Bank Of Canada Interest Rate Outlook: Job Losses And The Potential For Further Cuts

Table of Contents

The Current Economic Climate and Rising Unemployment

Canada's economy is currently facing headwinds. While experiencing growth in certain sectors, the recent surge in unemployment paints a concerning picture. Job losses are being reported across various sectors, with manufacturing and technology particularly hard hit. The impact of persistent inflation on consumer spending is further exacerbating the situation, leading to decreased demand and slowing economic growth. This interconnectedness between inflation, employment, and consumer spending creates a complex challenge for the Bank of Canada.

- Specific job loss numbers from recent reports: Statistics Canada's latest report indicates a net loss of X thousand jobs in [Month, Year], with the unemployment rate rising to Y%.

- Key industries affected by job losses: Significant job losses have been observed in manufacturing, technology, and retail sectors.

- Impact on consumer confidence: The rising unemployment rate has negatively impacted consumer confidence, leading to decreased spending and further slowing economic activity.

Bank of Canada's Current Stance and Previous Rate Decisions

The Bank of Canada has been closely monitoring the evolving economic situation. Their recent monetary policy statements reflect a cautious approach, acknowledging the challenges posed by rising unemployment and persistent inflation. Previous rate decisions have aimed to balance the need to control inflation with the desire to support economic growth. The Bank's inflation target remains at 2%, but the current trajectory suggests a deviation from this goal.

- Summary of recent rate decisions and their timing: The Bank of Canada last raised interest rates on [Date] by X basis points, bringing the overnight rate to Y%. Prior to that, there were [Number] rate increases.

- Key factors influencing the Bank's decisions (inflation, GDP growth, unemployment): The Bank's decisions are influenced by a multitude of factors, including inflation rates, GDP growth projections, and unemployment figures. The recent surge in unemployment has become a primary concern.

- Quotes from Bank of Canada officials: [Insert relevant quotes from recent Bank of Canada press releases or statements emphasizing the current economic challenges and their impact on policy decisions].

Inflationary Pressures and Their Impact on Rate Decisions

Inflation remains a significant concern. Current inflation rates are above the Bank of Canada's target, fueled by factors such as supply chain disruptions and rising energy prices. The relationship between inflation and employment is complex; while low unemployment can contribute to inflationary pressures, high unemployment can dampen demand and potentially lead to deflation. This delicate balance significantly influences the Bank's interest rate decisions.

- Current inflation rate and its comparison to the Bank's target: The current inflation rate is at Z%, considerably higher than the Bank of Canada's 2% target.

- Factors contributing to current inflationary pressures (supply chain issues, energy prices): Global supply chain disruptions and volatile energy prices have contributed significantly to the current inflationary pressures.

- Potential impact of inflation on future rate decisions: Persistent high inflation may necessitate further rate hikes, despite the rising unemployment rate. However, the severity of job losses may counter this.

Predicting Future Bank of Canada Interest Rate Movements

Predicting future interest rate movements is inherently challenging, but based on the current economic data, there's a significant likelihood of further interest rate cuts. Several scenarios are possible: a significant rate cut, a smaller cut, or even a hold. The probability of each scenario depends on several factors, including the pace of job losses, the trajectory of inflation, and global economic conditions. Geopolitical events can also play a significant role.

- Different scenarios and their potential outcomes: Scenario 1: Significant rate cut to stimulate growth. Scenario 2: Small rate cut to balance growth and inflation. Scenario 3: Holding rates to assess economic data further.

- Factors that could lead to further rate cuts or a hold: A further deterioration in the job market or a significant slowdown in economic growth could trigger further rate cuts. Conversely, if inflation remains stubbornly high, the Bank may hold off on cuts.

- Expert opinions and market forecasts: [Include summaries of expert predictions and market forecasts regarding the Bank of Canada's future interest rate decisions, citing reputable sources].

Implications for Businesses and Consumers

Potential interest rate cuts will have significant implications for businesses and consumers alike. Businesses will experience changes in borrowing costs, influencing investment decisions and expansion plans. Consumers will feel the impact through adjustments in mortgage rates and returns on savings accounts. Understanding these potential impacts is crucial for effective financial planning.

