Are You Selling On EBay, Vinted, Or Depop? Watch Out For HMRC's Nudge Letters

Table of Contents

What are HMRC Nudge Letters?

HMRC nudge letters are notices from Her Majesty's Revenue and Customs indicating that they believe you may have undeclared income from online selling platforms. These aren't formal investigations yet, but rather a gentle warning, designed to encourage tax compliance and prevent more serious action. The purpose is to prompt you to review your tax affairs and ensure you're correctly declaring all your income from sources like eBay, Vinted, Depop, and other online marketplaces.

Ignoring an HMRC nudge letter is a risky strategy. It can lead to a full-scale investigation, significant penalties, and a considerable tax debt. HMRC uses various data sources to identify potential undeclared income, including transaction data directly obtained from online platforms and payment information from banks and payment processors. Remember, even seemingly small amounts of sales can trigger a letter.

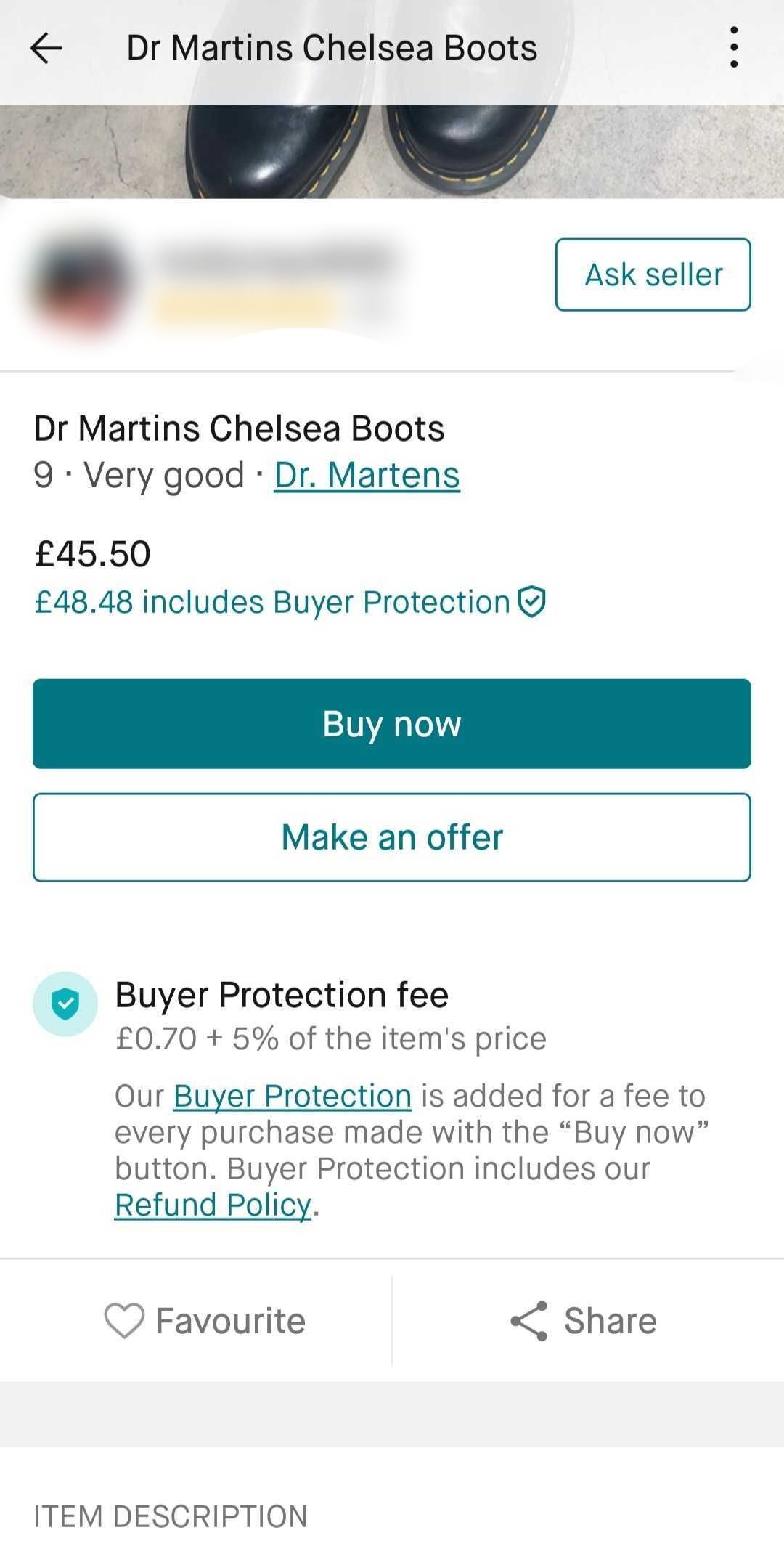

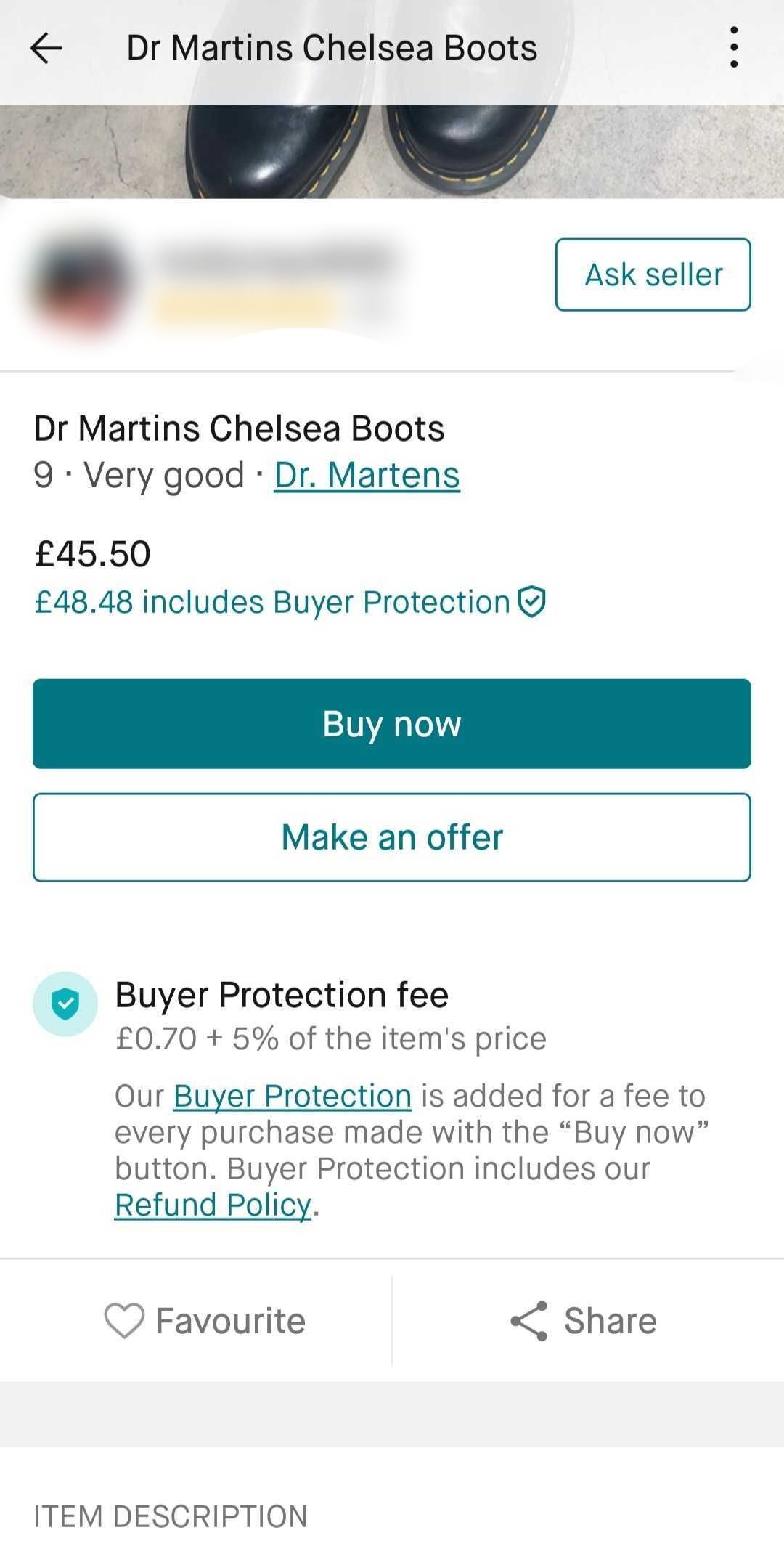

- Platforms Affected: eBay, Vinted, Depop, Etsy, Amazon, Facebook Marketplace, and other similar platforms.

- Data Used by HMRC: Transaction details, payment amounts, buyer and seller information, and details from payment providers.

