Bank Of Canada Interest Rate Outlook: Impact Of Tariffs And Job Losses

Table of Contents

The Impact of Tariffs on the Canadian Economy

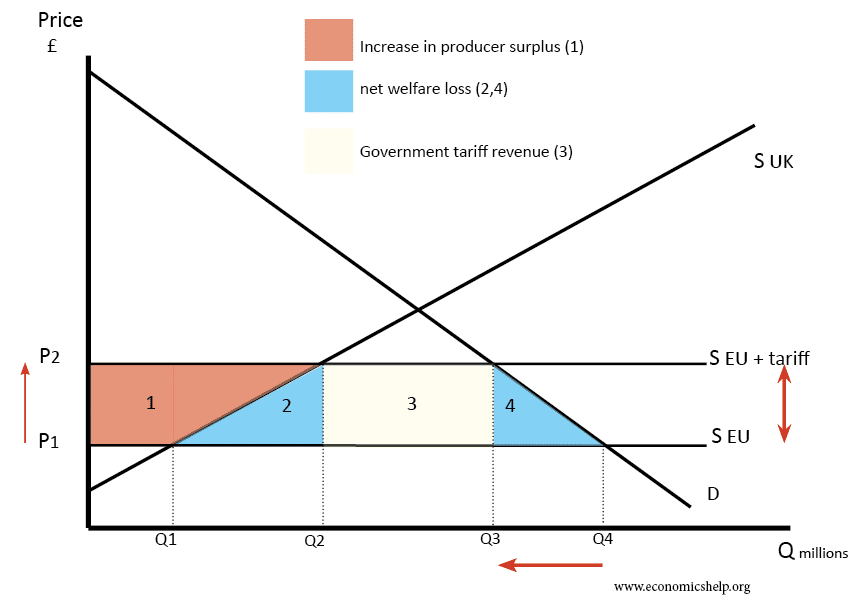

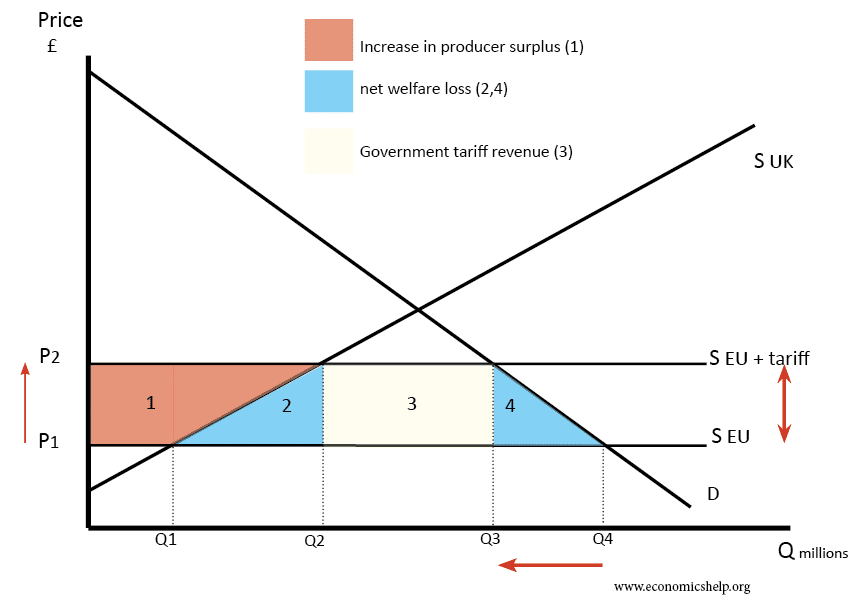

Tariffs, essentially taxes on imported goods, significantly impact the Canadian economy, creating a ripple effect across various sectors.

Increased Import Costs and Inflation

Tariffs directly increase the price of imported goods, a key driver of inflation. This reduces consumer purchasing power, as everyday goods become more expensive. Consequently, consumer spending decreases, leading to an overall economic slowdown. For example, increased tariffs on steel and aluminum have significantly impacted manufacturing costs, leading to higher prices for finished goods.

- Reduced consumer confidence: Higher prices erode consumer confidence, leading to less spending and investment.

- Increased business costs: Businesses face higher input costs, forcing them to either absorb the increased expenses or pass them onto consumers through price increases.

- Potential for supply chain disruptions: Tariffs can disrupt established supply chains, leading to shortages and further price increases.

