Assessing Google's AI Capabilities: A Look At Investor Sentiment

Table of Contents

Google's AI Investments and Technological Advancements

Google's commitment to AI is evident in its substantial investments and groundbreaking research. This commitment is manifested in two key areas: the advancements stemming from DeepMind and the seamless integration of AI into its core products.

DeepMind's Contributions

DeepMind, a Google subsidiary, has consistently pushed the boundaries of AI with remarkable breakthroughs. AlphaGo, which defeated a world champion Go player, showcased the potential of reinforcement learning. More recently, AlphaFold's ability to predict protein structures has revolutionized biological research and drug discovery. These "DeepMind AI" achievements, coupled with other significant research in areas like generative AI, have solidified Google's position as a leader in AI research. These "AI breakthroughs" are not just theoretical advancements; they hold immense potential for various industries. For example, AlphaFold's impact on healthcare is already being felt, accelerating drug development and disease research.

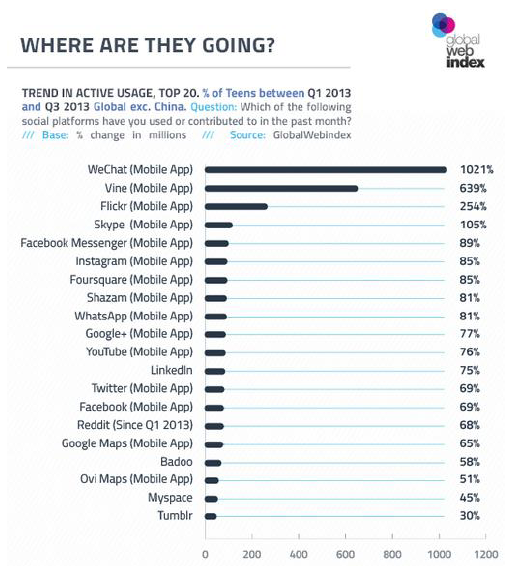

Google AI's Product Integration

Google is not simply conducting AI research; it's strategically integrating AI into its existing products and services. "Google AI products" are transforming user experience across the board. Google Search uses AI to deliver more relevant and personalized results, while Google Assistant leverages AI for voice recognition and natural language processing. "Google Cloud AI" offers a suite of tools and services for businesses, enabling them to leverage AI's power for their own applications. The "AI integration" is subtle yet pervasive, enhancing efficiency and creating new possibilities for users and businesses alike.

- Specific examples of AI features in Google products: Improved image search, smart compose in Gmail, personalized recommendations in Google Play, advanced fraud detection in Google Pay.

- Market impact and user adoption rates of these AI features: High user adoption rates across Google's product suite indicate a significant market impact and positive user feedback. Specific metrics, like increased search engagement or improved user satisfaction scores, would further quantify this.

- Partnerships and acquisitions related to AI advancement: Google's strategic partnerships and acquisitions continue to bolster its AI capabilities, expanding its reach and expertise.

