Assessing The Damage: Trump Tariffs And California's Projected $16 Billion Revenue Decline

Table of Contents

Agricultural Exports and the Tariff Toll

California's agricultural industry, a cornerstone of the state's economy, has suffered immensely from retaliatory tariffs imposed by countries impacted by the Trump administration's trade policies. These tariffs on agricultural products represent a significant blow to international trade and have created substantial trade restrictions.

-

Devastating Impact on Key Crops: California's prized agricultural exports, including almonds, walnuts, wine, and dairy products, have faced steep price drops and significantly reduced export volumes due to these tariffs. The resulting decrease in demand has left farmers struggling to maintain profitability and, in some cases, facing bankruptcy.

-

Ripple Effect on Rural Communities: The consequences extend far beyond the farmers themselves. Farmworkers, who form a significant portion of the agricultural workforce, have experienced reduced working hours and income. Related businesses, such as processing plants, transportation companies, and agricultural equipment suppliers, have also felt the impact, leading to job losses and economic hardship in rural communities.

-

Quantifiable Losses: Studies have shown a direct correlation between the implementation of Trump tariffs and the significant decline in revenue for California's agricultural sector. The exact figures vary depending on the product and the country imposing retaliatory tariffs, but the overall impact is undeniably substantial and contributes significantly to the projected $16 billion loss.

Impact on Manufacturing and Import Costs

The tariffs on imported goods have increased manufacturing costs in California, creating a chain reaction of negative economic consequences. This increase in import costs has impacted the state's competitiveness in the global market.

