BBAI Stock: 17.87% Drop – Analyzing Missed Targets And Instability

Table of Contents

BBAI's Missed Earnings Expectations and Their Impact

BBAI's recent earnings report significantly missed analyst predictions, triggering the substantial stock price decline. This shortfall highlights underlying weaknesses and raises concerns about the company's future performance.

-

Specific figures showcasing the shortfall: The company reported a revenue of [Insert Actual Revenue Figure], falling short of the anticipated [Insert Analyst Prediction for Revenue] by [Insert Percentage or Specific Figure]. Earnings per share (BBAI EPS) came in at [Insert Actual EPS], considerably lower than the projected [Insert Analyst Prediction for EPS].

-

Comparison to previous quarters: This represents a [Insert Percentage] decrease compared to the previous quarter's revenue and a [Insert Percentage] drop in EPS. This underperformance is markedly below industry benchmarks, where average growth was reported at [Insert Industry Benchmark Growth Figure].

-

Reasons behind missed targets: Several factors contributed to BBAI's disappointing performance. These include increased competition from established players, supply chain disruptions impacting production and delivery, and the broader impact of macroeconomic headwinds such as inflation and rising interest rates. These challenges directly impacted BBAI's revenue streams and profitability. The company's reliance on [Specific Market/Technology] also proved vulnerable to shifts in market demand. Analyzing BBAI's financial performance reveals a need for strategic adjustments.

Analyzing the Underlying Instability of BBAI Stock

Investing in BBAI carries inherent risks and significant volatility. Understanding these risks is crucial for potential investors.

-

High dependence on specific markets/technologies: BBAI's heavy reliance on [Specific Market/Technology] exposes it to significant risk if that market declines or alternative technologies emerge. This lack of diversification contributes to overall instability.

-

Regulatory risks: Changes in regulations, particularly those concerning [Relevant Industry/Technology], could negatively impact BBAI's operations and profitability. Navigating the regulatory landscape is a key challenge for the company.

-

Intense Competition: BBAI faces fierce competition from established industry giants and innovative startups. This competitive pressure limits pricing power and can impact market share.

-

Geopolitical factors: Global events and geopolitical uncertainty can significantly affect BBAI's operations, particularly if it has significant exposure to specific regions or relies on international supply chains. BBAI risk assessment needs to consider these external forces.

Technical Analysis of the BBAI Stock Price Drop

Technical analysis of BBAI's stock price reveals several indicators contributing to the recent decline.

-

Bearish Chart Patterns: The stock price displayed classic bearish chart patterns, such as [Specific Chart Pattern, e.g., head and shoulders], indicating a potential downward trend. These patterns suggest a significant loss of investor confidence.

-

High Selling Pressure: High trading volume accompanied the price drop, confirming significant selling pressure. This suggests a large number of investors are exiting their positions.

-

Support and Resistance Levels Broken: Key support levels were decisively broken, indicating a weakening of the stock's price floor and reinforcing the bearish momentum. BBAI chart patterns need careful monitoring for further insights. Understanding BBAI trading volume is also critical.

Investor Sentiment and Market Reaction to the BBAI Stock Decline

The negative BBAI earnings report and subsequent price drop have significantly impacted investor sentiment and market reaction.

-

Negative Media Coverage: The news was widely covered in financial media outlets, with many articles highlighting the company's missed targets and the potential for further declines. This negative media coverage fueled further selling pressure.

-

Increased Trading Volume: Trading volume spiked significantly following the earnings report, reflecting a heightened level of activity and a surge in selling. BBAI market reaction underscores the volatility surrounding the stock.

-

Erosion of Investor Confidence: The sharp decline in stock price and negative media coverage have eroded investor confidence, making potential future investments more risky. BBAI investor sentiment is currently heavily negative, impacting trading activity. BBAI analyst ratings have likely also been downgraded.

Conclusion

The 17.87% drop in BBAI stock is a result of a confluence of factors: missed earnings expectations, inherent instability due to market dependence and competitive pressures, negative investor sentiment fueled by media coverage, and bearish technical indicators. The significance of this drop underscores the volatility associated with investing in BBAI. The company faces substantial challenges that require decisive action to regain investor confidence.