Retaliatory Tariffs and Export Challenges

When Canada imposes tariffs, other countries may retaliate with their own tariffs on Canadian exports. This directly harms key Canadian industries, leading to job losses and reduced economic output. For instance, retaliatory tariffs on Canadian agricultural exports can severely impact farmers and related businesses.

- Decreased export revenue: Retaliatory tariffs reduce the demand for Canadian goods in international markets, leading to lower export revenue.

- Loss of market share: Canadian businesses may lose market share to competitors from countries not facing tariffs.

- Negative impact on specific sectors: Sectors heavily reliant on exports, such as agriculture, forestry, and manufacturing, are particularly vulnerable to retaliatory tariffs.

Job Losses and Their Effect on Interest Rates

Rising job losses exert significant pressure on the Canadian economy and directly influence the Bank of Canada's interest rate decisions.

Weakening Consumer Demand and Economic Growth

Increased unemployment leads to a decrease in consumer spending, weakening overall economic growth. This reduced aggregate demand puts downward pressure on inflation. This scenario might give the Bank of Canada more leeway to lower interest rates to stimulate the economy. For example, job losses in the manufacturing and retail sectors directly impact consumer spending and overall economic activity.

- Decreased aggregate demand: Fewer jobs mean less disposable income, leading to a reduction in overall demand for goods and services.

- Lower wage growth: High unemployment suppresses wage growth, further limiting consumer spending.

- Potential for a deflationary spiral: A sustained decrease in demand can lead to a deflationary spiral, where prices fall, leading to further reductions in spending and investment.

The Bank of Canada's Response to Economic Slowdown

Faced with an economic slowdown and rising unemployment, the Bank of Canada may respond by lowering interest rates to stimulate economic activity and combat job losses. However, lowering interest rates too aggressively risks fueling inflation. This necessitates a careful balancing act by the central bank.

- Potential for interest rate cuts: Lower interest rates make borrowing cheaper, encouraging businesses to invest and consumers to spend.

- Quantitative easing as a supplementary measure: The Bank of Canada might employ quantitative easing, purchasing government bonds to increase the money supply and lower long-term interest rates.

- Monitoring inflation closely: The Bank of Canada must carefully monitor inflation to ensure that its monetary policy actions do not lead to uncontrolled price increases.

Predicting the Bank of Canada's Next Move

Predicting the Bank of Canada's next move requires careful analysis of various economic indicators and global factors.

-

Analysis of current economic indicators (inflation, unemployment, GDP growth) provides a crucial basis for predicting future interest rate changes.

-

Consideration of global economic factors, such as global trade tensions and international economic growth, are essential to understanding the Canadian economic context.

-

The potential for a recession and its implications for interest rates must be carefully evaluated.

-

Review of recent Bank of Canada statements and press conferences: These provide valuable insights into the central bank's thinking and priorities.

-

Analysis of economic forecasts from leading financial institutions: These forecasts offer different perspectives on the future trajectory of the Canadian economy.

-

Assessment of the risks and uncertainties associated with interest rate projections: Predicting economic developments is inherently uncertain, and acknowledging these uncertainties is crucial.

Conclusion

The Bank of Canada interest rate outlook is profoundly influenced by the challenges posed by tariffs and job losses. These factors exert significant pressure on inflation, economic growth, and employment. The Bank of Canada must carefully navigate these challenges, balancing the need to stimulate economic growth with the imperative to manage inflation. Staying informed about the Bank of Canada interest rate outlook and its impact on the Canadian economy is crucial for individuals and businesses. Continue to monitor the Bank of Canada's announcements and economic data to make informed financial decisions regarding the impact of Bank of Canada interest rates on your personal and business finances.

Featured Posts

-

The Debbie Elliott Story A Look At Her Life And Career

May 11, 2025

The Debbie Elliott Story A Look At Her Life And Career

May 11, 2025 -

Trump Weighs Tariffs On Commercial Aircraft And Engines Impact On The Industry

May 11, 2025

Trump Weighs Tariffs On Commercial Aircraft And Engines Impact On The Industry

May 11, 2025 -

Virginia Giuffre Hvordan Skandalen Rystet Prins Andrew Og Kongehuset

May 11, 2025

Virginia Giuffre Hvordan Skandalen Rystet Prins Andrew Og Kongehuset

May 11, 2025 -

Keanu Reeves John Wick 5 Officially Confirmed By Lionsgate

May 11, 2025

Keanu Reeves John Wick 5 Officially Confirmed By Lionsgate

May 11, 2025 -

The Jamaica Observers Grand Slam Tournament Coverage

May 11, 2025

The Jamaica Observers Grand Slam Tournament Coverage

May 11, 2025