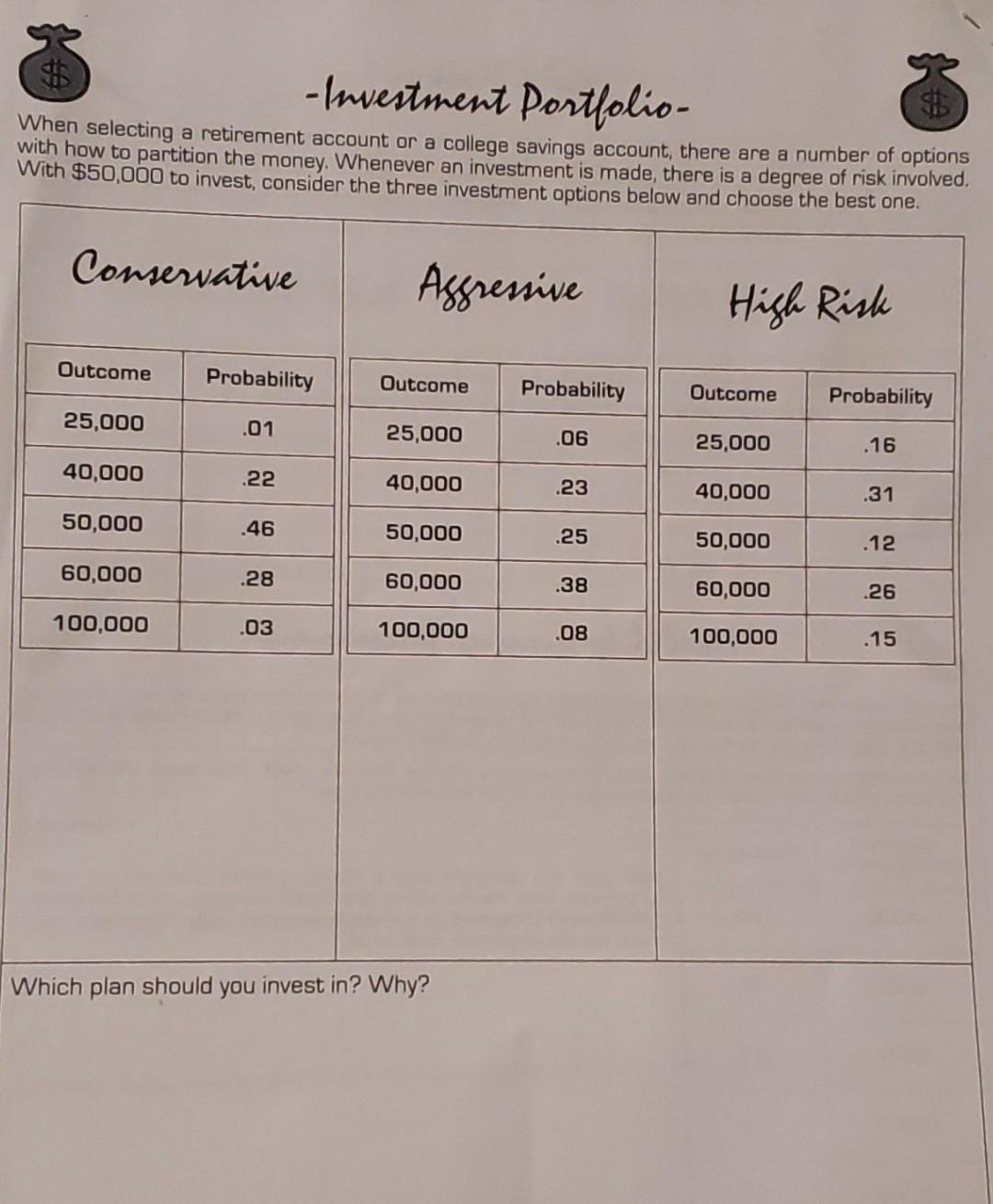

Assessing The Suitability Of This Novel Investment For Retirement

Table of Contents

Understanding Risk Tolerance and Retirement Goals

Before diving into the specifics of any novel investment, it's crucial to understand your risk tolerance and retirement goals. Aligning your investment strategy with these personal factors is paramount to achieving your financial objectives. Different individuals have vastly different retirement visions: some aim for early retirement, while others prioritize maintaining their current lifestyle. These goals directly influence the types of investments that are appropriate.

- Consider your age and time horizon until retirement: Younger investors generally have a longer time horizon and can tolerate higher risk, while those closer to retirement often prefer lower-risk, more conservative strategies.

- Assess your comfort level with potential losses: Are you comfortable with the possibility of losing some of your investment in pursuit of higher returns? This is a critical aspect of determining your risk tolerance.

- Define your specific financial objectives for retirement: How much income do you need to maintain your desired lifestyle? Understanding your specific financial needs is essential for setting realistic investment goals.

Analyzing the Novel Investment's Performance and Stability

Analyzing the performance and stability of a novel investment is crucial before considering it for your retirement portfolio. This involves examining several key factors:

- Historical Performance (if available): If the investment has a track record, compare its historical performance to traditional retirement vehicles like stocks and bonds. Look at both average returns and the variability of those returns (volatility).

- Volatility and Potential for Loss: High-growth investments often come with higher volatility, meaning the value can fluctuate significantly. Assess your comfort level with potential losses. A novel retirement investment strategy should be evaluated carefully for its risk profile.

