trends and anticipate increased corporate earnings in the coming years. This long-term growth outlook mitigates, in their assessment, some of the concerns related to high stock market valuations.

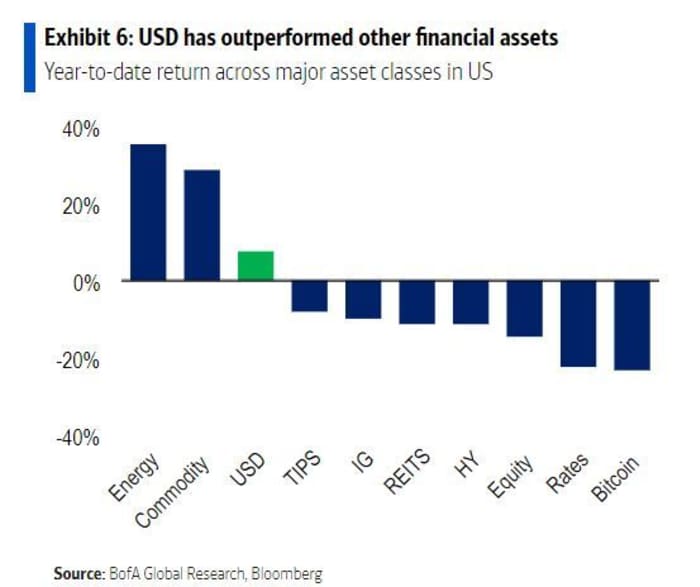

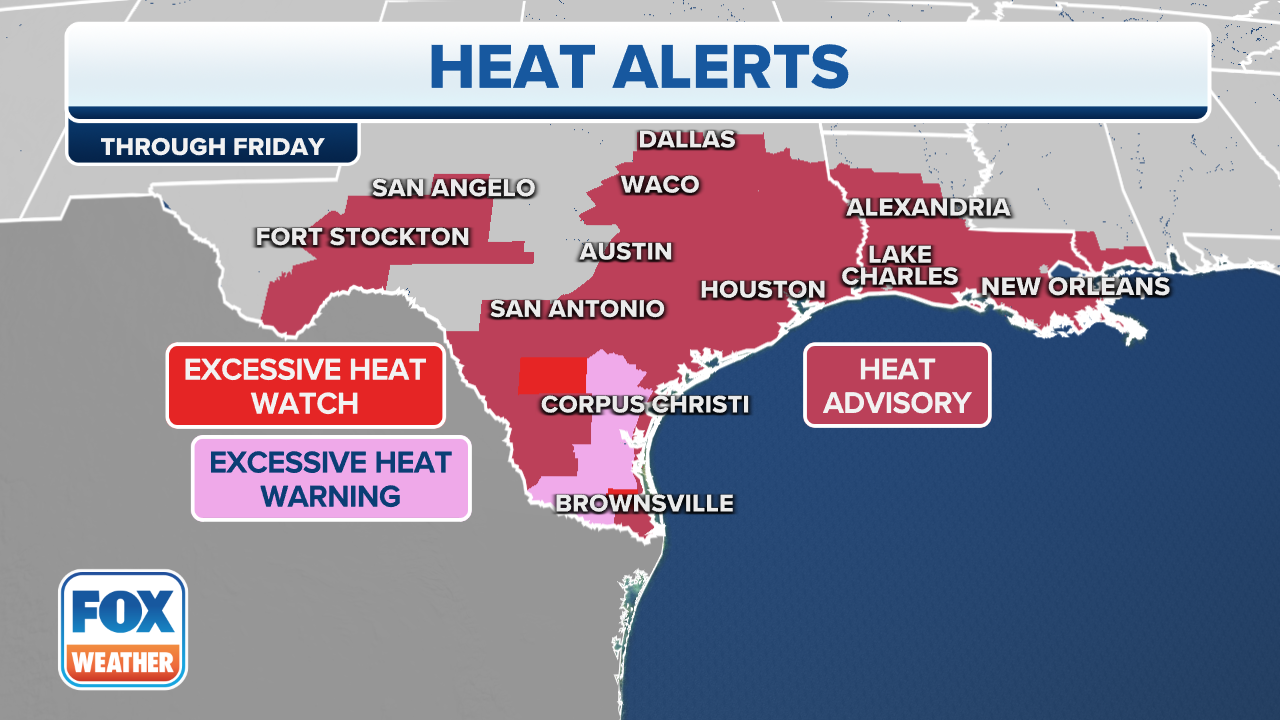

Analyzing the Metrics: A Deeper Dive into Valuation Indicators

BofA's analysis likely considers a range of valuation metrics to support its conclusions. While the widely-used Price-to-Earnings ratio (P/E) is a crucial indicator, other metrics offer a more comprehensive picture.