- Thresholds: Even small-scale sales can trigger a letter if HMRC identifies inconsistencies.

Identifying Your Tax Obligations as an Online Seller

Understanding your tax obligations as an online seller is crucial. The tax you owe depends on several factors, including the amount of profit you make and whether you're running a business or casually selling unwanted items. The main taxes you need to consider are Income Tax and potentially Capital Gains Tax (CGT) on the profit from selling certain assets, and Value Added Tax (VAT) if your turnover exceeds the VAT threshold.

-

Tax Thresholds & Allowances: HMRC provides allowances and thresholds; exceeding these typically triggers tax liabilities.

-

Business vs. Casual Selling: Casual selling usually involves selling a few personal items with infrequent sales and low profit. A business involves regular sales, aiming for profit, and might require registering as self-employed.

-

Relevant Taxes:

- Income Tax: Tax on profit from selling goods.

- Capital Gains Tax (CGT): Tax on profit from selling assets like collectibles or antiques, often at a different rate to income tax.

- Value Added Tax (VAT): A tax on sales above a certain threshold (currently £85,000 in the UK).

-

HMRC Guidance: For detailed information, refer to HMRC's guidance on online selling and self-assessment: [Insert relevant HMRC link here]

-

Example: If your profits from online selling consistently exceed £1,000 per year, you're likely required to declare this income to HMRC.

-

Self-Employment Registration: Failing to register as self-employed when required can lead to penalties.

Keeping Accurate Records: The Key to Avoiding HMRC Nudge Letters

Meticulous record-keeping is your best defense against HMRC nudge letters. Maintain detailed records of all your sales and expenses. This allows you to accurately calculate your profit and demonstrate your compliance. You can use simple spreadsheets or invest in dedicated accounting software. The key is consistency and accuracy.

- Record-Keeping Examples:

- Date of sale

- Item sold (with a clear description)

- Selling price

- Expenses (packaging, postage, materials, advertising fees, etc.)

- Payment method (PayPal, bank transfer, etc.)

- Accounting Software: Consider cloud-based accounting software for ease of access and data backup (e.g., Xero, FreeAgent).

- Beyond HMRC Compliance: Accurate records are vital for managing your business effectively, identifying areas for improvement, and making informed financial decisions.

Responding to an HMRC Nudge Letter

Receiving an HMRC nudge letter can be concerning, but acting promptly and correctly is essential. Don't ignore it. Review the letter carefully, gather all the necessary information, and respond within the specified timeframe. If you're unsure about any aspect, seek professional help from an accountant or tax advisor. Ignoring or misinterpreting the letter could worsen the situation.

- HMRC Contact: Contact HMRC directly via their website or helpline [Insert relevant HMRC contact details here] to clarify any uncertainties.

- Providing Information: Be prepared to supply detailed records of your sales and expenses.

- Don't Delay: Responding promptly and accurately is crucial to avoiding penalties.

Conclusion

Selling on platforms like eBay, Vinted, and Depop can be profitable, but understanding your tax obligations is crucial to avoid HMRC nudge letters and potential penalties. Accurate record-keeping is key. Don't wait until you receive an HMRC nudge letter. Take control of your online selling tax obligations today! Review HMRC guidance, keep accurate records, and consider seeking professional advice if needed. Proactive tax management will protect your business and ensure you remain compliant with HMRC tax regulations for online selling.

Featured Posts

-

15 Avril Mise En Place De Restrictions De Circulation Pour Les 2 Et 3 Roues Sur Le Boulevard Fhb

May 20, 2025

15 Avril Mise En Place De Restrictions De Circulation Pour Les 2 Et 3 Roues Sur Le Boulevard Fhb

May 20, 2025 -

Croissance Du Trafic Maritime Au Port Autonome D Abidjan

May 20, 2025

Croissance Du Trafic Maritime Au Port Autonome D Abidjan

May 20, 2025 -

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Wthdyat

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Wthdyat

May 20, 2025 -

Improving Hmrc Call Efficiency The Role Of Voice Recognition

May 20, 2025

Improving Hmrc Call Efficiency The Role Of Voice Recognition

May 20, 2025 -

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025

Latest Posts

-

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025 -

Typhon Missile System Us Army Doubles Down On Pacific Defense

May 20, 2025

Typhon Missile System Us Army Doubles Down On Pacific Defense

May 20, 2025 -

Second Typhon Missile Battery Us Army Expands Pacific Presence

May 20, 2025

Second Typhon Missile Battery Us Army Expands Pacific Presence

May 20, 2025 -

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025