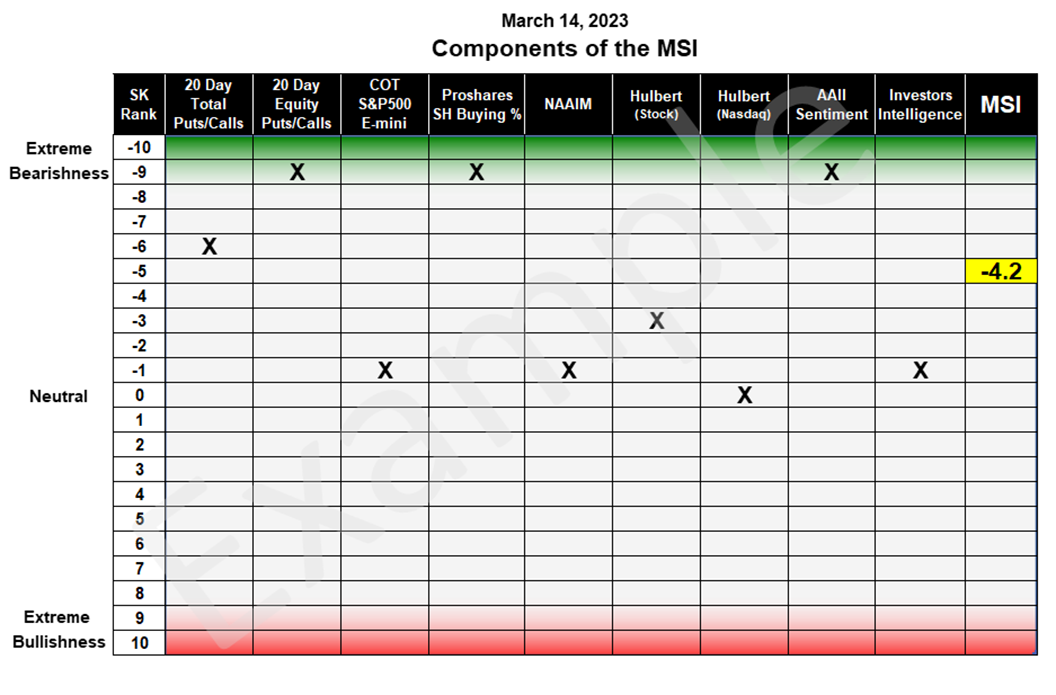

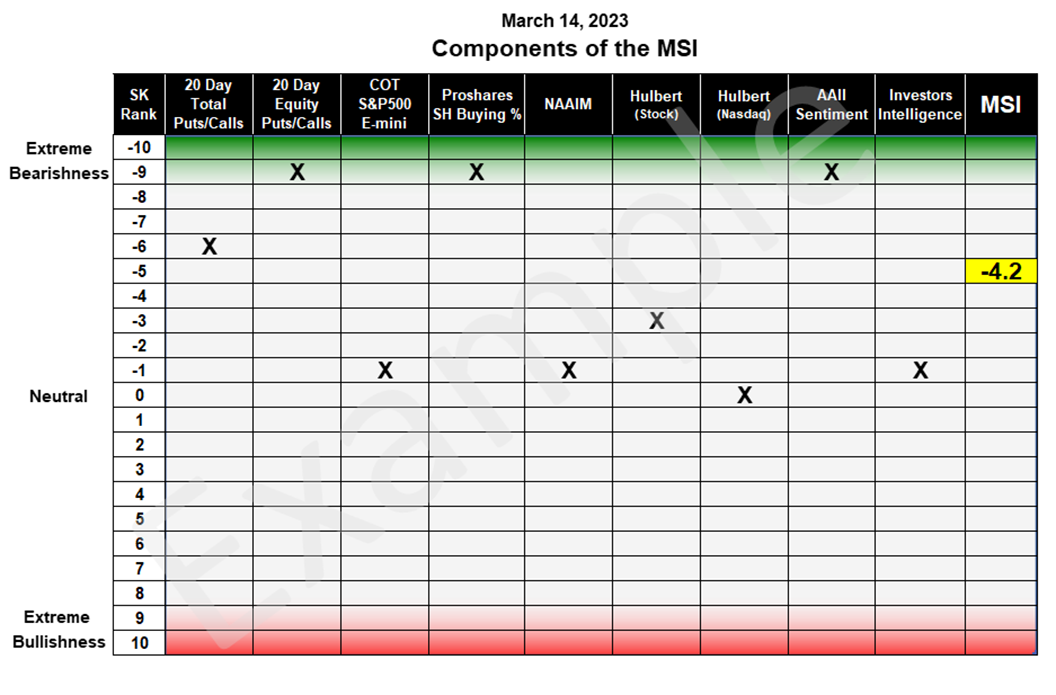

Investor Sentiment Analysis: Gauging Market Confidence

Understanding investor sentiment towards Google's AI endeavors is crucial for assessing its future prospects. Several key indicators reveal the market's confidence in Google's AI strategy.

Stock Performance and Market Reactions

Google's stock performance is a key barometer of investor confidence. Significant AI-related announcements often trigger market reactions, causing fluctuations in the "Google stock price." Positive news related to AI advancements and successful product launches generally leads to increased "AI market capitalization" and higher stock valuations. Conversely, setbacks or negative news can impact investor sentiment.

Analyst Reports and Predictions

Reputable analyst firms regularly publish reports evaluating Google's AI prospects. These "analyst predictions" often incorporate various metrics to forecast future growth potential. The "Google AI forecast" from these reports provides valuable insights into investor expectations and market sentiment.