-

Comparison to Historical Data: BofA likely contextualizes current P/E ratios by comparing them to historical averages. While current valuations might appear high compared to the long-term average, they might still be within the range of historical highs seen during periods of robust economic growth. This historical context offers a more balanced perspective on whether current levels are excessively high.

-

Sector-Specific Valuations: It's important to analyze valuations on a sector-by-sector basis. Some sectors, such as technology, often command higher valuations than others due to their growth potential. Understanding sector-specific valuations prevents making broad generalizations about the entire market. The analysis of relative valuations across sectors provides a clearer picture than a single aggregate measure.

-

Impact of Inflation: Inflation plays a significant role in influencing valuation metrics. High inflation can erode the purchasing power of earnings, potentially impacting the perceived value of high P/E ratios. Therefore, analyzing valuations requires careful consideration of the inflationary environment.

Counterarguments and Potential Risks: Addressing the Skeptics

While BofA presents a cautiously optimistic view, it's crucial to acknowledge valid concerns surrounding high stock market valuations.

-

Market Bubbles and Potential Corrections: The risk of a market correction or even a market bubble remains a legitimate concern. High valuations can be unsustainable and prone to sharp corrections if investor sentiment shifts negatively.

-

Interest Rate Hikes: Rising interest rates can exert downward pressure on stock valuations. Higher borrowing costs make stocks less attractive, potentially leading to a decline in prices. This is a key risk factor that needs careful consideration.

-

Geopolitical Uncertainty: Geopolitical events and economic instability can significantly impact market sentiment and valuations. External shocks can trigger corrections, irrespective of underlying fundamentals.

BofA's Investment Strategy Recommendations: Navigating High Valuations

Despite the elevated valuations, BofA likely advocates for a strategic approach to investment, rather than complete avoidance.

-

Sector Diversification: Diversifying investments across various market sectors is crucial to mitigate risk. Concentrating investments in highly valued sectors can amplify potential losses.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is recommended. Short-term market fluctuations should be viewed within the context of long-term growth potential. A patient approach is crucial for weathering temporary market corrections.

-

Risk Management Strategies: Implementing effective risk management strategies, such as stop-loss orders and diversification, can help protect against potential losses. This includes setting realistic expectations for returns and avoiding excessive leverage.

Conclusion: High Stock Market Valuations: A Cautiously Optimistic Outlook

BofA's analysis suggests that while high stock market valuations exist, they are not necessarily a reason for immediate alarm. Their rationale considers several supporting factors like low interest rates, strong corporate earnings, and technological innovation. However, they also acknowledge the potential risks, such as market corrections and rising interest rates. Understanding the nuances of these high stock market valuations is crucial. While BofA's perspective offers a reassuring counterpoint to prevalent anxieties, thorough due diligence regarding high stock market valuations remains crucial for sound investment decisions. Start your research today!