- Factors Influencing Stability: Market trends, regulatory changes, and the investment's underlying structure all play a role in its stability. Research these factors to gain a comprehensive understanding of potential risks.

Bullet Points:

- Examine past performance data (if available), comparing it to relevant benchmarks (e.g., the S&P 500).

- Assess the investment's diversification strategy – is it spread across multiple asset classes to mitigate risk?

- Analyze potential risks associated with the investment's unique characteristics, considering any factors that might not be present in traditional investments.

Comparing the Novel Investment to Traditional Retirement Options

To effectively evaluate a novel investment, it's essential to compare it to well-established retirement options such as 401(k)s, IRAs, and annuities. Consider the following:

- Liquidity: How easily can you access your funds if needed? Traditional retirement accounts often have limitations on withdrawals.

- Fees and Expense Ratios: High fees can significantly eat into your returns over time. Compare the fees associated with the novel investment to those of traditional options.

- Tax Implications: How will the investment be taxed during growth and at withdrawal? Many traditional retirement accounts offer tax advantages.

Bullet Points:

- Compare fees and expense ratios across different options.

- Analyze tax implications for both short-term and long-term growth to understand the overall tax efficiency of the investment.

- Discuss liquidity and accessibility of funds – how easily can you withdraw money when needed, and are there any penalties?

Legal and Regulatory Considerations

Before investing in any novel investment, it's imperative to investigate the legal and regulatory framework governing it. This step helps to identify potential compliance issues and risks. You should always:

- Check for Legitimacy and Regulation: Ensure the investment and the entities offering it are properly registered and comply with all relevant regulations.

- Understand Potential Legal Ramifications: Be aware of any potential legal or financial risks associated with the investment.

- Seek Professional Advice: Consult with a qualified financial advisor and legal professional to understand the complexities and potential pitfalls.

Bullet Points:

- Verify the legitimacy and regulatory compliance of the investment.

- Understand any potential legal ramifications and risks involved.

- Consider seeking professional legal and financial advice before making any investment decisions.

Making Informed Decisions About Your Novel Investment for Retirement

Choosing the right novel investment for retirement requires careful consideration of your risk tolerance, retirement goals, and a thorough comparison with traditional options. This analysis emphasizes the importance of aligning your investment choices with your personal circumstances. Remember that every innovative retirement option carries both potential rewards and risks. While a novel approach may offer attractive returns, it's crucial to conduct thorough research and seek professional guidance from experienced financial advisors before making significant investment decisions. Don't hesitate to explore various novel retirement investment strategies, but always prioritize informed decision-making for a secure and comfortable retirement. Contact a financial professional today to discuss your options and develop a personalized retirement plan that suits your needs.

Featured Posts

-

Uitbreiding Nederlandse Defensie Steun Neemt Toe Door Wereldwijde Onrust

May 18, 2025

Uitbreiding Nederlandse Defensie Steun Neemt Toe Door Wereldwijde Onrust

May 18, 2025 -

Eurovisions Most Controversial Acts A Look Back As The Uk Unveils 2025 Entry

May 18, 2025

Eurovisions Most Controversial Acts A Look Back As The Uk Unveils 2025 Entry

May 18, 2025 -

Cardinals Opener Will Jansen Dominate The Mound

May 18, 2025

Cardinals Opener Will Jansen Dominate The Mound

May 18, 2025 -

The Meaning Of Clasp Michelle Williams Reflects On Dying For Sex Scene

May 18, 2025

The Meaning Of Clasp Michelle Williams Reflects On Dying For Sex Scene

May 18, 2025 -

Kenley Jansens Influence On Ben Joyces Pitching In Anaheim

May 18, 2025

Kenley Jansens Influence On Ben Joyces Pitching In Anaheim

May 18, 2025

Latest Posts

-

Best Virginia Online Casinos 2025 Top Va Gambling Sites Reviewed

May 18, 2025

Best Virginia Online Casinos 2025 Top Va Gambling Sites Reviewed

May 18, 2025 -

Increase Your Fortune Coins March Towards Greater Rewards

May 18, 2025

Increase Your Fortune Coins March Towards Greater Rewards

May 18, 2025 -

Fortune Coins March To Fortune A Comprehensive Guide

May 18, 2025

Fortune Coins March To Fortune A Comprehensive Guide

May 18, 2025 -

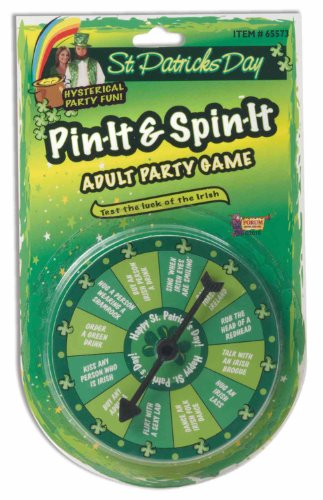

Poker Stars St Patricks Day Spin Of The Day Prizes And Probabilities

May 18, 2025

Poker Stars St Patricks Day Spin Of The Day Prizes And Probabilities

May 18, 2025 -

A Players Guide To Fortune Coins Mastering The March To Fortune

May 18, 2025

A Players Guide To Fortune Coins Mastering The March To Fortune

May 18, 2025