- Specific analyst firms and their reports: Reports from firms like Morgan Stanley, Goldman Sachs, and JP Morgan provide valuable data.

- Key metrics used to assess investor sentiment: Stock price fluctuations, trading volume, investor surveys, and options market activity are crucial indicators.

- Data points to support claims: For example, a specific percentage change in Google's stock price following a major AI announcement can reflect immediate market response.

Challenges and Risks Facing Google's AI Dominance

While Google holds a strong position in AI, it faces significant challenges. The competitive landscape and ethical concerns present both short-term and long-term risks.

Competition from Other Tech Giants

The AI sector is intensely competitive. Companies like Microsoft, Amazon, and OpenAI are making significant strides in AI research and development. This "AI competition" necessitates continuous innovation and strategic investment for Google to maintain its leadership.

Ethical Concerns and Regulatory Scrutiny

The ethical implications of AI are increasingly under scrutiny. Concerns about "AI bias," data privacy, and the potential misuse of AI technologies are growing. This "AI regulation" landscape is evolving rapidly, and Google must navigate these complexities to ensure responsible AI development.

- Specific examples of ethical dilemmas related to AI: Algorithmic bias in hiring processes, privacy concerns related to data collection, and the potential for autonomous weapons systems.

- Relevant regulations and their impact on Google: GDPR, CCPA, and other emerging regulations have significant implications for Google's AI initiatives.

- Potential risks and mitigation strategies: Proactive measures to address bias, ensure data privacy, and prioritize transparency are crucial for mitigating risks.

Conclusion

Investor sentiment towards Google's AI capabilities is largely positive, reflecting its significant investments, technological advancements, and successful product integrations. However, challenges remain, including intense competition and growing ethical concerns. The key takeaways highlight Google's substantial progress in AI, the positive but nuanced market reaction, and the need for continued innovation and responsible development. To stay updated on Google's AI capabilities and monitor investor sentiment in the AI sector, it is crucial to continue following developments in this rapidly evolving field. Learn more about Google's AI advancements and their impact on the global landscape.

Featured Posts

-

Coldplays No 1 Concert Music Lights And A Message Of Love

May 22, 2025

Coldplays No 1 Concert Music Lights And A Message Of Love

May 22, 2025 -

Real Madrid In Teknik Direktoerluegue Klopp Un Ancelotti Nin Yerini Almasi Ne Anlama Geliyor

May 22, 2025

Real Madrid In Teknik Direktoerluegue Klopp Un Ancelotti Nin Yerini Almasi Ne Anlama Geliyor

May 22, 2025 -

Exclusive Partnership Ford And Nissan Team Up For Battery Plant Reshaping The Ev Landscape

May 22, 2025

Exclusive Partnership Ford And Nissan Team Up For Battery Plant Reshaping The Ev Landscape

May 22, 2025 -

Fdas Ozempic Crackdown Supply Shortages And Access Concerns

May 22, 2025

Fdas Ozempic Crackdown Supply Shortages And Access Concerns

May 22, 2025 -

Superalimentos Cual Es El Mejor Para Prevenir Enfermedades Cronicas Este Podria Incluir El Arandano En La Descripcion

May 22, 2025

Superalimentos Cual Es El Mejor Para Prevenir Enfermedades Cronicas Este Podria Incluir El Arandano En La Descripcion

May 22, 2025

Latest Posts

-

Vidmova Ukrayini U Vstupi Do Nato Naslidki Dlya Bezpeki Ukrayini Ta Yevropi

May 22, 2025

Vidmova Ukrayini U Vstupi Do Nato Naslidki Dlya Bezpeki Ukrayini Ta Yevropi

May 22, 2025 -

Nato Nun Tuerkiye Ve Italya Icin Ortak Plani Aciklandi

May 22, 2025

Nato Nun Tuerkiye Ve Italya Icin Ortak Plani Aciklandi

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025 -

Taylor Swift And Blake Lively Amid The It Ends With Us Legal Drama

May 22, 2025

Taylor Swift And Blake Lively Amid The It Ends With Us Legal Drama

May 22, 2025 -

Nato Ta Ukrayina Aktualni Peregovori Ta Perspektivi Chlenstva

May 22, 2025

Nato Ta Ukrayina Aktualni Peregovori Ta Perspektivi Chlenstva

May 22, 2025