Bank Of Canada Faces Tough Decisions Amid Soaring Core Inflation

Table of Contents

Understanding the Current Inflationary Pressure in Canada

Defining Core Inflation

Core inflation measures the underlying rate of inflation, excluding volatile components like food and energy prices. These volatile components can be significantly impacted by temporary shocks, obscuring the true picture of long-term inflationary pressures. Headline inflation, on the other hand, includes these volatile elements. Understanding the difference is crucial for effective monetary policy.

- Examples of goods and services included in core inflation calculations: Rent, transportation (excluding gasoline), clothing, household furnishings, and some services.

- Current Statistics: As of [Insert date], Canada's core inflation rate is [Insert current statistic]. This persistent elevation signals a deeper-seated inflationary pressure that requires a robust policy response.

- Significance of Persistent Core Inflation: Persistent core inflation indicates that price increases are becoming entrenched in the economy, potentially leading to a wage-price spiral where rising prices lead to higher wages, further fueling inflation. This makes it more challenging for the Bank of Canada to control inflation.

Identifying the Root Causes of Soaring Core Inflation

Several intertwined factors are contributing to Canada's current inflationary surge.

- Supply Chain Disruptions: The lingering effects of the pandemic continue to constrain supply chains, leading to shortages and higher prices for many goods.

- Strong Consumer Demand: Pent-up demand from lockdowns and robust government support fueled a surge in consumer spending, exceeding the capacity of the supply chain to keep up.

- Rising Wages: As businesses compete for workers in a tight labor market, wages are rising, adding to inflationary pressures.

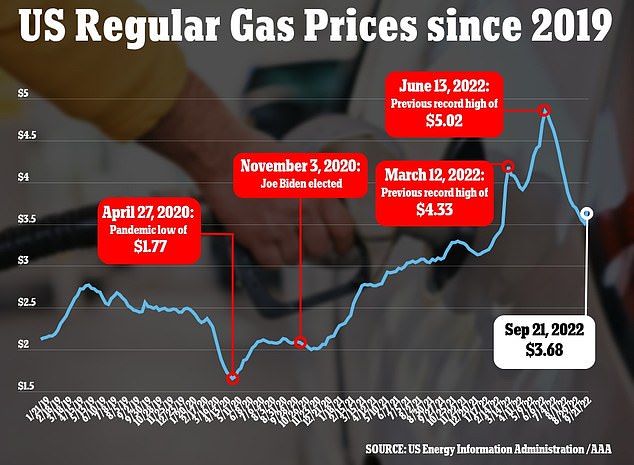

- Global Factors: Global factors, such as the war in Ukraine and increased energy prices, have significantly impacted commodity costs and contributed to inflationary pressures worldwide. These global forces exert significant pressure on the Canadian economy.

The interplay of these factors creates a complex challenge for the Bank of Canada.

The Bank of Canada's Policy Options and Challenges

Interest Rate Hikes

The Bank of Canada's primary tool to combat inflation is raising interest rates. Increasing interest rates makes borrowing more expensive, which reduces consumer and business spending, slowing down economic activity and cooling down inflationary pressures.

- Potential Benefits: Reduced demand, slower inflation, a more stable currency.

- Potential Drawbacks: Economic slowdown, job losses, decreased housing affordability, potential for a recession.

- Current Interest Rate: The Bank of Canada's current policy interest rate is [Insert current rate], following [Number] rate hikes since [Date].

Quantitative Tightening (QT)

Quantitative tightening involves the Bank of Canada reducing its balance sheet by selling government bonds it holds. This reduces the money supply, further curbing inflation.

- How QT Works: By selling bonds, the Bank of Canada removes money from circulation, increasing borrowing costs.

- Impact on Money Supply: QT aims to decrease the money supply, reducing inflationary pressures.

- Potential Risks and Benefits: While effective in reducing inflation, QT carries the risk of triggering a sharp economic slowdown.