- Impact on mortgage rates and affordability: Interest rate cuts will likely lead to lower mortgage rates, potentially boosting housing affordability.

- Effect on business investment and expansion: Lower borrowing costs will encourage businesses to invest and expand, potentially creating new jobs.

- Advice for consumers and businesses on financial planning: Consumers should review their financial plans and consider refinancing options if mortgage rates decrease. Businesses should assess their borrowing needs and explore investment opportunities.

Conclusion: Understanding the Bank of Canada Interest Rate Outlook

The current economic climate, marked by rising unemployment and persistent inflation, significantly influences the Bank of Canada interest rate outlook. While the Bank aims to control inflation, the severity of job losses adds a layer of complexity to their decision-making. Understanding the potential implications of these factors is critical for both businesses and consumers. Staying informed about the Bank of Canada rate forecasts and future interest rate predictions is crucial for making sound financial decisions. To stay updated, subscribe to reputable economic news sources, follow the Bank of Canada’s official announcements, and follow leading economic analysts on social media for insights into Canadian interest rates. Understanding the Bank of Canada interest rate outlook is key to navigating the current economic uncertainty.

Featured Posts

-

Mc Laughlins Pole Winning Performance At St Petersburg

May 12, 2025

Mc Laughlins Pole Winning Performance At St Petersburg

May 12, 2025 -

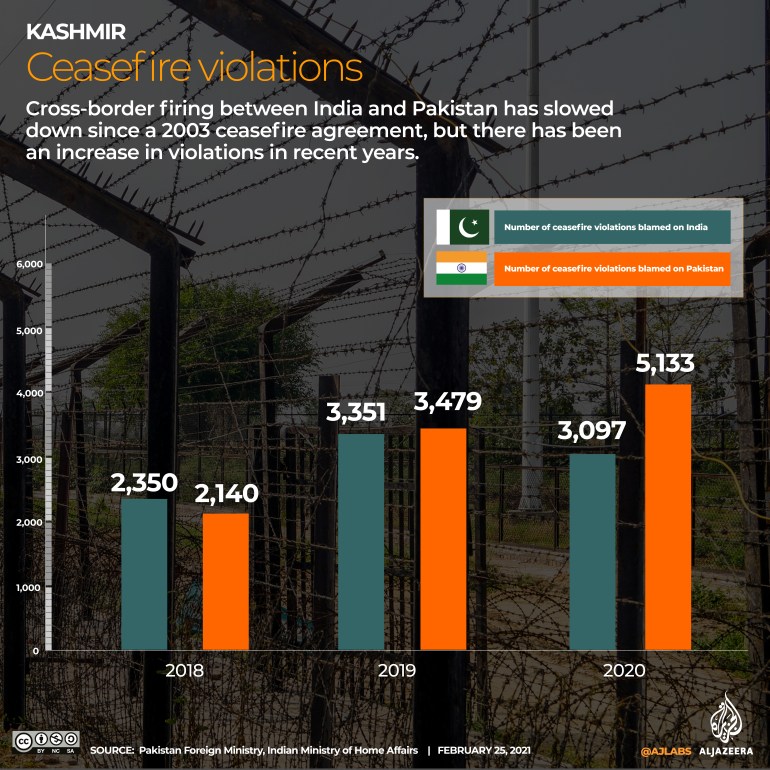

India Pakistan Ceasefire A Delicate Path To Peace

May 12, 2025

India Pakistan Ceasefire A Delicate Path To Peace

May 12, 2025 -

Analyzing The Next Papal Conclave Potential Candidates And Predictions

May 12, 2025

Analyzing The Next Papal Conclave Potential Candidates And Predictions

May 12, 2025 -

United Vs American The Battle For Chicago O Hare Airport Supremacy

May 12, 2025

United Vs American The Battle For Chicago O Hare Airport Supremacy

May 12, 2025 -

Improving Asylum Shelter Management Recommendations For E1 Billion In Savings

May 12, 2025

Improving Asylum Shelter Management Recommendations For E1 Billion In Savings

May 12, 2025