Featured Posts

-

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025 -

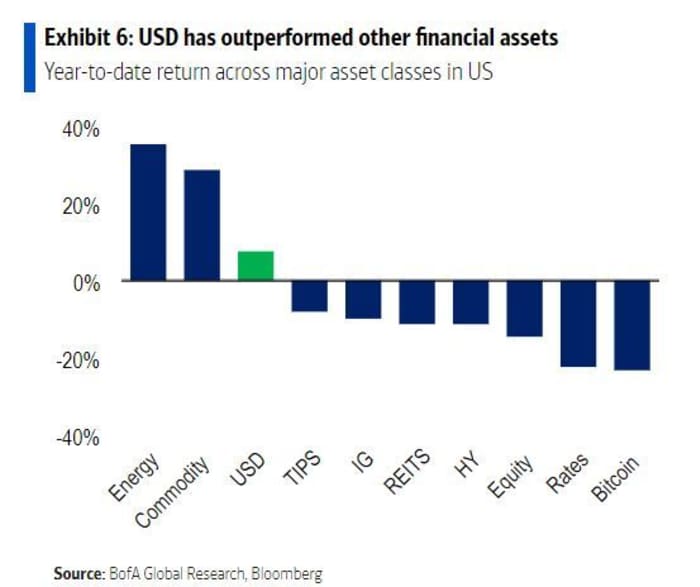

Texas Issues Heat Warning As Temperatures Expected To Soar To 111 F

May 30, 2025

Texas Issues Heat Warning As Temperatures Expected To Soar To 111 F

May 30, 2025 -

Anisimova Upsets Andreeva At Miami Open

May 30, 2025

Anisimova Upsets Andreeva At Miami Open

May 30, 2025 -

Bruno Fernandes Manchester United Stars Near Transfer To Tottenham Hotspur

May 30, 2025

Bruno Fernandes Manchester United Stars Near Transfer To Tottenham Hotspur

May 30, 2025 -

Jin De Bts Una Pelicula De Accion En El Nuevo Episodio De Run Bts

May 30, 2025

Jin De Bts Una Pelicula De Accion En El Nuevo Episodio De Run Bts

May 30, 2025

Latest Posts

-

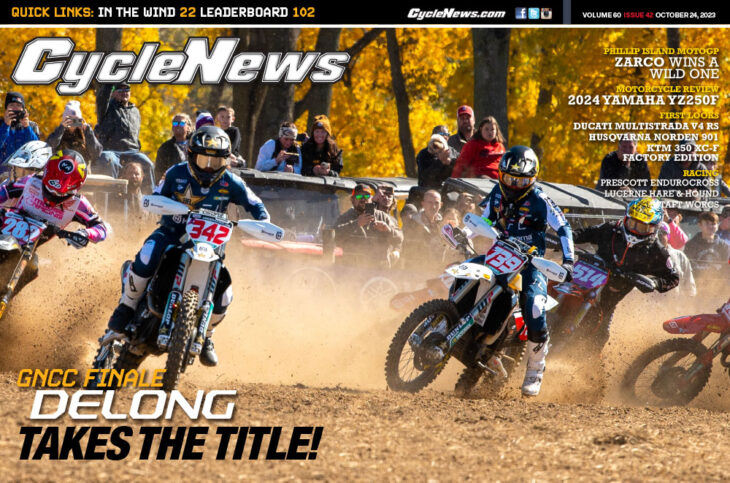

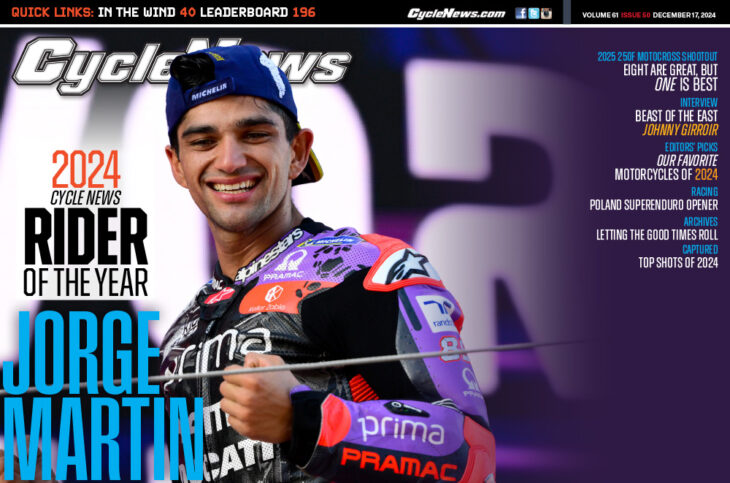

Cycle News Magazine 2025 Issue 17 Essential Reading For Every Cyclist

May 31, 2025

Cycle News Magazine 2025 Issue 17 Essential Reading For Every Cyclist

May 31, 2025 -

Join The 2025 Love Moto Stop Cancer Online Auction

May 31, 2025

Join The 2025 Love Moto Stop Cancer Online Auction

May 31, 2025 -

Cycle News Magazine 2025 Issue 17 Top Stories And Exclusive Interviews

May 31, 2025

Cycle News Magazine 2025 Issue 17 Top Stories And Exclusive Interviews

May 31, 2025 -

Supercross Salt Lake City 2024 A Riders Guide To The Event

May 31, 2025

Supercross Salt Lake City 2024 A Riders Guide To The Event

May 31, 2025 -

Cycle News Magazine 2025 Issue 17 Features Reviews And News From The Cycling Industry

May 31, 2025

Cycle News Magazine 2025 Issue 17 Features Reviews And News From The Cycling Industry

May 31, 2025