Communication and Transparency

Clear communication is vital for the Bank of Canada to manage market expectations and ensure confidence in its policy decisions.

- Role of Press Conferences, Economic Forecasts, and Public Statements: Transparent communication helps guide market expectations, reducing uncertainty and minimizing potential volatility in financial markets.

Potential Economic Consequences of the Bank of Canada's Actions

Impact on the Housing Market

Interest rate hikes significantly impact the housing market, already experiencing a slowdown.

- Potential for Decreased House Prices: Higher interest rates increase mortgage payments, potentially leading to decreased demand and lower house prices.

- Reduced Borrowing Power: Higher interest rates reduce the amount people can borrow, further dampening demand.

- Impact on Affordability: Increased interest rates make homeownership less affordable for many Canadians.

Impact on Employment

A slower economy resulting from interest rate hikes can lead to job losses.

- Sectors Most Vulnerable to Economic Slowdowns: Industries sensitive to changes in consumer spending and business investment (e.g., retail, construction) are most at risk.

- Potential for Unemployment to Rise: If the Bank of Canada's actions lead to a significant economic slowdown, unemployment is likely to increase.

Impact on Consumer Spending

Changes in interest rates influence consumer confidence and spending.

- Relationship Between Interest Rates and Consumer Spending: Higher interest rates reduce consumer confidence and spending as borrowing becomes more expensive.

- Potential for Reduced Consumer Demand: A decline in consumer spending can further slow down economic growth.

Conclusion: Navigating the Challenges Faced by the Bank of Canada

The Bank of Canada faces a difficult balancing act: controlling soaring core inflation without triggering a severe economic recession. Its decisions regarding interest rates, quantitative tightening, and communication will significantly impact the Canadian economy in the coming months and years. The potential consequences, from impacts on the housing market and employment to changes in consumer spending, are far-reaching. The complexities of managing inflation while supporting economic growth highlight the immense challenges faced by the Bank of Canada. To stay updated on the Bank of Canada's response to soaring inflation and its implications for the Canadian economy, regularly check the Bank of Canada's website and follow economic news closely. Stay informed about the Bank of Canada's decisions as they continue to manage core inflation.

Featured Posts

-

The Allure Of Cassis Blackcurrant Flavor Profile Uses And Benefits

May 22, 2025

The Allure Of Cassis Blackcurrant Flavor Profile Uses And Benefits

May 22, 2025 -

Jackson Hole Cwd Outbreak Elk Feedground Identified As Source

May 22, 2025

Jackson Hole Cwd Outbreak Elk Feedground Identified As Source

May 22, 2025 -

New Yorks Downtown The New Hotspot For The Wealthy

May 22, 2025

New Yorks Downtown The New Hotspot For The Wealthy

May 22, 2025 -

Images Interieures Du Theatre Tivoli A Clisson Selectionne Au Loto Du Patrimoine 2025

May 22, 2025

Images Interieures Du Theatre Tivoli A Clisson Selectionne Au Loto Du Patrimoine 2025

May 22, 2025 -

Are You Making These 3 Financial Mistakes Womens Edition

May 22, 2025

Are You Making These 3 Financial Mistakes Womens Edition

May 22, 2025

Latest Posts

-

20 Cent Increase In Average Gas Prices Nationwide

May 22, 2025

20 Cent Increase In Average Gas Prices Nationwide

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025 -

Gasoline Prices Surge In The Mid Hudson Valley

May 22, 2025

Gasoline Prices Surge In The Mid Hudson Valley

May 22, 2025 -

Virginia Fuel Costs 50 Cent Reduction From A Year Ago

May 22, 2025

Virginia Fuel Costs 50 Cent Reduction From A Year Ago

May 22, 2025 -

National Average Gas Price Jumps Almost 20 Cents

May 22, 2025

National Average Gas Price Jumps Almost 20 Cents

May 22, 2025