While the recent drop in BBAI stock presents challenges, a thorough understanding of the underlying factors is crucial for informed investment decisions. Conduct further research, consult with a financial advisor, and carefully consider your risk tolerance before making any investment decisions related to BBAI stock or similar high-volatility investments. Stay updated on BBAI news and BBAI market trends for informed decision-making.

Featured Posts

-

Nj Transit Avoids Further Disruption With Union Deal

May 20, 2025

Nj Transit Avoids Further Disruption With Union Deal

May 20, 2025 -

March 18 Nyt Mini Crossword Answers Solve The Puzzle Today

May 20, 2025

March 18 Nyt Mini Crossword Answers Solve The Puzzle Today

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge On Monday Reasons For The Increase

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge On Monday Reasons For The Increase

May 20, 2025 -

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025 -

The Enduring Appeal Of Agatha Christies Poirot An Analysis Of His Popularity

May 20, 2025

The Enduring Appeal Of Agatha Christies Poirot An Analysis Of His Popularity

May 20, 2025

Latest Posts

-

Dimosia Synantisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Dimosia Synantisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

Esperida Stin Patriarxiki Akadimia Kritis T Hemata Megalis Tessarakostis

May 20, 2025

Esperida Stin Patriarxiki Akadimia Kritis T Hemata Megalis Tessarakostis

May 20, 2025 -

Adas

May 20, 2025

Adas

May 20, 2025 -

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

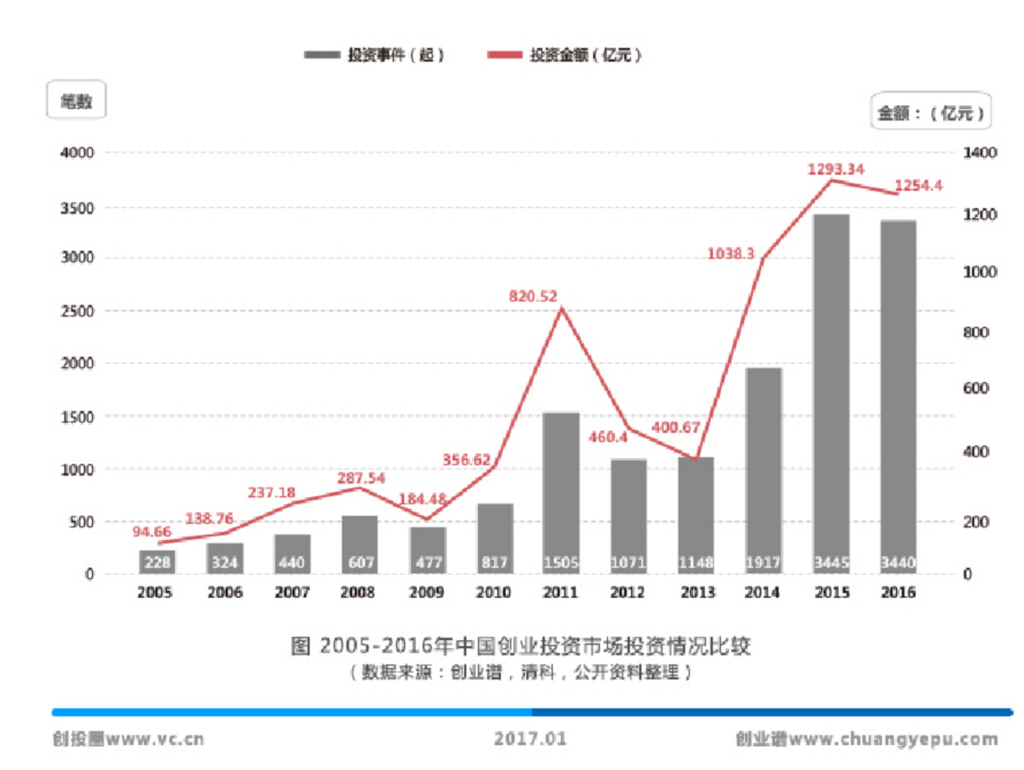

Vc 4

May 20, 2025

Vc 4

May 20, 2025