-

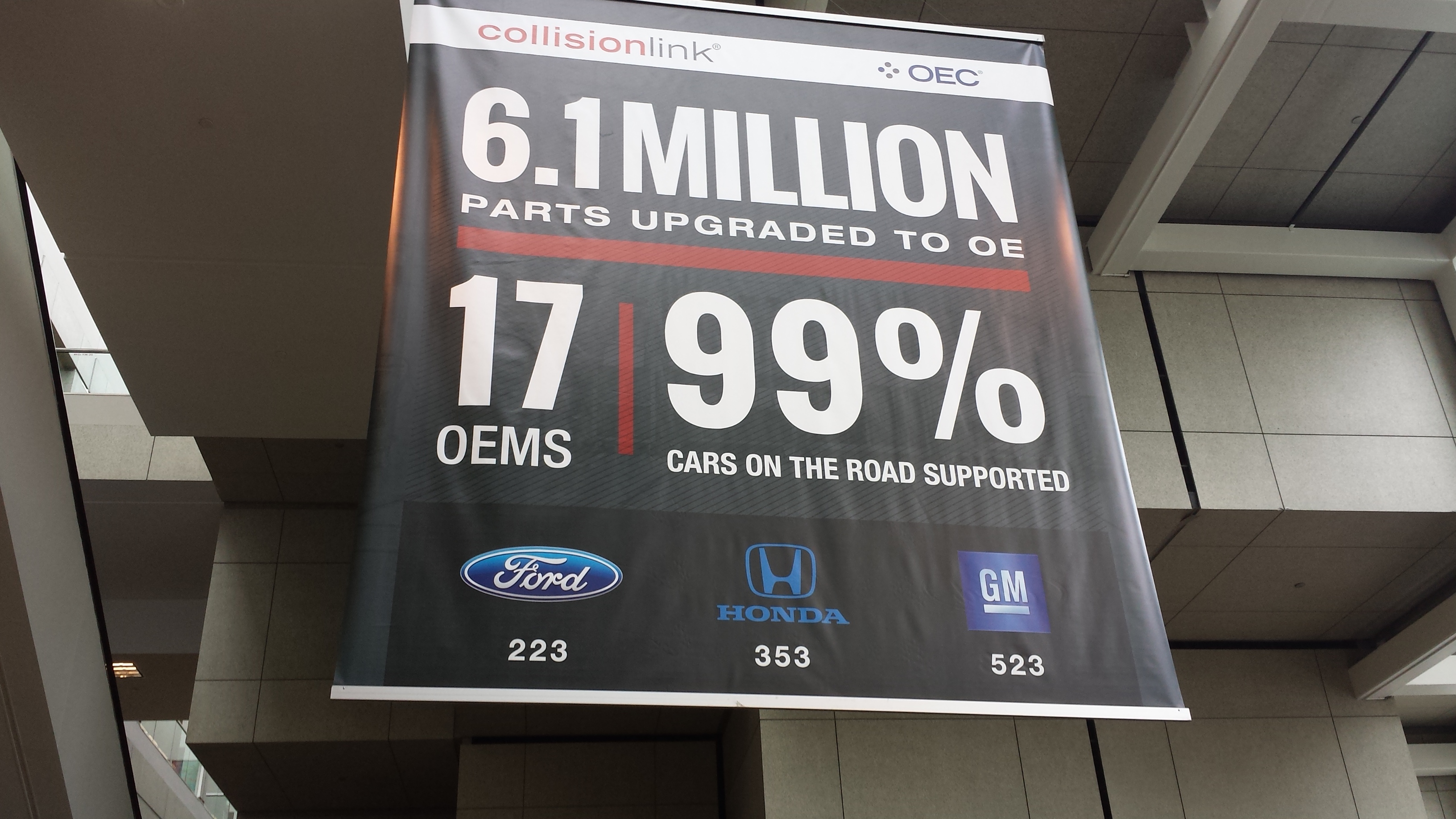

Increased Costs, Reduced Competitiveness: Industries such as furniture manufacturing, electronics assembly, and the automotive sector have faced higher input costs due to tariffs on imported materials and components. This has led to increased prices for consumers, making California-made products less competitive both domestically and internationally.

-

Supply Chain Disruptions: Tariffs have disrupted established supply chains, leading to delays, increased costs, and uncertainty for businesses. The reliance on imported goods within California's manufacturing sector makes it particularly vulnerable to these disruptions.

-

Job Losses and Economic Stagnation: The combined effect of increased costs, reduced competitiveness, and supply chain disruptions has the potential to lead to job losses in California's manufacturing sector, further hindering economic growth and contributing to the projected revenue decline.

The Ripple Effect on Small Businesses

The impact of Trump tariffs isn't limited to large corporations; small businesses are disproportionately affected by increased import costs and reduced consumer spending.

-

Struggling to Stay Afloat: Small businesses, with their often-limited resources and thinner profit margins, are particularly vulnerable to rising prices and reduced consumer demand. Increased import costs force them to increase prices, potentially driving away customers.

-

Specific Industries Hard Hit: Businesses reliant on imported materials or components, such as restaurants (due to food import costs) and retailers selling imported goods, are among the hardest hit.

-

Business Closures and Job Losses: Many small businesses are facing the difficult choice of absorbing increased costs, raising prices, or ultimately closing their doors. This leads to job losses and further weakens the overall California economy.

The State Budget Crisis and Fiscal Implications

The projected $16 billion revenue decline poses a significant threat to California's state budget, creating a fiscal crisis with far-reaching consequences.

-

Reduced Tax Revenue: The decrease in economic activity across various sectors translates to lower tax revenues for the state government. This shortfall directly impacts the state's ability to fund essential public services.

-

Cuts to Public Services: To address the budget deficit, the state may be forced to implement significant cuts to public services, including education, healthcare, infrastructure, and social programs. These cuts have wide-reaching implications for the quality of life for California residents.

-

Potential Solutions and Mitigation Strategies: Addressing this fiscal crisis requires a multifaceted approach. Potential solutions include exploring new revenue streams, implementing cost-saving measures within government, and potentially seeking federal assistance. However, the complexity of the situation demands careful consideration and comprehensive strategies.

Conclusion

The Trump tariffs have undeniably caused a significant $16 billion revenue decline in California, severely impacting its agricultural exports, manufacturing sector, small businesses, and ultimately the state budget. The ripple effects of these economic hardships are substantial, highlighting the unintended consequences of protectionist trade policies. Understanding the extensive impact of Trump tariffs on California's economy is crucial. Further research and analysis are needed to fully grasp the long-term consequences and to develop effective strategies to mitigate the damage caused by these trade policies. Stay informed on the ongoing effects of Trump tariffs and their impact on the California economy.

Featured Posts

-

Analysis Of Foot Locker Earnings Reveals Nikes Strengthening Position

May 16, 2025

Analysis Of Foot Locker Earnings Reveals Nikes Strengthening Position

May 16, 2025 -

Ahy Dan Proyek Tembok Laut Implikasi Keterlibatan China Terhadap Indonesia

May 16, 2025

Ahy Dan Proyek Tembok Laut Implikasi Keterlibatan China Terhadap Indonesia

May 16, 2025 -

Did Elizabeth Warren Successfully Defend Joe Bidens Mental State

May 16, 2025

Did Elizabeth Warren Successfully Defend Joe Bidens Mental State

May 16, 2025 -

Private Equity Buys Boston Celtics For 6 1 Billion Fan Concerns And Future Outlook

May 16, 2025

Private Equity Buys Boston Celtics For 6 1 Billion Fan Concerns And Future Outlook

May 16, 2025 -

A Conversation With Two Max Muncys

May 16, 2025

A Conversation With Two Max Muncys

May 16, 2025